March is over

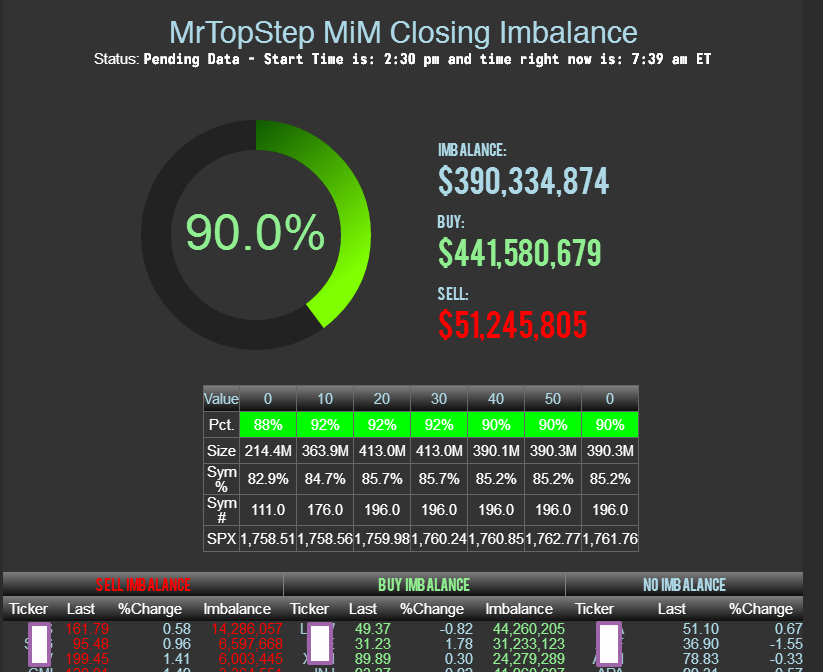

Today was the last trading day for this month., which I successfully closed in plus. Unfortunately, I didn’t trade today because I closed in the red on a dead market for the previous three days and lost about a third of my earnings for the month because of my persistence to conquer the market :) For the fourth trading day in a row, the market is standing still and there is practically nothing to trade. MOC were buy today, but everything collapsed and closed badly, thanks to the terminal lags, I didn’t get my basketball and stayed with the money. I will write the results of the month and its analysis at the weekend.. Now rest and prepare for April, which I should make my best month.