Lukoil (MCX: LKOH, LSE: LKOD) — the largest commercial organization in the Russian Federation.

About company

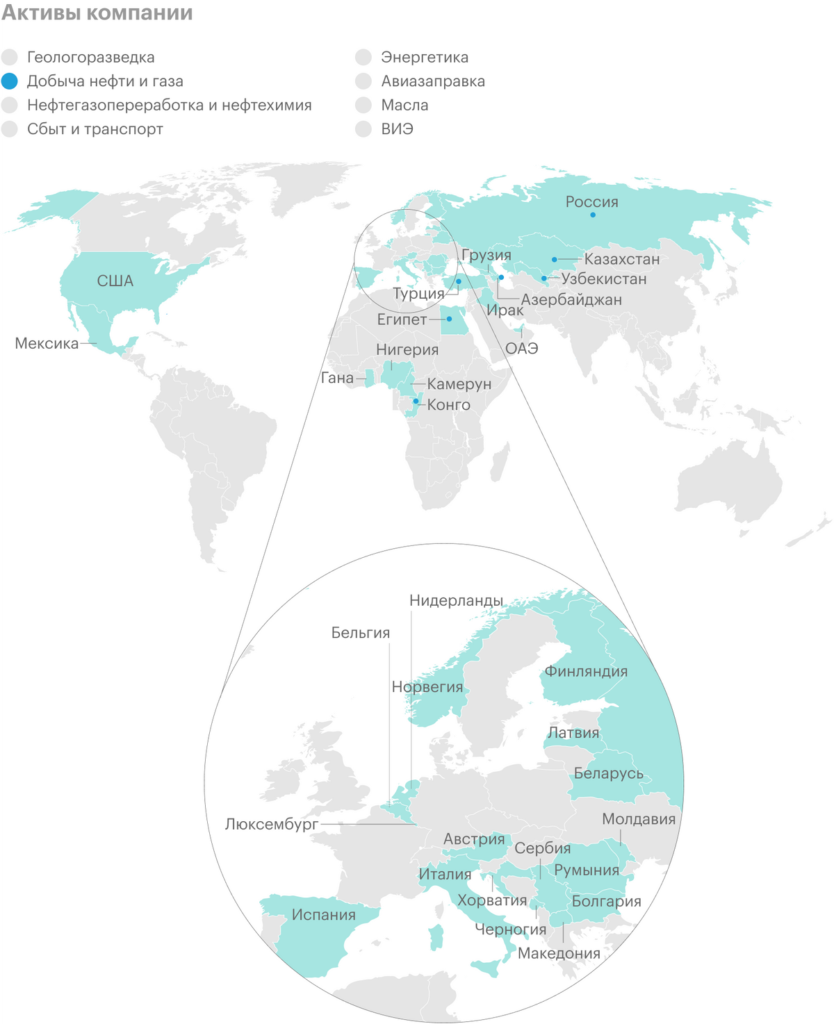

Lukoil is a large vertically integrated oil and gas producing organization, which was founded in 1991. Assess the scale of her business: it controls one percent of global proven supplies and provides two percent of global oil production and refining each. Lukoil is represented in 35 states on 4 continents, the main assets of the company are concentrated in the Russian Federation, where does she operate in 63 regions. No matter what vertically embedded company, Lukoil strives to keep the entire production chain under control - from exploration to sales of products to the end user.

In reporting, the company identifies three operating sectors.

Exploration and production. In this sector, the company is engaged in the exploration and production of oil and gas. As of early 2021, the company's proven reserves were 15.4 billion barrels of oil equivalent.: 11,7 billion barrels of oil and 22.2 trillion cubic feet of gas. Most of the supplies are conventional, but there are also hard-to-recover. Company secured with supplies for at least twenty years. Most of the supplies are located in the Russian Federation, where the company's license fund is constantly growing and at the end of 2020 it is seeking 563 licenses. In addition, exploration and production are carried out in Azerbaijan, Kazakhstan, Uzbekistan, Norway, Romania, Mexico, in the Middle East and Africa. Average daily production in 1 quarter of 2021 was at the level of two,2 million barrels of oil equivalent, of these, seventy-four percent were aqueous hydrocarbons.

