PetroChina (NYSE: PTR) - Chinese oil and gas production organization. The company experienced the Covid decline with honor and is now recovering.. However, there are political dangers.

What happens here

Readers have been asking us for a long time to start sorting out the financial statements and business foundations of foreign issuers.. Dismantling the company PetroChina was suggested by our reader fie you in the comments to the review of Equitrans Midstream. Offer in the comments of the company, analysis of which you would like to read.

The overview contains many screenshots with tables from reports. To make it more convenient to use them, we transferred them to google-sheets and translated into Russian. Direct your attention: there are several sheets. And keep in mind, that companies round off certain numbers in documents, therefore, the totals in graphs and tables may not converge.

Download the table from the report

What do they earn

Here is the crucial fact, next?? know about this company: PetroChina на 80,41 % owned by the Chinese oil and gas state corporation CNPC.

In accordance with the annual report, the company's revenue is divided into subsequent segments.

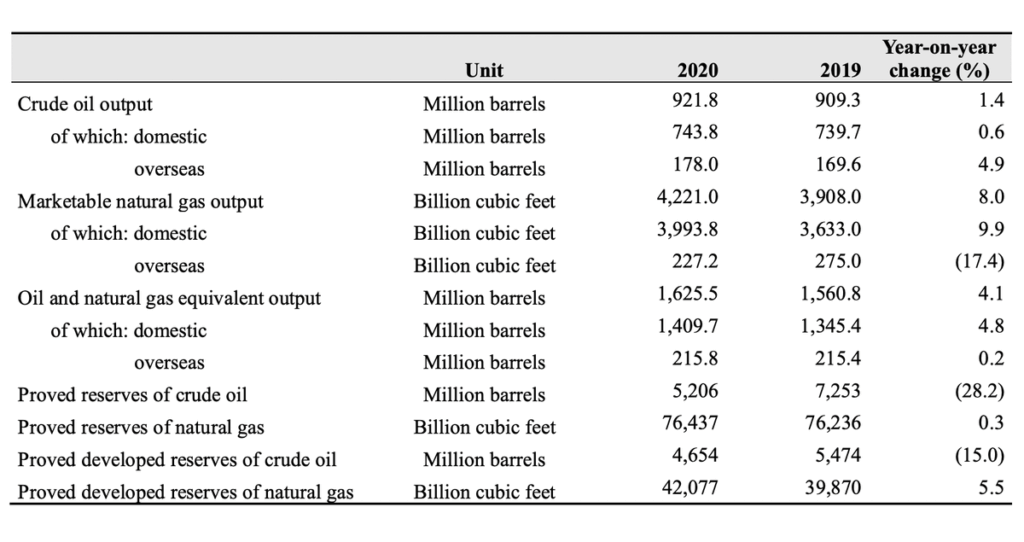

Exploration and production — 16,7 %. The sector's operating margin is 4,35 % from its proceeds.

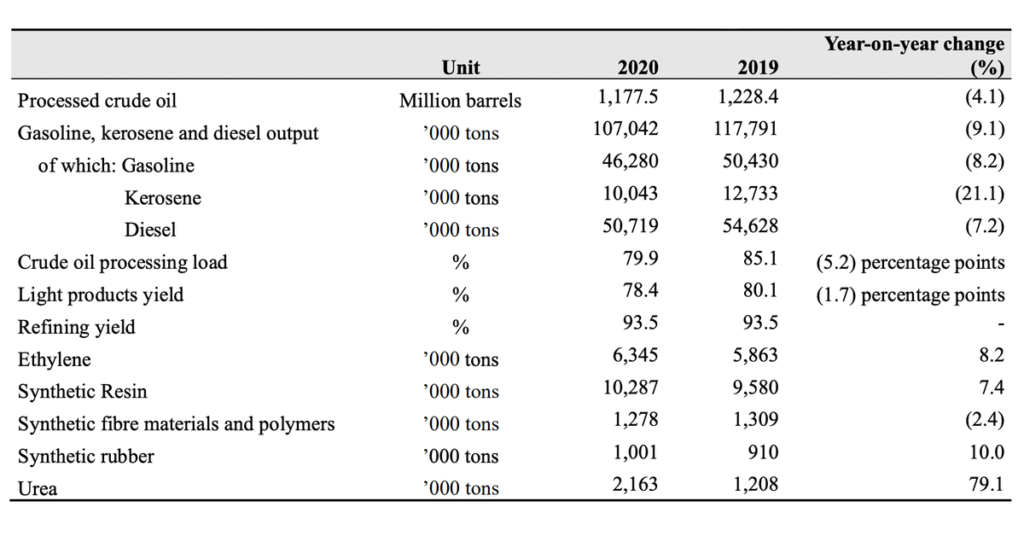

Processing and chemical creation — 24,38 %. Sector operating margin is negative: −0,23 % from its proceeds. Fairness worth reporting, that he was not constantly unprofitable: in 2019 its operating margin was 1,6 % from its proceeds.

