Sportswear & accessories manufacturer Nike releases first quarter fiscal year 2022 report. Comparing with the previous year:

- revenue increased by 16%, up to $12.2 billion;

- gross profit increased by 20%, up to 5.7 billion;

- net profit increased by 23%, up to 1.9 billion.

Nike retail sales rose by 28%, up to 4.7 billion. The company said, that physical stores have earned in the normal mode, and total store sales exceeded the level of two years ago.

Online sales have increased 29%. Nike continues to develop digital sales channel, who rescued the company during quarantine. According to management plans, by 2025 digital sales will be 40% from all proceeds.

In North America, in Nike's largest market, revenue increased by 15%. In Europe - on 14%, in Asia and Latin America - by 33%. In China, where Nike sales grew fastest until recently, revenue grew only by 11%. And excluding the exchange rate difference, it is even less - by 1%.

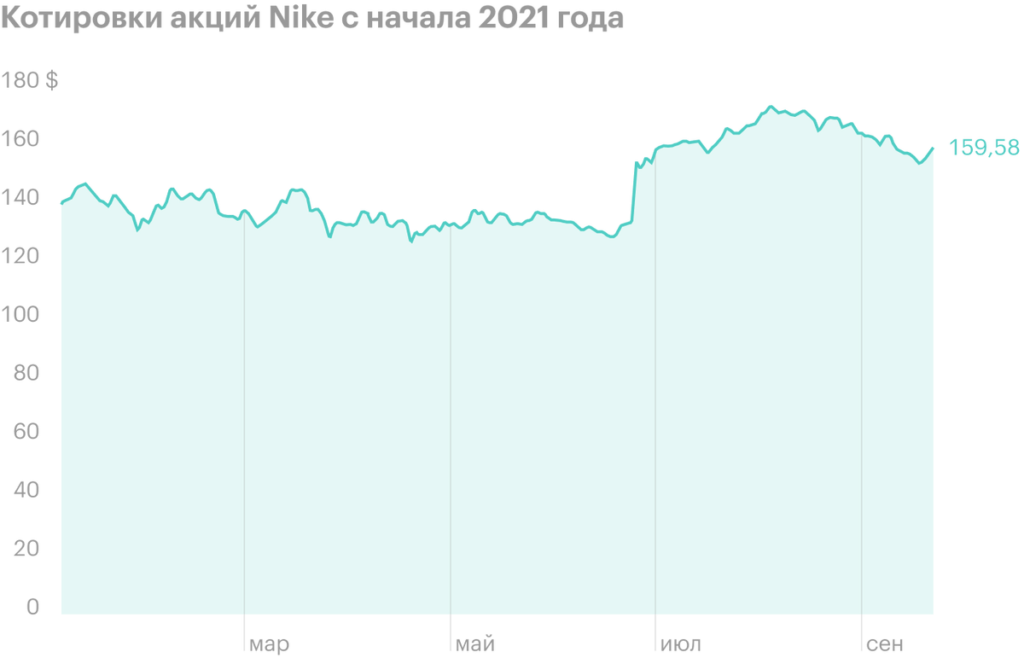

Total revenue and revenue in North America were lower, than analysts expected. After the report, Nike shares fell by 4%, to 153,3 $.

As explained by the company, Demand for Nike products remains high, but there was a shortage due to supply disruptions. About 50% shoes and 30% Nike manufactures clothing in Vietnam. More than half of Vietnamese factories due to the pandemic, with whom the company works, remain closed. According to Nike, it will take several months, to restore production.

Production problems exacerbated by shipping delays. According to Nike management, shipping time from Asia to North America has doubled, up to three months on average.

Due to disruptions, the company changed its forecast for fiscal 2022. How Nike thinks now, sales will grow not double-digit during the year, but only a few percent. Analysts hoped for growth in 12% based on the results of the second quarter and the whole year.

Since the beginning of the year, Nike shares have gained 14%, but fell already on 8% from the maximum in August, when the first talk about problems with production appeared.

Share of manufacturing companies in Vietnam

| Deckers Outdoor (DECK) | 50%+ |

| Capri Holdings (CPRI) | 45-50% |

| Columbia Sportswear (COLM) | 45%+ |

| Nike (NKE) | 43% |

| Tapestry (TPR) | 40-50% |

| Under Armour (UAA) | 40% |

| Lululemon (LULU) | 33% |

| VF Corp. (VFC) | 25% |

| LoveSac (LOVE) | 20-25% |

| Yeti Holdings (YETI) | 20% |

| Steve Madden (SHOO) |