Alrosa (MCX: ALRS) — mining company, world leader in diamond mining and a monopoly in Russia.

16 April, the company published operating results for 1 quarter of 2021. Results look good: the company sold twice as many diamonds, what produced, and market prices are gradually recovering following demand.

Situation in the industry

For Alrosa, the past year was one of the worst in the history of the company.. Amid coronavirus pandemic and restrictive measures, sales of the company fell to almost zero.

Nevertheless, in 2 half of 2020, sales began to recover amid easing restrictions and the effect of deferred demand. And at the end of the year, the company updated the sales record, what I wrote about in the Alrosa sales review for 2020. It softened the fall, although the dynamics of sales in the last few years is frightening.

IN 1 quarter of this year, the diamond market was recovering. The US and China fueled demand for gemstones amid Valentine's Day and Chinese New Year celebrations.. Engagement and bridal jewelry sales rebound due to pent-up demand: many couples have rescheduled celebrations from last year.

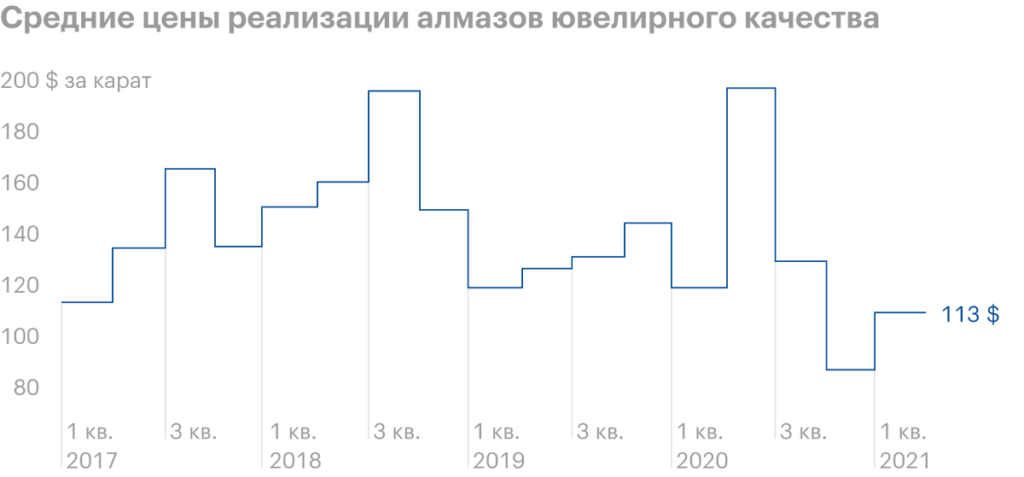

As a result, diamond prices at the end of 1 quarter rose after a deep fall. Average prices for gem-quality diamonds in January-March increased by 25% to 4 quarter of last year, although diamonds are still trading at multi-year lows.

Dynamics of sales of rough and polished products, billion dollars

| 2016 | 4,49 |

| 2017 | 4,27 |

| 2018 | 4,51 |

| 2019 | 3,34 |

| 2020 | 2,8 |

2016

4,49

2017

4,27

2018

4,51

2019

3,34

2020

2,8

Mining

The amount of diamonds produced depends on the amount of mined and processed diamond ore, as well as on the concentration of diamonds in this ore.

Ore processing volumes based on the results of 1 quarter of 2021 increased compared to 4 quarter of last year at 17% - up to 5.8 million tons.

Diamond content in ore decreased slightly - from 1,36 to 1,31 carats per tonne - due to increased production from mines with lower diamond grades.

As a result, diamond mining in 1 quarter of 2021 decreased by 8% - up to 7.5 million carats yoy.

Ore processing dynamics, million tons

| 2017 | 6,1 |

| 2018 | 5,7 |

| 2019 | 6,4 |

| 2020 | 5,9 |

| 2021 | 5,8 |

2017

6,1

2018

5,7

2019

6,4

2020

5,9

2021

5,8

Diamond content in ore, carats per tonne

| 2017 | 1,46 |

| 2018 | 1,30 |

| 2019 | 1,23 |

| 2020 | 1,36 |

| 2021 | 1,31 |

2017

1,46

2018

1,30

2019

1,23

2020

1,36

2021

1,31

Diamond mining, million carats

| 2017 | 8,9 |

| 2018 | 7,4 |

| 2019 | 7,8 |

| 2020 | 8 |

| 2021 | 7,5 |

2017

8,9

2018

7,4

2019

7,8

2020

8

2021

7,5

Sales

Diamond sales behind 1 quarter fell on 9% compared to 4 quarter of last year - up to 15.5 million carats, but grew by 65% quarter to quarter. Expensive diamonds sold 9.7 million carats, technical — 5.8 million.

The company mined 7.5 million carats of diamonds, and sold for 15.5 million carats, reducing its stocks by 38% - up to 12.8 million carats.

Sales revenue grew by 28% quarter to quarter - up to $ 1.16 billion. Diamonds made up 97% from proceeds, and diamonds are all 3%. Russia finds it difficult to compete with India, where the main cutting capacities are concentrated, and easier to sell rough diamonds for export, than creating finished diamond jewelry.

Sales of Alrosa at the end of the period, million carats

| Diamonds | Gem-quality diamonds | Diamond reserves | |

|---|---|---|---|

| 2017 | 14,1 | 11 | 18,2 |

| 2018 | 13,4 | 10,1 | 17 |

| 2019 | 10,6 | 7,9 | 22,6 |

| 2020 | 9,4 | 7,1 | 20,7 |

| 2021 | 15,5 | 9,7 | 12,8 |

Diamonds

2017

14,1

2018

13,4

2019

10,6

2020

9,4

2021

15,5

Gem-quality diamonds

2017

11

2018

10,1

2019

7,9

2020

7,1

2021

9,7

Diamond reserves

2017

18,2

2018

17

2019

22,6

2020

20,7

2021

12,8

Sales revenue for the first quarter, million dollars

| 2017 | 1,34 |

| 2018 | 1,61 |

| 2019 | 1 |

| 2020 | 0,90 |

| 2021 | 1,16 |

2017

1,34

2018

1,61

2019

1

2020

0,90

2021

1,16

What's the bottom line?

Operating results of Alrosa for 1 quarter look contradictory. On the one hand, the recovery of the market after the crisis, on the other hand, the slow increase in production capacity and the inability to meet growing demand. Diamond mining lags behind sales by more than 2 Times, because of what reserves are melting. At the same time, diamond prices are still at a low level..

Ahead of us is a phenomenal growth in 2 quarter due to low base effect. In April-July last year, the company stopped selling its products.. Nevertheless, talking about a full-fledged exit from the crisis and a return to previous production volumes, in my opinion, yet premature.

Alrosa management informs, that demand for jewelry remains strong in all key markets, and suggests, that the volume of rough diamond production in the medium term will be 20% below, than before the crisis. If the forecast turns out to be correct, then there will be a shortage of diamonds in the cutting industry. This will lead to an increase in demand and prices for the company's products.. Anyway, in production figures in 1 quarter, there is a clear imbalance between production and sales.