Processing, trade and sales. There are several subsegments in this sector.:

- Oil refining. 8 oil refineries: 4 In Russian federation, one in Italy, Romania and Bulgaria - and a share of forty-five percent of the plant in Holland. Total capacity - 80.4 million tons per year.

- Gas processing: 3 gas processing plants, also gas processing facilities at one refinery and one petrochemical plant, they are all in the Russian Federation.

- Petrochemistry: production of polymeric materials and other petrochemical products at 2 petrochemical enterprises in the Russian Federation, also at 2 oil refineries in Italy and Bulgaria, export of products to 30 states.

- Creation and sale of oils: creation of full-cycle oils at 2 oil refineries in the Russian Federation and blending of oils from finished components in the Russian Federation and abroad - in Finland, Austria, Turkey, Romania and Kazakhstan - on their own, solidary and involved proceedings. The company produces 800 types of oils, occupying a share of thirty percent in the market of the Russian Federation.

- Energy: the company has energy capacities in the Russian Federation, Romania, Bulgaria and Italy. She releases electro- and thermal energy. What is curious, the company has not only classical capacities, and power from renewable energy sources (VIE): 4 hydroelectric power plants, 3 solar and wind power plant. According to the results of 2020, seventy percent of the generated electrical energy was related to commercial generation, and thirty percent to the provider, in other words applied at their enterprises, which helped to bring the share of its electric energy in the structure of consumption by the company's organizations to thirty-eight percent.

- Wholesale and Trading: oil sale, gas and processed goods in the Russian Federation and abroad, apart from others involving 3 its sea terminals for transshipment in the Russian Federation and one in Spain, its floating oil storage, the company also has its own trading department.

- Most important distribution channels: here the company includes the retail sale of fuel and non-fuel products and services at a wide network of its own filling stations, who are in 19 States, sale of bunker, aviation fuel and bitumen.

Corporate center and more. This includes management, cash and non-core business transactions.

Revenue and form of ownership of the largest oil and gas companies in Russia for 2020

| Revenue, billion rubles | Type of ownership | |

|---|---|---|

| Gazprom | 6321 | State |

| Rosneft | 5757 | State |

| Lukoil | 5639 | Private |

| Gazprom Neft | 2000 | State |

| Surgutneftegaz | 1182 | Private |

| "Tatneft" | 721 | State |

| Novatek | 712 | Private |

| Bashneft | 527 | State |

Company reserves, million barrels of oil equivalent

| Proven | Probable | Possible | |

|---|---|---|---|

| 2016 | 16 398 | 6684 | 2981 |

| 2017 | 16 018 | 6409 | 3087 |

| 2018 | 15 931 | 6424 | 3242 |

| 2019 | 15 769 | 6217 | 3000 |

| 2020 | 15 385 | 5581 | 2802 |

Number of company licenses in Russia

| 2016 | 514 |

| 2017 | 523 |

| 2018 | 528 |

| 2019 | 539 |

| 2020 | 563 |

514

Company's production per day, thousand barrels of oil equivalent

| Liquid hydrocarbons | Gas | Total | |

|---|---|---|---|

| 2016 | 1875 | 401 | 2276 |

| 2017 | 1804 | 465 | 2269 |

| 2018 | 1806 | 541 | 2347 |

| 2019 | 1815 | 565 | 2380 |

| 2020 | 1651 | 466 | 2117 |

Refining indicators, thousand tons

| Refining of petroleum feedstocks | Release of petroleum products | Processing depth | |

