Workday (NASDAQ: WDAY) — manufacturers of software for personnel and financial management in the enterprise. Company business on the rise, but there is one big "but": the company is unprofitable and stands as a wing of the aircraft. So,, shares beg for correction.

What's going on here

In the comments to the Roku analysis, our reader Alexander Titov asked: "Tell, and analysis of the company is planned, whose stocks are likely to fall?» In the case of today's issuer, the probability of correction seems to be very high.

How do Workday earn

It is a cloud platform, where enterprises are given access to software to manage the following processes in the enterprise:

- accounting and expense management;

- personnel Management;

- business analytics;

- planning of the company's operating activities.

What does this software look like in action?, can be seen in this video. The company's revenue is divided into two segments:

- Subscription - 87,84%. Segment gross margin — 82,35% from its proceeds. This, actually, company software access fee.

- Professional Services - 12,16%. Unprofitable segment: the cost price here exceeds the revenue by 5,58%. In this segment, the company provides clients with software installation and optimization services., as well as staff training.

Clients come to the company from a variety of industries: it's not just commercial, but also educational and government institutions.

Geographically, the company's revenue is distributed as follows: 75,18% — USA, 24,82% - other unnamed countries.

The company is currently unprofitable.

Annual revenue, company profit and margin as a percentage of Workday

| Revenue, billion $ | Net income, million $ | Profit Margin | |

|---|---|---|---|

| 2017 | 2,14 | −321,22 | −15% |

| 2018 | 2,83 | −418,26 | −14,78% |

| 2019 | 3,62 | −480,67 | −13,27% |

| 2020 | 4,30 | −282,43 | −6,57% |

What plays into the hands of Workday

The company's revenue is constantly growing and ahead of forecasts, what two trends help. Moreover, these trends surprisingly contradict each other..

