Disclaimer: when we talk about that, that something has grown up, we mean a comparison with the same quarter a year ago. Since all issuers from the United States of America, then all indicators in dollars.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

Lords are back in town, lords are back in town

Cтартап Lordstown Motors (Nasdaq: RIDE) just wanted to create electric pickups, but something went wrong. The US Department of Justice opened an investigation into the company, and some financiers filed a lawsuit against the management of Lordstown Motors, accusing him of acts, which led to a drop in the company's capitalization. Before that, there was a request from the SEC for a background check in February., which the company presented in the process of preparing for going public.

In March 2021 scientific company Hindenburg Research presented, that Lordstown overestimated the number of pre-orders for their cars and does not have time to start creating by the appointed time. Hindenburg is a stakeholder: the company specializes in short stocks, about which he places data in research papers with a search for their weaknesses. So totally undeniable you shouldn't trust her. However, subsequent actions have shown, that her accusations were not so unfounded.

In May, Lordstown herself reported, that her expenses were higher than expected, cut plans for the production of cars for 50% and "delighted" investors with the news, that she actually needs more money just to, to start production of cars. Later in the press there were reports of numerous internal problems of the company.. In particular, Reported, that engineering work at Lordstown was done by interns, and the company's management embellished reality.

Unclear yet, how this story will end, but some conclusions can be drawn from it.

Firstly, SPAC is still a stigma. Yes, Lordstown was born from the merger of a startup with a shell company.. This backstory usually testifies, that the company, listed on the stock exchange, does not want to disclose information, which can scare away investors, - with a regular IPO or DPO, in terms of information disclosure, the demand from companies is much more stringent. Another electric car startup faced similar problems, Nikola, which was also SPAC.

Secondly, as I said in the Tesla review, the electric car industry is filled with stories of outright fraud. Stimulating the flow of money into this industry and the hype around it attract a lot of scammers and just adventurers there - just like the sphere of railway and canal construction in 19 century. It is already clear, that the result will remain, but along the way there will be a lot of bubbles and bankruptcies.

Creating bubbles and attracting capital to these industries: promises of steep returns "in the indefinite future" - this is a lure that is clearly more effective than the usual talk about "you know, let's take care of nature and make less emissions". On the other hand, may be, everything will be fine for Lordstown and now it will be possible to pick up shares at a lower price.

By the way, Lordstown pickups will be called Endurance - "overcoming".

I forbid you to post

The story about that, how the Chinese government attacked Chinese startups for listing shares in the US, there is a continuation, which will be relevant for everyone, who invests in Chinese stocks.

In the wake of these developments, Chinese regulators issued a statement last week, what will tighten the screws against companies, listing shares outside China, create a system of "extraterritorial application of Chinese capital laws" and generally fight "illegal securities activities". In practice, this could lead to the delisting of all Chinese companies from US exchanges.. In an article about the possible consequences of a confrontation around the Xinjiang issue, we told, that in fact many Chinese stocks, which Americans take to the USA, and we are on the St. Petersburg Stock Exchange, "fake".

China has serious restrictions on the size of shares held by foreign investors, and to get around this problem and raise money on the American stock exchange, Chinese companies create special legal entities, through which they place their ADR.

The problem is, that when you take ADR, say, DiDi, then you actually become a shareholder of a non-canonical DiDi, and a third party, created by DiDi.

DiDi on the American stock exchange is not the same DiDi at all, which provides services in China. It's just a company, registered in the Cayman Islands, which has contractual obligations with the "mainstream" Chinese DiDi. I.e, buying a DiDi share, you kind of become a shareholder of Chinese DiDi, but actually no: you own the shares of the company, which can be considered an intermediary, - it has an agreement with the parent company.

This method of placing shares is a classic case, when “if not allowed, but if you really want it, then you can". These actions seem to bypass Chinese bans., but Chinese regulators can nullify all these receipts as invalid. This is how they can do it, if they decide to interpret the contractual obligations of Chinese companies to shell companies on US exchanges as the subordination of a Chinese company to foreign investors. Or invalidate a specific company's receipt, because “here is an agreement drawn up in violation of Chinese law on share ownership”.

At best, the vague threats of Chinese regulators would mean, that Chinese companies will have more obstacles before listing in the US. Now they are not legally prohibited from listing their shares outside of China. All these obstacles are not such a big problem for holders of Chinese shares already traded on the exchange., but anything can happen. So if you plan to invest in stocks of Chinese companies, then keep that in mind.

“Give in to the gas!»

