Unipro (MOEX: UPRO) — Russian energy company. The main owner is the German alliance Uniper, owning?? 83,73 % Shares. A foreign financier is one of the global leaders in the electricity generation sector, works in 40 States.

About company

The main activity of Unipro is the creation and sale of electrical and thermal energy. The company has 5 GRES:

- Surgutskaya GRES-2 is the most powerful gas-fired power plant in the world, generating?? about forty percent of all electrical energy in the Khanty-Mansi Autonomous Region.

- Berezovskaya GRES is a Russian power plant in the Krasnoyarsk Territory. Uses coal to generate electricity.

- Shaturskaya GRES is one of the oldest power plants in the Moscow region. The main type of fuel is natural gas., but can also apply charcoal, fuel oil and peat.

- Yaivinskaya GRES - Perm power plant. Uses gas and coal to generate electricity.

- Smolenskaya GRES is the smallest facility of Unipro, Working?? on natural gas and coal. GRES produces ten percent of all electricity in the Smolensk region.

Installed capacity of power plants "Unipro"

| Installed capacity, Mw | Share of the total result | |

|---|---|---|

| Surgut GRES-2 | 5657 | 50,3% |

| Berezovskaya GRES | 2400 | 21,4% |

| Shaturskaya GRES | 1500 | 13,4% |

| Yaivinskaya GRES | 1048 | 9,3% |

| Smolenskaya GRES | 630 | 5,6% |

| Total | 11235 | 100% |

Resources for electricity generation

| Gas | 87,7% |

| Coal | 12% |

| Fuel oil | 0,3% |

87,7%

The third power unit of Berezovskaya GRES

Power unit No. 3 - the most complex and controversial project of "Unipro". In 2011, the company started construction of a new power unit at Berezovskaya GRES with a capacity of 800 MW. The facility was built under the CSA program with a priority status for the development of the Russian energy sector.

The project was completed in 2015 and commissioned in the third quarter, along with the launch, the company began to receive increased payments under CSA. But it hasn't even been two blocks., how 1 February 2016 in the boiler room of power unit No. 3 there was a fire, which completely disabled the new Unipro facility.

Having received insurance payments in the amount of 26 billion rubles, the company began repair and restoration work, which lasted more 5 years. The increased payments under the CDA at this time were stopped. In April 2021, Unipro announced the completion of the repair and testing of the power unit, who showed his 100% readiness to work. In May 2021, it was put back into operation.

Management has repeatedly stressed, how important is power unit no. 3 Berezovskaya GRES. From the results of this GRES until the end of October 2024, there will be increased payments for CDA - with the help of them, the company plans to increase dividends from 14 up to 20 billion rubles per year.

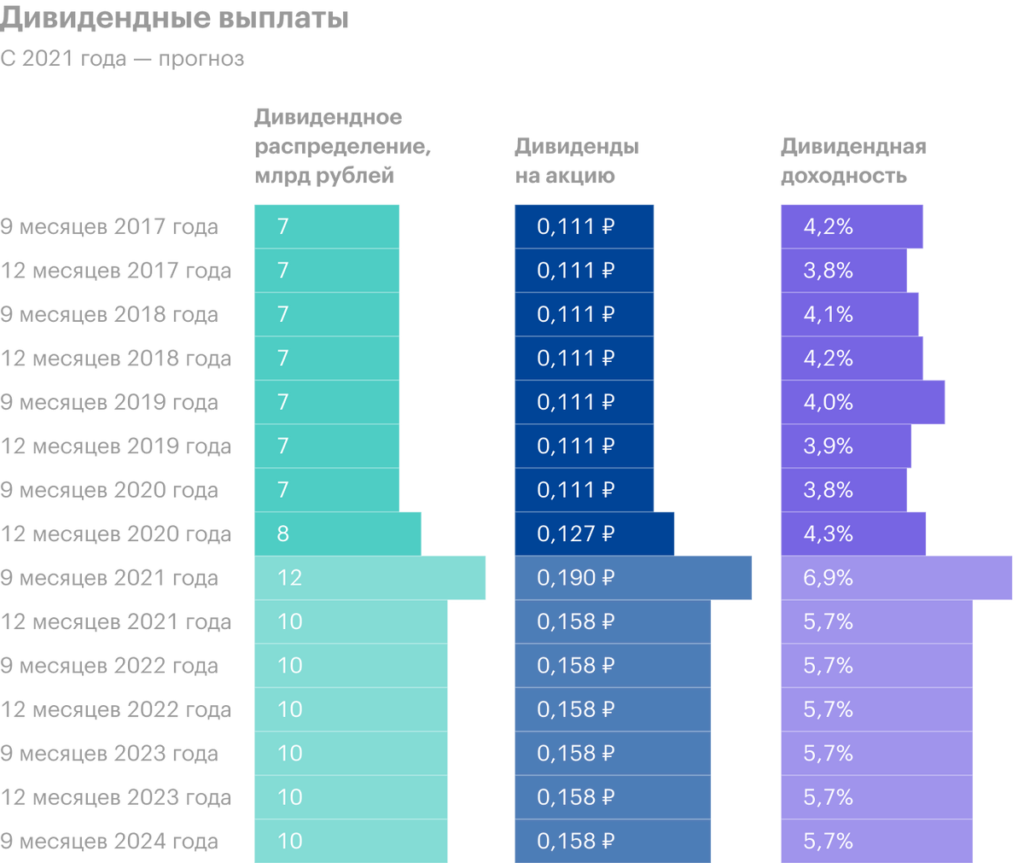

Dividend policy

Unipro fixed dividend payments until the end of 2022 at the level of 20 billion rubles per year, what corresponds to the payment 0,317 P per share. Frequency of distribution of dividends - twice a year, behind 9 And 12 Months, equal payments for 0,1586 P each.

