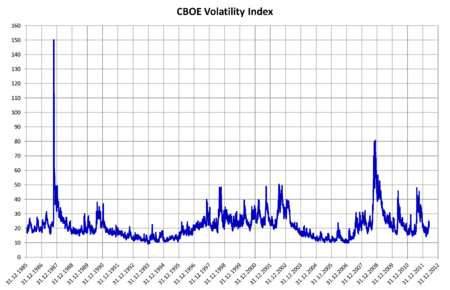

VIX fear index – shows the state of the market, his direction and mood. The regularity of the indicator is as follows, what when the market falls, volatility index is growing, and when the market grows, volatility index is decreasing.

VIX Index – ticker symbol for the Chicago Option Exchange Volatility Index, popular measure of implied instability S&P 500 index options. High value corresponds to a more volatile market and therefore more expensive options, which can be used, to pay the risk of volatility. If investors see high risks of price changes, they will demand, for a large premium to insure against such a change, selling variants. Often called the Fear Index, this represents one measure of market expectations for volatility over the next 30 day period.

VIX computed and distributed in real time Опционной exchange in Chicago. This – a weighted mixture of prices for a range of options on S&P 500 indices. The formula uses a kernel smoothed evaluator, which takes as inputs the current market prices for all claims “из денег” and places for the front month and second month expirations. [2] цель состоит в том, to estimate the implied instability S&P 500 indices for the next 30 days.

BARELY – the square root of the exchange rate for the forward trades parity difference for a 30-day term, started today. Отметьте, what are these vix – variability of the exchange of DIFFERENCE and the wrong of exchange of VARIABILITY (vol be the square root of var). The difference exchange can be perfectly statically copied across vanilla, places and calls, whereas the exchange of volatility requires dynamic hedging. These VIX – risk neutral expectation of volatility S&P for the following 30 calendar days. These VIX quoted on an annualized basis of the difference.

VIX replaced senior VXO as preferred volatility index, используемый СМИ. VXO still has a lot of value, though, since VXO diagrams show much longer, исторический schedule time than VIX.

VIX is quoted in terms of percentage points and translates, about, to the expected movement in S&P 500 indices for the next 30-day period, on an annualized basis. For example, if these VIX in 15, this represents the expected annualized change 15 % over the next 30 days; thus you can deduce, what index option markets expect, that S&P 500 will move or down ![]() за следующий 30-дневный период. In this way, index options are priced at 68% probability (one standard deviation), that the quantity S&P 500's 30-day return will be less than 4.33 % (or down).

за следующий 30-дневный период. In this way, index options are priced at 68% probability (one standard deviation), that the quantity S&P 500's 30-day return will be less than 4.33 % (or down).

Rate options for premium trades and option for sale can be used, to compute the implied instability, because variability – one of the factors, используемых, to calculate the value of these options. Above (or below) the variability of the underlying security makes the choice larger (or less) ценным, as there is more (or less) probability, that the choice will expire in money (то есть с рыночной стоимостью выше ноля). Thus, a higher premium rate implies greater volatility., при прочих равных условиях.

Investors believe, that the high value of the VIX translates into a high degree of market uncertainty, while low VIX value is compatible with greater stability.

Although these VIX are often referred to as “индексом страха,” a high VIX is not necessarily bearish for Shares. Instead, this VIX is a measure of fear of volatility in any direction., including to the top. In practical terms, when investors expect more volatility upside, they do not want to sell stock options “requirements” верха, unless they get a big bonus. Choice buyers will be willing to pay such high premiums, only if the same big top warning moves. The resulting set of price increases “на требование” stock option top raises the VIX in the same way, how does cumulative growth in “placed” downside selection premiums, which happens, when choice buyers and sellers expect a likely sharp downside move. That, when the market, it is believed, just as likely takes off, to plummet, composing any choice, which will cost the author in the event of a sudden large movement in any direction, may look equally dangerous. Hence high VIX readings mean, that investors see significant risk, that the market will move dramatically, or down or up. Highest VIX readings occur, when investors expect, that huge steps in any direction are likely. Только то, when investors do not feel any significant downside risk, no significant limiting potential, will vix be low.

