Vroom playground (Nasdaq: VRM) - not just an online platform, where to buy and sell used cars, and the business ecosystem, where each user receives assistance at all steps of owning and using their vehicle.

What do they earn

Vroom gives owners and buyers:

- buy a used car;

- finance a deal through a partner bank;

- conduct radio frequency identification and check the serviceability of all components and parts;

- use high-quality pre-sale service or return the car after a tragedy;

- get a guarantee for a car within 90 days from the date of purchase;

- use full-fledged logistics services from home to home.

Created in 2013, a successful interface for online purchase of used cars Vroom lost 3 of its own founders by 2018: Chesrow brothers and Kevin Westfall, who, for unknown reasons, sold their shares in the company.

Vroom is now ruled by employees with the fewest shares.

One of the main objectives of the company, according to the management, make the process of selling and buying any used car safe and comfortable.

How was the IPO

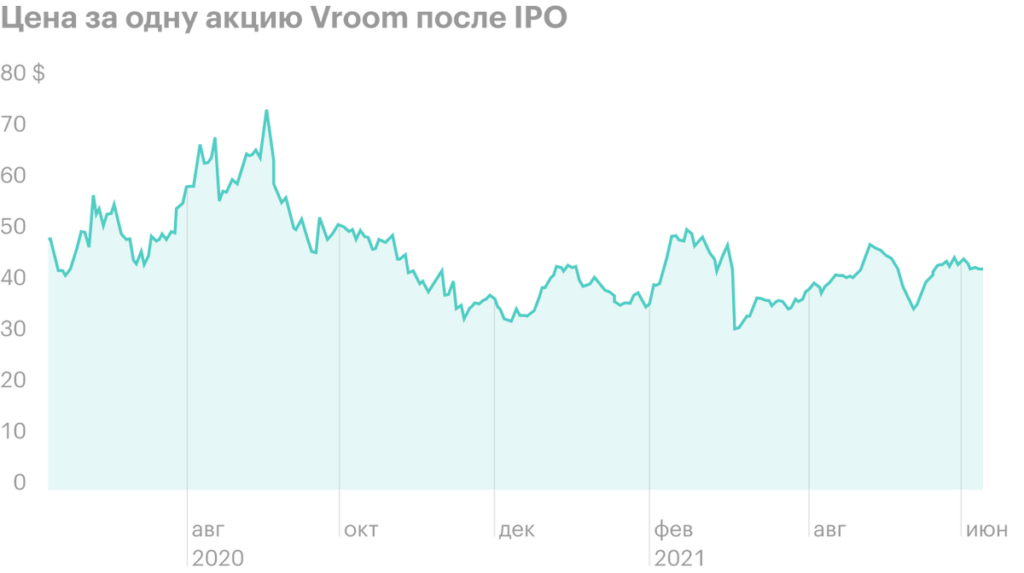

Vroom Shares, despite the loss of the company, took advantage of the high demand already on the first day of the IPO. By the end of the first day of trading on Nasdaq, shares have risen in price by more than one hundred percent..

Stocks continued to rise for 2 months, but in september, after the release of the quarterly report, which turned out to be worse than expectations, fell to the level of the first day of location. Vroom Raised $721M Through Eight Funding Rounds Pre-IPO, moreover, the last round - series H - evaluated Vroom shares at a price 27,19 $ per share with a total capitalization of $1.3 billion.

Not only Vroom benefited from the IPO, but also major investors, who initially expected to sell part of their shares in an IPO. It's L Catterton and T. Rowe Price. Both companies owned more than 15%. National auto dealer AutoNation owned 5.9% of Vroom. AutoNation performed service and repair work for Vroom, but the agreement with the supplier was terminated before the IPO. Vroom now considers AutoNation as a potential competitor, therefore not interested in further cooperation.

Vroom IPO was more than successful: The capitalization of the company grew to 4.6 billion dollars. It can be assumed, that Vroom was lucky with the chosen time: public offering of a company 10 June 2020 coincided with the overall market growth. 9 June saw a record increase in the NASDAQ Composite index, which for the first time in its history crossed the mark of 10 thousand points, following the growth of the shares of the main issuers of the FAANG group.

