Yandex N. V. (Nasdaq, MCX: YNDX) — Dutch holding, the parent company of the international technological giant with Russian roots - "Yandex".

What happens here

Readers have been asking us for a long time to start looking into the financial statements and business foundations of Russian issuers.. The idea to review Yandex was proposed by our reader Alex Freeman in the comments to the IPO Fix Price review.. Offer in the comments of the company, analysis of which you would like to read.

About company

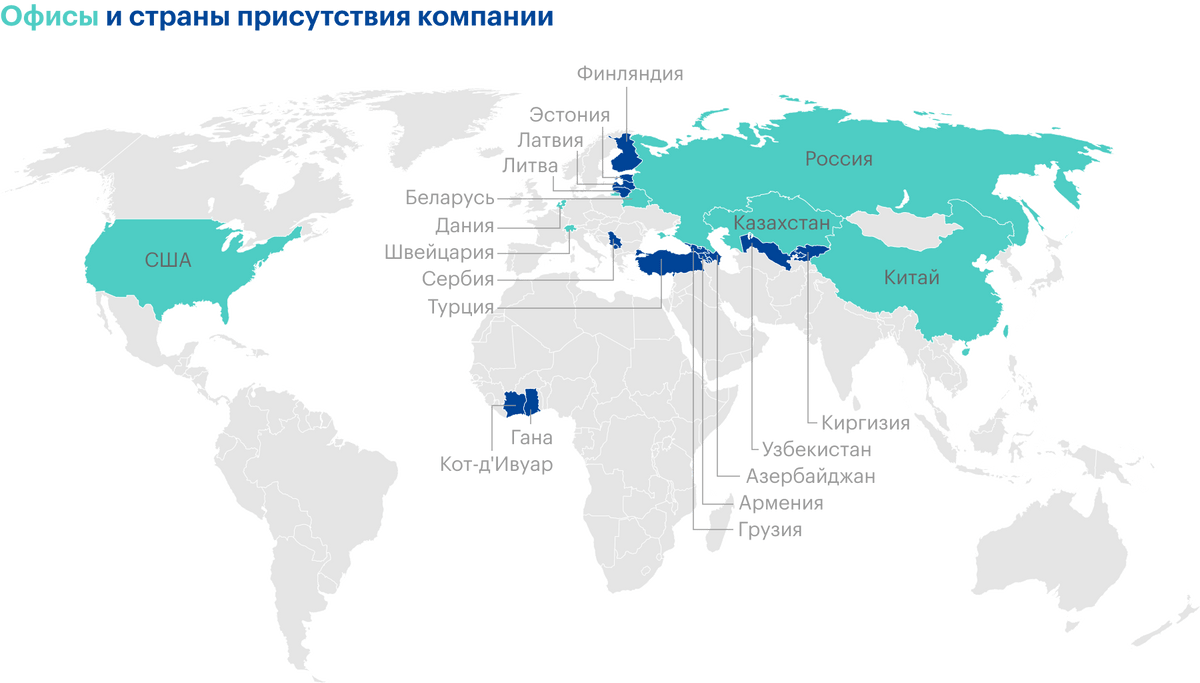

Yandex is a large international technology company with Russian roots. Does business like in the Russian Federation, so and still in 21 country. The company's business model does not involve the development of software to order or direct sale to its customers - the company focuses specifically on the development and development of full-fledged user services based on the software produced by the company. Almost all the company's services are practically aggregators, almost all are free for a wide range of clients.

Yandex considers 1990 to be the beginning of its own history, when the first products of the company began to be developed within Arcadia and CompTek. In the form of some organization, the company was founded in 2000, and in 2007, the head Dutch company Yandex N. V.

In the first years of existence were made: search method, which also gave the title to the search portal of the same name, marketing engine, other services such as mail, kart. In the first half of the 2010s, the company began the path to active expansion and expansion of the business range - you can report, that she went offline - she began to create products and began to digitize ordinary offline businesses.

