Patternism.

started useful, in my opinion, a business, with the publication of technical puzzle patterns. From my side, I want to support the initiative, and deepen it a little. Ie. besides the pattern examples themselves, I will give a graphical structure and description. Why am I doing this? Systematization. Identification of possible errors and consideration of special cases. Discussion. Someone just might be useful. All parties benefit from the discussion. so, let's begin.

In frendlente saw, that many yawned a powerful corrective movement, although they were waiting for him. How to recognize its beginning, and where to start preparing?

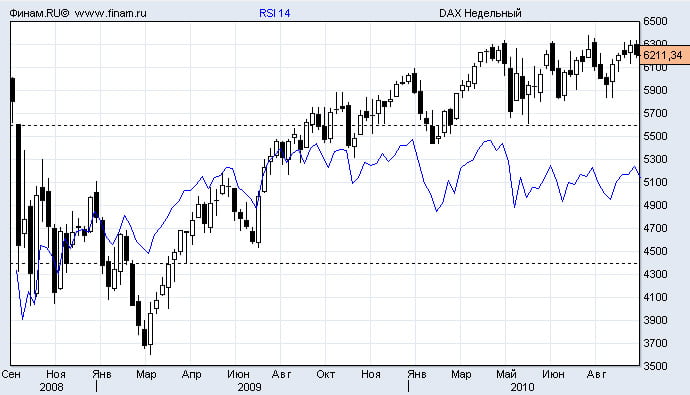

The pattern works in a bull market, in areas of strong overbought. realization, often happens on the news.

Usually has five (A-C), less often, seven-phase (D) Structure. In the first phase, there is a rapid ejection from a narrow range or a sluggish corrective movement, a kind of impulse. Often coincides with the lower boundary of an ascending channel or the 200th moving average. Second phase – flag correction, sometimes happens horizontally (B) or tilted up (With). Phase three – new impulse up. More often it is weaker than the first. Fourth phase – ascending, fading upward movement, sometimes with a final take-out candle. Important note – this movement should be exactly co-directional, otherwise we are dealing with either a 7-wave figure, or with something else. Fifth (or seventh) – the tastiest – the ability to make money quickly. Actually the bummer itself, start commit. You need to enter on the breakout of the parabolic or the absorption of the last bullish candle. You can set a signal or pending. Profit / loss ratio – Good, usually 1 to 2, 1 to 3. Profit taking on supports – it can be moving averages (100-200 period) better step by step, channel boundary, or at the starting point of the pattern implementation. A small position can be left, on occasion, if there was a trend reversal.