Major shareholders of Vroom, million pieces

| Number of shares | share | |

|---|---|---|

| L Catterton | 19,4 | 20,6% |

| T. Rowe Price | 15,0 | 16,0% |

| Cascade | 6,8 | 7,2% |

| General Catalyst | 6,0 | 6,4% |

| AutoNation | 5,6 | 5,9% |

Vroom financial performance

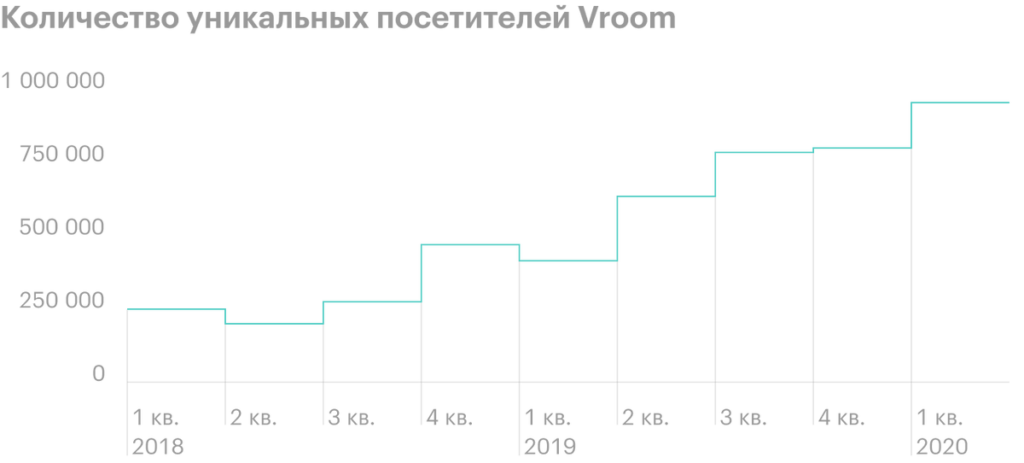

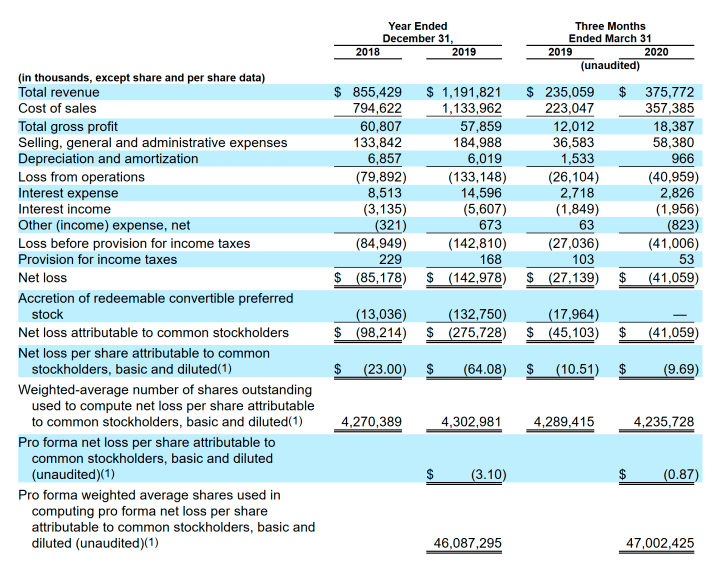

Before the IPO, Vroom presented financial statements for 2 full calendar years. Despite rising revenue, the company remains unprofitable. Moreover, the net loss, generated by the growth of administrative and other expenses, outstripping revenue growth.

Decline in gross margin coupled with robust growth in marketing spend led to higher operating losses for the company in 2019.

They amounted to $ 133 million, which is 67% more, than an operating loss of 80 million in 2018.

Despite significant growth in total revenue, gross profit per vehicle sold, usually, moving in the opposite direction. In 2019, gross profit per vehicle sold decreased by 33%. In the first quarter of 2020, gross profit per machine sold decreased by 41%.

