Risk / reward ratio

As we already know, risk option buyers limited by premium, and potential no profit.

When buying a Call option, our profit is not limited in the event of an increase in the price of the underlying asset (futures).

When buying a Put option, our profit is not limited in the event of a decrease in the price of the underlying asset (futures).

For this reason most newcomers start their work on the market with the purchase of options - the risk is limited, potential profit no.

Why, at all, sell options? We will return to this question later., but for now, also, like most novice traders, let's start by buying options.

Why is it needed?

Actually i don't use purchase (how, however, and sale) individual options in their trade. I use separate option strategies, which include both purchased, and sold options.

As a matter of fact, individual options are elements (elementary cubes) for more complex option strategies. No matter how complex strategy we trade, it is always a combination of purchased and (or) sold options.

Therefore, interpret the profit / loss profile of these positions, understand the risks of buying options and be able to manage a position from purchased Call or Put options – an extremely important preparation stage for the implementation of more complex strategies in the market.

Buying a call option

Let's take a look at schedule exchange rate of the US dollar to the Russian ruble. Let's admit, it's the end of summer 2016 of the year, the last couple of years, from autumn to the end of the year, the US dollar has strengthened strongly against the Russian ruble.

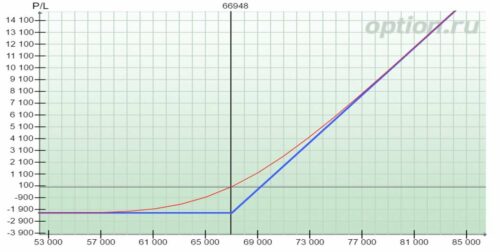

For example, we expect this trend in the current 2016 year. Let's admit, current futures price - 66 948 rubles. In anticipation of the growth of the underlying asset, we decided buy option Call the most liquid center strike 67 000 by price 2 197 rubles.

LESSON 22. PROFILE OF PROFIT / LOSS FOR PURCHASED CALL OPTION

Let's draw the risk profile of this position now..

We remember, what on the axis X (who forgot the school mathematics course is the horizontal axis) - BA price change, along the Y axis (vertical axis) - our financial result (profit or loss) by current position.

Vertical line - current price of the US dollar futures.

If BA decreases (below the current price), it will be unprofitable for us to exercise the option (ie. buy futures by 67 000), and our maximum loss at the expiration date is the premium of this option, ie. 2 197 rubles for any decrease in the BA price.

At the growth of BA the cost of the option will rise in price, and we will make a profit. But not for any height, and with growth above the so-called break-even points (point, where the graph crosses the horizontal line). The break-even point is that BA price, at which the cost of acquiring the option will pay off. Obviously, what we need, for futures to rise, at least by the amount of the strike + option premium (ie to 69 197 rubles).

Above this price we will have unlimited profit, That for expiration will linearly depend on, how much futures will rise.

As you can see, It is quite easy to build a Long Call position profile on your own. In fact, in practice, you will not do this., because. there is a specialized analytical toolkit (we'll talk about him later). He will do the job for you.. All these programs and services plot position charts for further analysis..

And what, if we buy a Call option of another strike, for example, 70 000?

Let the price of this option for today be 1 185 rubles.

LESSON 22. PROFILE OF PROFIT / LOSS FOR PURCHASED CALL OPTION

When finding a futures below 70 000 rubles at the expiration date we will not exercise the option and will lose the premium in the amount of 1 185 rubles. Breakeven point this position will be equal to the strike + premium = 71 185 rubles. With an increase in BA for expiration above 71 185 rubles we, as in the previous example, will have unlimited potential profit.

As we see, when buying the second option, we have less risk(less premium paid), but also more distant from the current market break-even point.

The further we remove the strike of the purchased Call from the current BA price, the less our option costs And, respectively, lesion, but also less likely to cash outon the purchased option.