Disclaimer: when we talk about that, that something has grown up, we mean a comparison with the same quarter a year ago. Since all issuers from the United States of America, then all indicators in dollars. And in the development of the idea used sources, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

Man, do you have a robot? You have a job, man

Inventory management device and services maker Zebra Technologies buys Fetch Robotics startup for $290M (English. "Bring robotics"), who works in the field of warehouse automation. Fetch builds solutions to seamlessly integrate robots into warehouse workflows.

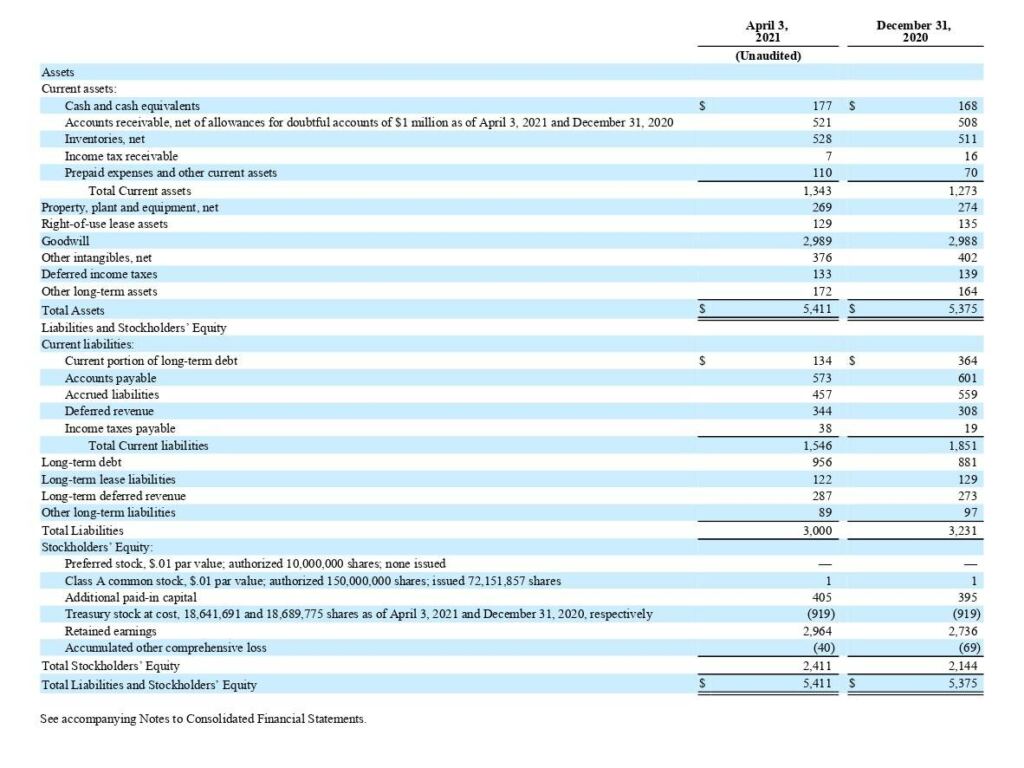

This is a completely natural addition to Zebra's line of offerings.. However, here's what's wrong: Zebra has not so few funds at its disposal and, Most likely, this purchase will add to its debt burden - a rate hike is on the horizon, And, hence, debt service and new loans will become more expensive for the company.

