Alrosa is one of the largest diamond mining holdings in the world in terms of diamond production., also on the mineral resource base, constituting?? more billion carats. According to the results of 2020, the company accounted for about twenty-eight percent of the total global supply of diamonds.

9 July 2021, the company’s website made public the preliminary sales figures for rough and polished diamonds for June and the first half of 2021. According to this information, for the 1st 6 months of the current year, the sales of Alrosa more than doubled the indicators of the corresponding time period of the last year, when the crisis raged on the global diamond market.

Position in the realm

In the Russian Federation, on average, every 4th diamond is mined in the global market, at the same time, Alrosa occupies a monopoly position in our state with a fraction of about ninety percent.

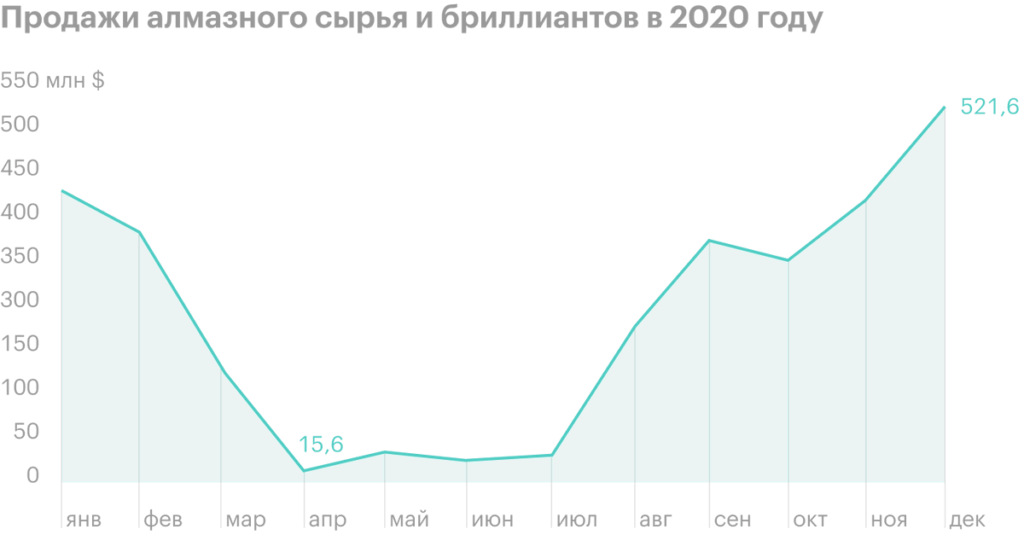

The diamond market experienced a real shock in the 1st half of 2020, which was caused by a decrease in buying activity and prices for diamonds in the context of a strong epidemic of coronavirus infection. About that, how deep was the crisis, can be judged by the dynamics of sales of Alrosa itself, collapsed?? in April-July last year, actually to zero.

Sales have been recovering since August 2020, so that the constraints were uniformly relaxed.

Situation in 1H 2021

After last year's decline, demand and prices for diamonds are almost back to pre-Covid levels this year. At the same time, rough diamond reserves in India, where is the world center for diamond production today, remain at historically low levels. Against this background, a number of diamond deposits in the world are depleted and the reserves of mining companies are declining to local minima..

According to Alrosa management, the ability of global manufacturers to rapidly increase diamond production is limited. This situation may well lead to a shortage of diamonds on the world market., due to which prices can rise.

Against the backdrop of improving market conditions, the company is gradually resuming production, which was suspended in 2020 due to the crisis and restrictions being introduced. Therefore, in the 2nd half of the year, we can expect further growth in diamond production from Alrosa.

What about sales

In the first 6 months of 2021, Alrosa sold diamond products worth $2,336 million, which is 136% more, than the amount of sales for the same period last year. Of these, rough diamonds accounted for $2,229 million, and for diamonds - only 106 million.

Alrosa sales by segments for 1H 2021, million dollars

| Rough diamond | 2229 |

| Diamonds | 106 |

Rough diamond

2229

Diamonds

106

Sales of diamond products in the 1st half of the year, million dollars

| 2017 | 2497 |

| 2018 | 2689 |

| 2019 | 1811 |

| 2020 | 991 |

| 2021 | 2336 |

2017

2497

2018

2689

2019

1811

2020

991

2021

2336

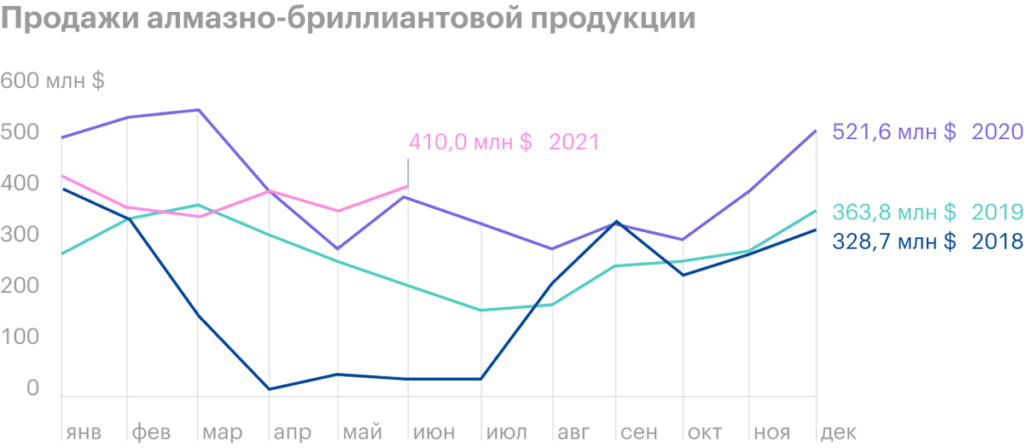

It is worth noting, that the company's sales remained stable throughout the entire half year, when compared with the results of recent years. The company sold products monthly in the range of 357-430 million dollars, what can we say about the stable demand for products.

What's the bottom line?

Alrosa's stable sales in January-June this year against the backdrop of a recovery in diamond prices allow us to count on the company's strong financial results for 1H 2021.

There is a shortage of rough diamonds on the market amid low stocks of the cutting sector in India, as well as a structural decline in production at a number of diamond deposits in the world.

The recovery in prices and potential shortages create favorable conditions for the operation of the Alrosa business and the increase in production volumes in the second half of the year. In June, the company resumed production at the Zarya open pit, which can make it possible to additionally extract more than 1.2 million tons of ore by the end of the year.

If sales in July-December turn out to be no worse, than were in the 1st half, then the company will be able to update the annual historical maximum in terms of sales of diamond products.