Selling uncovered options is associated with three main risks:

1. Ba Movement Against Our Position (price risk)

2. Increased market volatility

3. Possible increase in the margin for the position

Note, what, as opposed to buying options, time works for us, not against. As we already know, when the expiration date approaches, options become cheaper (their time value decreases), what do we, naturally, on hand.

For example, back to our sold October Call option with a strike 105 000 points.

Today (behind 42 days before expiration) – 1 294 points

For 30 days (at the same futures price and volatility) – 908 points +386 points in the form of a variation margin

For 15 days - 375 points +919 points in the form of a variation margin

For 5 days - 42 item +1 252 item in the form of a variation margin

As experienced market participants say - a trend in the market may be, maybe not, and time goes one way anyway, depreciating options. This could be another reason for selling options..

But back to the risks.

BA movement against our position (price risk)

Obviously, sold option Call, BA growth is unprofitable for us, because. at the same time, our Call option will rise in price, and we will receive a loss in the form of negative variation margin.

Selling the Put option, a decrease in BA is highly undesirable for us for the same reason.

Price risk is the easiest to understand. But I would like to focus on one important issue., which is not always considered in the literature and other educational sources.

Non-linearity of loss

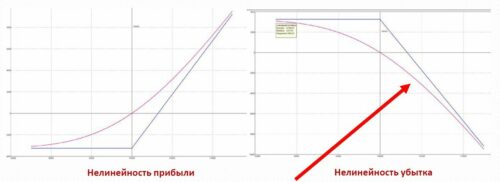

Let's compare the current position profiles of the bought and sold Call options..

As we see, when buying an option we have the so-called nonlinearity of profit - with a positive scenario of the development of events (straight to) we earn more, in a negative scenario (decrease in BA) - we lose less with the same amount of futures change. We talked about this in one of the previous lessons..

When selling an option we already have nonlinearity of loss. In a positive scenario (decrease in BA) we get less profit, in a negative scenario (straight to) we get more losses for the same change in the BA price.

It is seen, that with the growth of a futures on 5 000 points our loss will be -3 161 paragraph, and with a decrease in futures by the same 5 000 points profit will be only 1 973 item.

And, the stronger the range of changes in the BA price, the greater this difference. With the growth of a futures on 10 000 items loss -7 261 paragraph, and the profit with the same movement in the other direction is only 2 891 paragraph.

In this way, should be understood, what when the option is sold, the losses grow stronger, than profit with the same change in the BA price one way and the other.

Increased market volatility

With increasing volatility in the market, the likelihood of getting out into the money on purchased options increases and, respectively, options go up (with constant volatility and time to expiration).

For example, if we go back to our sold October strike option 105 000 points.

Today (with volatility 22%) – 1 294 points

With volatility 30% (at the same futures price and time) – 2 229 points -935 points in the form of a variation margin

With volatility 50% – 4 838 points -3 544 item in the form of a variation margin

With volatility 70% – 7 530 points -6 236 points in the form of a variation margin

It is seen, that the increase in volatility strongly affects the option price and, Consequently, by the amount of losses on our position. Many people forget about it, however, a significant loss when selling options can be obtained not only because of the strong movement of the BA against our position, but also as a result of increased market volatility.