Friday 27.05.11 an interesting event happened with one of the most liquid securities as the Ukrainian Exchange.

() – one of the largest coke-chemical enterprises in Ukraine.

From a technical point of view, the paper was at annual lows. And I guess the reversal should have happened next week.

A fundamental paper also has colossal growth potential. Recommendations for it can be viewed .

Все было бы хорошо, but then his majesty happened:)

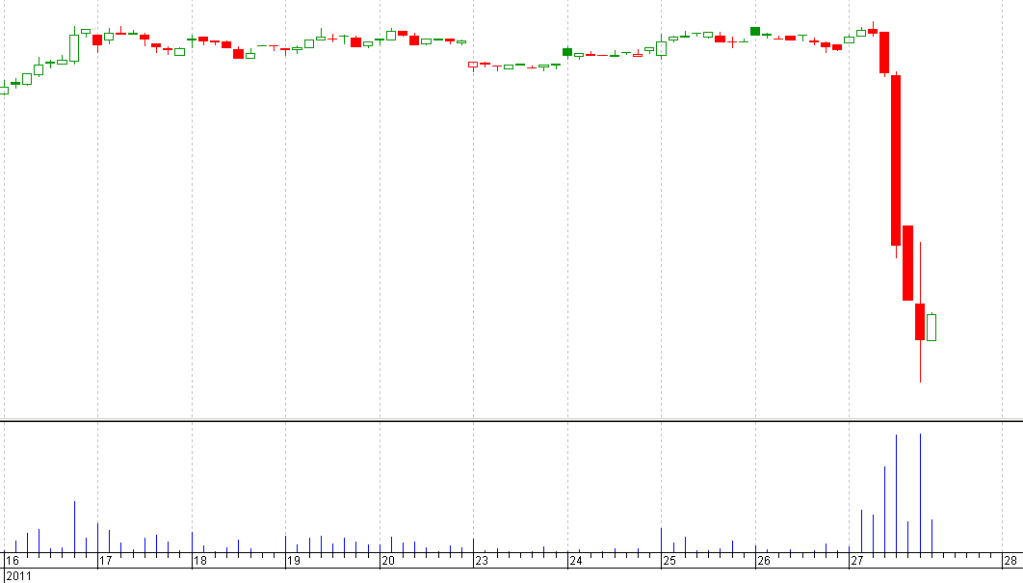

To 27 the numbers, as seen on the graph, nothing like that happened to paper, sausage myself in the corridor.

Here's the thing. 20 May, the decision of the State Commission for the Securities and Stock Market comes out, which no one knows about. And everyone is trading quietly the share.

The decision says about the suspension of the circulation of the share on 1 year. And also on this day two more decisions are released., according to which more shares of two issuers are also frozen at 1 year. The most interesting thing is that all these issuers are part of the group of businessman Viktor Nusenkis, which the .

Near 13:00 27 May, across 7 days after the decision was released, appears . And within an hour, panic sales begin. Lost paper 35% for an hour and then trading on it was suspended. The solution itself is extremely difficult to find in any of the regulatory frameworks. And nowhere do they know anything about him.

The most interesting thing is that the decision was made on the basis of the deputy's appeal. I wonder what kind of violation, that the deputy was forced to apply. Or to put it bluntly, this is the same tin that can be in our country, where a person gifted with power can suspend the appeal for 1 year and thereby freeze investors' money. Who will then invest in such a country? Given that this is one of the liquid stocks, and of the liquid ones, there are only 7. And why was the news so hidden?

I myself held a small package of these shares. But the point is not even that money can freeze, I think that it's «hitting». And within a month everything will fall into place. But the problem is different., that interest in paper could cool off. Investors will transfer money to Metinvestovsky , which, under the current government, I think is not threatened with such assaults and has the same strong fundamental indicators.

P.S. Unfortunately I could not watch it live, but if I could, for speculative purposes, I would buy a small stake :)