At the moment, Yandex is not just a diversified business. Yandex is one of the leading players, who organized their ecological system - a significant number of different services, trying to meet the largest number of daily user needs in one place. The ecosystem is comfortable for Yandex itself, which is also why, that new experimental services can use existing developments and services as their infrastructure, creating synergy.

The company highlights 6 operational parts of the business, each with several services.

Search & Portal. This sector includes quite diverse services.:

- Search engine.

- Search portal and application.

- "Yandex browser".

- Voice assistant Alice.

- Mail 360: "Yandex-mail", cloudy file storage "Yandex-disk", service for video conferencing "Yandex-teleconference", "Yandex-calendar", "Yandex notes".

- Geoservices: "Yandex-cards", "Yandex-navigator", Yandex-Auto, "Yandex refueling", "Yandex routing", "Yandex-business".

- Other services: "Yandex-news", "Yandex weather", "Yandex travel", "Yandex services", "Yandex-Q".

The meaning of this sector, based on the convictions of business, boils down to, to provide users with a significant number of comfortable and mostly free services, and in the process of using them to show users ads. Advertising revenue for many, many years has been, in general,, remains the main source of income for Yandex.

Advertising earnings are significantly affected by the size of the online advertising market - and everything is fine with it: he grows up, flowing from the least effective offline. Despite the wealth of services, search is still the main thing, so it is extremely important for the company to maintain its first place in the RuInternet, what is hard, since the main competitor is the global search hegemon - Гугл. While it comes out.

Taxi. Offline businesses of the company are united here, related to mobility:

- Yandex Taxi is a joint venture with Uber, which has already been presented in 17 states and in almost 800 cities.

- Short-term car rental "Yandex-Drive", who works in the capital of Russia, St. Petersburg, Kazan and Sochi and possessing approximately 16 thousand cars.

- Delivery service of ready-made food "Yandex-food": 170 host cities, over 33 thousand partner restaurants and shops. Delivery service of goods "Yandex-shop", which is presented in the capital of Russia, St. Petersburg, Nizhny Novgorod, includes a network of over 270 dark stores.

- Logistic solution for business and buyers on delivery.

In the taxi section, the company has already occupied a significant part of the market, so the FAS even blocked the purchase of "Lucky", Believing, that then "Yandex-taxi" can take seventy percent of the market of the Russian Federation of taxi aggregators. The rest of the services are also growing at a good pace.. In 2020, the company released a single super-application "Yandex Go", uniting all services in one place.

"Yandex Market". Multi-category marketplace and price comparison service. It has recently become a full-fledged part of Yandex again.. From a business standpoint, it's a competitor to Ozon, in an article about which we examined in detail this business segment and its prospects. Number of commodity items, sold on Yandex Market, exceeded two million, number of sellers - 8 thousand. The company has 4 fulfillment center: three in Moscow and one in Rostov-on-Don, — 8 sorting centers, 632 pick-up points and 1187 pick-up points. The company actively uses the courier service "Yandex-shops".

Media services. This includes services, entertainment related:

- Yandex Music, the largest streaming music platform in Russia, with a catalog of more than 65 million music tracks.

- Large resource "Kinopoisk", on the basis of which the company launched the Kinopoisk HD online cinema a few years ago.

- Service for selling tickets for Yandex-Afisha events.

- Yandex TV program service.

- Launched in 2018, its own content production studio Yandex-Studio.

- The company also includes a Yandex-plus subscription in this segment., thanks to which the user can more profitably use a variety of services of the company and its partners. As of February 2021, the number of subscribers exceeded 8 million people. Subscription available at 11 countries.

Verticals. This includes various ad services:

- "Auto-ru" - car sales, motorcycles and spare parts.

- "Yandex real estate" - rent and sale of real estate.

- "Yandex-work" - job search.

- "Yandex-Announcements" is a private ad service launched only in December 2020.