I would like to, so that everything is somehow normal

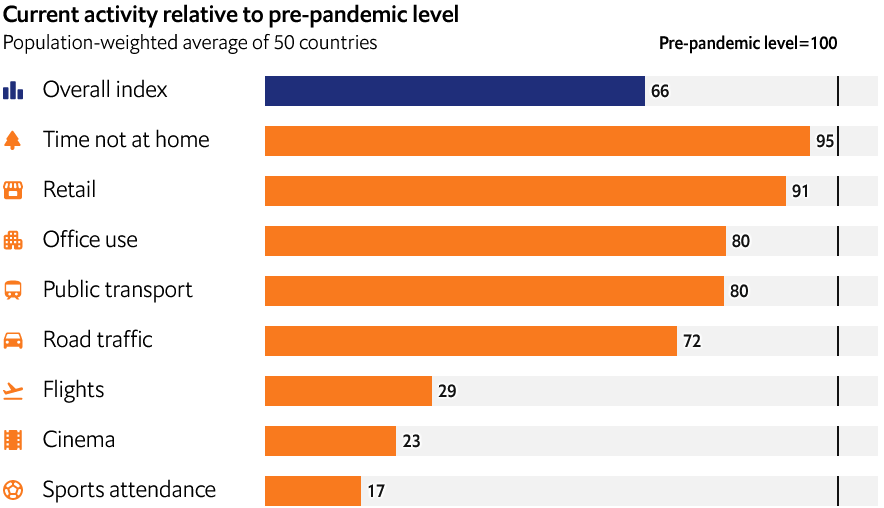

English magazine The Economist began publishing the Index of Normality, in which evaluates, how close is the world today to the level of various activities, who was in the world right before the start of the pandemic. There, the state of a number of parameters is assessed in 50 countries of the world, where lives 76% population of the planet:

- Attending sporting events.

- Visiting cinemas.

- Flights.

- Traffic congestion.

- Public transport congestion.

- Office utilization rate.

- Retail attendance rate.

- Total amount of time, spent outside the home.

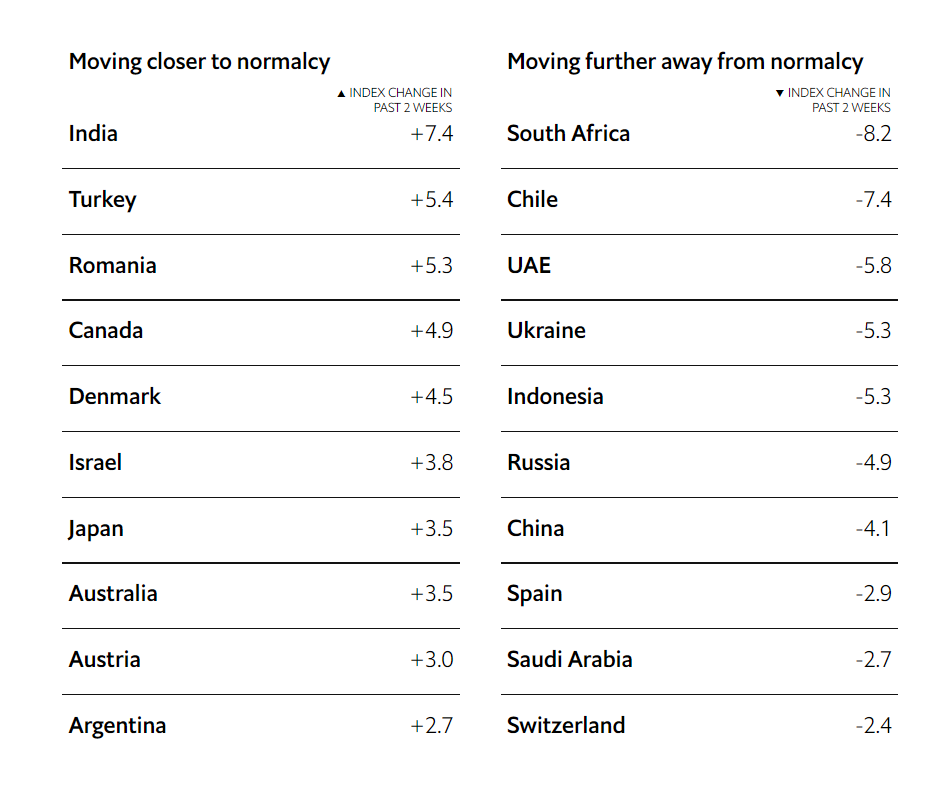

The average of these activities in the world, Where is 100 - this is the level before the start of the pandemic in February 2020, - this is the indicator, how life in the world has returned to normal before the pandemic. The index is currently at the level 66. It's almost twice as much, than in April 2020, but still markedly below the pre-pandemic norm.