Черная-Scholes формула – quantifying that, how the value of choice depends on the volatility of underlying holdings.

How the VIX is calculated

VIX is calculated and issued by the Chicago Board Options Exchange in real time. Theoretically, this is a weight mixture of prices for a number of options in the S index&P 500. 26 Martha 2004 the first trading of VIX futures on the CBOE futures exchange began (CBOE Futures Exchange, CFE). With 24 February 2006 of the year it became possible to exchange VIX option contracts. Several exchange-traded funds (Exchange Traded Fund, ETF) track its result. The formula uses the kernel smoothing function, which has the current market prices of all out-of-the-money calls and put options at the entry with expiration in the next and next month. The goal is, to estimate the implied volatility of the S index&P 500 на следующие 30 days.

VIX is calculated as the square root of the value of the swap rate fluctuation for a 30-day period, starting today. Notice, that the VIX is the volatility of the swap change, not swap volatility (volatility, which is the square root of change or standard deviation). Swap changes can be fully statically duplicated through a simple put and call., whereas the volatility of the swap requires dynamic hedging. VIX - square root of risk-neutral expectation of fluctuations S&P 500 на следующие 30 calendar days. VIX is quoted as standard deviation, пересчитанное на год.

VIX replaces the older VXO as the preferred volatility index, используемого СМИ. VXO was a measure of implied volatility, which was calculated, using 30-day options at your own (at-the-money) on the index S&P 100.

Interpretation

VIX is measured as a percentage and approximates the expected movement in the S index&P 500 на следующий 30-дневный период, which is then recalculated for a year. For example, if VIX is 15, it corresponds 15% annual expected change. For example, suppose, that the index options markets are expecting a move S&P 500 down or up by 15% / √ 12 = 4.33% за следующий 30-дневный период. In this way, index options are assessed with probability 68% (one standard deviation), that the magnitude of the change in S&P 500 behind 30 days will be less 4.33% (up or down). Call and put prices can be used to calculate implied volatility, because volatility is one of the factors, used to calculate the value of these options.

Более высокая (или низкая) the volatility of the underlying security makes the option more (или менее) ценным, because there is a large (или меньшая) probability, that the expiration of the option will happen in the money (то есть с рыночной стоимостью выше нуля). In this way, a higher option price implies more volatility, ceteris paribus. Even though, that VIX is measured as a percentage, not in dollars, there are many derivatives, VIX-based, including:

- – VIX futures contracts, which began to be traded in 2004 year;

- – VIX exchange options , which started trading in February 2006 of the year;

- – VIX futures, based on exchange-traded bonds and exchange-traded funds, such as:

- – VIX S short-term futures&P 500 ETN (NYSE: VXX) and temporary VIX S futures&P 500 ETN (NYSE: VXZ), launched by Barclays iPath in February 2009 of the year;

- – VIX S&P 500 ETF (LSE: VIXS) launched by Source UK Services in June 2010 of the year;

- – short-term VIX ETF futures (NYSE: VIXY) and temporary VIX ETFs (NYSE: VIXM) launched by ProShares in January 2011 of the year.

Similar indexes for bonds include MOVE indexes, LBPX. Although the VIX is often referred to as "индексом страха», a high VIX does not necessarily mean, that stocks are falling.

Actually, VIX is a measure of market perceived volatility in any direction, including upward movement. On practice, when investors expect more volatility up, they are reluctant to sell potential rising call options on stocks without a large premium. Option buyers would be willing to pay such a high premium, only if a big upward movement is expected.

Resulting cumulative increase in rising stock call option prices drives VIX higher, similarly, as the cumulative increase in the premiums on the put options of falling stocks, which is happening, when option buyers and sellers expect a likely sharp drop. When it is believed, what the market, probably, will take off or plummet, writing any option for the option seller can be equally dangerous in the event of a sudden large move in any direction.