In this segment, the company earns on commissions for raising ads and additional services., on an advertisement.

Other business units and initiatives. This includes other services of the company - not suitable for the topics of other operating segments or those, what are considered experimental and which the company is not ready to separate into separate business units:

- Social information platform "Yandex-Zen", where anyone can start a blog, and artificial intelligence will select personalized content recommendations. By December 2020, the average number of daily active users of the platform exceeded 20.3 million people.

- Cloud platform "Yandex-cloud" is an extremely promising service, recently even separated into a separate business unit. It is already used by more than 15 thousand users, and in the future it may become one of the main points of growth for Yandex's business for several reasons. As we know from the analysis of the business of such giants, how Amazon and Microsoft, cloud computing is very profitable and promising for companies, providing such services. Yandex has a competitive advantage over foreign cloud giants: Russia has laws, according to which some data must be stored on servers, physically located in Russia.

- Self-driving car project, spun off from Yandex Taxi.

- Goods - several types of smart column "Yandex-station". The number of speakers sold has already exceeded 1.3 million.

- Other services: Yandex Education, Yandex-health, Yandex services.

- Investments in the aggregator of discounts and special offers "Edadil" and in financial services.

Yandex is flexible in its approach to operating segments, periodically moving services from one to another. For example, Yandex Drive has only recently entered the Taxi segment, and starting from 2021, "Yandex Services" and "Products" were moved to "Other Services and Experiments", which at the same time were renamed into "Other business units and initiatives", and geoservices moved to "Search and Portal".

Also worth mentioning, that Yandex not only independently develops new services from scratch, but also periodically does not shy away from buying them for subsequent integration into their ecosystem. Purchased as whole large services, which remain conspicuous parts of the ecosystem, such as "Kinopoisk" and "Avto-ru", as well as smaller assets - for example, "Party of Food" and part of the assets of "Lucky".

Share of search engines in Russia by years in percent

| «Yandex» | Mail.ru | ||

|---|---|---|---|

| 2016 | 56,0 | 37,1 | 4,1 |

| 2017 | 55,1 | 39,6 | 3,4 |

| 2018 | 56,3 | 40,0 | 2,2 |

| 2019 | 57,0 | 40,1 | 1,6 |

| 2020 | 59,2 | 38,6 | 1,1 |

«Yandex»

2016

56,0

2017

55,1

2018

56,3

2019

57,0

2020

59,2

2016

37,1

2017

39,6

2018

40,0

2019

40,1

2020

38,6

Mail.ru

2016

4,1

2017

3,4

2018

2,2

2019

1,6

2020

1,1

Volume of the advertising market in Russia by structure and years, billion rubles

| A television | radio | Press | Outdoor advertising | Internet | Total | |

|---|---|---|---|---|---|---|

| 2016 | 150,8 | 16,5 | 22,3 | 38,3 | 136,0 | 364,0 |

| 2017 | 170,9 | 16,9 | 20,5 | 42,7 | 166,3 | 417,3 |

| 2018 | 187,0 | 16,9 | 18,0 | 43,8 | 203,0 | 468,7 |

| 2019 | 175,0 | 16,0 | 15,1 | 43,8 | 244,0 | 493,8 |

| 2020 | 169,0 | 11,2 | 8,0 | 32,2 | 253,0 | 473,4 |

A television

2016

150,8

2017

170,9

2018

187,0

2019

175,0

2020

169,0

radio

2016

16,5

2017

16,9

2018

16,9

2019

16

2020

11,2

Press

2016

22,3

2017

20,5

2018

18

2019

15,1

2020

8

Outdoor advertising

2016

38,3

2017

42,7

2018

43,8

2019

43,8

2020

32,2

Internet

2016

136

2017

166,3

2018

203

2019

244

2020

253

Total

2016

364,0

2017

417,3

2018

468,7

2019

493,8

2020

473,4

Volume of the cloud services market in Russia by structure and years, billion rubles

