American Deposit Bank Goldman Sachs Tracks Backpack Dynamics, which consists of shares of companies more affected by a strong epidemic. Due to concerns over the spread of the more contagious delta virus, almost all stocks in the knapsack are in drawdown..

The bank determines the opening of the economy after quarantine on a ten-point scale, Where is 1 - completely closed, 10 - completely open. Despite the increase in the number of infections, the Goldman index is at the level of 8 points - on 4 score higher, than early 2021.

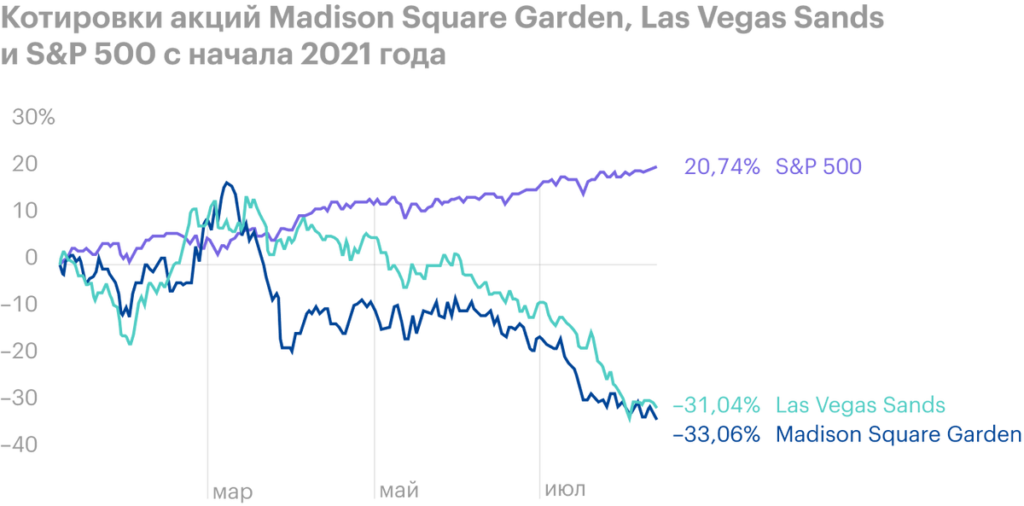

Stocks keep breaking records. Last week S&P 500 increased to 4468 points, or twenty-one percent since the beginning of the year. Almost all companies are again giving their products and services, but some stocks are well behind the broad market index.

According to Goldman, there is potential in the shares of companies affected by a strong epidemic. "We are thinking, the pessimism of the market regarding the delta option made it possible to buy some shares ", - emphasized the bank's strategist David Kostin.

And Goldman Sachs raised his motivated level in S&P 500 at the end of the year from 4300 to 4700 points.

Airline shares are allocated separately in the investment bank, cruise operators, casinos and travel companies. Since May, the portfolio of such stocks has lagged behind S&P 500 on 20 Percent.

Madison Square Garden shares have fallen more than others since the beginning of the year - by thirty-three percent. Shares of Las Vegas Sands and Melco Resorts down 31 percent, and Wynn Resorts by eleven percent.

Companies on the Goldman Sachs list

| Ticker | Since the beginning of the year | |

|---|---|---|

| Madison Square Garden | MSGE | −33% |

| Las Vegas Sands | LVS | −31% |

| Melco Resorts | MLCO | −31% |

| Wynn Resorts | WYNN | −11% |

| Booking Holdings | BKNG | 2% |

| Hyatt Hotels | H | 2% |

| United Airlines | UAL | 12% |

| Royal Caribbean | RCL | 12% |

| Live Nation Entertainment | LYV | 15% |

| Hawaiian Holdings | HA | 16% |

| TripAdvisor | TRIP | 23% |