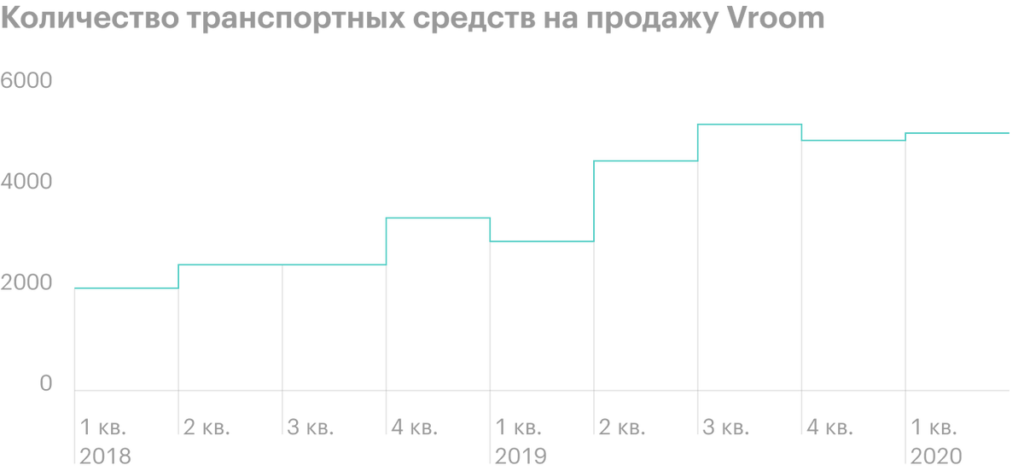

Wholesale segment Vroom, representing auction sales, generates 18% of revenue and about 1% of gross profit. In 2019, wholesale revenue increased by 22%, due to an increase in the average selling price by 12% and an increase in the number of cars sold by 10%.

Back in December 2015, Vroom acquired Texas Direct Auto Auto Repair Center (TDA). Vroom's TDA segment accounted for about ⅓ of the company's total revenue in 2019. The total revenue of the TDA segment in 2019 increased by 3%. In the first quarter of 2020, TDA segment revenue fell by 7%.

Revenue from car sales over the same period fell by almost 8%, which is logical due to the reduction of cars in the general catalog by 10%.

This decrease was partially offset by an increase in the average selling price. The overall decline in demand for used car deals in the first half of 2020 is attributed to the pandemic.