| IaaS | SaaS | PaaS | Total | |

|---|---|---|---|---|

| 2016 | 9,1 | 31,1 | 2,3 | 42,5 |

| 2017 | 13,1 | 38,3 | 3,2 | 54,6 |

| 2018 | 17,9 | 46,7 | 4,3 | 68,8 |

| 2019 | 23,4 | 54,9 | 5,1 | 83,4 |

| 2020 | 29,5 | 64,1 | 6,1 | 99,7 |

| 2021 | 37,5 | 75,6 | 7,4 | 120,5 |

| 2022 | 47,6 | 89,3 | 8,9 | 145,8 |

| 2023 | 60,0 | 105,3 | 10,8 | 176,1 |

| 2024 | 75,5 | 124,3 | 13,1 | 212,9 |

IaaS

2016

9,1

2017

13,1

2018

17,9

2019

23,4

2020

29,5

2021

37,5

2022

47,6

2023

60

2024

75,5

SaaS

2016

31,1

2017

38,3

2018

46,7

2019

54,9

2020

64,1

2021

75,6

2022

89,3

2023

105,3

2024

124,3

PaaS

2016

2,3

2017

3,2

2018

4,3

2019

5,1

2020

6,1

2021

7,4

2022

8,9

2023

10,8

2024

13,1

Total

2016

42,5

2017

54,6

2018

68,8

2019

83,4

2020

99,7

2021

120,5

2022

145,8

2023

176,1

2024

212,9

Number of Yandex Plus subscribers by year, million people

| 2018 | 0,9 |

| 2019 | 2,7 |

| 2020 | 7,9 |

2018

0,9

2019

2,7

2020

7,9

Long way to financial services

With such an abundance of services, it would be logical for Yandex to provide its users with financial services as well.: Firstly, this would be a good infrastructure solution, which would be used by other services of the company, Secondly, the financial sphere is quite important for a person, so it is a very important element for the ecosystem.

Yandex has long had a service of electronic money and payments "Yandex-money", but back in 2012 75% shares were sold to Sberbank, and in 2017, cooperation expanded and Yandex-Market became jointly owned. It seemed, that financial services will continue to develop as part of a joint venture with the help of banking developments, but in mid-2020, the companies restructured the business: by agreement of the parties, Yandex-Market returned to Yandex, and Yandex-Money went to Sberbank.

After that it seemed, that Yandex quickly found a new banking partner: in September 2020 announced negotiations to purchase 100% shares of TCS Group, but less than a month later the negotiations were terminated.

As a result, Yandex decided to develop financial services independently: registered trademarks in the banking, investment and insurance sectors, and more recently, spring 2021, launched the Yandex Pay payment service and agreed to buy a small Akropol bank to obtain banking licenses.

Financial indicators

Yandex has excellent financial performance: revenue is growing at an excellent pace, net profit is great, although it slowed down its growth, net debt is permanently negative and constantly growing in nominal terms, that is, the company has more and more money at its disposal.

The structure of revenue shows, that the main operating segment is still "Search and Portal", but the segment "Taxi" is actively catching up with him. A significant event took place in the first quarter of 2021: Search & Portal segment revenue for the first time was less than 50% in the overall structure of revenue - a clear success of the company's many years of work on business diversification! If you look from the point of view of EBITDA, then the gap between the “Search and Portal” segment is still huge, and most operating segments are unprofitable.

