Today is the first of September, Knowledge Day. Congratulate everyone, who is studying now: schoolchildren, students, Adults. Century lives on, century learn.

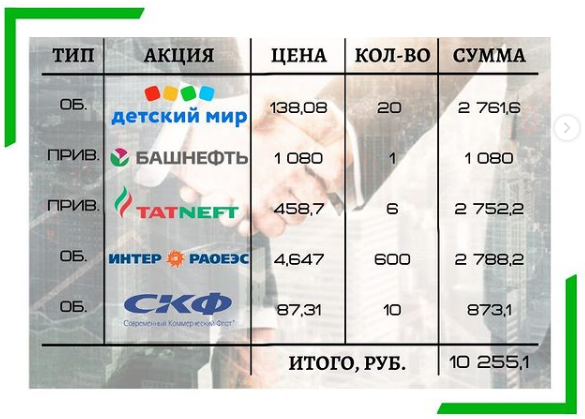

Stocks in portfolioShares in portfolio

For me, the end of August and the beginning of September are an excuse to buy new shares on my IIS by monthly investment strategy.

The Moscow Exchange index for August rose by 3,91% and reached another historic high. It means, that I again buy shares for the minimum amount - 10 thousand rubles. As you remember, the purchase amount will increase only then, when the index starts to decline. Not yet., Unfortunately.

Even despite market highs and high prices for most stocks, I easily chose the papers to buy. Let's find out, what and why:

1. Child's world. I buy shares of this company for the second time at IIS, because. they are now in correction and have not grown anywhere in August. Even the purchase price is almost the same as in July. Why I buy? Because the company is showing excellent growth in revenue and profits, pays good dividends, opens new stores and is actively developing. According to their strategy, want to double their revenue to 2024 G. and open hundreds of new stores across the country. At the same time, there is a significant risk in the form of a huge debt burden of the company.. The company has no equity capital.

2. Bashneft priv. Troubled times and the worst for Bashneft, probably, behind, because. in August, a report was released with good indicators of revenue and profit at the level 2019 of the year, which means, that the company is reaching pre-pandemic production figures. This, in turn, gives hope for dividends., if not at the level 2019 of the year, then at least not lower 2020. Share, meanwhile, in August fell to almost historic lows.

3. Tatneft priv. TATNEFT has not yet passed the turmoil, the negative still remains after the abolition of privileges for the production of extra-viscous oil. If you look at the report, then the revenue increased by one third compared to 2019 G., but the profit has decreased, and so already 2 quarter in a row, ie. the profitability of the activity decreases. The company allocated only 50% arrived, although investors expected 100%. Because of all this, stocks are not going up yet.. I buy for a long term, because. the company can reorient from oil production to oil refining and take over other companies in the refining sector for this, to what she, probably, and saves on dividends.

4. Inter RAO. So we got to Inter RAO. I will not write about good financial performance again., prospects and possible acquisitions of other companies, because. I write all this literally every time in posts about buying shares. That is why I like this company., and she already takes 2 place by share on IIS after purchase. TO 20 in August, stocks fell to the low of last year's crisis, but unfortunately for me, to 31 in August, stocks were already rising by 12% with a minimum. But this was not a reason not to buy stock., because. even now they are quite cheap.

5. Sovcomflot. Everyone forgot about the company's shares after the payment of dividends, therefore, there are no growth drivers in the near future. Most likely dividends next year will be penny judging by the profit in the report for 1 half a year 2021 G. Therefore, we are waiting for the implementation of Novatek projects in the Arctic., where Sovcomflot is the main LNG carrier to other countries. But this is all long term to 2025 year.

In this way, purchase amount was 10 255,1 rub., what is added to the initial cost of buying shares on the IIS for the entire time. Now she composes 424 065,9 rub.

In addition to shares, Purchased 31 august, also bought bonds during the month, including Technolizing, Gruzovichkoff, Taksovichkoff, Ebis. On average, the yield on purchased bonds is quite high - 9% per annum.

I buy bonds, I calculate the yield on them and follow the yield using my spreadsheet for calculating the yield of bonds Excel.

All in all, we continue to invest despite strong market growth and are waiting, finally, its correction.

Even more useful information about investments and finance in my Instagram – @long_term_investments . Subscribe!