While the correction is awaiting, I play short strategies. And in terms of position duration and direction. Since during corrections the mood of speculators consists in quick profit taking, then the correct method would be, first of all, short something that suddenly grew quickly and buy something that fell quickly, to get into resonance with profit taking by speculators. The main thing is not to play too much and do not miss the moment of the end of the correction, when this logic stops working and when institutional investors take the helm of the market.

And, in my opinion, shorts are now much safer than longs, as strong growth in shares on the general market correction is unlikely to give, and will quickly fix profits, but picking up on the fall is very risky, since stocks can fall as much as necessary.

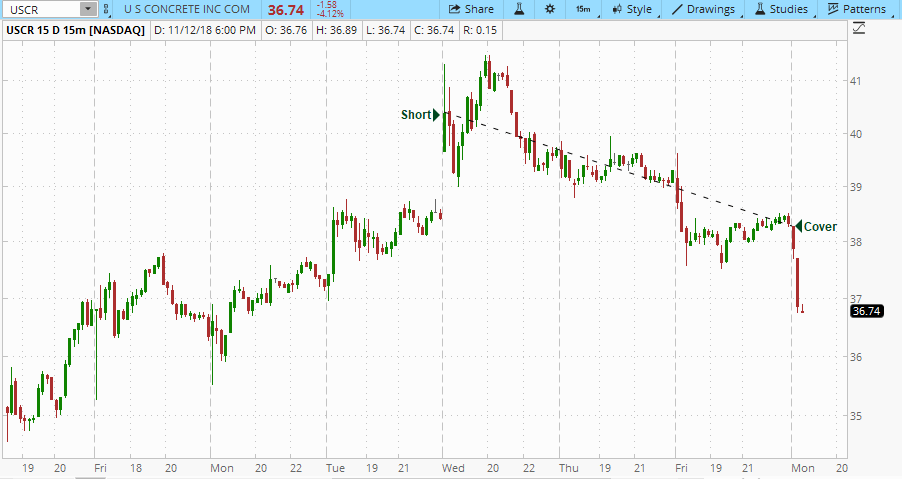

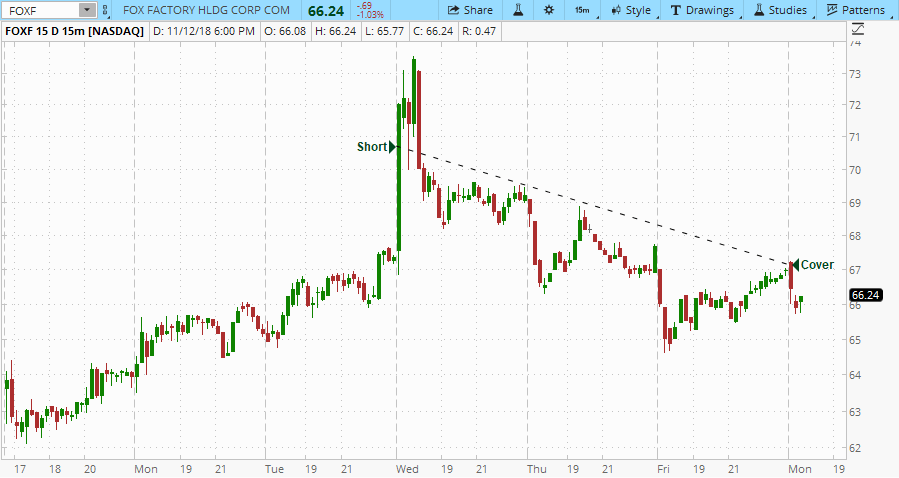

Closed several short positions today. apparently, hurried, you had to wait half an hour from the beginning of the session, but who knew. Here are examples: