Always know your goal exactly

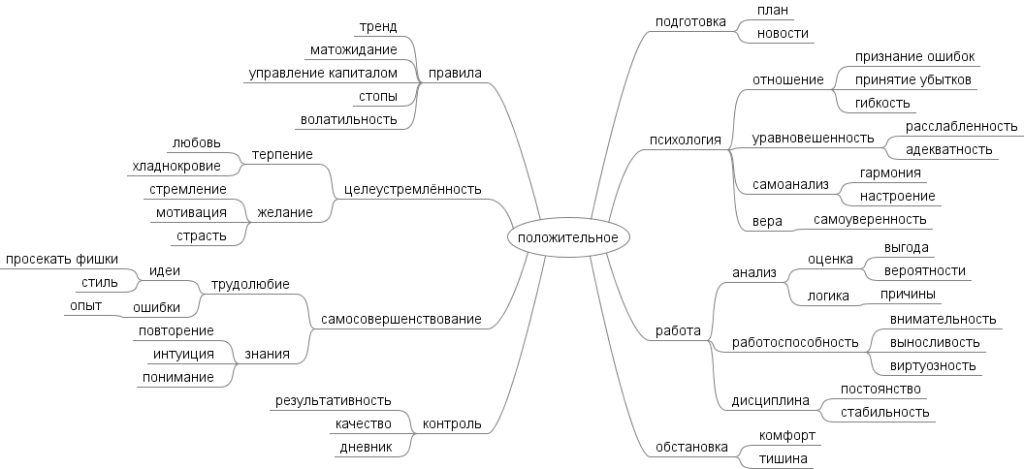

I like to read books very much, but most of what I read is not fiction, and business and psychology. There it is always written everywhere, what you exactly should mean your goal and it should be real, as soon as you put it you go to her on a subconscious level. This applies not only to trading., but also to life goals. You will never achieve them in a couple of days and easily, most likely you will need to spend a lot of time and effort to achieve. When I first came to the firm, on my first trading day, I wrote a plan for the year. How much do I want to earn in a year, month, week and day. Of course they were very optimistic and in general it was too early to think that they would come true soon. Like everyone else, I had to work very hard, bump into new mistakes and your own cockroaches every day.