|---|---|---|---|

| 2016 | 66 061 | 62 343 | 85% |

| 2017 | 67 240 | 63 491 | 87% |

| 2018 | 67 316 | 63 774 | 88% |

| 2019 | 68 746 | 65 081 | 89% |

| 2020 | 58 608 | 54 964 | 93% |

Gas processing volume, million cubic meters

| 2016 | 3901 |

| 2017 | 4038 |

| 2018 | 4308 |

| 2019 | 4239 |

| 2020 | 3977 |

3901

Production volume of petrochemical products, thousand tons

| 2016 | 1270 |

| 2017 | 1171 |

| 2018 | 1246 |

| 2019 | 1137 |

| 2020 | 1228 |

1270

Oil production and blending figures, thousand tons

| Full cycle oil production | Mixing oils | |

|---|---|---|

| 2016 | 917 | 118 |

| 2017 | 998 | 128 |

| 2018 | 961 | 131 |

| 2019 | 963 | 138 |

| 2020 | 923 | 161 |

Commercial generation indicators

| Production of electricity from renewable sources, million kWh | Electricity production total, million kWh | Thermal energy, million Gcal | |

|---|---|---|---|

| 2016 | 977 | 21 704 | 12,4 |

| 2017 | 1053 | 20 189 | 10,7 |

| 2018 | 1365 | 19 919 | 11,0 |

| 2019 | 1100 | 18 307 | 10,1 |

| 2020 | 822 | 17 138 | 10,0 |

Wholesale oil sales, gas and processed products

| Oil, million tons | Gas, million cubic meters | Oil- and gas products, million tons | |

|---|---|---|---|

| 2016 | 77,4 | 18 908 | 121,6 |

| 2017 | 75,8 | 22 837 | 128,5 |

| 2018 | 85,3 | 27 896 | 123,5 |

| 2019 | 89,6 | 28 727 | 121,0 |

| 2020 | 87,4 | 24 065 | 104,8 |

The number of filling stations of the company and the volume of sales of petroleum products at them

| Number of gas stations | Volume of sales, thousand tons | |

|---|---|---|

| 2016 | 5309 | 14 193 |

| 2017 | 5258 | 14 238 |

| 2018 | 5168 | 15 144 |

| 2019 | 5044 | 14 129 |

| 2020 | 5005 | 12 699 |

Bunker sales volume, aviation fuel, million tons

| Bunker fuel | Aviation fuel | |

|---|---|---|

| 2016 | 3,3 | 1,8 |

| 2017 | 4,5 | 1,9 |

| 2018 | 4,7 | 2,2 |

| 2019 | 4,3 | 2,1 |

| 2020 | 2,7 | 1,1 |

Structure of the company's production by regions for 2020

| Oil | Gas | |

|---|---|---|

| Western Siberia | 42% | 44% |

| Timan-Pechora | 19% | 6% |

| Pre-Urals | 19% | 5% |

| Volga region | 13% | 6% |

| International projects | 5% | 39% |

| Other | 2% | 0% |

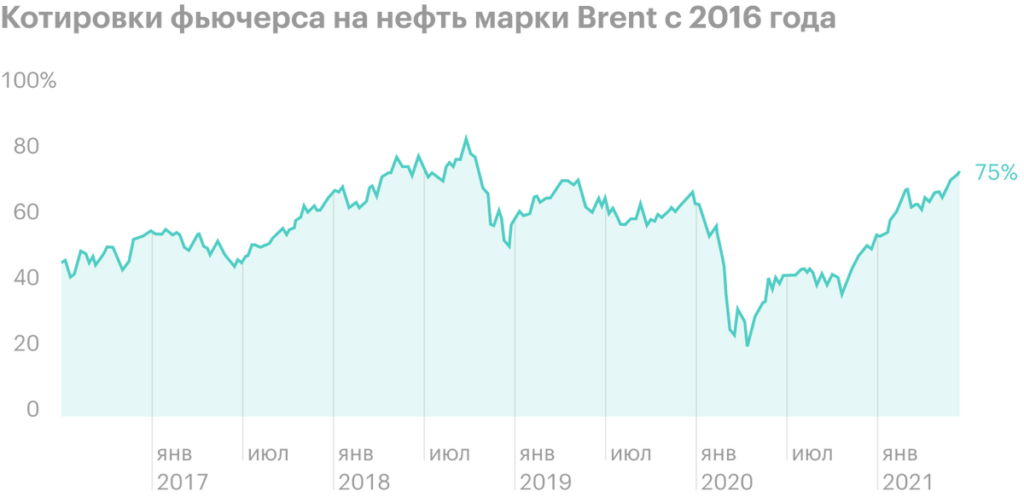

The perfect storm in the oil and gas industry

The oil and gas industry has not had the best of times in 2020: it all started with the collapse of the OPEC+ deal in March. The collapse of the deal caused a collapse in oil prices, then the situation continued with a sharp decline in demand for hydrocarbons due to widespread quarantine, pandemic coronavirus. Then a new OPEC + deal followed, due to which producers had to significantly reduce production. All this together has dealt a double blow to the oil companies.: production had to be cut along with a significant drop in prices for their products.