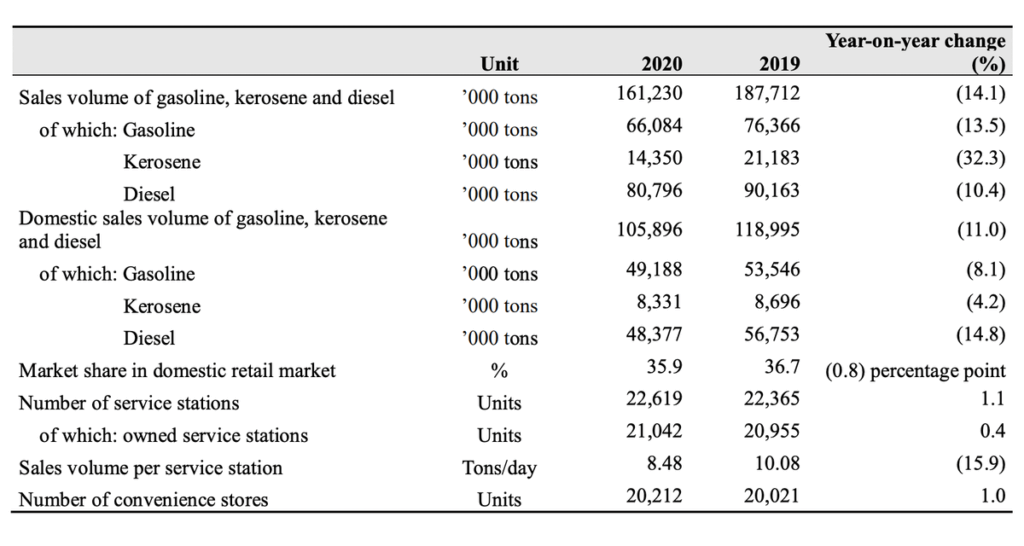

Sale of energy resources — 47,13 %. Sector operating margin is negative: −0,19 % from its proceeds.

Natural gas and pipelines — 11,66 %. The sector's operating margin is 19,52 % from its proceeds.

Operation of the central control and more — 0,13 %. This, in fact, technical sector, who doesn't have to be here. The loss from the sector's operations exceeds the revenue by almost 4,5 Times.

There is nothing in the report about foreign sales of the company, but such information is not required.: it becomes clear from the reporting, that the main clients of PetroChina are located in China.