Consequently, high VIX means, that investors see significant risk in, that the market will plummet or rise. Highest VIX occurs, when investors expect, that huge movement is possible in any direction. Only when investors feel no significant downside risk, no significant lifting potential, VIX will be low.

Black-Scholes formula (Black–Scholes)

uses a stock price dynamics model to, to evaluate, how the value of an option depends on the volatility of the underlying assets.

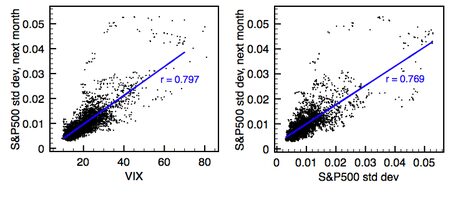

VIX Results (left) compared to past volatility (справа) as a prediction of volatility on 30 days, for the period January 1990 – сентябрь 2009 G. Volatility is measured as the standard deviation of overnight income S&P500 per month. Blue lines indicate linear regression, leading to the shown correlation coefficients r. Notice, that the VIX has virtually the same predictive power, as past volatility, since the shown correlation coefficients are almost identical.

Critical remarks

Despite the complex structure, critics claim, that the predictive power of most volatility forecasting models is the same as for simpler methods, such as just past volatility. However, other works objected, that these critics did not correctly implement complex models. Some practitioners and investment managers, seems, completely ignore or reject volatility prediction models.

For example, Nassim Taleb (Nassim Taleb) superbly titled one of his articles in the Journal of Portfolio Management: “We do not quite understand what we are talking about., when we talk about volatility ".

In similar notes, Emanuel Derman (Emanuel Derman) expressed his disappointment with the sheer number of proposed empirical models, which are not fixed by theory. He claims, that while “with the help of theories, they are trying to reveal the hidden principles, justifying the world around us, like Albert Einstein (Albert Einstein) with his theory of relativity ", we must remember, that “models are metaphors, Analogy, who describe some things through others ".

Timeline of some key events in the history of the VIX Index:

- 1987 year - the volatility index was proposed in an academic article by Professors Menachem Brenner and Dan Galai, published in the "Financial Analysts Journal" for July / August 1989 of the year. Brenner and Galai wrote, that “Our volatility index, named Sigma Index, will be updated frequently and used as the underlying asset for futures and options… The volatility index will play the same role, what the market index plays for the options and futures index ".

- 1992 year – American Stock Exchange announced, that she is preparing a feasibility study for the volatility index, proposed as "Sigma Index". “The Sigma Index will be the underlying asset for futures and options, which investors will use to hedge against the risk of changes in volatility in the stock market ".

- 1993 year – 19 January 1993 of the year, the Chicago Board Options Exchange held a press conference to announce the launch of the real-time recording of the CBOE Market Volatility Index or VIX.

- The original formula for the VIX was developed for the CBOE by Professor Robert Waley and was based on the option prices of the CBOE S index&P 100 (OEX).

- 2003 year – CBOE Provides More Detailed Methodology for VIX. Working with Goldman Sachs (Goldman Sachs), CBOE refined further computational methodologies and revised the core index CBOE S&P 100 (OEX) на CBOE S&P 500 (SPX).

- 2004 year – 26 Martha 2004 the first ever trading of VIX futures on the CBOE futures exchange began (CFE).

- 2006 year - VIX Options launched in February 2006 of the year.

- 2008 year – 24 October 2008 of the year VIX hits an intraday high 89.53.

- Между 1990 year and October 2008 year the average VIX was 19.04. IN 2004 And 2006 years, respectively, VIX futures and VIX options, were named "Most Innovative Index Product".

- Майкл Харрис (Michael Harris) objected, that the VIX is simply tracking price reversals and as a result has no predictive power.