Revenue, net profit and net debt by year, billion rubles

| Revenue | Net profit | net debt | |

|---|---|---|---|

| 2016 | 75,9 | 14,1 | −44,3 |

| 2017 | 94,1 | 15,4 | −47,9 |

| 2018 | 127,7 | 22,1 | −68,8 |

| 2019 | 175,4 | 23,5 | −88,3 |

| 2020 | 218,3 | 21,0 | −154,9 |

| 2021 | 73,1 | 2,2 | −145,1 |

Revenue

2016

75,9

2017

94,1

2018

127,7

2019

175,4

2020

218,3

2021

73,1

Net profit

2016

14,1

2017

15,4

2018

22,1

2019

23,5

2020

21

2021

2,2

net debt

2016

−44,3

2017

−47,9

2018

−68,8

2019

−88,3

2020

−154,9

2021

−145,1

Revenue by operating segments by years, billion rubles

| Search & Portal | Taxi | "Yandex Market" | Media services | Verticals | Other business units and initiatives | |

|---|---|---|---|---|---|---|

| 2016 | 69,3 | 2,3 | — | 0,6 | 1,3 | — |

| 2017 | 82,4 | 4,9 | — | 1,2 | 2,1 | 1,8 |

| 2018 | 101,0 | 20,7 | 1,7 | 1,9 | 3,7 | 4,2 |

| 2019 | 121,5 | 45,6 | — | 3,9 | 5,4 | 7,9 |

| 2020 | 124,3 | 68,0 | 13,9 | 7,8 | 5,8 | 11,9 |

| 2021 | 35,1 | 26,6 | 7,3 | 3,5 | 1,8 | 4,7 |

Search & Portal

2016

69,3

2017

82,4

2018

101,0

2019

121,5

2020

124,3

2021

35,1

Taxi

2016

2,3

2017

4,9

2018

20,7

2019

45,6

2020

68

2021

26,6

"Yandex Market"

2016

—

2017

—

2018

1,7

2019

—

2020

13,9

2021

7,3

Media services

2016

0,6

2017

1,2

2018

1,9

2019

3,9

2020

7,8

2021

3,5

Verticals

2016

1,3

2017

2,1

2018

3,7

2019

5,4

2020

5,8

2021

1,8

Other business units and initiatives

2016

—

2017

1,8

2018

4,2

2019

7,9

2020

11,9

2021

4,7

Adjusted EBITDA by operating segments by year, billion rubles

| Search & Portal | Taxi | "Yandex Market" | Media services | Verticals | Other business units and initiatives | |

|---|---|---|---|---|---|---|

| 2016 | 28,4 | −2,1 | — | −0,4 | −0,0 | — |

| 2017 | 37,7 | −8,0 | — | −0,4 | 0,0 | −2,2 |

| 2018 | 48,4 | −4,7 | — | −0,8 | −0,2 | −3,1 |

| 2019 | 57,6 | 0,1 | — | −2,2 | 0,3 | −5,0 |

| 2020 | 60,0 | 3,4 | −4,1 | −3,7 | 1,1 | −7,3 |

| 2021 | 16,4 | 3,7 | −6,5 | −1,3 | 0,4 | −2,4 |

Search & Portal

2016

28,4

2017

37,7

2018

48,4

2019

57,6

2020

60,0

2021

16,4

Taxi

2016

−2,1

2017

−8,0

2018

−4,7

2019

0,1

2020

3,4

2021

3,7

"Yandex Market"

2016

—

2017

—

2018

—

2019

—

2020

−4,1

2021

−6,5

Media services

2016

−0,4

2017

−0,4

2018

−0,8

2019

−2,2

2020

−3,7

2021

−1,3

Verticals

2016

−0,0

2017

0

2018

−0,2

2019

0,3

2020

1,1

2021

0,4

Other business units and initiatives

2016

—

2017

−2,2

2018

−3,1

2019

−5,0

2020

−7,3

2021

−2,4

Share capital

Like some foreign technology companies, Yandex has several classes of shares:

- Class A - one vote.

- Class B, owned by founders and former employees, which can be sold, only by converting to class A, — 10 of votes.

- Class C - technical class of shares, required to convert class B shares to class A shares.

With this shareholding structure, the company, On the one side, large free float, which helps to have a fairly large weight in stock indices, on the other hand, control of the company remains with the founders.

