Illumina Company (NASDAQ: ILMN) - American company, engaged in genetic research. Coronacrisis has spoiled her sales., but recovery is just around the corner. Investors should take into account the fact, that the company's expansion into more promising areas met with strong resistance from regulators.

What's going on here

Readers have been asking us for a long time to start looking into the financials and business foundations of US issuers.. Suggest in the company's comments, analysis of which you would like to read.

There are many screenshots with tables from reports in the reviews. To make it easier to use them, we translated them into Google tables and translated them into Russian. note: there are several sheets. And keep in mind, that companies round up some numbers in their reports, therefore, the totals in graphs and tables may not converge.

What do they earn

The company is engaged in the production and sale of systems for genetic research. According to the annual report, The company's revenue is divided into two segments.

Goods — 84,4% of total revenue. Segment gross margin — 71,19% from its proceeds. 84,24% from the revenue of the segment give consumables - these are mainly tests and then, what do they need: Reagents, fuel cells. 15,76% provide tools and devices for testing.

Services — 15,6% proceeds. Segment gross margin — 56,35% from its proceeds. Maintenance of the company's products and assistance to its customers in the analysis.

For the company's profit, where already mixed and goods, and services, can be viewed in another way.

Sequencing - 88,88%. It's like tests., and DNA analysis software. DNA microchips - 11,12%.

The company's clients are scientific laboratories, as corporate, as well as non-commercial. In general, this business works to serve pharmaceutical companies.: its products and services are used in the research of such Big Pharma representatives, like AstraZeneca, Bristol-Myers Squibb, Bayer, Gilead, Merck.

Most of the proceeds are made in the USA - 51,09%, the rest is in other countries and regions.

