Prize (price) an option on the market consists of two components:

1. intrinsic value option.

This is the amount, which we will receive, if a now we are experimenting option and close the position in the underlying asset at the current market price.

Example. Futures on an ordinary share of Sberbank costs 14 000 rub. и Long Call 13 500 (Bonus = 830 rub.). Intrinsic value = 500 rub.

As a matter of fact, this difference between the current BA price and the option strike.

2. Time value option.

This is a kind of premium to the option price., driven by, that there is still some time before the expiration date, and the option does not expire today. Actually, some price of opportunity, which the option provides.

Time value = 330 rub. (830 – 500).

this is the difference between option premium (the price of the option on the market) and its intrinsic value.

Some Western traders have a concept volatile value, but we will not introduce it and will focus on the classic version.

Important to understand two main points:

- When the option expires, we get only intrinsic value (as in the example above - 500 rubles). If there is liquidity, it is profitable to close options in the order book.

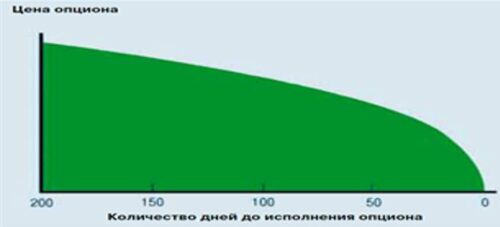

- The time value of an option decreases nonlinearly as the expiration date approaches. In this way, even if the intrinsic value of the option does not change (BA - const), then the option is still cheaper by the amount of the time component

These concepts will help us in choosing the right strike and explain different liquidity for certain strikes of a specific option series.

In options trading intrinsic value matters. Because. intrinsic value is linear with an increase and decrease in BA, then, in fact, exactly the presence of time value in the option price and gives this instrument special properties.

Hence the conclusions:

1. ITM Options have little time value (light weight) in the total option price. As a matter of fact, the deeper the option is in the money, the less its temporary cost and the more like a linear underlying asset (i.e. the corresponding futures). For this reason, there is practically no liquidity for these options. (or very low), because. easier to buy and sell futures (more liquid instrument).

There is no point in using these options in the overwhelming majority of cases..

2. OTM options have no intrinsic value (which is understandable - it is unprofitable to perform them). The entire value of a non-monetary option is intrinsic value.. It is important to understand, what, if the market does not overcome the strike of this option, then the final price of the expiration option will be equal to zero.

Can be used in trading if there is sufficient liquidity in the order book.

3. ATM options have maximum weight of time value in the option price and maximum nonlinearity. For this reason, they are the most liquid on the market. When the BA moves up or down from the current levels, the liquidity of these options will decrease.