What is imbalance on the NYSE, NASDAQ ? Market trading

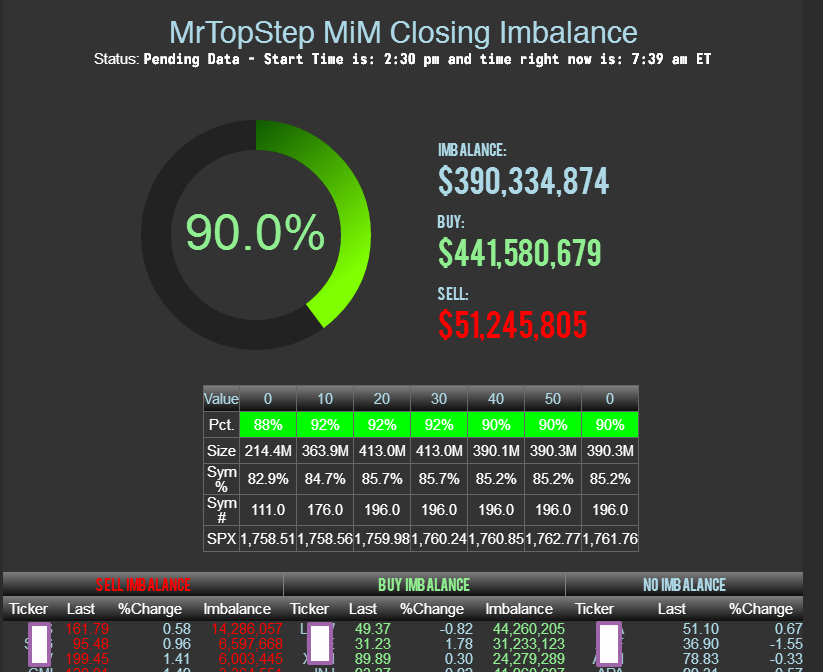

Have you ever wondered about the intricacies and strategies of trading MOC Imbelants on the NYSE? Understanding its mechanics becomes vital for beginners and experienced traders as, how this form of trading is gaining momentum. Join us on this all-round journey, in which we cover every aspect of trading MOC Imbelants on the NYSE. MOC Imbelants trades on the NYSE: Overview When we discuss trading MOC Imbelants on the NYSE, we dive into one of the most interesting aspects of the stock market world. The term itself may sound like something mysterious, but it plays a key role in modern trading strategies. MOC Imbelants Basics MOC Imbelants is based on complex strategies and trading algorithms. Their evolution over the years has brought them to the forefront of trading on the NYSE.. Traders used manual tactics in the past, but with the advent of the digital age, algorithms and sophisticated tools have become the gold standard. Historical Context The trading history of MOC Imbelants is rich in traders' stories, who took the bull by the horns. The development of MOC Imbelants trading With the passage of time, MOC Imbelants trading has become more sophisticated. Many traders and investors have recognized its potential and have integrated it into their investment strategies.. Key Strategies in Trading MOC Imbelants Adopting the Right Mentality Successful trading requires more than just knowledge and experience, but also the right mentality. Mood & Confidence …

What is imbalance on the NYSE, NASDAQ ? Market trading Read more