According to Bloomberg, PayPal wants to buy Pinterest for $45 billion. Pinterest could become the biggest social media takeover since 2016, when Microsoft bought LinkedIn for $26 billion.

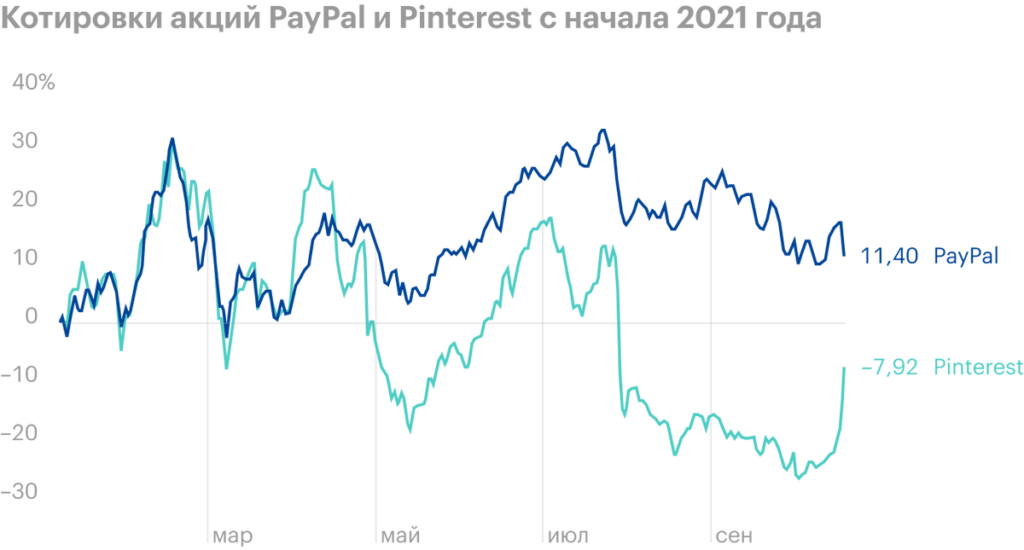

According to one of the sources, PayPal has offered Pinterest to shareholders 70 $ per share. It's on 25% more, what were the shares of the social network on Tuesday, even before the release of absorption data. On Wednesday news, Pinterest shares rose by 13%, to 63 $. PayPal shares fell by 5%, to 258 $.

The parties have not yet fully determined the terms and size of the deal.. Probably, PayPal will pay Pinterest for the most part with its own shares. During quarantine, people began to use electronic payments more often, and PayPal shares have doubled in a year and a half since the start of the pandemic. According to the source, PayPal will announce the deal 8 November - along with the release of the third quarter report.

According to experts, Buying Pinterest will help the payment system diversify revenue through advertising and increase the volume of payments. “This is a beneficial combination, especially if the Pinterest marketplace is integrated with Honey", - said in the investment company Wedbush.

Honey is a service, which helps people save money on online shopping: receive price reduction notifications, look for promo codes and more. PayPal bought Honey in early 2020 for $4 billion. With Honey, PayPal can better track consumer preferences.

And Pinterest is a photo-sharing platform., where users can combine them into thematic collections. Sellers use the service to promote products, Does Pinterest make money from ads?.

Together, Pinterest and Honey will offer shoppers more relevant products. This will help make advertising more expensive and increase the number of transactions through the PayPal service..

Despite all the advantages of integration, 45 billion dollars for the recently unprofitable Pinterest is a lot. The service reported its first profit in a couple of years in the fourth quarter of last year..

In 2021, people began to spend less time on the Internet, therefore, the growth in the number of active users on Pinterest began to slow down. In the first quarter - until 30%, in the second - up to 9%. In both cases, the company's shares fell by 25-30% within a couple of weeks after the report.. Multibillion-dollar Pinterest posted net income of $69M in latest quarter.