What can be boasted

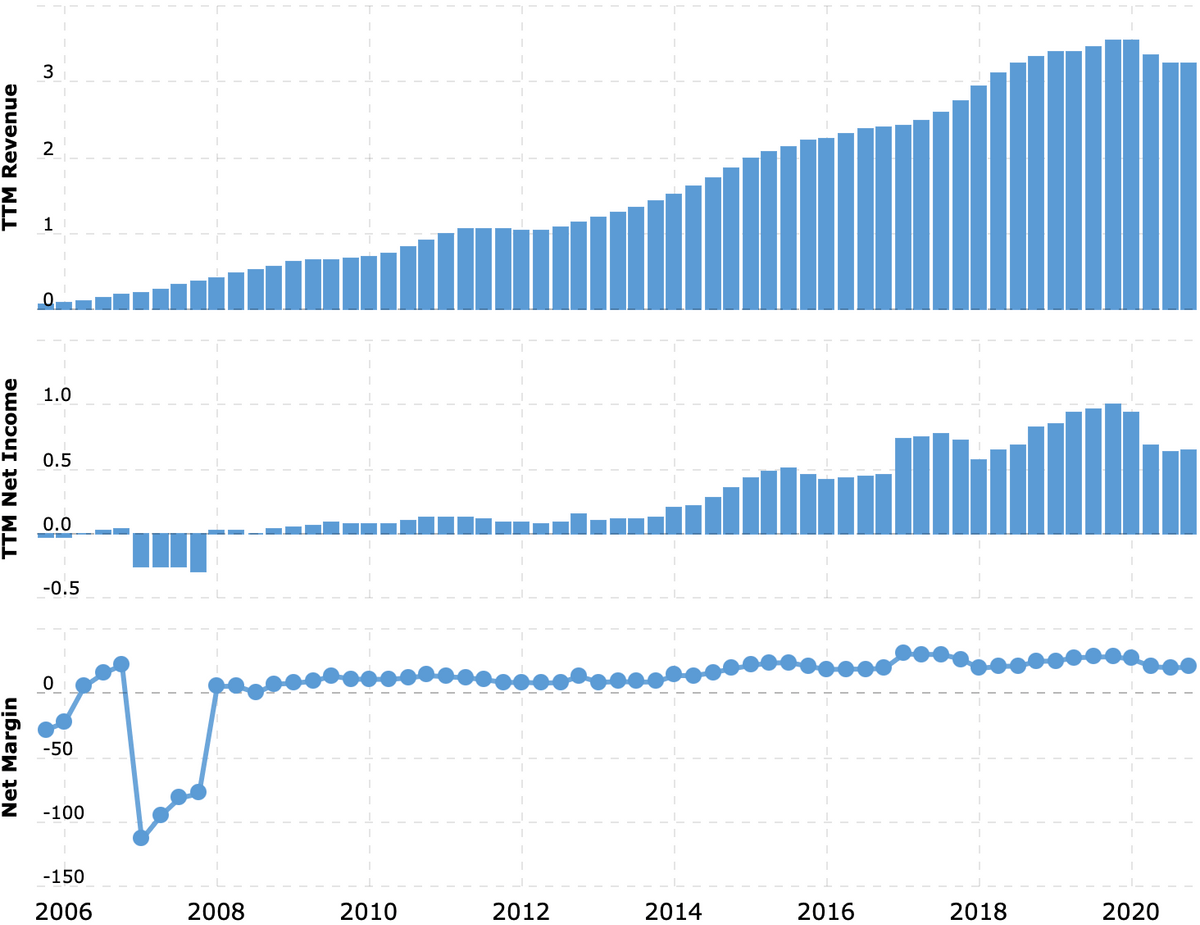

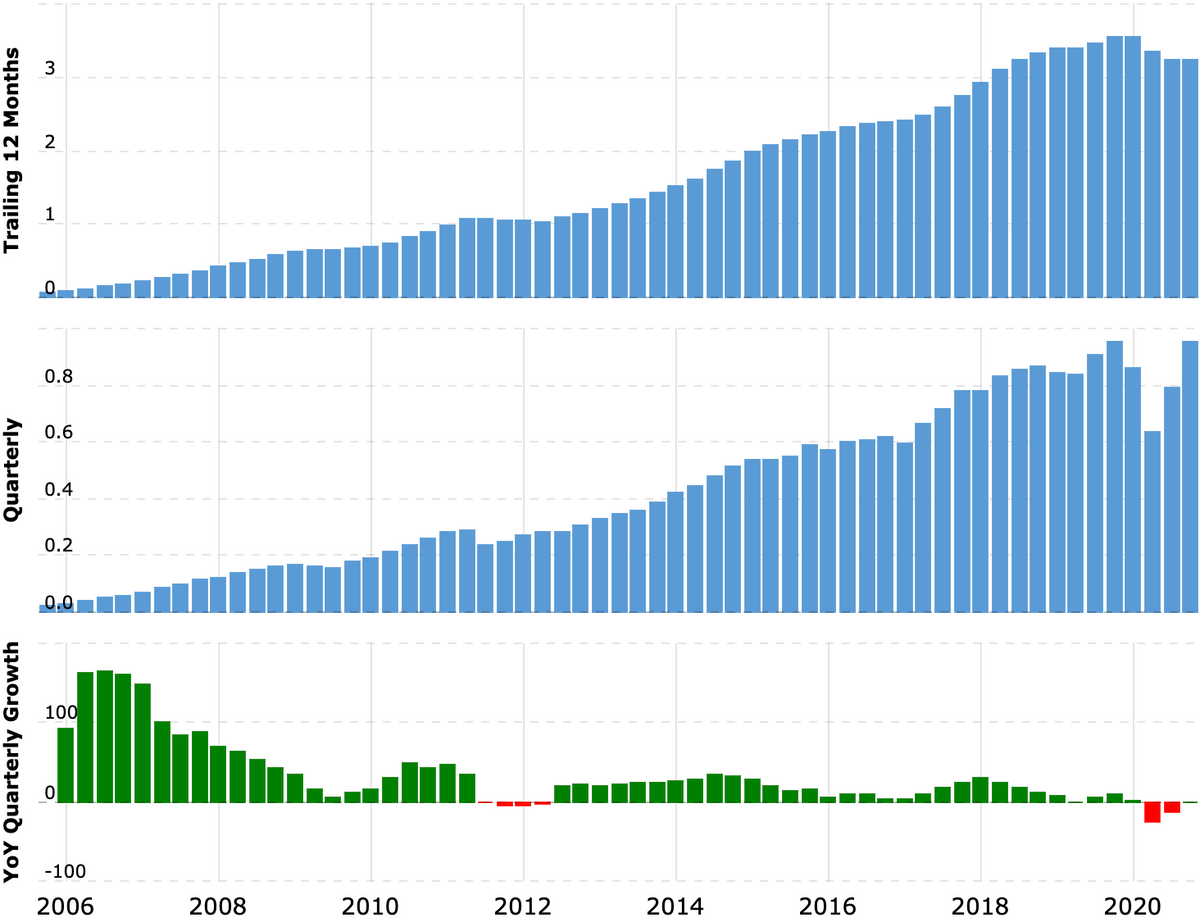

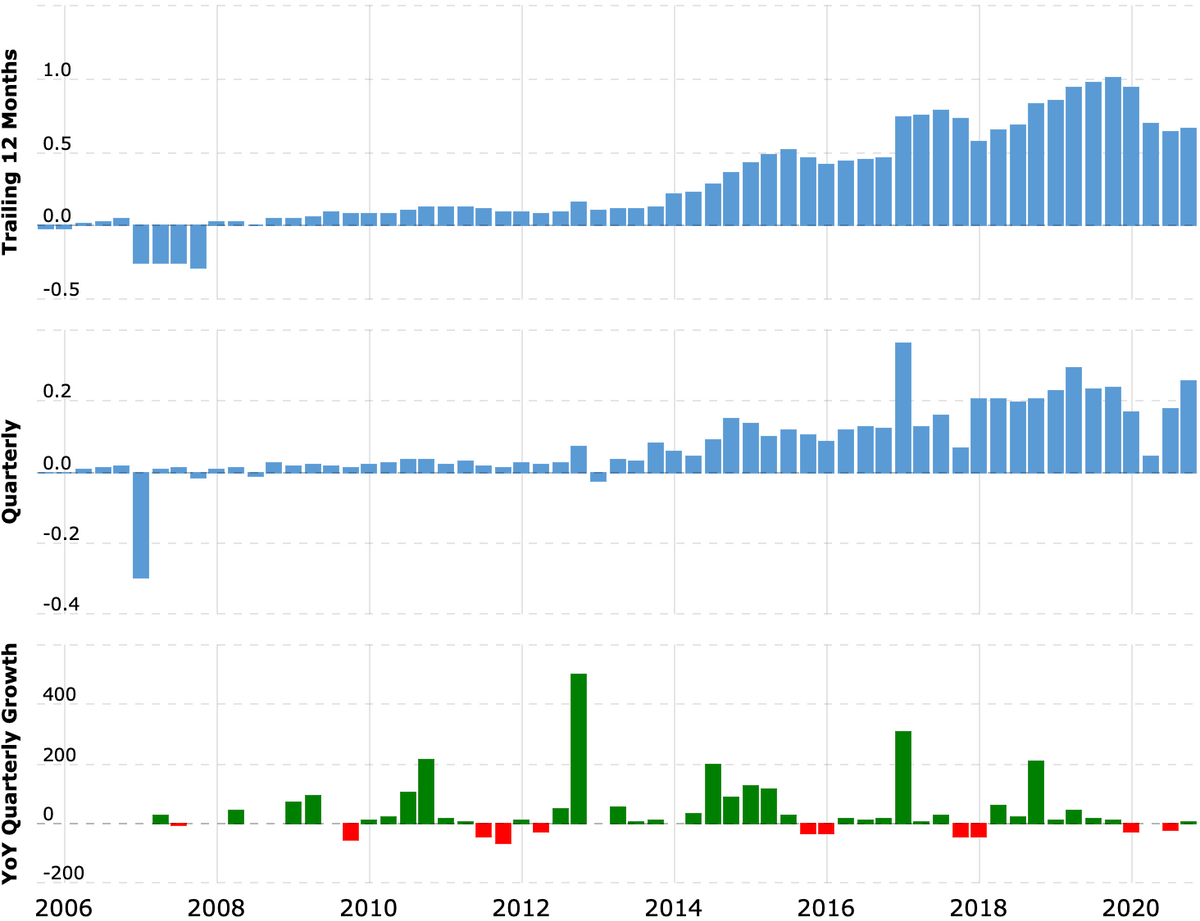

IN 2020 year, the company's revenue fell markedly due to the pandemic and disruption of normal business activities.