About the industry

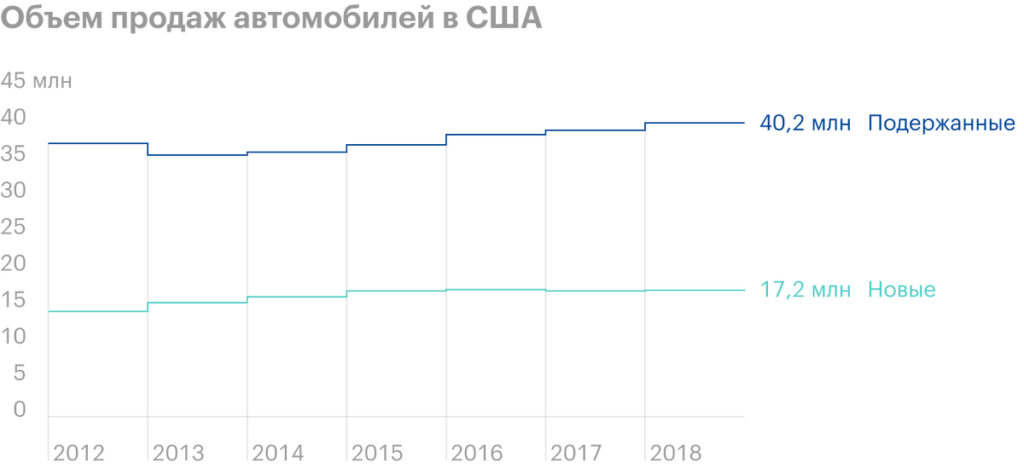

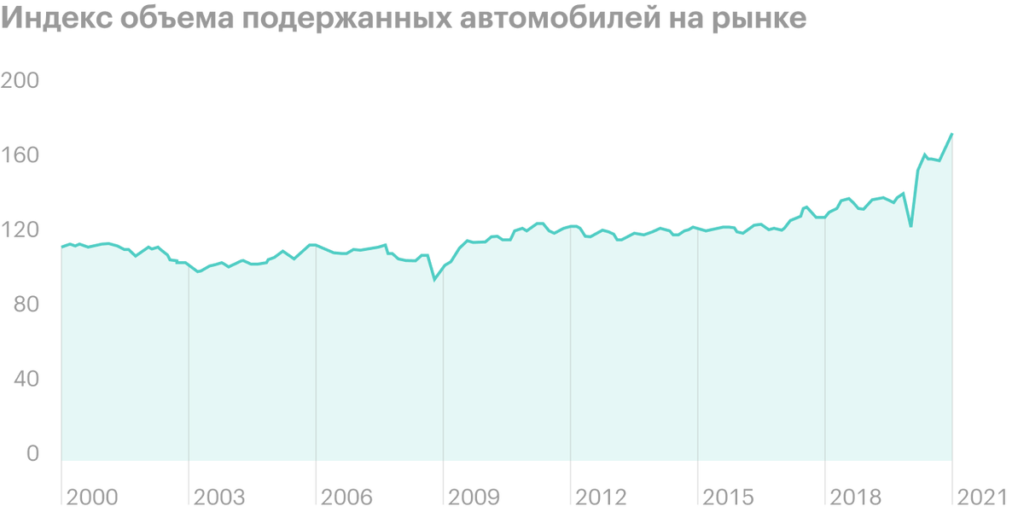

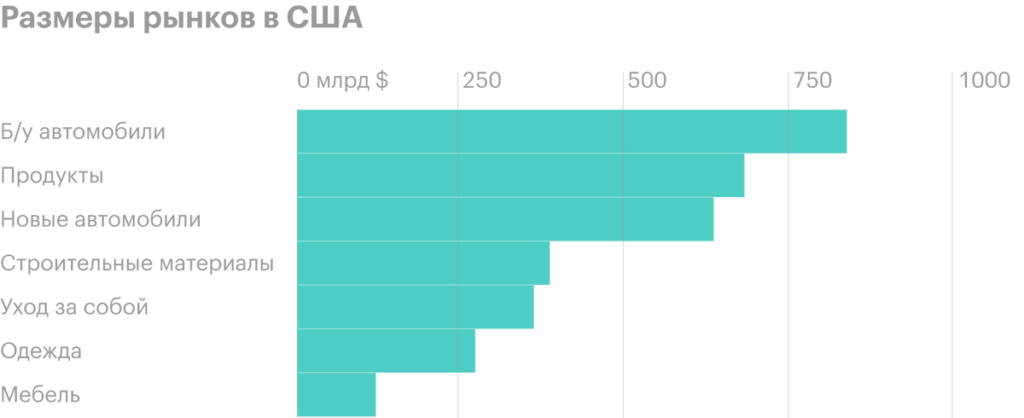

Used car sales in the US are one of the largest sales categories in the consumer market., twice the volume of new car sales. The market is still significantly fragmented and the consumer is divided among themselves by more than 40 thousand car dealers. There are also innumerable private sellers and buyers on the market., using classified sites.

The outdated business model of selling-buying a used car through classifieds sites carries risks for both parties to the transaction for many reasons.. No full transparency, it is difficult for buyers to thoroughly check the vehicle and have to communicate with strangers, share personal information with them.

According to research by the analytical company Gallup, car dealer profession, along with private sellers of used cars, causes maximum distrust among consumers in the US. More 80% buyers are dissatisfied with the process of buying a car from car dealers and private owners.