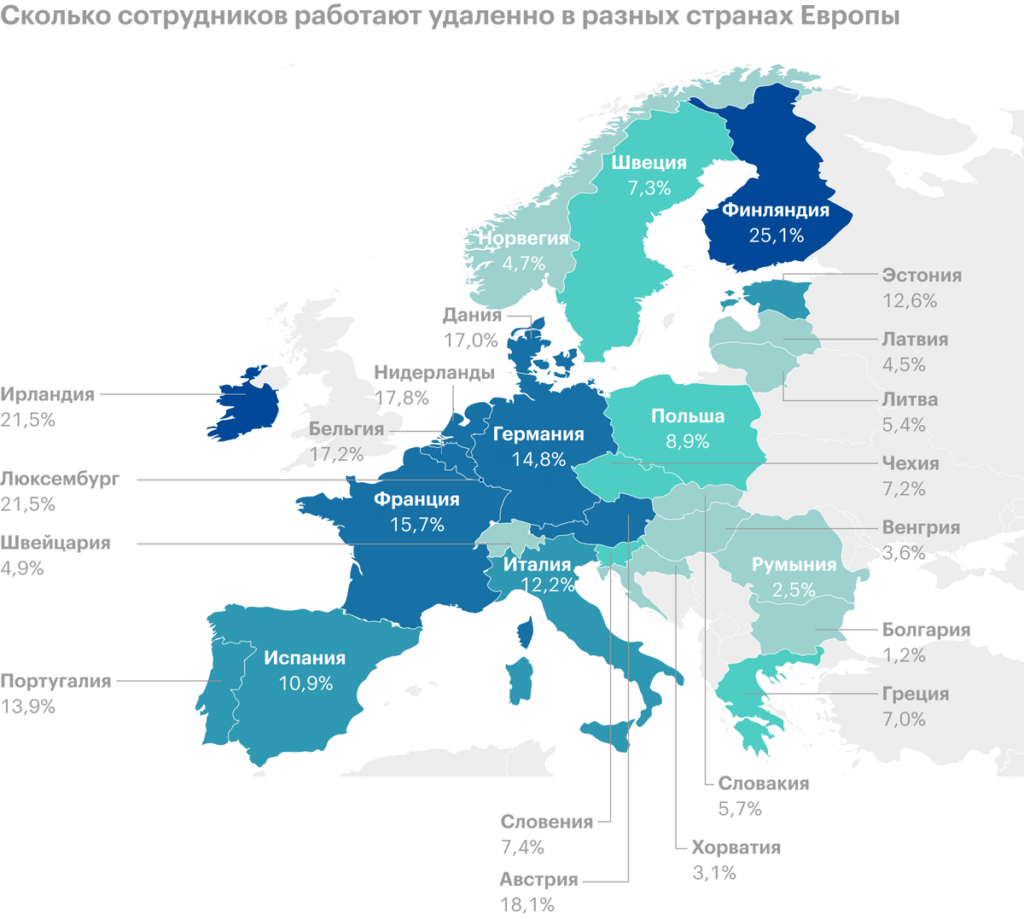

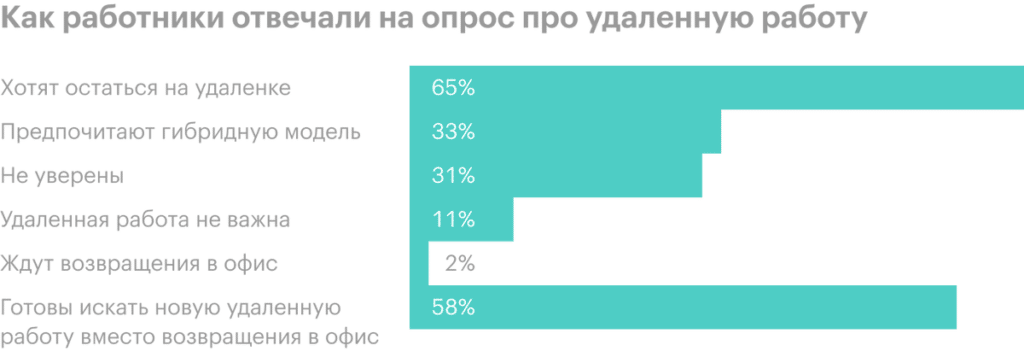

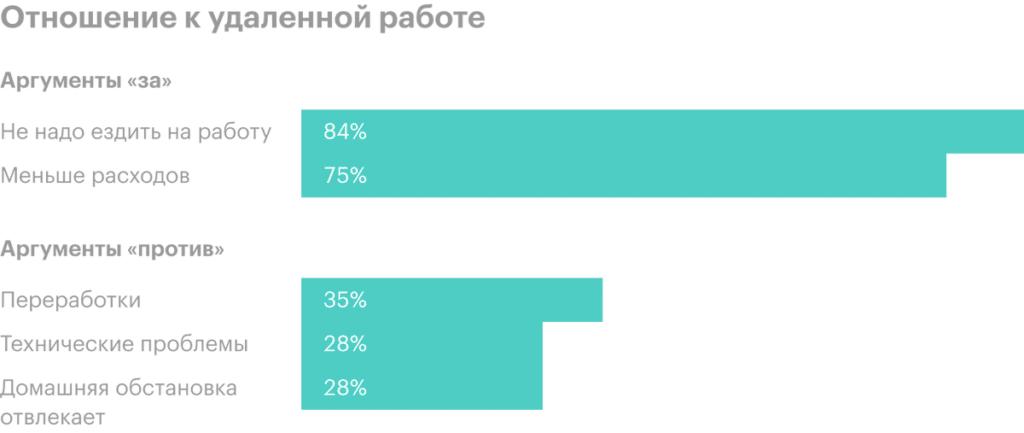

First trend. This is the rise in remote employment. At all, for Workday, the whole story with the coronacrisis did not mean any bonuses - and even vice versa: the decline in employment and activity in most enterprises did not bode well for the company, making software for HR and accountants. However, this story had a flip side.: isolation and quarantine forced most enterprises to start moving operations to the online sphere, which spurred demand for Workday software even in a technical recession. So in the end, the company was able to increase revenue by spreading remote work around the world.. AND, seems to be, remote will stay with us for a long time, although it has its problems and challenges.