The largest oil and gas companies in the world by revenue

| Company | Country | Revenue, billion dollars |

|---|---|---|

| PetroChina | China | 280,7 |

| Sinopec | China | 271,1 |

| Saudi Aramco | Saudi Arabia | 229,7 |

| BP | United Kingdom | 180,0 |

| Exxon Mobil | USA | 178,2 |

| Royal Dutch Shell | United Kingdom | 170,2 |

| Total | France | 119,7 |

| Chevron | USA | 94,4 |

| Gazprom | Russia | 90,5 |

| Marathon Petroleum | USA | 75,0 |

PetroChina

Country

China

Revenue, billion dollars

280,7

Sinopec

Country

China

Revenue, billion dollars

271,1

Saudi Aramco

Country

Saudi Arabia

Revenue, billion dollars

229,7

BP

Country

United Kingdom

Revenue, billion dollars

180,0

Exxon Mobil

Country

USA

Revenue, billion dollars

178,2

Royal Dutch Shell

Country

United Kingdom

Revenue, billion dollars

170,2

Total

Country

France

Revenue, billion dollars

119,7

Chevron

Country

USA

Revenue, billion dollars

94,4

Gazprom

Country

Russia

Revenue, billion dollars

90,5

Marathon Petroleum

Country

USA

Revenue, billion dollars

75,0

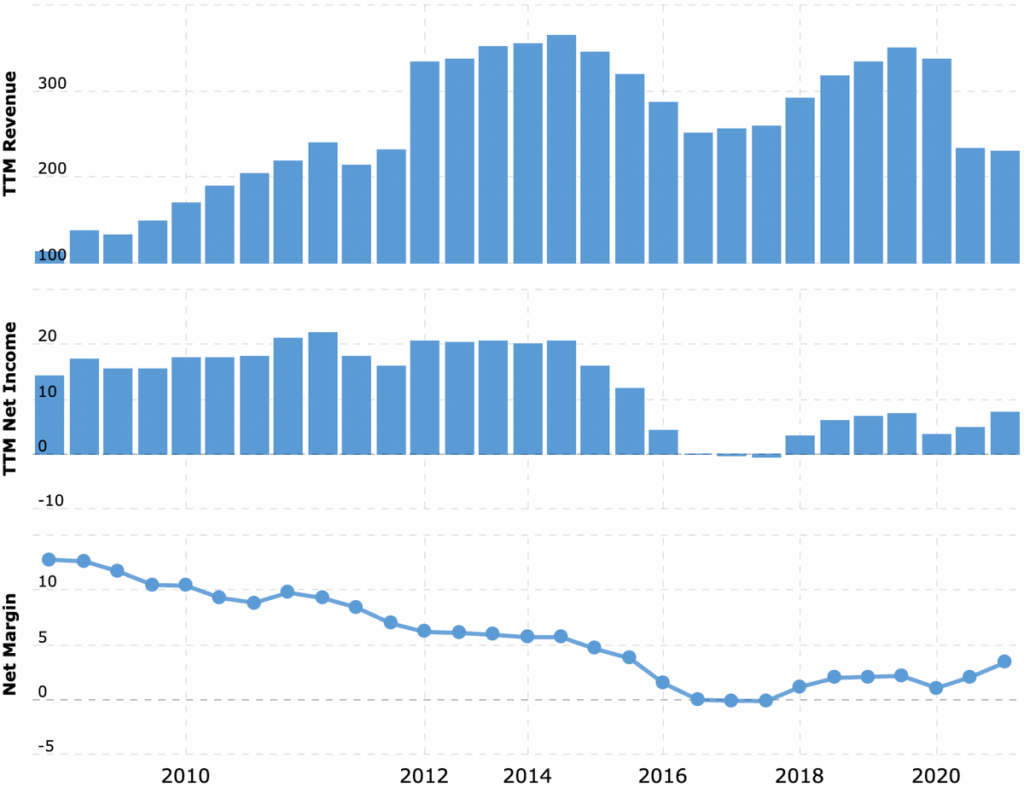

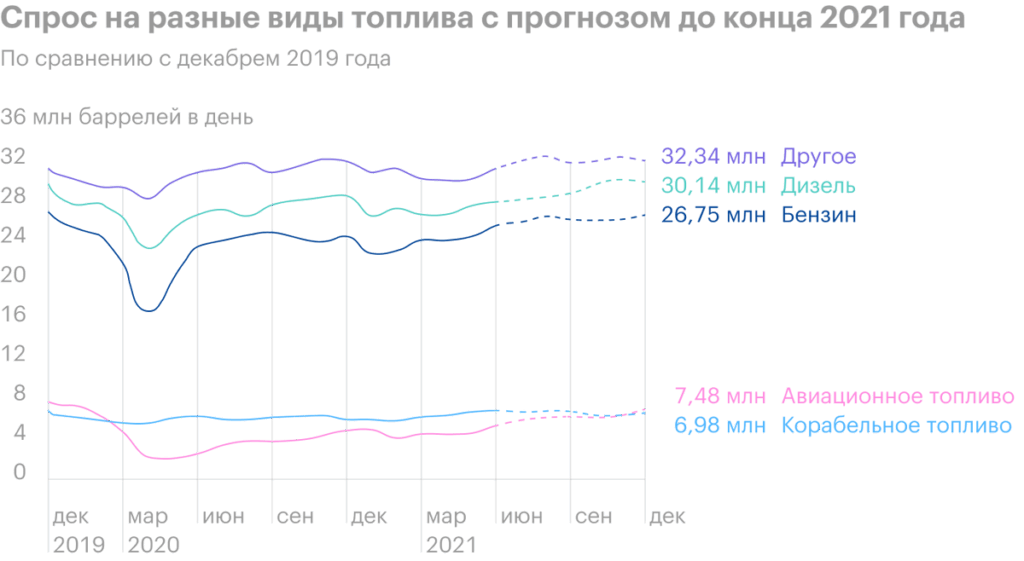

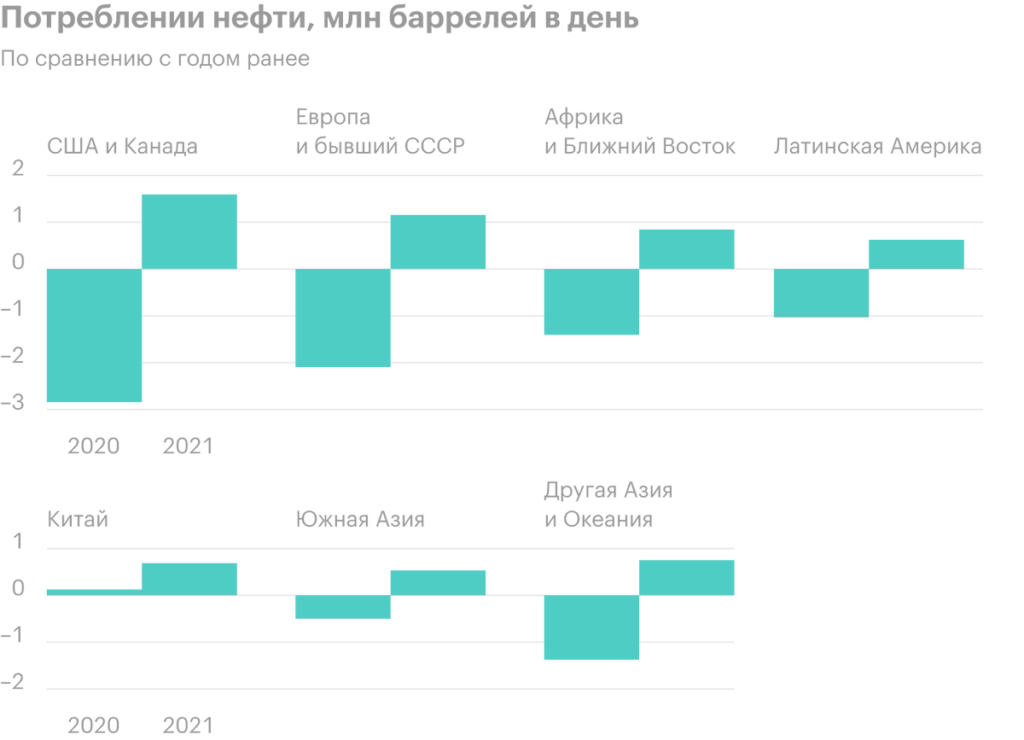

Better future

The company did not have a good year last year., like most of her colleagues from the West, but now its main indicators are being corrected and things are generally improving. For example, the company is now profitable, not at a loss, which is quite expected against the backdrop of a recovery in demand for energy resources around the world.

