Disclaimer: when we talk about that, that something has grown up, we mean a comparison with the same quarter a year ago. Since all issuers from the United States of America, then all indicators in dollars. Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

Watching reports

Charles Schwab (NYSE: BLACK) amused financiers with news about an increase in revenue by eighty-three percent, and profits rose from $671 million to $1.265 billion , almost doubling.

Autoliv (NYSE: VAT), manufacturer of products in the field of auto security, said about revenue growth of eighty-three percent, and the loss of 174 million was replaced by a profit of 105 million.

More crap!

Royal Dutch Shell, which last year cut securities earnings for the first time since World War 2, in 2021, at one point she made a promise to raise a surplus of free funds, resulting from the increase in the cost of oil, for the purchase of shares and dividend payments. We are talking about 20-thirty percent of the operating currency flow - this is approximately $ 2 billion per quarter.. According to experts J. P. Morgan, if the price of a barrel of oil remains at 75 $, then Shell only in 3 quarter of this year will be able to acquire its own shares in the amount of $ 500 million.

All this in general is faster positive news for current owners of the company's shares.. The acquisition of securities of the organization artificially provokes the demand for them, and prices are rising, and the increase in dividends will also provoke an influx of passive efficiency fans into stocks., and from this prices will also rise.

But for whom this news will not be good is for the owners of shares of oilfield service companies.. Shell plans to delay spending on fixed assets renewal at a low level. This is in line with its forecast of a transition to unblemished energy sources., to which she was forced not so long ago by a Dutch court.

However, Shell shareholders should not be very happy: the company said earlier, that payments for shareholders will not begin until, than it will significantly reduce the volume of its debts. So there is a chance, that payments will have to wait a long time.

The "took off" of the week

10 April 2020 we advised to take shares of the cloud company Five9 in anticipation of that, that it will be the beneficiary of the transition of many businesses to remote work. What we were counting on: to 20% in absolute in the coming months, to 15% per annum during 5 years. And instead it will come out 178% in less than a year and a half.

Internet calling giant Zoom buys company for $ 14.7 billion - or roughly 220 $ per share. Truth, they will not buy for money, and for shares: All Five9 shareholders will receive 0.5533 Zoom shares per share. So that, in theory, Zoom shouldn't fall much from such news..

Five9 still suffers operating losses, you may have the following questions: when can Zoom make the company profitable — if at all?? well, only time will tell.

There will still be cinema

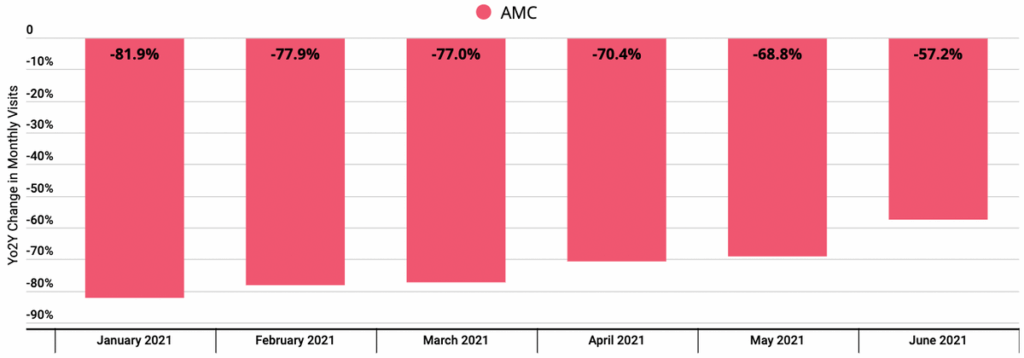

The service of collecting and analyzing geodata Placer released an analysis of visitor traffic in various American institutions. Specifically, we are interested in traffic in AMC cinemas, because this data can also be indicative to Cinemark shareholders and not only to shareholders of all companies in general., who receive money from film distribution, like Disney, Discovery и ViacomCBS.

Compared to 2019 figures, it's still very bad.: cinema attendance in June 2021 was 57,2% below, than for 2 years before that. But things are gradually getting better.: back at the beginning of 2021, the attendance was on 81,9% below. It is seen, what a series of high-profile blockbusters, for example the ninth "Fast and the Furious", Marvel's Black Widow and the new Space Jam, lures visitors back to cinemas - which is also facilitated by an increase in vaccination of the population.

So that, maybe, the hour is not far off, when Cinemark shareholders will be able to reach zero.

At the same time, this news carries certain risks for companies., producing content for screening in cinemas. Blockbusters mentioned above, which gave cinemas good returns, - it's a pretty expensive movie: "The Widow" and the new "Fast and the Furious", for example, are worth in the region of $ 200 million. From this, the studios-producers can draw a not unreasonable conclusion that, that it makes sense to invest only in such expensive blockbusters. In this regard, the shareholders of the same Disney should be wary of the growth of costs for the production of content., which will be able to compete in these realities with the releases of their competitors.

"So cowardly, that even a chicken can't be stolen."

Elon Musk, founder of the Tesla car company, was in the middle of an unpleasant trial. Several pension funds, who were Tesla shareholders, accuse Musk of the following: the decision to buy the business of selling and installing power generating panels SolarCity for 2.6 billion dollars at the expense of Tesla in 2016 was made for personal enrichment. In their opinion, SolarCity was on the verge of bankruptcy and Musk decided to combine an unviable business with Tesla, to save it from final collapse. Here the plaintiffs need to prove some points.

Who is the extreme. "Musk was responsible for making the final decision on the purchase of SolarCity" - such an argument is difficult to prove, because then Musk had 22% Tesla shares and the decision to buy SolarCity was voted on during the Tesla shareholder meeting. On the other hand, if Musk hid important information about the real situation of SolarCity from Tesla shareholders, then he may be held responsible for the charge.. You should also consider that, that Musk and other members of Tesla's board of directors were also shareholders of SolarCity, what could have influenced their decision. By the way, these same directors agreed to settle the dispute with the plaintiffs and paid them $ 60 million in compensation - only Musk went to court.

Was there a boy?? “SolarCity was bought at a higher price, what could be, in connection with what the interests of Tesla shareholders were damaged" - it is difficult to say about this accusation, is this really the case: the prosecution and the defense here say the exact opposite things.. Plaintiffs say, that Tesla overpaid, and Musk's representatives say, what, against, SolarCity was bought very cheaply and was able to create a unified vertically integrated company for the benefit of all.. If the judge decides, that SolarCity was worth nothing at the time of purchase, then Musk may be asked to fully compensate for the damage to Tesla - to return $ 2.6 billion.

In the short term, the consequences will be rather neutral.: it's about Musk's compensation for damages from personal money, let and, maybe, at some point this will affect the quotes not in the best way - most likely, Musk will have to sell Tesla shares for the appropriate amount. But in the long term, the effect can be negative.: if Musk loses, then, probably, in the future, he will be attacked by activist investors and forced to leave the company.. In this case, Tesla may lose the lion's share of its attractiveness in the eyes of many investors.. Musk is a pretty media personality, which has a positive effect on the company's quotes, attracting the attention of retail investors to them. Without Musk, it won't be such an interesting venture.. In any case, it is expected, что суд вынесет свой вердикт в ближайшие недели.