Machines are not produced. Clean energy makes money. Twitter repenting to investors.

Disclaimer: when we talk about, that something has grown, we mean a comparison with the same quarter a year earlier. Since all issuers are from the USA, then all results in dollars. When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

I forbid you to buy cars

Analytical company IHS Markit (NYSE: INFO) cut its forecasts for passenger car production: on 6,2% in 2021 - up to 75.8 million cars, on 9,3% in 2022 - up to 82.6 million cars - and 1,1% in 2023 - up to 92 million cars.

IHS Markit rarely adjusts its own forecasts downwards, but circumstances intervened: semiconductor shortages are forcing automakers to shut down factories until much-needed components are available.

This, certainly, sad news for car manufacturers: for them it means lost revenue. But, basically, they have already incorporated such expectations into their forecasts, so there is no big shock for their shareholders.

What about auto parts manufacturers?, this is really bad news for them.: many, due to their small size and not the largest cash reserves, will be forced to suffer, until their major automotive customers ramp up orders to previous forecasts.

It is hard to say, How will this affect car dealers?. On the one side, a disruption in the supply of new cars will lead to a shortage of supply of cars on the market - and will allow dealers to increase prices. But they have already grown much more than the level, what consumers expected, so don't expect too much, that dealers will be able to earn even more by selling existing cars at exorbitant prices.

This news could lead to consolidation in the manufacturing industry: taught by bitter experience of lack of components and stoppage of production, large industrial conglomerates will strive to vertically integrate their supply chains. In a practical sense, this allows the shareholders of small manufacturing enterprises to hope, that these issuers will soon be bought by someone larger.

Clean energy for conservatives

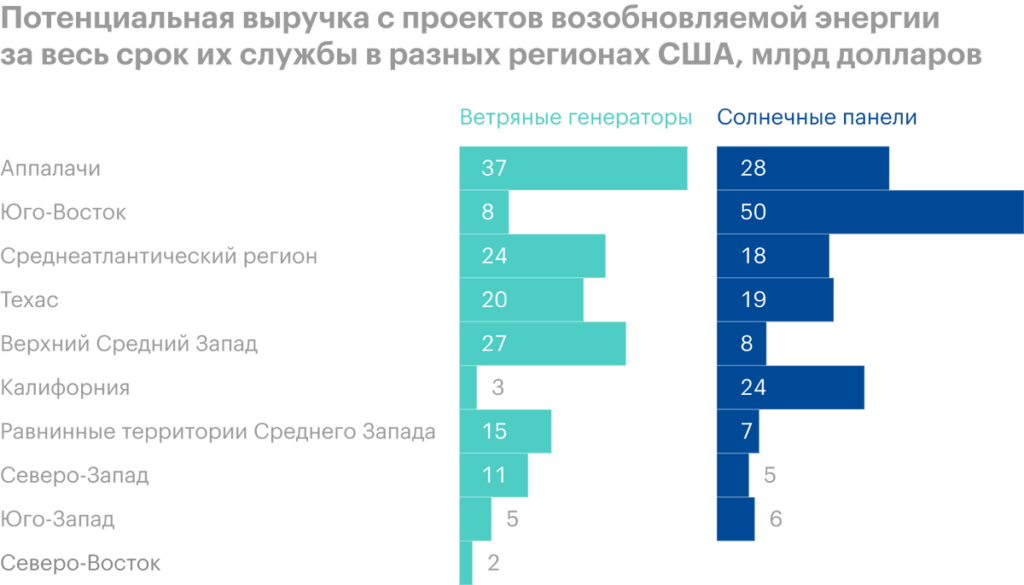

Clean energy research firm RMI shares its economic benefit analysis with Axios, expected by various US states from the implementation of projects in the field of renewable energy, which will be built in the period 2021-2030.