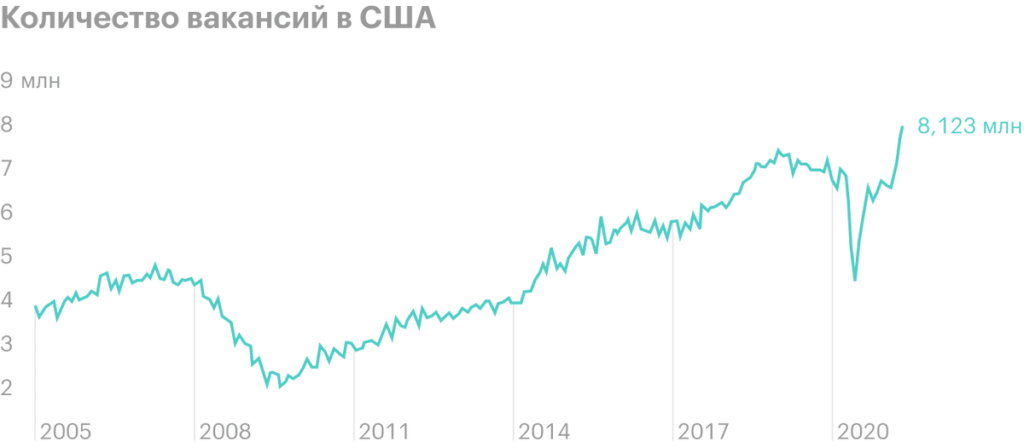

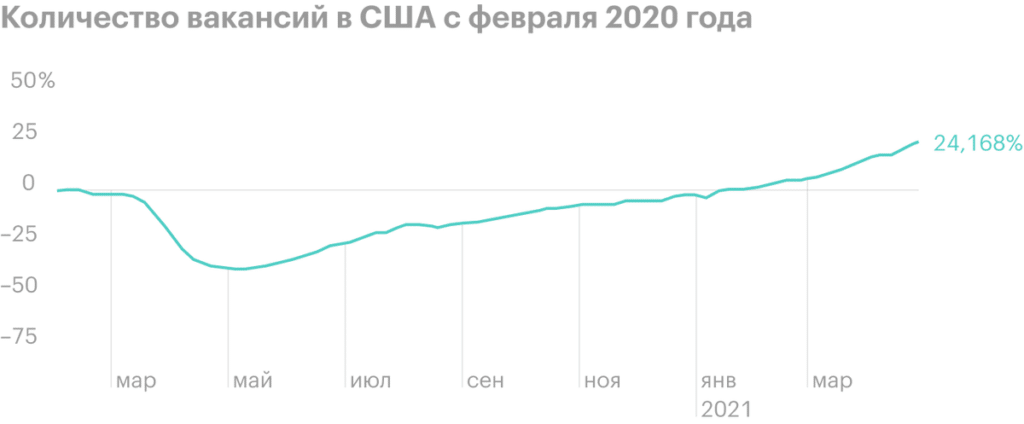

Second trend seasonal. The American economy is starting to bounce back, and this translates into an increase in the number of vacancies. Consequently, we can expect an increase in demand for the company's software from those, whose main operational activity takes place offline.

So here the company looks protected from both flanks..

Also a plus is that, that the profit situation there is gradually improving: in the last quarter, the operating loss was already 3,3% from proceeds - against 14,2% in the same period a year earlier.