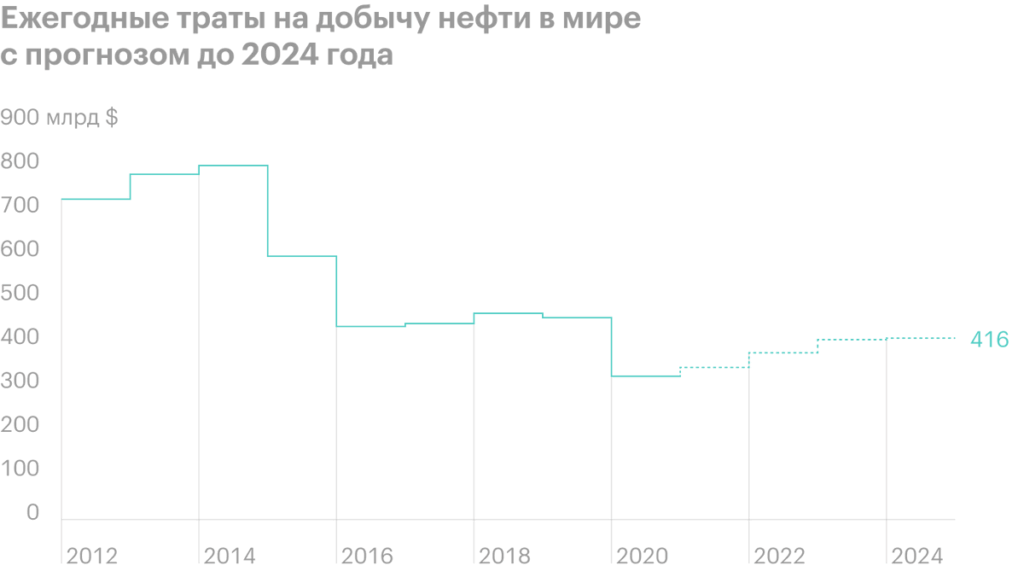

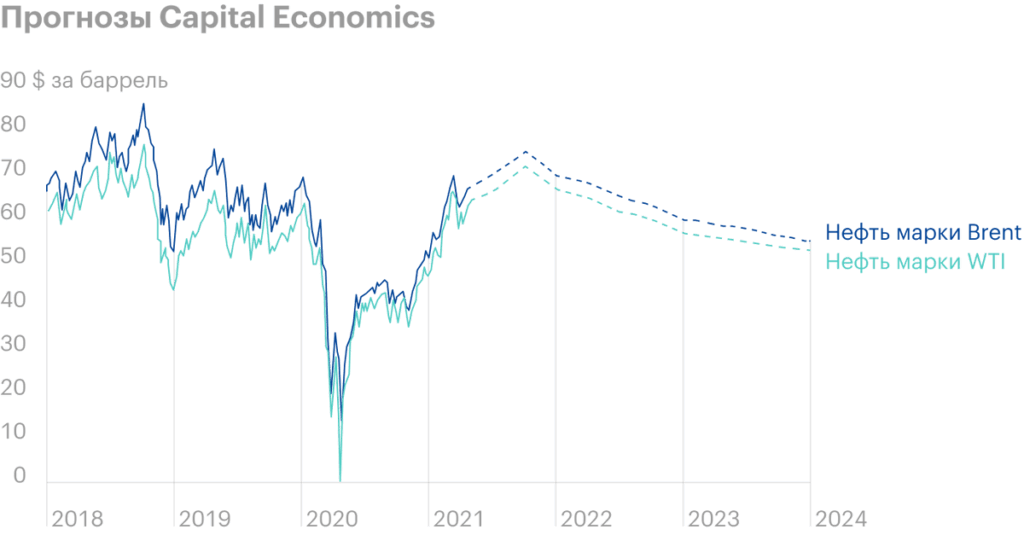

In the medium term, PetroChina is also playing into the hands of, that in the world as a whole, spending by energy companies on exploration and production at new fields is falling. This may lead to some shortage of supply and a moderate increase in oil prices in the future..

But the key word here is moderate.. Predictions are different, certainly, but on average they boil down to, that the price will be lower 90 $ per barrel. So there is no talk of super profits.

Another plus for the company will be the relatively positive experience of experiencing the coronavirus crisis in China. All the worst happened there quickly enough, and the industry bounced back quite a bit after the start of the pandemic. If history with quarantine repeats itself, then I think, that PetroChina will survive it again with honor.

For lovers of payments on a note

The company pays 2,67 $ dividend per share per year, which gives approximately 5,6% per annum. By today's standards, that's a pretty steep yield.. I'm totally against it, to rely on payments, but, Considering, that the main shareholder of the company is, in fact, Chinese government, one can safely hope, that dividends will keep.

