In this issue, we continue to analyze the reporting of companies, whose activities we covered on the site.

Disclaimer: when we talk about, that something has grown, we mean a comparison with the same quarter a year earlier. Since all issuers are from the USA, then all results in dollars.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

Genuine Parts (NYSE: GPC) reported revenue growth on 25,1%. The segment of auto parts grew the best - by 28,1%, sales in the industrial segment grew by 19,6%. The company has increased its sales forecast for this year: if growth was previously expected in the range of 5-7%, now it is expected to be around 10-12%. Loss in 564,372 million was replaced by a profit of 196,496 million. Truth, It should be noted, that for the same period a year ago, the main losses were associated with the loss of value of intangible assets.

Cleveland-Cliffs (NYSE: CLF) increased revenue by almost 5 once - to 5,045 billion, and the loss in 108 million was replaced by a profit of 795 million. Certainly, this growth looks impressive. Everything was really bad last year, but even in comparison with the "pre-war" performance, Cleveland-Cliffs now looks very cool. Lack of steel in the United States plays into the hands of the company, and in the conditions of industrial boom, she can count on the continuation of the banquet.

Nucor (NYSE: NUDE), another steel mill, has already caught up and surpassed the pre-crisis indicators: revenue increased from 4,327 to 8,789 billion, and profit — from 133 million to 1,571 billion.

Newmont (NYSE: NO). The gold mining corporation reported an increase in revenue from 2,365 to 3,065 billion, and profits have grown since 347 to 661 million.

Homebuilding company Tri Pointe (NYSE: TPH) increased revenue of the residential real estate segment from 767,81 million to 1,015 billion, the revenue of the financial segment increased from 2,296 to 2,681 million. The profit increased from 56,528 million to 117,869 million.

Another construction company, PulteGroup (NYSE: PHM), reported an increase in revenue from 2,593 to 3,359 billion and profit from 348,62 to 503,399 million.

At the building materials manufacturer Simpson Manufacturing (NYSE: SSD) things are going well: revenue increased by 25,8%, and profits have grown since 53,479 to 72,483 million.

Snap messenger (NYSE: SNAP) reported an increase in revenue on 116% and on the reduction of losses from 325,951 to 151,664 million.

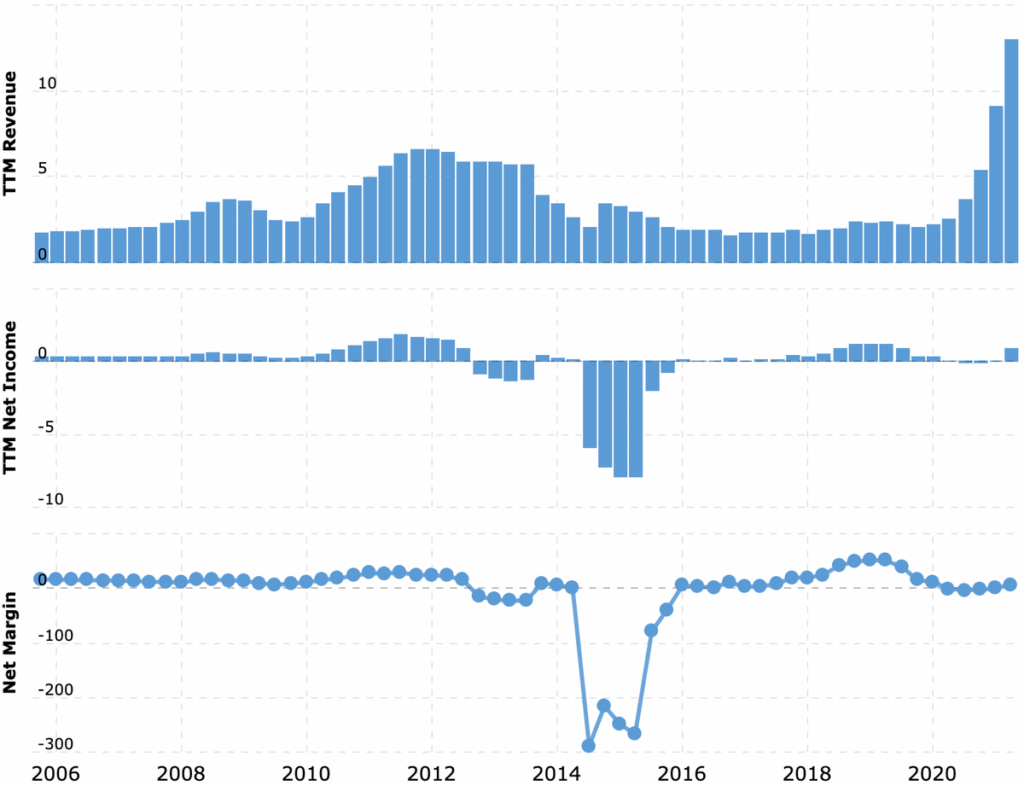

Social network Twitter (NYSE: TWTR)