Newly developed countries group - USA, ES, UK and Canada - announced the adoption of sanctions against persecutors of Muslim Uyghurs in the Chinese region of Xinjiang. In this article, we will tell you a little about, what is happening in China and what implications this may have for the exchange.

Who are the Uyghurs

This is the indigenous population of the Xinjiang Uygur Autonomous Region in the far west of China.. Uighurs are Turks and Muslims, which greatly distinguishes them from the vast majority of the population of China - the Han Chinese, the Chinese themselves.

What is the problem with the Uyghurs

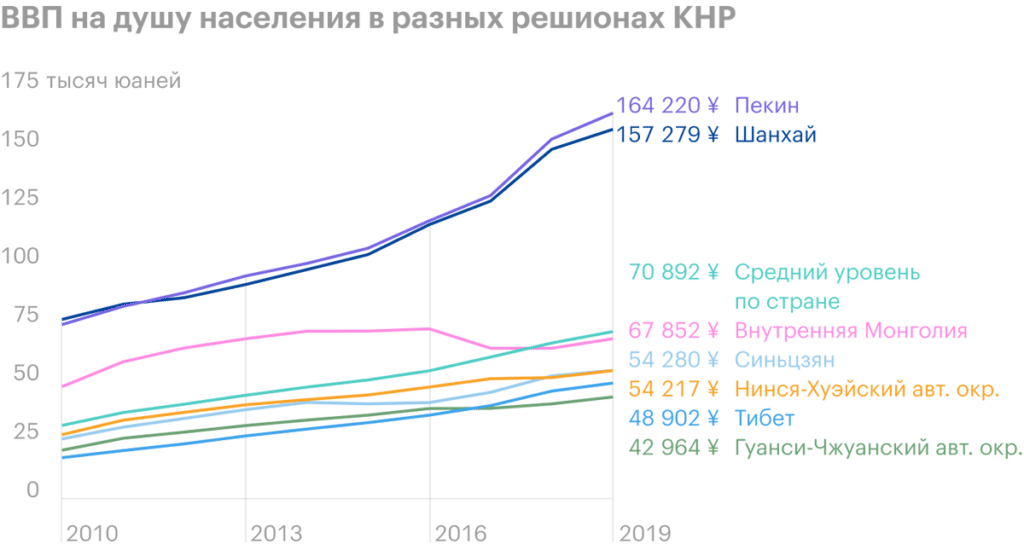

Without going into history, let's outline the main points. Sometime since the 1950s, a Chinese population appeared in Xinjiang, which is constantly growing and periodically collides with autochthons. The Uighurs are for the most part just a rural population., and in the course of the inevitable migration to the cities in the labor market, it is difficult for them to compete with the Han people, who occupied the best positions in economic terms. And Xinjiang itself, frankly,, not the richest region in China - below the national average. This naturally causes friction between the Uyghurs and the Chinese..

At the same time, the Uighurs 10,1 million people, and in Xinjiang they make up the majority of the population - 65,6%. So terrorism and stabbing in Xinjiang in the 2010s were pretty common..

The Chinese authorities are fed up with all this, and somewhere with 2016 years, the order in Xinjiang began to tighten: set up cameras and police stations, began to pressurize Muslim believers, began to restrict and monitor the movement of local residents and, finally, began mass sending these same residents to concentration camps, where they are re-educated in accordance with the values of the PRC and forced to work. A variety of estimates of the number of Uyghurs in the camps are circulating on the net., up to 3 million people. In any case, there are many people in the camps, and there is a lot of all sorts of tin going on - for this officially sanctions were introduced.

What are the sanctions

In fact, the measures are more symbolic: sanctions against two officials, in fact, this is just an addition to earlier sanctions. In general, this is just a ritual shaking of the air.. In response, the Chinese said: "Who calls them names, that's what it's called", - and imposed sanctions on a number of Western politicians. But the practical consequences of this entire sanctions situation may be as follows:.

Possible source of problems in the future. Companies, owned by Xinjiang Production and Construction Building (SPSK), powerful organization. SPSK, in addition to its main agricultural activities, has been pursuing Beijing's policy in the region for many decades.. This is such a hybrid of the army and a commercial organization, who manages entire factories and cities in the region, - works there 12% population of the region and produced 17% Xinjiang GRP. Sanctions against the SPSK were introduced by the United States back in 2020 year.