Calculated tax revenues, payments for land use, new jobs and other things, related directly to these projects. Was, that the benefits there will be tens of billions of dollars over the life of the projects. Moreover, the most noticeable beneficiaries will be regions like Appalachia - states with a rural population and a large number of vacancies in the field of traditional energy - in particular, coal and oil production.

If the numbers are real, then this argument can serve the cause of widespread adoption by conservative States of the eco-energy agenda. For all issuers in this area, this would significantly expand the American business.. Moreover, the financial argument in favor of clean energy is now more relevant for the states than ever.: The coronacrisis cut local tax revenues and crippled local economies, so, may be, states will seize on clean energy as an opportunity to create a new growth point for the economy in their region.

You will be fined - but you do not chirp

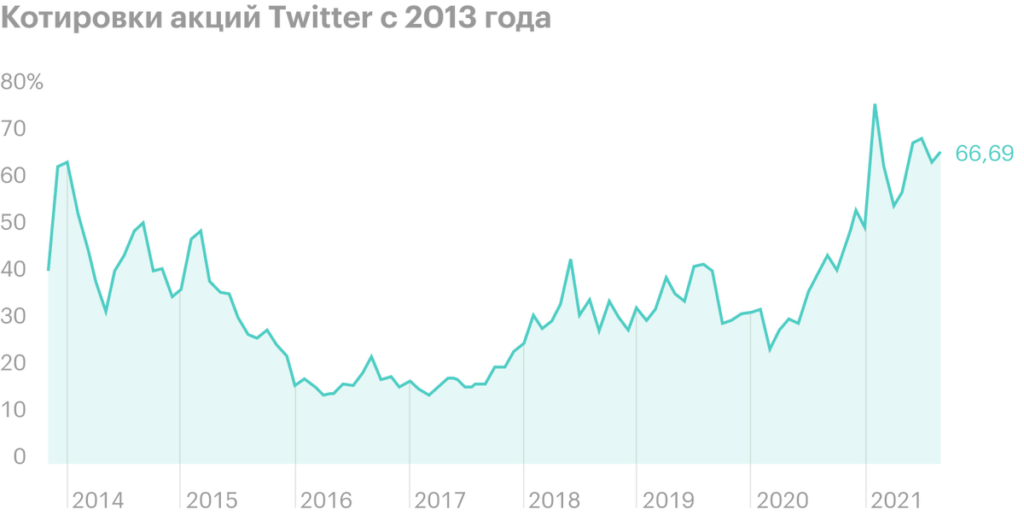

Social network Twitter (NYSE: TWTR) entered into an agreement with investors on a misinformation lawsuit. The management of the company was accused of, that it hid from investors information about important business development metrics, in particular about the growth in the number of users. Lack of information led to excessive growth of quotations, which then gave way to a fall in stocks after, how the true state of affairs was revealed, — i, respectively, some investors lost money. Under the terms of the agreement, Twitter will pay the plaintiffs $809.5 million of its own money..

Basically, more than enough money at the disposal of the company: she has $4.125 billion in her accounts alone. So it can't be said, what a terrible loss. On the other hand, this claim, which stretches as far as 2016, demonstrates the weakness of the company.

In 2014, Twitter management said, which aims to increase the number of monthly users to 550 million in the medium term and to make more than a billion in the long term. In 2019, when the company stopped reporting data on this indicator to investors, it only had 330 million monthly users. Now Twitter tells investors about the number of daily monetized users - their number is 206 million.

Obviously, that Twitter's growth ended up worse, than management and investors dared to hope at the beginning of the glorious path of the company. Maybe, other "promising startups" are also now overestimating their growth - what will come back to haunt them in the future.

The outcome of the case for Twitter shareholders is rather sad. Think, that this experience will motivate company management to avoid overly optimistic forecasts for the business going forward. And this will slow down the growth of quotations, because investors are pecking at these unrealistic promises of cosmic growth, buying shares of technology startups with a shaky business model. After all, as Joe said on Friends on a similar occasion, "Without your humor, you're just a bad lover".