19 May, the cost of the most popular digital currency fell to 30 thousand dollars. At the moment, bitcoin is trading in the region of $40 thousand - forty percent below its mid-April highs.. Shares of companies, whose profit depends on the value of the digital currency, also adjusted.

Bad news for bitcoin

Bitcoin is an intangible and highly volatile asset, the cost of which is determined in almost everything by the information background. Here are some news reports that caused the digital currency to become cheaper in the last month:

- China has banned financial institutions and payment companies from providing services, related to transfers in digital currency, also warned against speculative trading in digital currencies. "Speculation in this market encroaches on the security of people's property and disrupts the normal financial and monetary order", - reported by the authorities.

- Tesla stops selling vehicles for bitcoin. The company does not intend to sell its crypto assets yet, since it is not environmentally friendly. “We are alarmed by the increasing adoption of fossil fuels for bitcoin mining and operations, especially coal ", Tesla CEO Elon Musk tweeted..

- Head of the SEC - Securities and Exchange Commission - Gary Gensler reported, that crypto investors need additional fraud protection, and the regulator should have the ability to control crypto exchanges.

- the media became aware of the intentions of the head of the United States of America, Joe Biden, to raise tax on investment income for wealthy Americans. This may apply to crypto investors as well., received?? huge profits in the past months.

- The head of the Kraken crypto exchange Jesse Powell presented, that the cabinet of ministers of various states may begin to restrict the introduction of cryptographic currencies.

Over the year, bitcoin has increased in value by 317%. The recent decline may be related to the fact, that financiers fix profits and invest in the least risky assets. Specialists J. P. Morgan reports, that institutional financiers sell bitcoin and buy gold.

Why stocks are falling

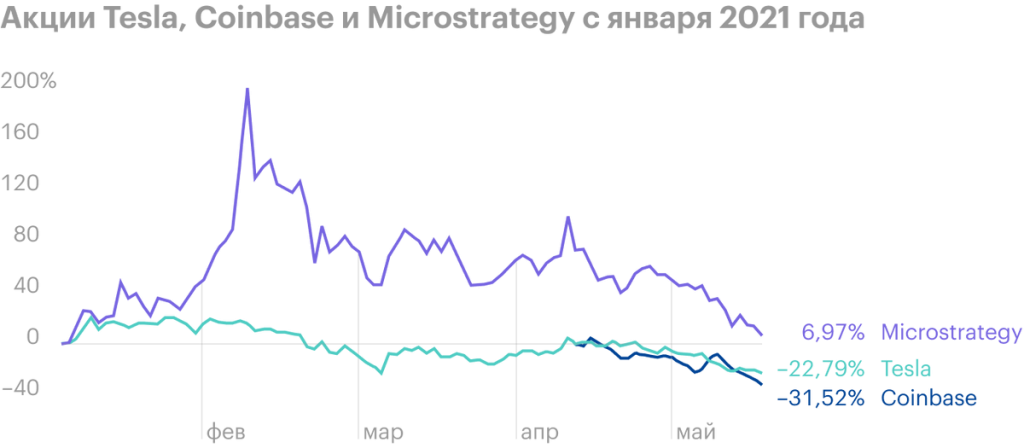

Tesla car manufacturer (Nasdaq: TSLA) in February announced the acquisition of bitcoins for 1.5 billion dollars. Soon the company sold some of them, which brought in $ 101 million, or twenty-three percent of total income in the first three months. Tesla's main business of selling electric vehicles remains unprofitable, because the securities of the organization are so correlated with the price of bitcoin.

Following Tesla, Microstrategy software developer (Nasdaq: MSTR) Reported, that he bought 20 thousand bitcoins worth billion dollars at an average cost of 53 thousand. In total, the company had 90 thousand bitcoins at that time.. Microstrategy shares are down 64% since February.

Company, whose business is directly related to bitcoin, - Coinbase cryptocurrency exchange platform (Nasdaq: COIN). The exchange receives a huge part of its revenue from commissions from the purchase and sale of cryptographic currencies. Coinbase shares are trading thirty-two percent below the location price 14 April.

Stocks correlated with digital currency

Stocks correlated with digital currency, the change 19 May

| Company | The change 19 May | |

|---|---|---|

| TSLA | Tesla | −2,5 % |

| COIN | Coinbase | −5,9 % |

| MSTR | Microstrategy | −6,6 % |

| SQ | Square | −1,5 % |

| NVDA | Nvidia | 0,4 % |

| PYPL | PayPal | 0,6 % |

Tesla (TSLA)

−2,5 %

Coinbase (COIN)

−5,9 %

Microstrategy (MSTR)

−6,6 %

Square (SQ)

−1,5 %

Nvidia (NVDA)

0,4 %

PayPal (PYPL)

0,6 %