GC "Airplane" (MOEX:SMLT) — one of the largest construction companies in the Moscow region — presented operating and cash results for the 2nd quarter of 2021.

Everything grows

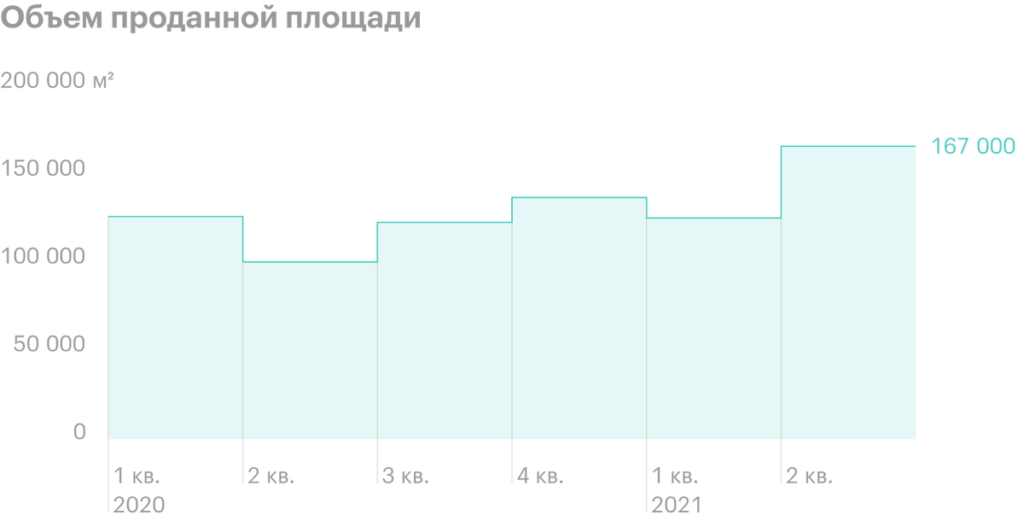

Sales in 2 quarter of 2021 increased by sixty-six percent - from 100,6 up to 167.1 thousand square meters - in comparison with the corresponding time period of the past year.