Exchange in Chinese. The first thin moment for the stock exchange: SPSK belongs to 13 listed Chinese companies. Here, the most likely risk is borne by the fact, that American financial institutions, for example banks, may “by mistake” invest in these companies and run into sanctions from their own State Department or condemnation of American investors.

Cotton Territory. Second factor, which investors should pay attention to: 80% cotton in the PRC is grown in Xinjiang and its production is somehow connected, if not directly with the SPCS, then with the forced labor of the Uighurs. Using cotton from Xinjiang becomes a stigmatization, and many American companies are under pressure, so they stop using it to make their clothes. Here, American companies can suffer both from the sanctions of America itself., - if it turns out, that the company was purchased from SPSK, - and from the boycott of shares by socially concerned investors.

Komsomol activity of American companies. American companies can start to fuss on their own - how, for example, Apple. The company recently cut ties with Chinese component supplier Ofilm following reports that, that Ofilm is participating in a program to transfer imprisoned Uighurs to other parts of the PRC for forced labor in factories. Another example: Nike refused to use cotton from Xinjiang and even forced its suppliers to do the same. The company is now looking into, so that the labor of the Uyghurs is not involved in the production of goods at all, sold under its brand.

It is unlikely that we should expect a serious increase in production costs for American companies because of their moralizing: cotton is not so rare a commodity, although Xinjiang cotton is considered to be of very high quality. But you should be wary of a boycott of the goods of these companies inside China.: calls for this are already loud enough in Chinese society, this situation can lead to a real drop in sales.

Wherein, probably, American companies will have to choose a side in this conflict and remain neutral will not work. Given the popularization of calls for boycotts in the West and the ESG investment associated with this phenomenon, I would expect, that investors will require companies to disclose the Uyghur bonded labor component in their products, forcing companies to state their position on this issue as loudly as possible.

So, British retail chain Boohoo Group has banned its suppliers from using cotton from Xinjiang. Furthermore, The management of the company is considering, to force their suppliers to provide a certificate that they do not have Xinjiang cotton. I try not to give accurate predictions, but, it seems to me, certification of this kind may become widespread among Western companies in the future.

Restrictions on the export of certain types of goods to China. This is the least likely option., but it should be kept in mind. For example, well known, what is Nvidia products, Seagate, Intel and Western Digital used for security cameras in Xinjiang. As part of the development of the concept of ESG activism, a number of large funds or banks may well require, say, Intel provide a guarantee that, that its products will not be used in spying on Uyghurs. Sounds like something difficult to accomplish, because it's not clear, how to track product usage. On the company, exporting complex technological goods to China, may well impose a duty to make sure, that their products "will not be used for unethical purposes". This threat is hypothetical, but due to the hype around ESG investment, it should be taken into account.

Anyway, even without government sanctions, Western defenders of the Uyghurs always have the option to punish companies financially: or complicating access to borrowed money, or simply refusing to invest in the shares of such companies.

Let's say, Nvidia will not interfere with the use of its products in creating a dystopia in Xinjiang and "conscious, socially responsible" heads of investment funds will refuse to invest in these shares, what will cause them to fall. Maybe, Western companies will get nothing for pandering to what is happening in Xinjiang. Disney didn't get hurt, who filmed the Mulan remake in Xinjiang, — the company was criticized and forgotten. Activision Blizzard banned the streamer player, supporting protests in Hong Kong, and she had nothing for it. So that, may be, everything will be ok. Or not.

What should investors be afraid of

The conflict between China and Western countries around Xinjiang can become quite brutal. It's still Asia, things can very easily reach pogroms, how it was in vietnam 2014, when the country found itself in a state of diplomatic conflict with China. If the dispute over the Uyghur issue escalates, Most likely, U.S. Issuers Should Prepare for Trouble. Their size depends on many factors..

Greater China is China, Hong Kong, Macau and Taiwan, and the latter is actually an independent state, Yes, and under US military protection. The total revenue of Greater China is 2% from the revenue of companies S&P 500, but some companies have a very high percentage of sales in China.

It seems to me, the threat to semiconductor companies is still small: China is highly dependent on the import of sophisticated equipment and machinery into the country and will most likely not put pressure on these companies. But some “useless” companies like Nike and Starbucks, the Chinese authorities may well “punish” in an exemplary manner, taking away their license to work or simply putting spokes in the wheels. A good example of Chinese "punishment of the violent" is the clothing chain H&M.