Besides, due to the strategic importance of Yandex, they have invented special mechanisms against unwanted takeovers: first, in 2009, they issued a "golden share" and transferred it to Sberbank, as a state, public and having no interests in IT- and media areas of the company. The owner of this share had the right to veto the action, which lead to the concentration in one hand of a package of more than 25% company shares. At the end of 2019, we decided to change this mechanism a little.. Proposed to create a Public Interest Fund, including both representatives of the top management of "Yandex", and representatives of universities and non-governmental organizations.

Fund's rights are similar, but broader, than the owner of the "golden share": nominate 2 from 12 members of the board of directors, veto the consolidation of more 10% company shares, transfer personal data of users or significant intellectual property to anyone. In 2020, the fund council was formed from 11 human, entered there, in particular, head of Gazprom Neft Alexander Dyukov, Head of the RSPP Alexander Shokhin and Dean of the Faculty of Biology of Moscow State University Mikhail Kirpichnikov.

Also worth mentioning, that a year ago the company issued convertible bonds, so in 2025 the shares may become a little more, but not a fact, since they can be redeemed as class A shares, and money - at the choice of the company itself.

Share capital structure in percent

| Economic share | Voting share | |

|---|---|---|

| Family Trust CEO Arkady Volozh | 8,67 | 45,48 |

| The rest of the top management | 0,85 | 0,45 |

| Former employee Vladimir Ivanov | 3,33 | 6,16 |

| Capital Group Companies | 9,91 | 5,21 |

| Invesco Limited | 8,10 | 4,26 |

| FRM LLC | 4,59 | 2,41 |

| Free float | 64,55 | 36,03 |

Economic share

Family Trust CEO Arkady Volozh

8,67

The rest of the top management

0,85

Former employee Vladimir Ivanov

3,33

Capital Group Companies

9,91

Invesco Limited

8,10

FRM LLC

4,59

Free float

64,55

Voting share

Family Trust CEO Arkady Volozh

45,48

The rest of the top management

0,45

Former employee Vladimir Ivanov

6,16

Capital Group Companies

5,21

Invesco Limited

4,26

FRM LLC

2,41

Free float

36,03

Why stocks can go up

Successfully diversifying growth company. Yandex is one of the few growth companies in the Russian stock market in its classical sense: excellent revenue growth, no dividends - all funds go to further business development. At the same time, Yandex boasts well-established internal processes for launching new services, which has been successfully proven over the years, - there is reason to believe, that the ongoing business diversification will continue successfully.

Interesting sector. Technology businesses are extremely popular these days., Consequently, expensively priced. And it's no wonder, because this sector combines technologies and innovations that excite the minds of investors, as well as high business margins due to relatively low capital costs. In addition, in Russia the technology sector is represented by just a few companies., so it’s quite difficult for those who want to invest in it to pass by Yandex shares.

Compared to virtually the only obvious public competitor in the sector, Mail.ru, - then Yandex significantly outperforms it in terms of financial performance: ROE higher, constant profit, larger negative net debt.

Why stocks might fall

Very expensive estimate. Certainly, growth companies are always quite expensive, but, as they say, it's an honor to know: "Yandex" is really very expensive by the multiplier P / E. Such an expensive valuation is due, among other things, to the rapid growth of the company's share prices - almost twice - in a short period from May to September 2020. This happened against the backdrop of investor interest in the technology sector due to the coronavirus pandemic., due to expectations, actually, due to heavy weighting in the MSCI Russia index and negotiations to acquire TCS Group.

Don't forget, that the worst thing for growth companies is a slowdown in growth, which can lead to serious collapses of quotations, But Yandex has many strong competitors in all major business segments. Only a part of them: Google, Ozone, Avito and Sberbanks building their ecosystems, Mail.ru, Tinkoff, MTS.