This is mainly due to a decrease in sales in the consumables category.: sales of sequencing products fell by 36 million dollars, and DNA microarrays - on 52 million. Sales of services also fell: decreased volume of orders from companies, engaged in R&D.

The reason for this is simple.: laboratories working with company goods or have slowed down their operations, or refocused on the creation of a vaccine against coronavirus.

Despite numerous logistical and production challenges due to the pandemic, Illumina's gross margin fell slightly: with 69,6% from revenue to 68%.

In the end 2020 year, the company's sales began to recover - in part because, that she became involved in the story of the coronavirus: Illumina now does, among other things, coronavirus tests. But basically this is the merit of the main consumers - laboratory enterprises., that began to return to normal activities mainly due to the restoration of normal operating activities.

Planet volubilis, pecunia labes

The long-term environment for Illumina looks moderately positive for the same reasons., same as Veeva Systems. Pharmaceutical companies are motivated to spend huge amounts of money to develop new drugs, until the patent protection of their current drugs has expired.

For example, you can see the expiration date of patent protection for medicines of one of the company's clients - Gilead. Many of the patents will expire soon, and Gilead will lose in revenue and profit, unless he gets an adequate replacement for them. Consequently, Gilead is highly motivated to spend on R&D, what's good for Illumina.

Even the long terms of many patents are no reason to relax. The full development cycle of new drugs can take 10-15 years, and not to lose in the long run, "Big Pharma" needs to work now. As they say, prepare a sleigh in the summer.

What really should be a concern, so it's a huge price Illumina: P / E at the level 90 - it's too much. Such an assessment, maybe, prompted by news of, that the company plans to buy cancer test maker Grail.

Grail is not cheap - approximately 7 billion dollars, but this amount is justified. Expected, what to 2035 year, the market for cancer tests will be 75 billion dollars. And without Grail, Illumina's target market will be only 15 billion dollars a year - which is significantly less than its current capitalization. By the way, Grail was once a division of Illumina - now the company has decided to buy Grail back in its entirety.

So far, the deal is blocked by US regulators., who reasonably expect, that after the purchase of Grail Illumina will strangle competitors, because the only alternative to Grail in the US is Thermo Fisher Scientific. So the long-term prospects of Illumina will depend on the further development of this situation.. In the existing framework, its business is cramped, but expansion beyond them no longer depends on the company itself, and from the position of the regulators.

Gilead Patent Expiration Dates

| Product | When does a US patent expire? | When does a patent expire in the EU? |

|---|---|---|

| Remdesevir | 2035 | 2035 |

| Lenacapavir | 2037 | 2037 |

| Bulevirtide | 2030 | 2029 |

| Filgotinip | 2030 | 2030 |

| Cilofexor | 2032 | 2032 |

| Axicabtagene ciloleucel | 2027 | — |

| Brexucabtagene autoleucel | 2027 | — |

| Sacituzumab govitecan-hziy | 2023 | 2029 |

| Magrolimab | 2031 |

2031 |

Resume

27 April Illumina releases this quarter report. I think, that the recovery of the company's core business has continued and the report will not bring any unpleasant surprises, but the high value of these shares already in itself predisposes to volatility.

Plus, the lack of clarity on the situation with Grail makes it much more difficult to objectively analyze the prospects for Illumina.. The current business of the company is stable and good, but the company's market is limited and does not justify the current value of its shares.

So investing in Illumina at current levels is at your own risk..