The company was very non-aggressive about Xinjiang last year., without much specifics, in the style of "for all the good against all the bad, so that the sun shines and so that the children do not get sick ", but after some time the Chinese public woke up and decided to punish the company: first it was removed from a variety of online stores and applications in China, and then landlords started kicking the company out of stores. The same can happen with any other network.: there will be no terrible damage to China's GDP, but "who did not understand, he will understand ".

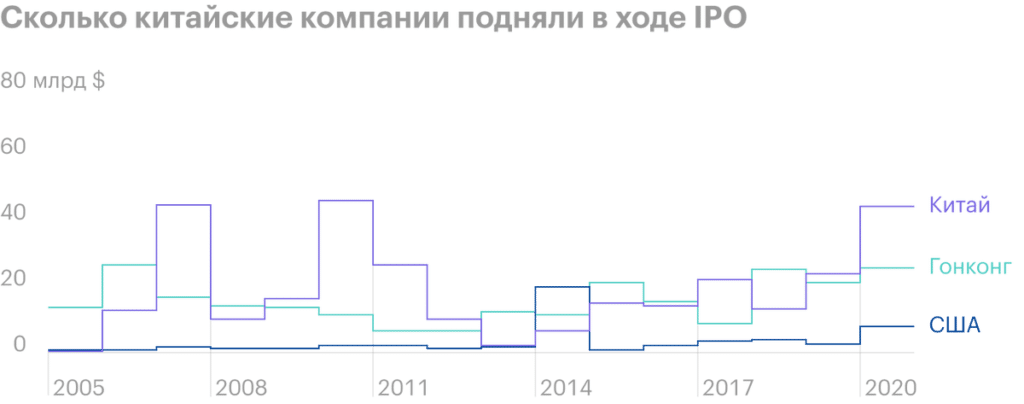

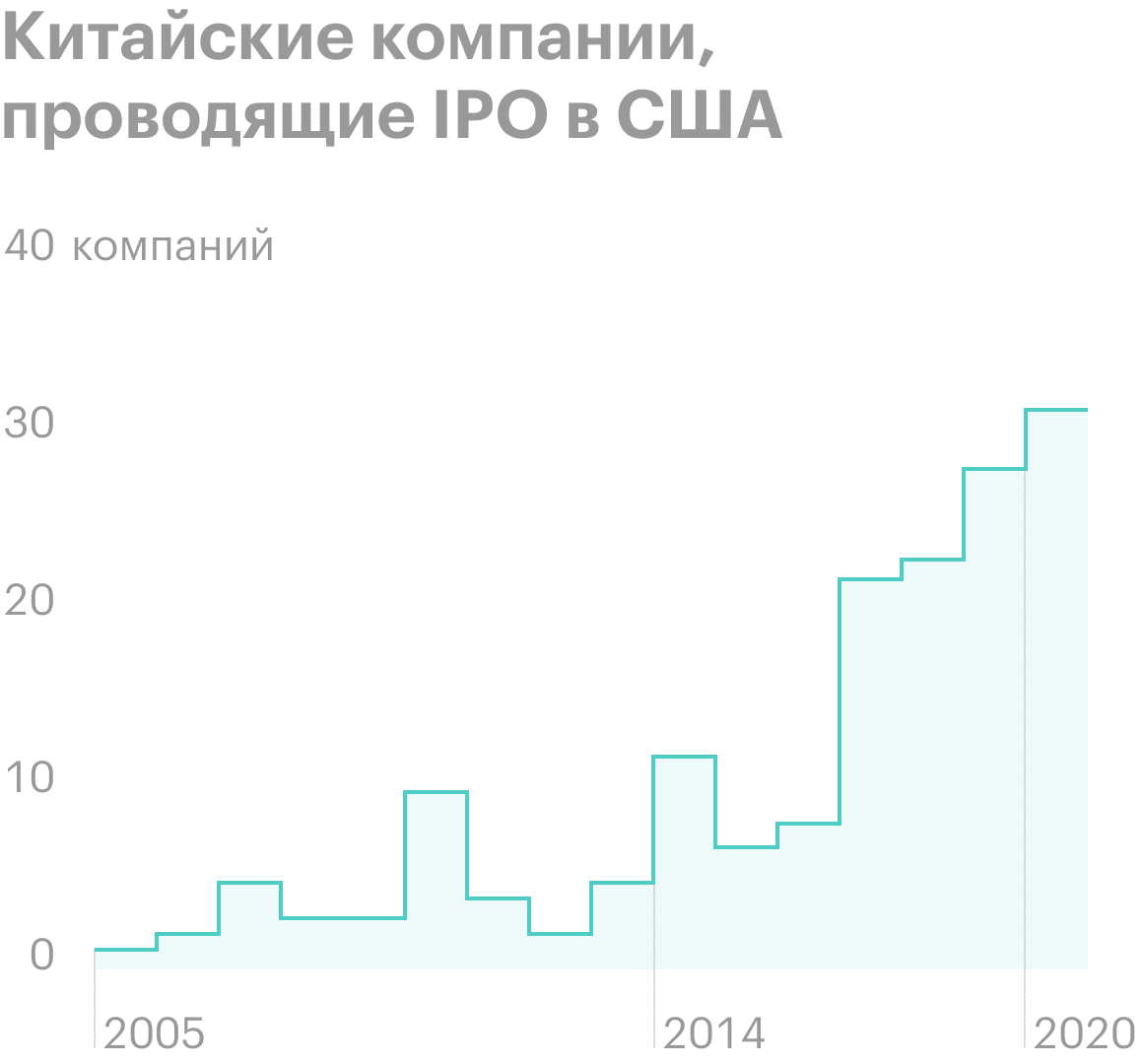

In the long term, a quarrel between the US and China may result in a decrease in the activity of Chinese companies on the US stock exchange: US IPOs have been very popular with Chinese companies in recent years. Among the victims there will be, certainly, US underwriting banks - J. P. Morgan, for example. And American exchanges will not receive money, on which these IPOs are held: Nasdaq и Intercontinental Exchange. But I would not expect serious losses in business for them.: Chinese companies don't give them as much money compared to "domestic" IPOs.

A tougher option. A huge number of American depositary receipts are traded on the American exchanges (ADR) Chinese companies are receipts for shares in dollars. A significant number of Chinese companies, traded on the American stock exchange, and presented, actually, ADR. And that could be a problem: China has serious restrictions on the size of shares held by foreign investors and, to get around this problem and raise money on the American exchange, Chinese companies create special legal entities, through which they place their ADRs in the USA.

The problem is, that when you take ADR, say, Vipshop, then you actually become a shareholder of a non-canonical Vipshop, and a third party, created by Vipshop. Many ordinary investors like us and large funds or banks invest in these ADRs.. Total Market Value of Shares in American Hands in October 2020 was about 500 billion dollars - we are talking about huge amounts. If the PRC government decides to do disgusting to Americans, then it can simply revise the status of all these legal entities, through which Chinese companies sell their ADRs to the US, and reset their value, invalidating.