In 2021, there was already one dividend payment - for 12 months of 2020. Due to weak performance in 2020 and late commissioning of power unit No. 3 Berezovskaya GRES "Unipro" paid less than the required norm - 8 instead of 10 billion rubles. Management plans to pay the missing RUB 2 billion during the second dividend distribution in 2021.

After 2022, the company may extend the current dividend policy for another two years, which implies the payment of 20 billion rubles a year, if Unipro fails to win the competitive selection of CSA RES projects.

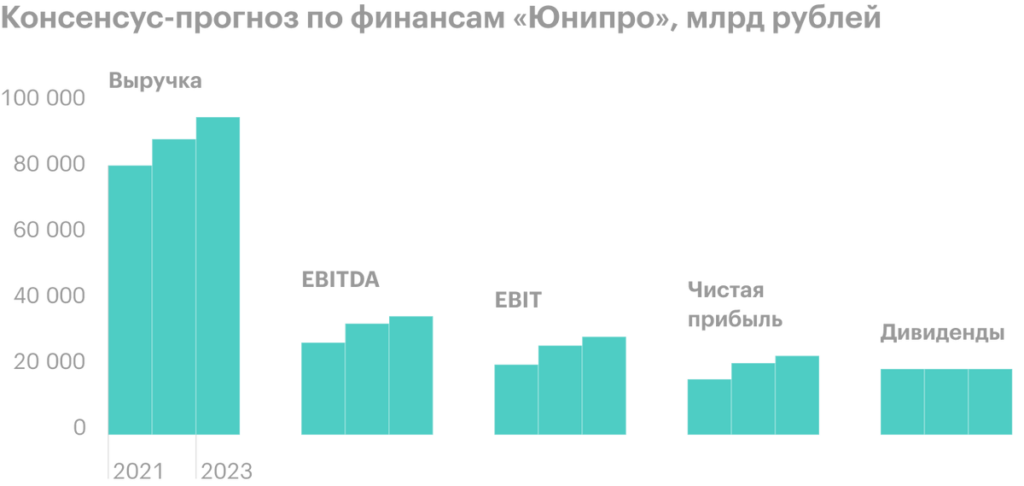

Financial indicators and forecasts

The last 7 years Unipro shows stable results, ignoring 2016 and 2017. In 2016, there was a fire at power unit No. 3 Berezovskaya GRES, because of what the company missed profit, and in 2017, vice versa, she received a huge income in connection with insurance payments due to an accident.

Like the analysts, The Ministry of Energy of the Russian Federation also gives a positive outlook for Unipro: in Russia, an increase in demand for electricity is expected in the period up to 2026. Reducing electricity consumption in Russia by 2% in 2020 due to quarantine restrictions due to COVID-19, OPEC + agreement and an abnormally high temperature in 1 quarter of 2020.

Financial performance of the company, billion rubles

| Revenue | EBITDA | Net profit | net debt | |

|---|---|---|---|---|

| 2014 | 80 | 25,2 | 17,5 | Negative |

| 2015 | 78,6 | 24,3 | 15,5 | Negative |

| 2016 | 81,1 | 20,7 | 10,5 | 0,6 |

| 2017 | 79,1 | 42,5 | 30,1 | Negative |

| 2018 | 81,3 | 28,8 | 18,9 | 0,9 |

| 2019 | 84,8 | 29,2 | 18,7 | Negative |

| 2020 | 80,3 | 25,7 | 15 | Negative |

Arguments for

Double-digit dividend yield. Unipro will show dividend yield in 2021 10%, and in 2022 this value will grow to 11%.

Low debt burden. As of 1 quarter of 2021 the company has negative net debt.

Growing demand for electricity. The Ministry of Energy predicts a 10% increase in electricity consumption in Russia by the end of 2026.

Volatility. Unipro has a low beta, for the last year it is 0,21. This parameter shows the degree of dependence of the asset on the overall market dynamics, stocks with higher parameters have more risk.

Arguments against

New renewable energy projects. The company plans to participate in the competitive selection of CSA RES. This is good news for long-term investment., as it will lead to an increase in cash flow after 2024, but for the short term, may result in lower dividends in 2023 and 2024.

DPM. In fact, the company has only one object left, who gets higher payouts, - power unit No. 3 Berezovskaya GRES. At the end of 2020, the contract for block No. 5 Yaivinskaya GRES and at unit 7 of Shaturskaya GRES, and for blocks no. 7 And 8 Surgutskaya GRES-2, the completion date of the program is scheduled for August 2021.

What's the bottom line?

Unipro is a stable company in the electric power sector. Strong financial stability and low volatility of results in comparison with other industries allow Unipro to confidently overcome all the downturns of the Russian economy.

The company may be of interest to those investors, who are trying to find an issuer with high dividend payouts in their long-term portfolio, yes, twice a year, and simple business. A plus will be the demand for the issuer's products or services, which remains at a high level even in times of crisis.