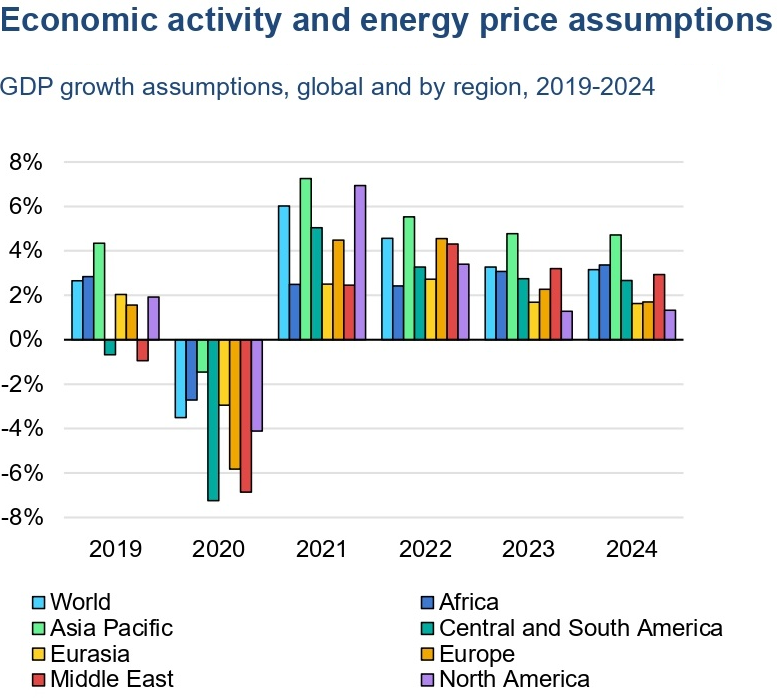

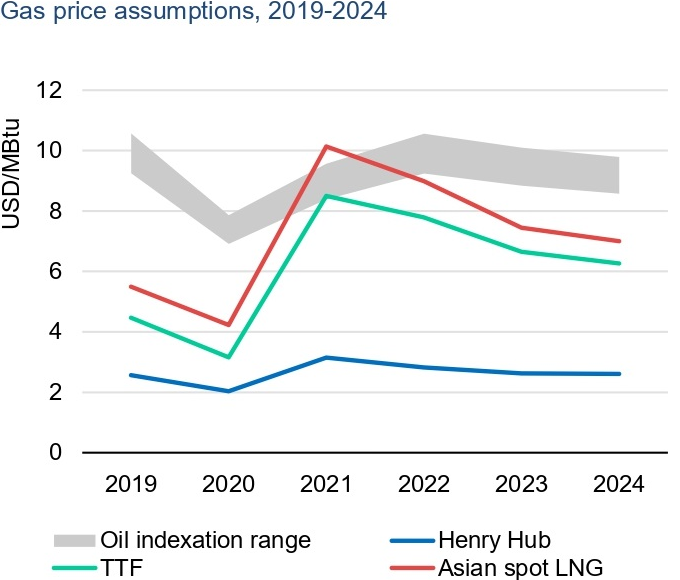

International Energy Agency (IEA) released a major report on the state of affairs in the gas market. According to the authors of the report, global gas consumption growth rates will slow down next year: 1,7% on average in 2022-2024 against 3,6% in 2021.

Interesting, that the IEA emphasizes, that even such slow growth rates will not be in line with the plans of various governments to reduce emissions into the atmosphere. Therefore, one can expect, that the powerful ESG lobby will at least begin to push for tougher restrictions on the issuance of loans to energy producers.

It is unlikely that this will have a very bad effect on the quotes of the largest oil and gas companies.: for the most part, they submitted to the requirements of investors, requiring "greening", and regularly invest in the development of clean energy sources and sell off their oil and gas assets. But for service companies and suppliers of related equipment, this will definitely become a problem.: fact, that large companies are moving away from large projects in the field of oil and gas, presupposes, that their expenses for the renewal of fixed assets will not increase or even decrease.

Lost fear

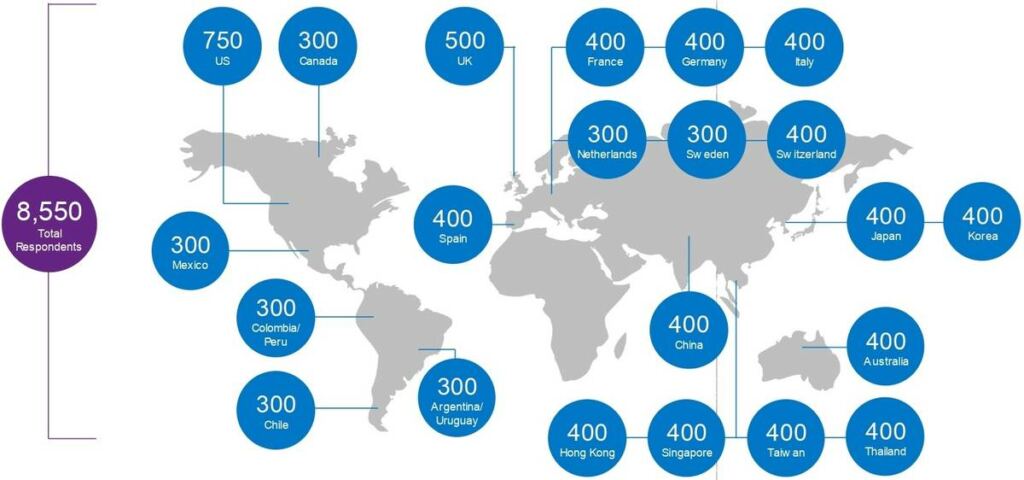

If you were looking for signs, the market has gone crazy, Here is another proof of this. French investment bank Natixis conducted a study among 8,550 individual investors around the world.

There's a lot of interesting stuff there., but we are interested in the point of expectations: the main investor mass due to the market growth in 2020-2021 seriously expects the average annual growth rate of the stock market in the region 14,5% over inflation for a long time.

For you to understand, how much is that: investment management professionals consider it reasonable to hope for long-term CAGR 5,3% over inflation. Several conclusions follow from all this..

The market will be more volatile. Such impudent expectations of investors are sure to be accompanied by tantrums when faced with reality., and therefore drawdowns in the market will become more sudden and painful.

"You can not win - earn". In many investment ideas, I indicate a certain mass of investors as one of the growth factors: they pump stocks on assumption, that “this is a promising topic, must be taken ". Based on the Natixis poll, I was convinced of the validity of this argument.: you can really invest in the most brazen and risky startups like Lordstown and it’s not unreasonable to expect quotes to grow. This is due to the influx of mass: she's chasing profitability, which cannot be obtained for a long time.