One important point to note. Let's simulate the position from the previous lesson now.

In any option analysis toolkit, we see two position profiles:

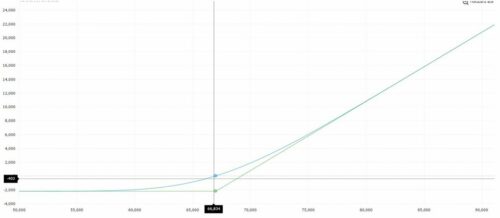

1. Expiration profile is that profile, which is depicted by the green line

2. Current position profile (blue line) - this is our financial result at the moment and its change with an increase or decrease in BA. Ie, if today the futures rises to the level of 70 000 rubles, then your profit from buying the option will be 2 000 rubles, although for expiration it will be less. If futures declines today to the 65 000 rubles, then your current loss will be 776 rubles, but not the whole prize (2 197 rubles), as for expiration.

The current profile of any option position will approach its final expiration profile on a daily basis.

Remember!

The first important rule of option trading:

Your task – build your options trading based on the current position profile.

Expiration profile purely theoretical and doesn't make much sense, because. most positions do not live up to expiration. There can be many reasons:

1. Arranges current profit by position (you don't want to wait, close the position earlier and fix the financial result that suits you)

2. Accumulate big risks by position and there are no options to neutralize them (close earlier too). This is one of the main reasons, on which position, usually, close before expiration.

3. The current option position using simple combinations (adding a certain number of bought or sold options) can become completely new strategy with a completely different expiration risk profile

4. Margin calland forced closing of a position by a broker in case of a negative scenario (negative variation margin and growth of GO)

As you can see, many options, and not all of them I have listed.

I don't use the expiration position profile at all, but I only work with the current profile. You are just starting to trade in the options market, so use both profiles focusing on the current profile profit/loss. Let the expiration profile be for you a kind of landmark. Sooner or later, you will learn to use only the current risk profile..