Let's take a look at the price chart of a “blue chip” stock such as Sberbank.. Let's admit, current share price 138,44 ruble.

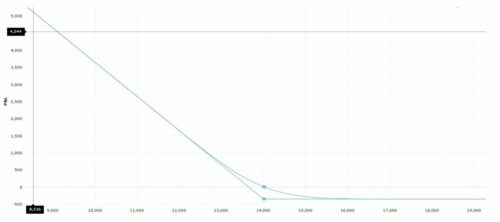

Seems, that after such a strong growth of the stock, a correctional movement is possible. To capitalize on a possible decline, we buy option Put on futures on Sberbank shares ATM with strike 14 000 by price 349 rubles.

After that, how we previously built an expiration position profile in the case of a purchased Call, here it will be much easier for us (cm. Lesson 22).

When finding a futures above 14 000 rubles as of the expiration date, we will not exercise the option and will lose the premium in the amount of 349 rubles. The breakeven point of this position will be equal to the strike – premium = 13 651 ruble. With a decrease in BA for expiration below 13 651 ruble we will have unlimited potential profit.

Remember, you must know by heart the profit / loss profiles for the purchased Call and Put options.

I have already mentioned, that they are part of more complex strategies. As you can see, this is not difficult.