Hello! June ends today, which means it's time to buy shares into an individual investment account.

Buying a share on IISBuying a share on IIS

Now I'll tell you about that, what stocks I bought just a couple of hours ago regarding the publication of this post. And all why? Because I regularly invest despite the highs or lows, ups or downs of the stock market.

I am often asked, why exactly on the last working day of each month? This is done for the purpose of controlling emotions., so that there is no temptation to buy something "that has become cheaper". Long-term investments imply systematicity and lack of psychology and all emotions.

At the end of June, the Moscow Exchange index rose again: +3,23%. Even yesterday's correction has been canceled by today. Due to market growth, I have to buy shares again at the minimum 10 thousand. rub.

I will briefly tell new subscribers, that I only increase my monthly purchase of shares if, when the market starts to fall. And every 5% falls are added by 10 thousand. rub. to the minimum investment amount.

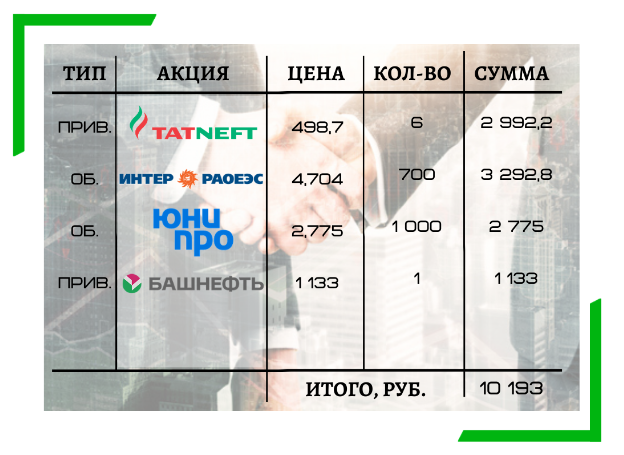

This time the amount is small, but even for this amount it is difficult to find stocks in a growing market. But I did it, so:

1. Tatneft, private. Thought for a long time, to take or not to take almost by 500 rubles, whereas in previous months the price was in the region 460-470 rub. For lack of other options on the market, decided to take. Tatneft is still lagging behind, when compared with other oil and gas companies, who have reached historic highs. The reason for this is reduced dividends and the problem with the cancellation of privileges for the production of extra-viscous oil. Think, these medium-term problems, and as the oil market recovers (but in fact he has already recovered) indicators will return to normal.

2. Inter RAO. The company's shares decline despite the company's excellent financial performance. News also arrives, that the export of electricity from the Russian Federation reached a record with 2012 of the year. And Inter RAO is the operator of export-import of electricity in Russia. A plus, do not forget about the huge financial "box" of the company. All this is suggestive, that the so-called "safety margin" of shares is growing. Situation, when positive reality is not reflected in promotions.

3. Unipro. Who has been with me for a long time and regularly reads posts should already be aware of, why Unipro. Because stocks are stable, the company increased its dividends, which are now more 10% per annum, a block of Berezovskaya GRES was commissioned, which will provide cash flow. When the markets are high, Unipro seems to be the best conservative option.

4. Bashneft, private. Oil demand continues to rise, but the offer remains at the same level. Therefore, OPEC is likely to increase production quotas in the near future.. This may not be very good at the moment, reflected in prices., but will allow oil companies to increase production. And Bashneft in Russia suffers the most from quotas due to taking over almost the entire quota of Rosneft., as a subsidiary

Until recently, I also wanted to buy X5 Retail Group as in previous months. But June stocks gained more than 16%, what already seems to be overkill for a purchase, although stocks remain far from highs. Also among the considered shares were Rosseti, Rostelecom, PIK group, NMTP, but for one reason or another, I haven't bought them yet.

The total purchase amount was 10 193 ruble. There are even unused dividends IIS. that is OK, let them save up for purchase in July, suddenly the crisis hits and you need more money for shares.

Even more useful information about investments and finance in my Instagram – @long_term_investments . Subscribe!