Quarterly revenue, company profit and margin as a percentage of Workday

| Revenue, billion $ | Net income, million $ | Profit Margin | |

|---|---|---|---|

| 2017 | 1,06 | −28,02 | −2,65% |

| 2018 | 1,10 | −24,34 | −2,21% |

| 2019 | 1,13 | −71,71 | −6,36% |

| 2020 | 1,17 | −46,52 | −3,96% |

Why Stocks May Fall Workday

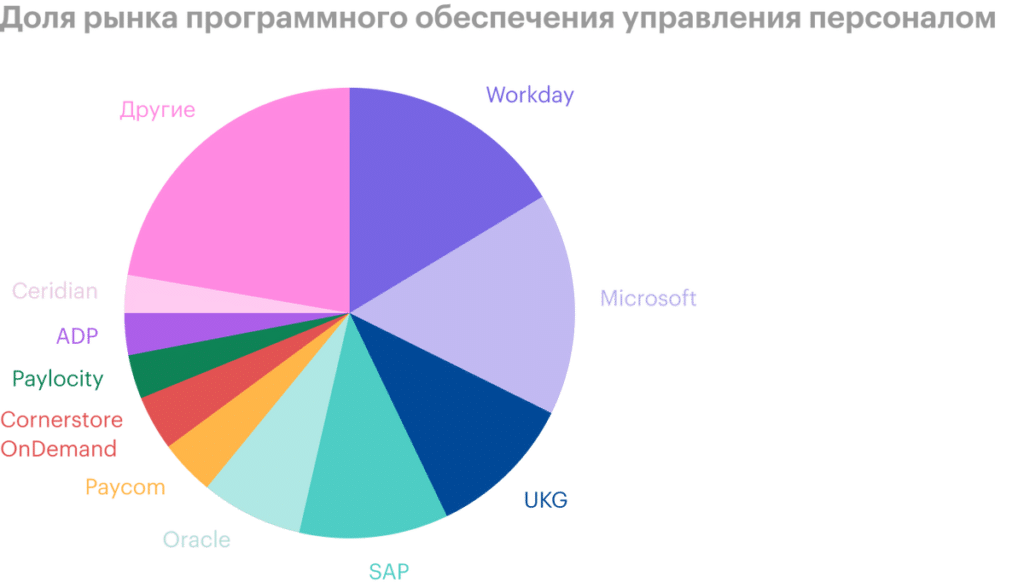

Workday's mainstream market has capacity 18 billion dollars. And its capitalization - 55,95 billion dollars, despite the fact that the company does not occupy even half of this market.

If you are as sympathetic as possible to the company, then one can be far-fetched with such an argument in its favor: allow, that its target market in the broadest sense is approximately 81 billion dollars. But even in this case, the company will look prohibitively expensive - then it will turn out, what does it take about 5% from your market, and costs almost 70%. And that, Workday is also unprofitable.

In my opinion, unprofitability and disproportionate value may be appropriate in the case of companies with a much smaller capitalization: in the region of 4-5 billion dollars, when their overvaluation is not evident. Но Workday, remaining a loss-making startup, stands like a serious big company. And given the price, I wouldn't hope, that someone will buy the company: it costs unrealistically expensive. Although, certainly, there is always an opportunity, that some Microsoft will buy a company - after all, Bill Gates' company tried to buy terrible Pinterest for about the same money. But in the case of Workday, this possibility seems extremely unlikely to me..

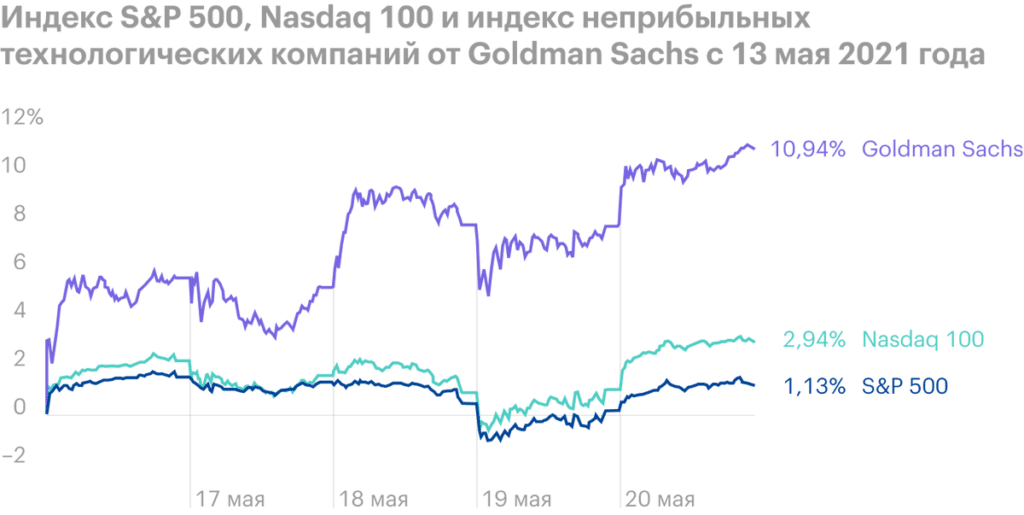

On that, that Workday will continue to grow at the expense of investors, I wouldn't count: the company is too expensive, so that the group from Reddit can speculatively pump these stocks.

So I think, that the company's shares should fall, and fall hard. No scientific calculations will help in this case - for a loss-making company, any figure can be taken from the ceiling.

But given the stubborn love of investors for these shares, I don't think, that stocks will be allowed to fall below 135 $. Therefore, catching Workday is somewhere in these limits.. It's going to happen., according to my calculations, during the next stock market correction, which always happen unexpectedly. As always in such cases, the first whip goes to unprofitable overvalued companies, and Workday is undoubtedly such. Even taking into account the possibility of the company reaching a profit in some indefinite future, Workday trite costs more, than it should.

Resume Workday

Workday is a horrendously overpriced company, you can invest in which you can only after a drop in quotes in order to make money on a rebound. I would take these shares for 135 $ with the prospect of a rebound to 175 $ during 15 Months, following the fall.