We have three options:

1. Options IT have a high likelihood of execution, low liquidity and, the most important thing, a very small fraction of the time value in the option price. Therefore, it is ineffective to sell these options..

2. Options ATM characterized by maximum time value and, Consequently, maximum profit potential. The most risky selling option, but quite possible. If there is understanding, how to defend a position, sufficient supply of free funds, then you can consider this option for sale.

3. Options OTM, in my opinion, the most comfortable selling option, because. provide some reserve of the BA against your position. For example, when selling a Call option on a futures on Sberbank shares with a strike 16 000 and the current BA price - 15 600 rubles, the price of this security should rise more than, than on 4 ruble, so that there is a loss on our position. Ie. in fact, we have three scenarios for making a profit:

BUT) decrease in BA

B) consolidation its at the current level (lateral market movement)

IN) rise of a futures before a sell strike

Despite lower risk compared to ATM options, this does not change the fact, that this sale option still requires protective measures. On one hope, that the market will not reach the sell strike, it is impossible to build any serious work with short positions in options.

Choosing a specific OTM strike to sell

Choosing a specific “off-the-money” strike, ie. its distance from the current futures price, can be carried out based on the analysis of the BA graph, choosing a specific price level, which in your opinion the market will not overcome.

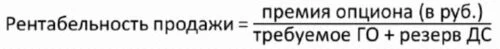

I prefer to choose a sell strike based on this characteristic., how profitability:

Option premium - price, at which we sell the option

The required GO when selling an option of a specific strike can be found in the trading terminal., either in the used analytical service or program.

I recommend having a cash reserve for this position in the amount of at least 2-3 rubles for one ruble, invested in guarantee.

Profitability of selling “non-cash” options depending on the strike

Let's admit,

BA - futures on the RTS index

Current BA price - 98 370 points

Expiration – across 41 day

Trading account size - 100 000 rub.

The maximum size of a GO for sale - 27%

Cash reserve - 3 ruble per ruble

conclusions:

1. Selling OTM options more efficiently with strikes, not too far from the current BA price. It is these strikes that have the maximum profitability.. If the probability of profit is more than 50% you can claim profitability of the order 3-5% per month, subject to the limit on the cash reserve.

2. Selling distant “off-cash” options has a minimal profitability due to the very low premium of these options. To get any reasonable return, you need to sell them in much larger quantities, thereby increasing investments in collateral and reducing the amount of free funds.

Selling in this way is one of the biggest mistakes when working with options.. Some investment companies fire traders for this (can you believe me). The fact, that similar positions, despite the low probability of the option “in the money” going to expiration, are overly risky:

BUT) exceeding the GO limit will sooner or later lead to the loss of the trading account;

B) these options (as we know from the previous material) have maximum leverage, and their value will grow very strongly when the market moves in the direction of the strike. Even a relatively small change in the market against your position can lead to, that the current loss on the position will be greater than the expected profit.

For example, sold Call strike 115 000 on 110 points (or 140 rubles). Current BA price - 98 370 (+16 630 points before the sale strike).

Market grows in a week, allowable, on 5% (to 103 289 points). At the same time, our options rise in price up to 300 points (or 390 rubles), bringing us a current loss 250 rubles per option, ie. already almost in 2 times more, than our potential profit per position.

If the market rises by the same 5%, for example, in a shorter time after opening a position, then the current loss will exceed the expected profit even more times.