Naturally, Lukoil also suffered from this. The increase in production was only in the petrochemical segment, where the company's largest plant increased occupancy after repairs in 2019. But the company went through a difficult period with dignity., helped well diversified - as in geography, and by the structure of production - business. As a result, Lukoil even increased capital expenditures by 10% compared to 2019 and regularly highlights in reports and messages from top management, what “as soon as, so right away "is ready to significantly increase production.

In 2021, the agreement to reduce production is still in effect, but in smaller volumes, and oil prices have risen significantly, which creates a springboard for a significant improvement in the production and financial results of the company.

Company capital expenditures, billion rubles

| 2016 | 497 |

| 2017 | 511 |

| 2018 | 452 |

| 2019 | 450 |

| 2020 | 495 |

497

Financial indicators

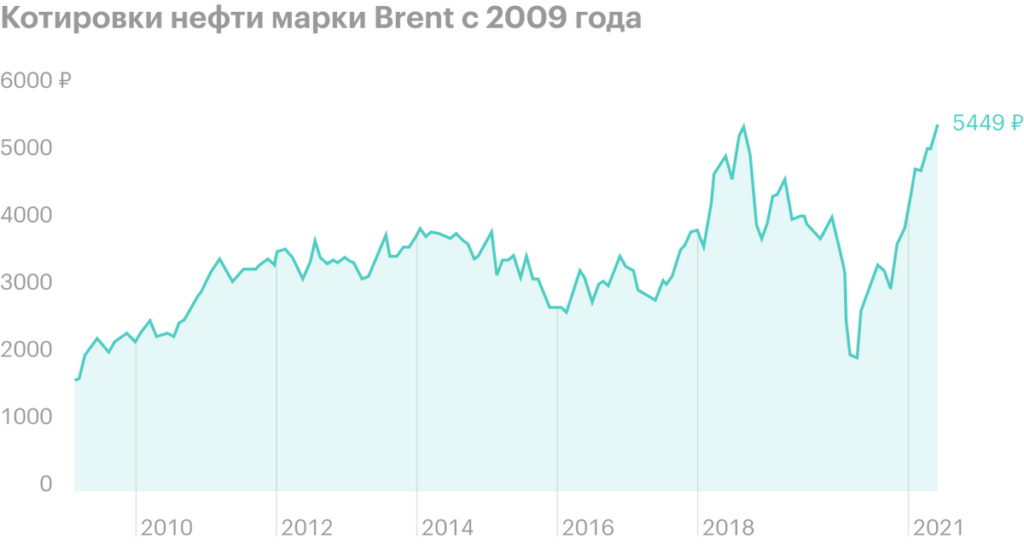

The main financial indicators of the company are quite volatile, since it largely depends on the situation: oil exchange prices, OPEC + agreements, as well as such non-monetary items, as exchange differences and impairment of assets. The strength of the company is a very low debt burden.

The dynamics of indicators also demonstrates, that even in such a difficult 2020, Lukoil managed to maintain profit, made free cash flow three-digit, and net debt, though significantly increased, but did not reach any critical values. Indicators 1 quarter of 2021 pleases - things are going well on all fronts.

Revenue structure shows, that the company traditionally earns most of its money from processed products. Lukoil also earns most of the money abroad in foreign currency.