The best thing is with time indicators, spent outside the home, — 95 and retail - 91. However, in the case of retail, there is nothing surprising: large retail chains in most countries remained open even during the most stringent quarantine. Offices feel relatively good, which can be considered moderately good news for office REIT shareholders. "Moderately", because the future will be less "office", than now, which means, there is no point in hoping for an increase in dividends.

In San Francisco, the vaccination rate of the population is already very high., but the level of workload of offices is almost 50% below pre-pandemic levels. Similar situation in Houston and Dallas., in NYC 19% offices are free - this is the highest level ever since this indicator was calculated. However, The woes of office landlords are nothing compared to those of companies in the hardest-hit industries in the index..

Worst of all, according to the index, things are going in the field of flights - 29, at the cinemas - 23 and sporting events - 17. In all these areas, further progress depends both on the pace of vaccination, and from the situation with new strains of the virus. However, some major airlines with major deals give their shareholders some confidence in the future. In the case of cinemas, the fees are already better, than a year ago, although much worse, than two years ago, - so, maybe, shareholders will see improvement in the near future. With sporting events, everything is more difficult, and therefore issuers, who are given bread and butter by sports broadcasts, probably, nothing good to wait.

The publication of this index is a great help for investors. Based on the data from it, you can follow the, how the situation is changing in different industries, and plan your actions in the market.

Step up the game

Hacker group REvil, which some time ago shook 11 million dollars from the meat producer JBS, paralyzing his work, struck again and raised the stakes, by attacking the computer systems of hundreds of small and medium-sized enterprises throughout the United States. The number of affected computers goes to tens of thousands. The hackers said, what systems will unblock, if they receive a collective ransom in the amount of 70 million dollars. Even individual enterprises have their own options: pay separately, to unlock your system, depending on size - from 25 thousand dollars to 5 million.

Regardless of whether, how this story will end, must be recognized, that the progression of damage from hacker attacks is generally not encouraging: Actions are getting bigger and more costly for the victims. Therefore, cybersecurity issuers are a good addition to a long-term portfolio.. But there is one caveat.

As you remember from the story with SolarWinds, fighters against hackers themselves can become their victims. We do not yet know anything about leaving the company of large clients, but the company's revenue growth slowed down after these events. This can be a problem: the lion's share of companies in this sector are unprofitable and attract investors with their start-up sales growth rates. If we take away these growth rates, then investors will lose interest in quotes.

The wheels are spinning, prices are rising

American automotive information website Edmunds has calculated, that in the second quarter 2021 sold about 4,468 million cars, What's on 51,6% more, than the same period a year earlier, and on 14,8% more indicators of the first quarter 2021. A significant part of the increase was given by steep sales in April 2021, and even more they were not allowed to grow difficulties with the supply of semiconductors, because of which the pace of production of new cars can no longer keep up with demand.

This problem is likely to get worse in the near future.. In early July, Ford stopped work or reduced production at a number of large plants and reduced production of a number of models.. In Germany, carmakers' troubles even spoiled overall industrial numbers. This situation has advantages for some issuers and disadvantages for others..

Companies are among the losers, producing cars, - for them, all this leads to a loss of profit. But for car dealers, everything is not so clear.. Edmunds reports, that demand is so strong, that consumers are willing to pay exorbitant prices for those cars, what can they find. If it really is, then it's a really good time for car dealers, but to a certain extent. Stocks in their warehouses are not endless, and do not overestimate the financial capabilities of most Americans. In the medium term, this will be a big plus for auto parts suppliers.: instead of paying a lot of money for a new car, many will be more profitable to repair an old clunker indefinitely.