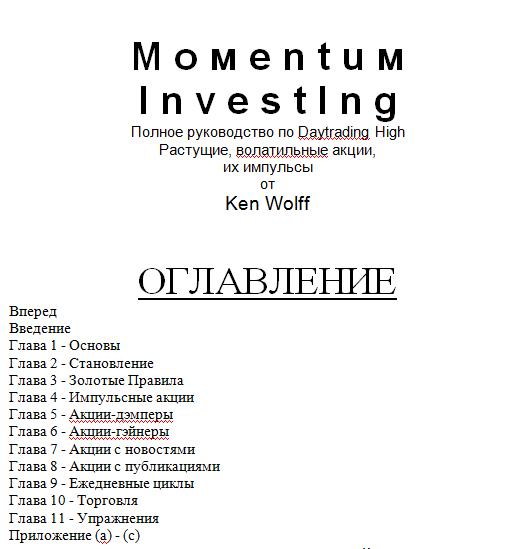

Мoмentuм Investing. The Complete Guide to Daytrading High. Growing, volatile stocks, their impulses (Ken Wolff)

The purpose of this book is, to create a clear picture, explaining step by step, how to invest your own money in the stock market, through your personal computer, using my investment methods, what I think is the safest and most profitable stock trading system for a small investor. I've polished my methods so much over the years, that they deserve to be on a par with the best tools on Wall Street, and give profit, more than the best mutual fund can bring. Using my methods, you can make a living, trading less than $ 20,000; they can be used as a beginner, so hardened day trader. I have taught successfully as amateurs, and professionals, making a profit by trading my methods 80 % portfolio profit for two months. Just imagine: you work at home, Live, Where you want, while making good money! I have one student, which the, trading on 36 foot yacht, in one month from enclosed $ 3000 Did $ 33,000.