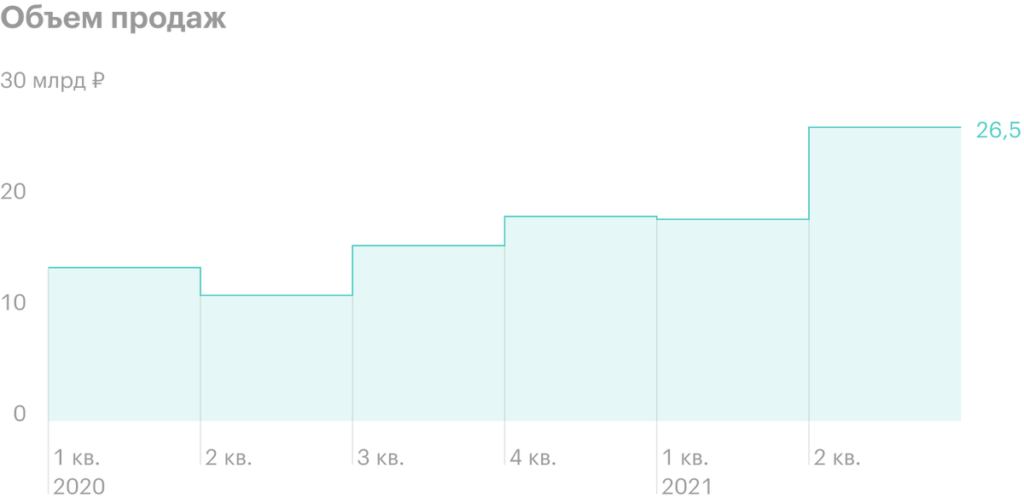

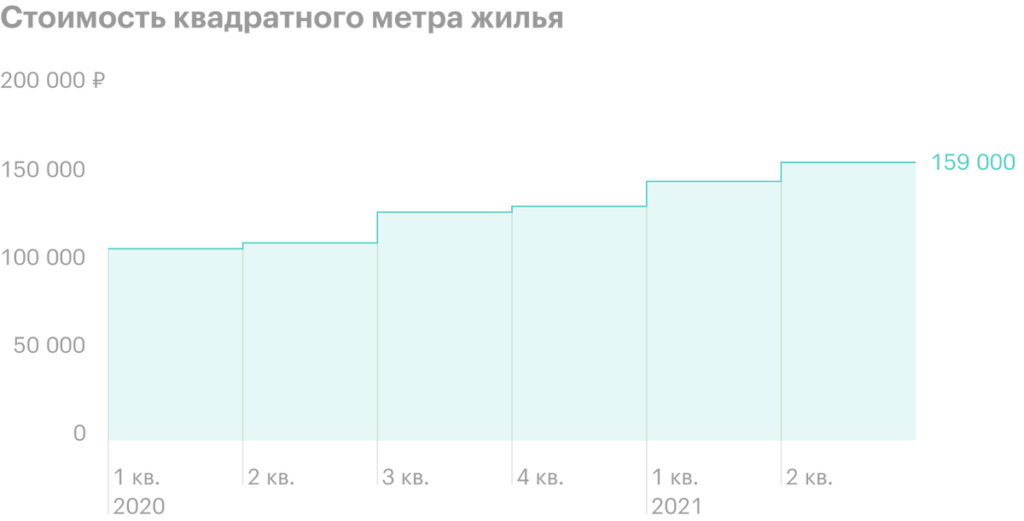

In foreign currency terms, the total volume of sales increased more significantly - by 133%, to 26,5 billion rubles. This difference - due to an increase in the average price per square meter by forty percent - from 113 up to 158.9 thousand rubles.

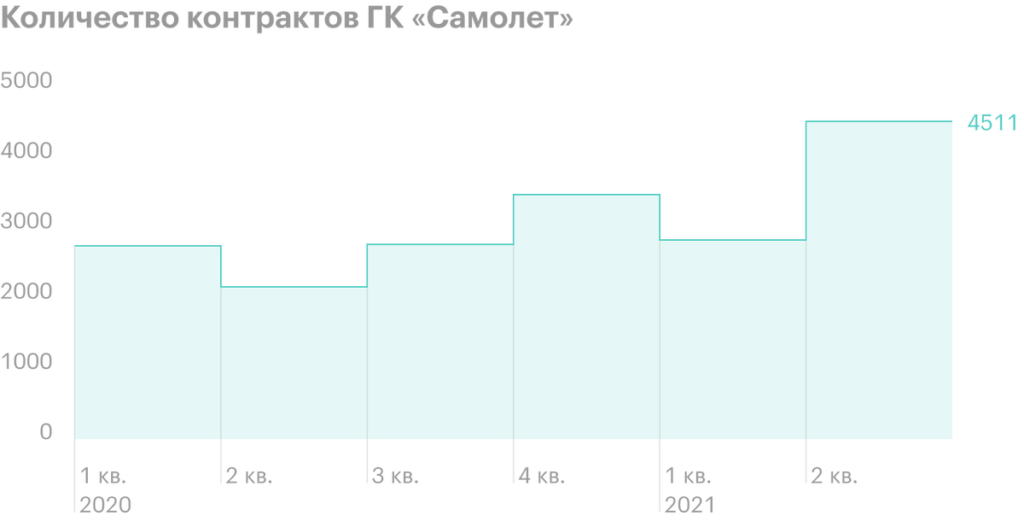

The total number of contracts increased by 108%, to 4511, - against 2173 in the 2nd quarter of 2020.

Financial performance of Samolet Group of Companies, billion rubles

| Revenue | EBITDA | Net profit | |

|---|---|---|---|

| 1 P. 2020 | 25,7 | 4,6 | 1,4 |

| 1 P. 2021 | 46,7 | 12,4 | 6,97 |

| Difference | 81% | 169% | 397% |

Samolet Group management forecast for 2021

| Revenue, billion rubles | EBITDA, billion rubles | Volume of sales, thousand sq.. m | |

|---|---|---|---|

| 2020 | 60 | 11 | 490 |

| 2021 | 102 | 22 | 732 |

| Difference | 70% | 100% | 149% |

Dividends

The company approved a new dividend policy before entering the IPO. The minimum level of annual dividend payments will be 5 billion rubles, which corresponds 83 P per share. Payment rules are as follows:

- If the ratio of net debt and adjusted EBITDA is less than one, at least 50% net profit.

- With a ratio of net debt to Adjusted EBITDA of 1 to 2 at least 33% net profit.

The company has published preliminary data for 1 half year 2021, without disclosing the amount of net debt in them. Assuming, that the indicator remained at the level 1 quarter of 2021 - 23,7 billion rubles, — then the current ratio of net debt to EBITDA is about 1,2.

Considering the financial results, "Plane" for 1 half year 2021 can pay dividends in the amount of 38.34-58.08 R - from 33 to 50% of net profit - this corresponds to 1.8-2.7% dividend yield. In this case, the most likely option is to pay 2,5 billion rubles, or 41 P per share.

Outcome

A stable business model and the state program of preferential mortgage allow Samolet Group to feel very confident even at the current time. The company is highly likely to fulfill its forecast for 2021 due to the continued rise in property prices.

Against the backdrop of growth, management set ambitious goals: hold an SPO at the end of 2022, to increase the free float of shares to at least 30%, and increase its capitalization threefold - from the current 134 up to 400 billion rubles and more.