It will mean, that China is ready to cut off its access to Western capital markets, and that's why it seems unlikely to me.. But you should not plan your actions from the position of “well, they won’t”: 2020 the year showed, what will "be". In addition, China still owes the United States 1,6 trillion dollars including interest on pre-revolutionary bond debt. So the PRC has long been, in fact, is in selective default, but continues to enjoy access to global financial markets with impunity, and no one reminds her of a huge debt and even imposes sanctions on this matter.

Revenue of US companies in the Chinese market

| Revenue, million dollars | Percentage of total revenue | |

|---|---|---|

| Apple | 44 764 | 19,6% |

| Intel | 14 796 | 23,6% |

| Qualcomm | 14 579 | 65,4% |

| Boeing | 11 911 | 12,8% |

| Micron Technology | 10 388 | 51,1% |

| Broadcom | 9466 | 53,7% |

| Cisco Systems | 7650 | 15,9% |

| Texas Instruments | 6600 | 44,1% |

| Procter & Gamble | 5205 | 8,0% |

| Starbucks | 4512 | 20,2% |

| Western Digital | 4271 | 22,4% |

| Nike | 4237 | 12,4% |

| 3M | 3255 | 10,3% |

| Skyworks Solutions | 3018 | 82,7% |

| Applied Materials | 2746 | 18,9% |

| TE Connectivity | 2414 | 18,4% |

| Corning | 2230 | 22,0% |

| Abbott Laboratories | 2146 | 7,8% |

| Cummins | 2137 | 10,5% |

| Amphenol | 2067 | 29,5% |

What's the bottom line?

Should be understood, that the leadership of developed countries does not particularly care about the fate of the Uyghurs. China got to the bottom not "because, what Xinjiang ", and therefore, what this country for the last 10 years has seriously strengthened its economic and military positions. Therefore I would expect, that the pressure on China, among other things, and on the exchange front, will gradually increase. So it is better to plan investments in China with this factor in mind..