Now let's outline the basic rules for selling options, focusing on the entrance, creation and time spent in these positions.

Entering a position

It makes sense to sell options if, when you do not expect a strong market movement in one direction</b>. Do not expect strong market growth - sell Call options, do not expect a strong decline in the market - sell Put options. Everything is simple here.

The most important thing, as we noted above, have an adequate supply of free funds, to withstand a potential increase in collateral and be able to defend your position in a negative scenario.

I highly do not recommend investing in guarantee collateral for sold options. more 25-30% from your trading account. Ie. with a deposit of 100 000 rubles - the maximum GO for your uncovered options should not exceed 25 000 – 30 000 rubles.

Highly often come across recommendations to sell options on 70-80% on the size of the trading account. Do not do this under any circumstances.. This is a very aggressive option trading option., which is fraught with big problems for your wallet.

Position creation

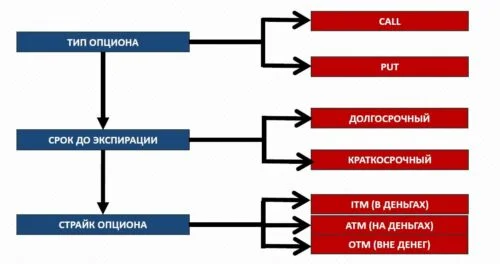

Option type

We can sell Call (in counting, that the BA price will not rise above the sell strike) or Put (in counting, that the BA price will not fall below the sell strike, taking into account the option premium).

Which is more efficient?

We previously noted, that buying a Put option can be more efficient, than buying a Call option due to the asymmetric dynamics of the stock market, and due to the impact of changes in market volatility on our position.

Obviously, that for the same reasons Selling a Put option can be more dangerous than selling a Call. As we noted above, increased market volatility negatively affects both positions, but her strong growth, usually, occurs at the time of a landslide fall in the market.

Selling option Put, we are losing money on reducing BA, and the resulting In most cases the general increase in market volatility gives us an even greater loss on the position.

Selling Call Option, we are losing money on the growth of BA, but lower volatility, which is usually (I emphasize, not always) accompanies the growth of the instrument works for us and improves our financial performance in terms of position.

The most interesting, despite, that selling Put seems like a riskier strategy, warranty coverage for it below, than when selling a Call option (on equidistant strikes).

For instance, at the price of the December futures on PJSC Gazprom shares - 14 500 rubles:

when selling the October Put option strike 14 000 (on 500 rubles OTM) - GO = 1 742 rub.

when selling the October Call strike option 15 000 (on 500 rubles OTM) - GO = 1 841 rub.

In this example, this difference is small., but sometimes the GO for sold calls can be many times more.

This paradox has a perfectly understandable explanation..

For the exchange (I emphasize, specifically for the exchange), in terms of risks, a sold Call option is a riskier strategy, because. in the most negative scenario of the development of events, BA can grow to infinity (like your losses in theory), but only go down to zero. Risks up higher, than down - that's why the collateral for the sold Call options is always higher. At the same time, the trading experience seems to hint at the opposite..

This phenomenon is typical for the Russian options market., I have never seen anything like it on the American market.