so, watching covered stakes and uncovered bindings, came to the conclusion that they, are really identical and, at all, are no different in different situations. If you do not take into account the various little things about what is covered кол can, on occasion, receive dividends for purchased shares, or that there is less commission to pay for an uncovered put. Confused by one circumstance — the majority of American stock market brokers divide the option combinations according to the gradation of complexity into 4-5 levels, and not everyone trader or an investor can be eligible to trade at the third level and below. Usually, give the first and second levels. So here, the first level is exactly the covered colas, which every beginner can get the right to trade. And uncovered fetters, usually, are at the fourth to fifth levels, and not every trader has access to them.

He looked for an explanation, why is that. I did not find anything intelligible about this. Only there was an opinion that, usually, investors already have shares in their portfolio and have sold the corresponding number of calls for these shares, they can protect stock with a safety cushion. Therefore, everyone is allowed. And uncovered bonds are already difficult, since the action is performed without shares, which is not typical for investors, but characteristic only of experienced speculators. Well, maybe that's why. On the one side, logical.

All in all, it turns out in vain I bought covered colas. It was easier to just sell puts of the same strike..

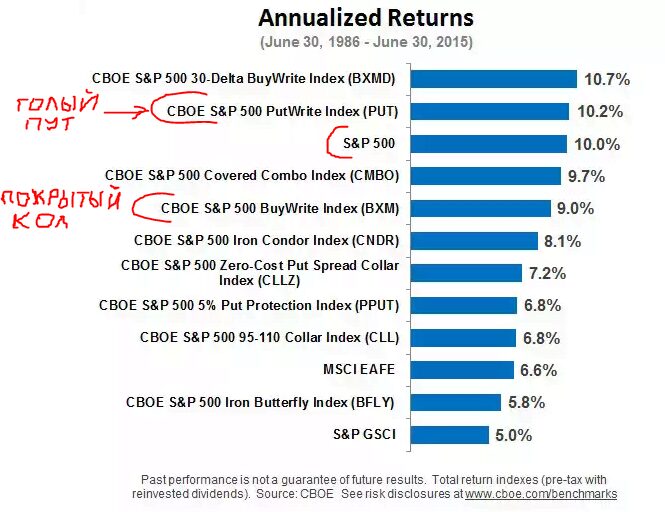

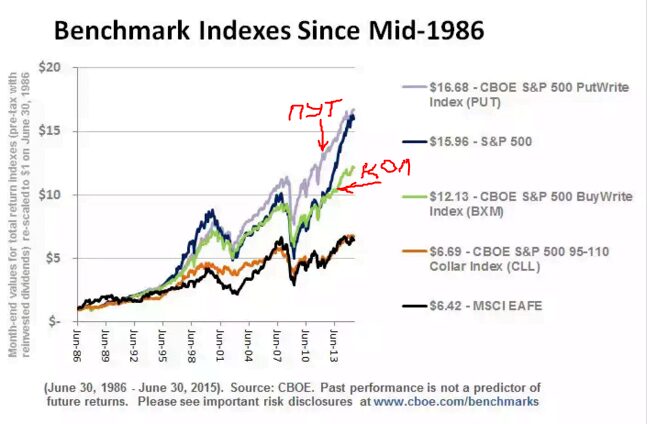

By the way, the CBOE website has indexes of profitability of various option combinations on the SP500 index for many years.. Without going into details of how they are calculated, you can see that an uncovered put on the SP500 index over a long period of time outperforms in profitability as a covered call on the SP500 index, and the SP-500 index itself.

———————————————————————————————————————————

——————————————————————————————————————————–

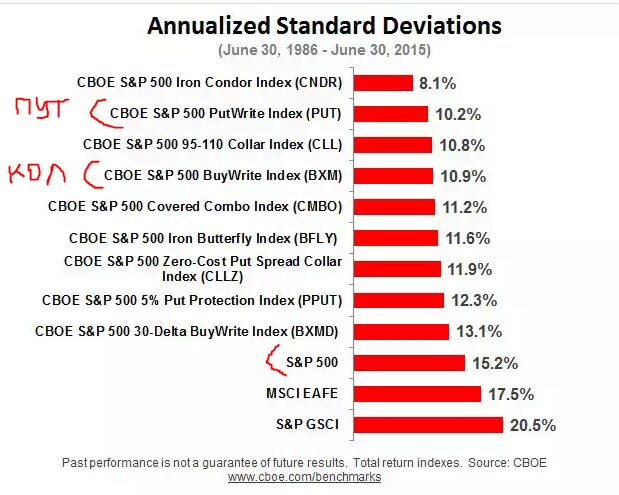

Also, an uncovered put has less annual yield volatility than a covered call and significantly less than the SP500 index., which is also important. As they say, smoother equity :)

Graphs from here