Revenue, net profit, free cash flow and net debt, billion rubles

| Revenue | Net profit | free cash flow | net debt | |

|---|---|---|---|---|

| 2017 | 5937 | 399 | 247 | 286 |

| 2018 | 8036 | 619 | 555 | 42 |

| 2019 | 7841 | 640 | 702 | 37 |

| 2020 | 5639 | 15 | 281 | 316 |

| 2021, 1 neighborhood | 1876 | 157 | 164 | 172 |

Revenue by business segment, trillion rubles

| Processing products | Raw materials | Energy and more | |

|---|---|---|---|

| 2017 | 4,0 | 1,7 | 0,3 |

| 2018 | 5,0 | 2,7 | 0,3 |

| 2019 | 4,8 | 2,9 | 0,1 |

| 2020 | 3,4 | 2,0 | 0,2 |

Revenue by geographic segment for 1 Quarter 2021, billion rubles

| Russia | 666 |

| Abroad | 1589 |

| Exceptions | −379 |

| Total | 1876 |

666

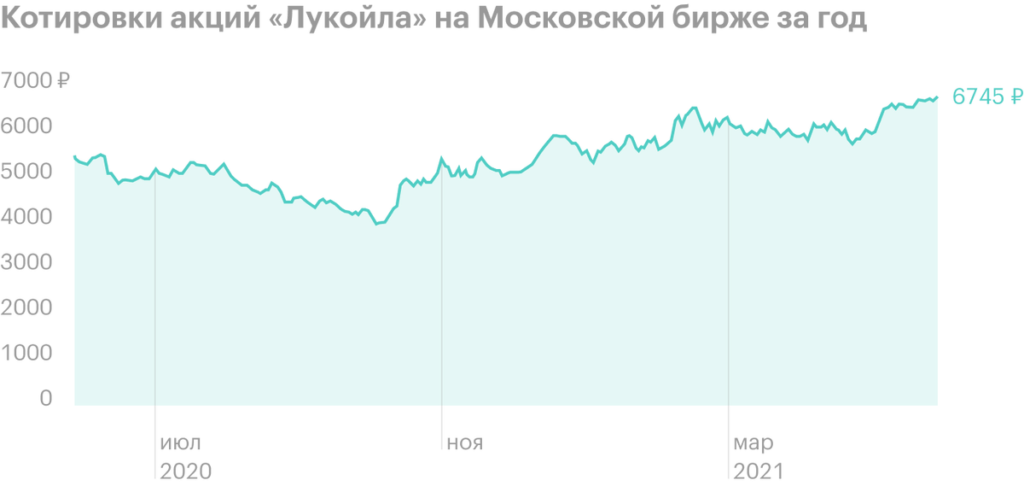

Share capital

At the beginning of 2021, the share capital of Lukoil consisted of approximately 693 million shares. Largest shareholders: CEO Vagit Alekperov and Vice President for Strategic Development Leonid Fedun. Most of the shares are in free float, which, together with a huge capitalization, allows the company to enter the top 3 in terms of weight in the main stock exchange indices for Russian shares: 11,7% in the Moscow Exchange and RTS indices and 13,31% в MSCI Russia.

The company is actively repurchasing and then redeeming its shares: in 2018-2019 there was a $3 billion buyback, a similar program is still running until the end of 2022. In total, 158 million shares have been redeemed since 2017, of which about 22 million - in February 2020.

Equity structure

| Vagit Alekperov | 28,3% |

| Leonid Fedun | 9,3% |

| Rest of management | 1,7% |

| Cyproman Services Limited is the operator of the long-term motivation program for key employees | 5,4% |

| Free float | 55,3% |

28,3%

Why stocks can go up

Huge diversified exporter. Lukoil is very large, stable and well diversified business, one of the industry leaders, good safety factor, which he showed in such a difficult year for the industry in 2020. Important, that the company earns most of the revenue, selling just processed products, i.e. high value added products. Well, of course, Lukoil is an exporter, predominantly earning in foreign currency, so the possible devaluation of the company's ruble is not terrible, but rather on hand.

Dividends. In 2019, the company adopted a new dividend policy with very good conditions for shareholders. It is supposed to pay dividends 2 once a year, distributing all free cash flow, adjusted for interest paid, lease obligations and share buybacks. The result was a huge dividend for 2019, more than double the 2018 dividend. Certainly, total dividends for 2020 will be significantly lower, but in payments for 2021, growth can be expected again.