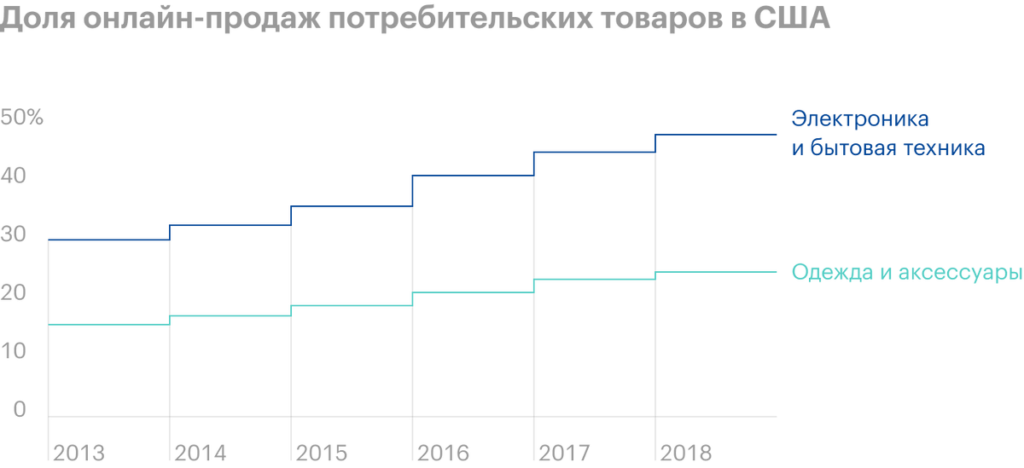

In spite of this, before 2020, no more than 1.5% of buyers used e-commerce sites when buying a used car - in contrast to the cases of buying other consumer goods, the share of purchases of which on the Internet averaged at least 16%. And in some sectors, such as clothes, reached 25%.

The pandemic has nearly wiped out outdated rules for buying used cars through dealers and has been a key driver of the growing popularity of e-commerce and mobile auto-commerce sites.. If before the pandemic, only 30% of buyers were ready to use mobile applications and e-commerce sites when buying a car, by the end of 2020 their number has doubled.

Have an opinion, that until 2030, electronic and mobile auto-commerce will grow at a rate, significantly exceeding the growth rates in other sectors of the consumer market, and the US market will show the highest growth rates.

Competitors

There are several companies in the USA, specializing in the sale of used cars and using electronic and mobile platforms for this purpose.

Shift offers services to users, including test drive, detailed study and specification, service and repair of the vehicle chosen by the buyer.

Internet platform CarGurus is a marketplace, connecting sellers and buyers and offering secure transactions through its website. The project is known not only in the USA, but also in the UK, Canada, Germany, Spain, Of Italy. CarGurus uses the business model of standard marketplaces, like Airbnb and HomeAway, and by and large puts all the difficulties when buying a used car on the buyer, not responsible for history, vehicle inspection and delivery. The main convenience when buying and selling a car through CarGurus is the safe transfer of money and a guarantee of their return in case of force majeure.

Vroom's main competitor, as close as possible to the business model and the desired audience, - Carvana platform, offering users the same services.

Both companies are unprofitable, their revenue is growing, But along with revenue, losses also grow.. Nevertheless, Carvana looks more stable in most financial indicators.. But thanks to the increase in the amount of accounts after the IPO, Vroom significantly improved the ratio of assets to its liabilities.. Besides, Vroom is not burdened by long-term debt obligations, and Carvana has almost $900 million worth of them.

Financial performance of Vroom and Carvana

| Carvana | Vroom | |

|---|---|---|

| Revenue, million dollars | 1955 | 1192 |

| Cars sold | 94 108 | 31 963 |

| Sales as a percentage of revenue | 22% | 16% |

| Gross profit per unit, in dollars | 2090 | 1696 |

| EBITDA | −6,2% | −10,7% |

Eventually

Vroom is a fast growing company. She is no exception to the rule, just like Uber or Airbnb, sacrifices such a key factor for growth, how profitability. If the vector of the company's development remains the same, then the future of Vroom will look hazy.

Nevertheless, Vroom CEO Paul Hennessy is confident in the future success of the company.. Speaking to shareholders following the release of Q1 2021 financials, he said: “Our results have exceeded my wildest expectations: year on year sales increased by 96%, and gross profit - by 123%".

Paul Hennessy assured investors, that the growth of revenue and gross profit will continue during the current year and the company will start investing in logistics.