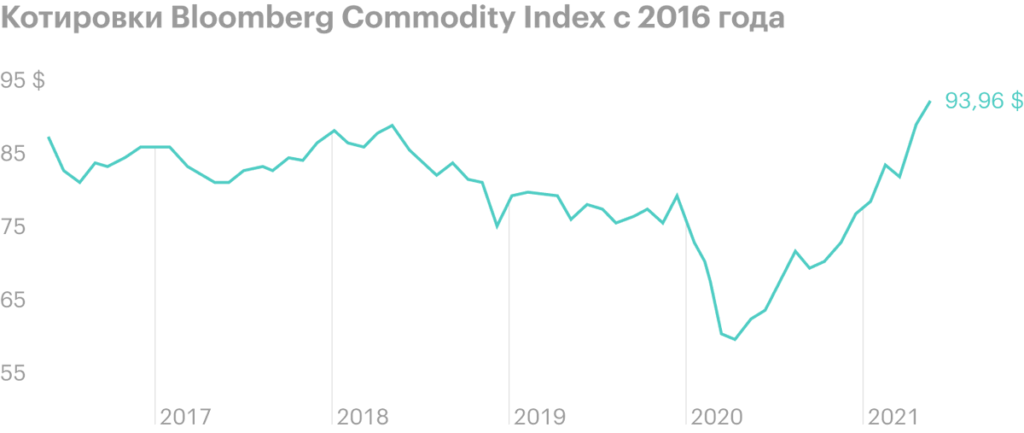

Possible change of the economic supercycle. Inflation has risen a little lately, what we have already discussed a little in the article about the Segezha IPO, and almost all commodities showed a noticeable increase in prices. For example, based on the futures prices of various commodities, the Bloomberg Commodity Index has grown significantly over the past year and is at five-year highs.

Maybe, we are now on the verge of a new commodity supercycle, characterized by the dominance of shares in the real sector of the economy. But in recent years, technology companies have dominated the global stock market.. If the really economic supercycle is changing, then money can begin to flow from overvalued technology companies to undervalued companies in the real sector, in particular in raw materials, - and then Yandex quotes can be seriously affected.

Political risks. Worth considering, that "Yandex" in some way is between two fires. On the one side, acting as a strategic company for Russia, he may sooner or later become a victim of an analogue of the Gorelkin bill and will be forced to change the registration of the parent holding to the Russian one - we recall the fall in quotations due to the news about this bill. On the other hand, trading on the Nasdaq, the company may in any way become a victim of US sanctions.

Yandex multipliers by years

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| 2017 | 40,7 | 18,5% | −1,65 |

| 2018 | 28,8 | 12,1% | −1,74 |

| 2019 | 37,8 | 12,1% | −1,73 |

| 2020 | 73,2 | 6,4% | −3,11 |

| 2021 | 85,2 | 5,5% | −3,02 |

P / E

2017

40,7

2018

28,8

2019

37,8

2020

73,2

2021

85,2

ROE

2017

18,50%

2018

12,10%

2019

12,10%

2020

6,40%

2021

5,50%

Net debt / EBITDA

2017

−1,65

2018

−1,74

2019

−1,73

2020

−3,11

2021

−3,02

Multipliers of "Yandex" and Mail.ru for 1 Quarter 2021

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| «Yandex» | 85,2 | 5,5% | −3,02 |

| Mail.ru | — (lesion) | — (lesion) | −1,08 |

P / E

«Yandex»

85,2

Mail.ru

— (lesion)

ROE

«Yandex»

5,50%

Mail.ru

— (lesion)

Net debt / EBITDA

«Yandex»

−3,02

Mail.ru

−1,08

Eventually

Yandex is a great business with excellent growth rates, at the same time profitable and financing new projects at its own expense. It has long ceased to be just an IT business, making money from advertising, but penetrated into many areas of people's lives and begins to penetrate into the financial sector, so the company still has a lot of growth points.

But this success is visible to many market participants, in addition, the technological sphere is now extremely popular - Yandex is simply indecently expensive by Russian standards.