MMK is one of the largest ferrous metallurgy companies in the world and the leader in the Russian Federation in terms of production of premium metal products: the company's share in this sector according to the results of 2020 amounted to twenty-seven percent.

14 On June 2021, the operating characteristics of the business for the 2nd quarter and 1st half of 2021 were made public. In the context of a low base in the 1st half of last year, the holding showed an increase in steel production and sales of commercial products by twenty-five percent in January-June 2021.

Considering that, that sales prices in the 1st half of the year increased by 49.3 % relative to the corresponding time period of the past year - up to 836 $ per ton, - the company's financial indicators at this time will also be able to amuse financiers.

What about creation

MMK's management took advantage of the situation during the crisis: the company carried out repair work and improvement in production. In July 2020, we completed the technical re-equipment of blast furnace No. 2 and launched hot rolling mill 2500 after the refurbishment.

The holding increased its production volumes quite rapidly as demand recovered in the metal products market starting from the 2nd half of 2020. In the first half of this year, MMK's industrial performance almost returned to pre-crisis levels.

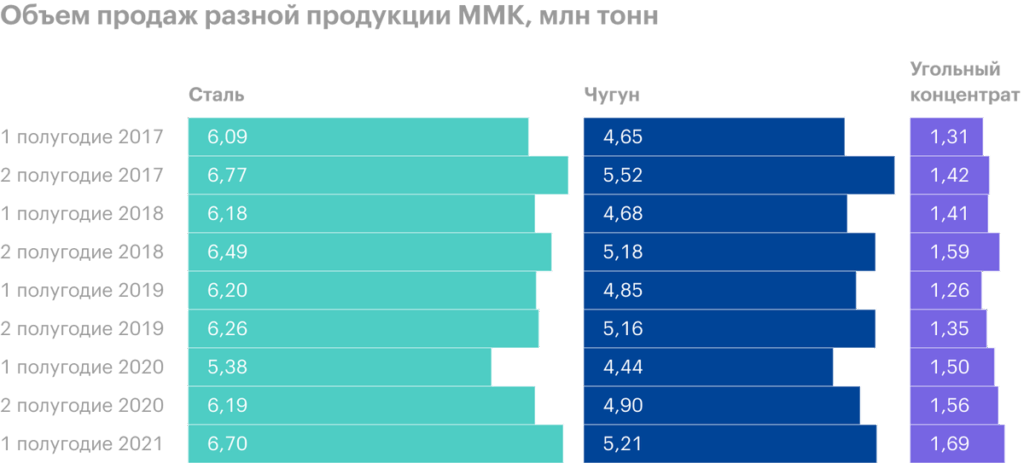

Smelted steel size in January-June 2021 amounted to 6.7 million tons, which is twenty-five percent more than the corresponding time period of the past year, when repair work and equipment improvements were carried out at the company's industrial sites.

Pig iron smelting volumes reached the highest for this period 5.21 million tons, up seventeen percent on a low base last year, when the production of pig iron decreased to a long-term minimum due to overhaul at the blast furnace.

Creation of coal concentrate in the 1st half of the year grew by thirteen percent and reached 1.69 million tons in the face of growing demand for raw materials within the group itself.

What about sales

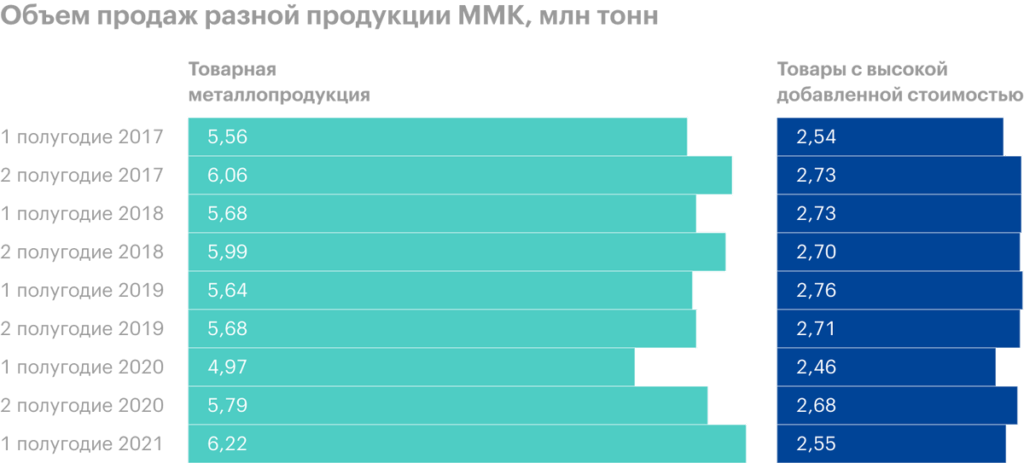

Sales volume of commercial metal products increased by 25% compared to the 1st half of 2020 - up to 6.22 million tons, which became a record level of sales for this period. The reason: increased demand for products and subsequent price increases.

Hot rolled sheet sales increased by 59% to 2.97 million tons, as a result, this type of product accounted for almost half of all company sales in 1H 2021.

Sale of long products decreased by 7% to 0.59 mln t due to scheduled maintenance of rolling equipment during this period.

Premium products increased by only 4% to 2.55 million tons due to increased sales of downstream products, which added 10% and grew to 1.74 million tons. Galvanized steel sales increased by 19%, hardware products - by 9%, pre-painted steel — by 4%. At the same time, the company reduced sales of thick plate by 6%, and cold-rolled sheets - by 11%.

As a result, the share of premium products in MMK's total sales fell from 49.5% in 1H 2020 to 40,9% in January - June 2021.

Sales structure by types of products

| Hot-rolled sheet products | 47,7% |

| Galvanized steel | 15,7% |

| Long products | 9,4% |

| Thick sheet (mill 5000) | 6,7% |

| Cold-rolled sheet products | 6,2% |

| Pre-painted rolled products | 4,9% |

| Hardware products | 3,5% |

| Other | 5,9% |

Hot-rolled sheet products

47,7%

Galvanized steel

15,7%

Long products

9,4%

Thick sheet (mill 5000)

6,7%

Cold-rolled sheet products

6,2%

Pre-painted rolled products

4,9%

Hardware products

3,5%

Other

5,9%

What's the bottom line?

In 1H 2021, MMK increased steel production and in-kind sales of marketable steel products by a quarter. This result is admirable., but don't forget, that the countdown is from the low base of the 1st half of 2020. Then the crisis reigned in the ferrous metallurgy market, caused by restrictive measures and general uncertainty, because no one could reliably predict, how deep and long will the decline in demand and prices for steel products be.

The fall in the ferrous metallurgy market was quickly replaced by rapid growth, and prices for most goods increased by tens of percent. According to MMK, prices for various steel products increased by 49-61%, and prices for slabs and billets - even by 136%. This indicates a clear shortage of goods on the market..

Taking advantage of the favorable market conditions, MMK launched production at its plant in Turkey in July, which has been frozen since 2012. Upon reaching full capacity, the enterprise will annually produce an additional 2 million tons of hot-rolled steel. Besides, the foreign site will allow to partially bypass export duties on metal products, which will start operating in Russia from August 1, 2021.