When selling a Call option, our maximum profit is limited by the amount of the premium option, and our the risk is not limited in the event of an increase in the price of the underlying asset</b>.

We remember, that the buyer of the Call option earns on the growth of the market, respectively, selling option Call мы, in fact, we bet, that the growth of the underlying asset (futures) will not. This is an important note.!

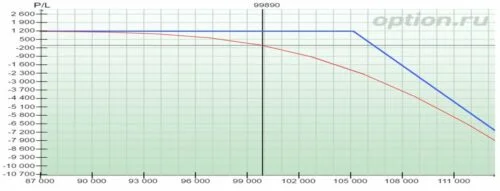

Let's illustrate it, looking at the profile of our position.

Turning to the October Options Board for the RTS Index Futures. Let's admit, current futures price 99 920 points. For example, we're deciding sell Call option strike 105 000. The price of our option is 1 180 points.

Let's draw the risk profile of this position now..

Obviously, what, if the BA at the expiration date does not overcome the strike of our option, ie. futures will not rise above the 105 000 points, then the buyer of this option (who has the right to buy futures at a price 105 000) it will be unprofitable to perform it, because. on the market he will be able to buy BA cheaper. In this case, our profit will be equal to the option premium, ie. 1 180 points.

At BA growth above the mark 105 000 points the option will be exercised, because. gives the right to buy futures cheaper, than its market price. But due to the fact, that we sold the option at the price 1 180 points, not free, then our loss will not arise immediately from the strike price, and above break-even points (strike + prize received), ie. above level in 106 180 points.

At BA growth above this mark we will have a loss, which the expiration linearly increases with further growth of the futures.

Conclusions on the position profile

1. As seen from the picture, when selling an option, we get a profit in the amount of a premium not only if, when:

– BA price changes in our direction (in this case, with a decline in futures);

– while maintaining the BA price at the current level(sideways market movement);

– when selling an OTM option when the futures move against our position(sale strike + prize gained).

As a matter of fact, we only lose money when there is a strong trend against us. Therefore, I made the remark earlier, what, selling the Call option we place a bet, that the BA price will not rise. (ie strike Call + prize received).

Obviously, what with from a mathematical point of view, the probability of making a profit when selling options is higher, than when buying options. Let me remind you, that when buying options, we get profit on expiration only in one variant - the movement of the BA in our direction above the break-even point. Yes, profit on selling options is limited, but it's still profit.

What's better - to receive most of the time limited and pre-known profits in the market or wait for your chance in an attempt to get much rarer, but also, maybe, a much greater return on option trading?

2. main reason, according to which traders bypass the sale of options by the side, is an unlimited position risk. Некоторые российские Brokers (especially banks) even prohibit the sale of options to their clients for this reason. But it must be understood, that when selling an option our expiration risk is equal to that of the underlying asset (i.e. futures). From that, how much the expiration futures price will rise, our total loss on a position when selling Call also depends.

But in theory, almost any transaction in the financial market is associated with unlimited loss. - for example, buying shares, currency, futures you have the same unlimited loss, if the market begins to decline after opening a position. Yes, this risk on a line instrument can be limited (for example, set stop orders), but when selling options, we can also control and neutralize our theoretical unlimited risk on the position.

I have repeatedly asked the representatives of these brokers - why do you prohibit clients from selling options?, but do not prohibit futures trading, despite having the same unlimited risk, but I never got a clear answer. I repeat again – the risk of selling an expiration option is equal to the risk of a futures.

Understandably, what if you don't know, how to manage the risks of these positions, it's too early for you to sell options in the market, but, if you are prepared, understand the risks and know how to neutralize them, I don't see any special problems here.

And what, if in this example we sell an option of another strike, for example, 115 000?

The price of this option of the same period for the same BA is 120 points.

When finding a futures below 115 000 points at the expiration date, the option buyer will not exercise it and will lose the premium, and our profit will be 120 rubles from one option. Breakeven point this position will be equal to the strike + premium = 115 120 points. With an increase in BA for expiration above 115 120 items we, as in the previous example, we will have a loss, which for expiration will increase linearly as the futures grows.

It is seen, which in the second case probability its failure (And, respectively, receiving us arrived) significantly higher, because. BA needs to grow much stronger. But also the amount of our remuneration (prize received) significantly less (120 points against 1 180).

The further we remove the sell strike of the Call option from the current BA price, the less will be our profit from the transaction, but also higher likelihood of getting it.

We will talk about selling very distant OTM options in the next lessons., when will we consider the issues of creating a position.