Good business environment. In the first half of 2021, the environment favors real sector companies in general and oil and gas companies in particular: inflation is rising, oil prices in dollars at a fairly high level, and in rubles - at historical highs, vaccination in many countries is in full swing. unknown, how long this will last, but quite likely, that with the lifting of coronavirus restrictions, passenger traffic will begin to recover, which will positively influence the demand for oil and oil products, and pent-up demand will be realized, which will further accelerate inflation.

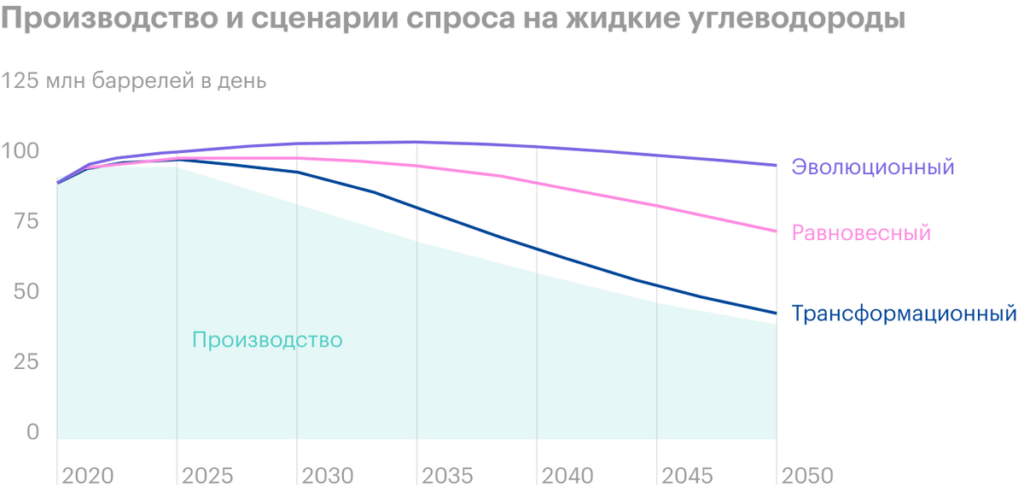

With long-term trends, everything is not so clear. In a presentation for investors, Lukoil considers several possible scenarios for the consumption of hydrocarbons, depending on the development of renewable energy sources (VIE) and the global climate agenda:

- Evolutionary: meeting national targets for greenhouse gas emissions.

- Equilibrium: balance between energy availability and climate targets.

- Transformational: radical changes in global industry and energy.

In all these scenarios, according to the company, hydrocarbons will still be very necessary and important.

Maybe, the company is not wrong about this: in cold winters, it is impossible to do without hydrocarbons. You can also draw analogies with coal: it would seem that, everyone understood long ago, that you should not use it because of its non-environmental friendliness. But the truth is, what, for example, The United States is still one of the three leaders in its consumption and it is still growing, and even in progressive Germany they plan to completely abandon it only by 2038.

