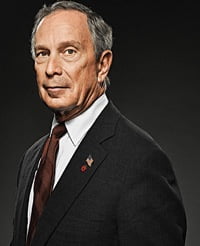

Michael Bloomberg: the story of a mayor and a billionaire | Bloomberg

There are not many politicians in the world, who also boast the status of a dollar billionaire. Remembering Europe, Silvio Berlusconi immediately comes to mind. But America has its own Berlusconi, whose name is Michael Bloomberg. A real financial Mogul and a very successful mayor, loved by all New Yorkers. The first confirms the fact, that Bloomberg is one of the richest Americans on the Forbes list. And about the success of Bloomberg, how does politics say that, that the New York City Legislative Council allowed him to run for mayor for the third consecutive time.. Working for an "uncle" as a way to earn start-up capital Michael Bloomberg was born 14 February 1942 of the year in Boston. His parents were never very wealthy – his father worked as an accountant., and the mother was a secretary. That's why Michael had to earn money at a gas station., to continue his studies at Johns Hopkins University. IN 1964 The University was completed, and Michael became a bachelor in electrical engineering. That was the beginning.. Two years later, Bloomberg became a graduate of Harvard.. He got an MBA., becoming a Master of Business Administration. Ie. Michael received a brilliant education, combined in itself, as a technical, and the business part.