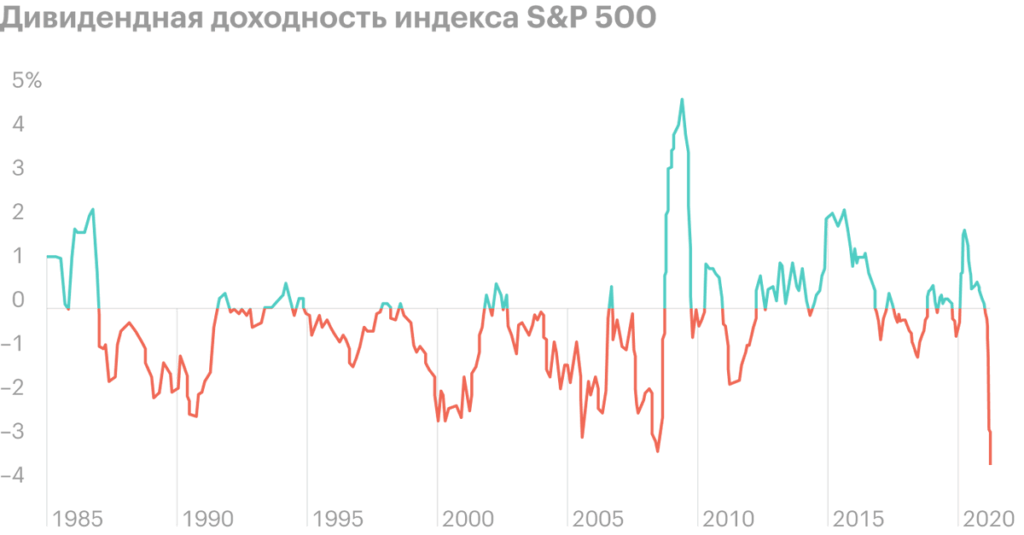

Certainly, they may well be cut in the future, but so far the situation for the company is quite positive. Profitability here for the present is royal, therefore, a variant with a noticeable growth of these shares is quite possible, simply due to the arrival of lovers of passive profitability in them, because the real dividend yield S&P 500 no longer pleases anyone.

On the other hand, after all, payments can always cut. And a repetition of the quarantine story can lead to a cut in payments or even their complete cancellation.. In this case, the company's shares will fall sharply., because almost the whole attraction of PetroChina lies in large payouts.

Registration problems

The company is owned by the Chinese state and could well add to the ever-growing State Department blacklist., and PetroChina stocks in America - and we are buying here exactly American ADR companies - can arrange delisting. In this case, the stock will fall, because investors will sell them furiously, and after delisting from the American stock exchange, the papers will end up in purgatory.

Although even after the delisting, you seem to continue to receive dividends on these shares. But in order to sell them, you will need to ask Bank of New York Mellon, which PetroChina's ADR in the US and posted, exchange these ADRs for company shares on the Shanghai Stock Exchange. And all this only on the condition that, what's your broker gives access to this exchange. All in all, it will be a so-so quest.

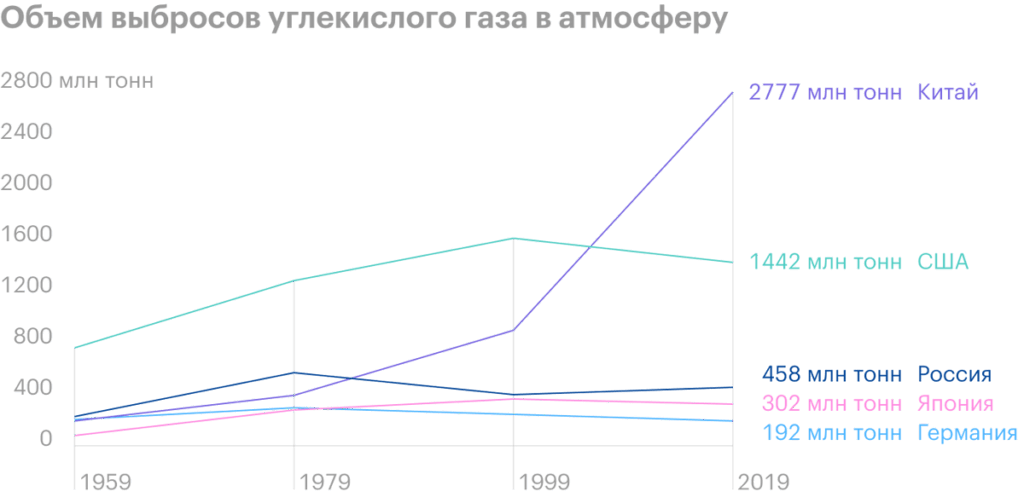

Chinese companies are not super-safe investments for this reason, that in this country cases of deception of shareholders are not uncommon. But in the case of PetroChina, I am more or less calm in this regard.: it is unlikely that the Chinese state will tolerate deception and ignore the reporting problems of its dividend cash cow. The main risk here is precisely an attack on the company from the United States.. Moreover, there can be any reason for such an attack - from participation in the oppression of the Uyghurs to ecology.. The latter is highly probable: the company often falls into different lists of enterprises, spoiling the environment. Ecology is a very convenient reason to get to the bottom of China from Western countries due to the huge amount of emissions, generated by the Chinese economy, so PetroChina could easily get hit here.

Resume

PetroChina is a good dividend story. Should, certainly, keep in mind the political risks and the likelihood of a repeat of the quarantine. But if you are very afraid of these risks, then it is better to bypass the shares of the company.