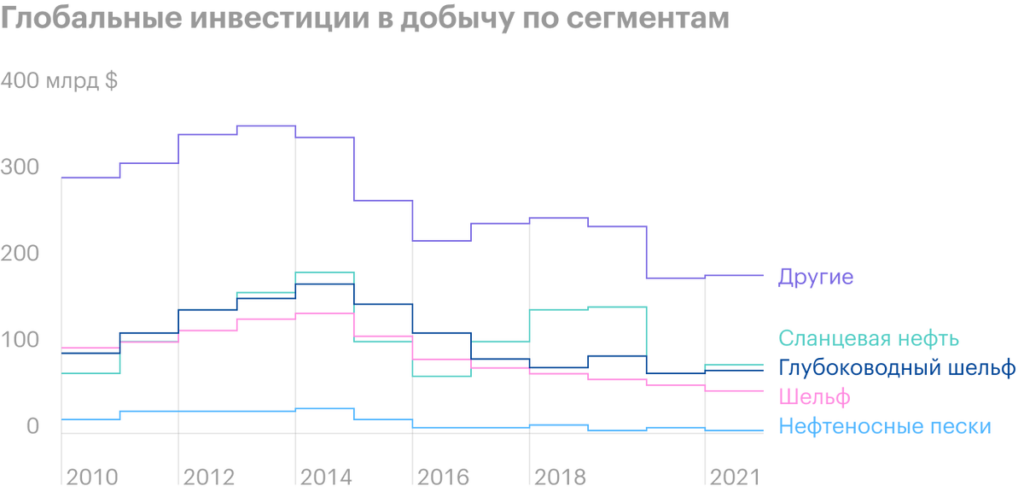

The oil and gas industry can also be like this., that due to the desire for renewable energy, its systematic underinvestment will continue. According to the Norwegian consulting company Rystad Energy, it is seen, that investments in production in 2016-2019 decreased significantly across all segments compared to 2010-2015, and then the decline in investment only continued. Also, don't forget, that the oil and gas industry has a rather long investment cycle. All this can cause a shortage of production capacity and cause high oil prices..

Dividends and dividend yield of Lukoil

| Dividend per share | Dividend yield | |

|---|---|---|

| 2016 | 195 R | 5,7% |

| 2017 | 215 R | 6,4% |

| 2018 | 250 R | 5,0% |

| 2019 | 542 R | 8,8% |

| 2020 | 259 R | 3,8% |

Why stocks might fall

Not the best cartoonists. Until 2020, Lukoil showed good efficiency, which resulted in a good ROE, but now the company looks somewhat overvalued relative to competitors: oversized P / E and small ROE. Although I must admit, what about debt, vice versa, the company is doing very well.

Dependence on market conditions. 2020 year is the best proof, that even the best and most efficient oil and gas companies are highly dependent on market conditions, - such is their nature. Oil prices and constant discussions of OPEC+ production cut volumes bring significant volatility to the financial performance and quotes of oil and gas companies. So that, if the situation worsens, for example, lifting sanctions on Iran, - this may negatively affect the quotes of Lukoil shares.

The fight for the environment. Future, the more long-term, difficult to predict. There is a possibility, that environmental initiatives will not be so scary for the oil and gas industry, but the opposite is also possible.. A serious technological breakthrough in renewable energy, especially for batteries, can really make this industry more competitive, and already declared by the governments of different countries carbon taxes can adversely affect the financial performance of oil and gas companies, both because of the taxes themselves, and because of the need to invest significant money in improving the environmental friendliness of enterprises. Well, yet again, ESG does not sleep and may be the reason why investors refuse to invest in oil and gas companies, and banks - in issuing loans to them.

Possible change of ownership. Over the years there have been rumors, that someone will buy the company, usually assuming by this the sale of blocks of shares by the management of the company. This is rather a hypothetical scenario., but if it is still implemented, probably, the company's quotes will get a lot.

Cartoonists "Lukoil"

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| 2017 | 7,10 | 11,5% | 0,34 |

| 2018 | 6,05 | 15,2% | 0,04 |

| 2019 | 6,29 | 16,1% | 0,03 |

| 2020 | 290,3 | 0,4% | 0,46 |

| 2021, 1 neighborhood | 20,2 | 5,1% | 0,20 |

Multipliers of the largest oil companies in Russia for 1 Quarter 2021

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| Lukoil | 20,2 | 5,1% | 0,20 |

| Rosneft | 12,7 | 9,0% | 2,86 |

| Gazprom Neft | 9,45 | 10,0% | 1,12 |

| "Tatneft" | 10,1 | 14,1% | −0,12 |

Eventually

Lukoil is a huge private oil and gas company, earning a significant part of the money in foreign currency. Her business is well diversified, and the main part of the revenue comes from processed products. The company has a progressive and shareholder-friendly dividend policy, good corporate governance, low debt burden. 2020 the year was not easy for Lukoil, as well as for the entire oil and gas industry, but in 2021, the situation has improved significantly - and with it, the company's business.

Lukoil seems to be somewhat overvalued relative to competitors, but in any case, he is one of the main candidates for inclusion in the portfolio of an investor in the Russian oil and gas sector.