EnerSys (NYSE: TO US) is an American manufacturer of industrial batteries and related equipment.. It has an indisputable plus - the need for almost all fast-growing industries, but there is a downside: it's expensive, and it asks for abundant investments.

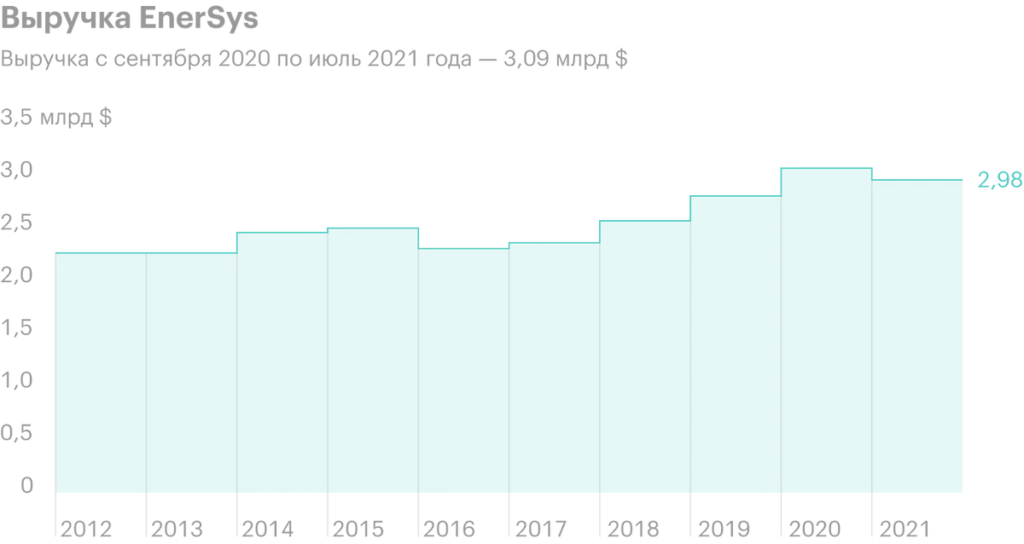

The company operates in more than 100 countries and with more than 10 thousand clients, because it does not depend on one sphere or region. Over the past nine years, revenue has grown by 3,4 % once a year, taking into account the difficult interest (CAGR). But not everything is great, as we would like. However, more on that later..

Direct your attention, that the company has entered the 2022 fiscal year. Just subtract one year from the monetary, to get the calendar.

What the company makes money on

From Fiscal Year 2021, the company is posting revenue across three sectors.

Energy Systems (energy systems) - forty four percent. Sale of continuous power supply systems, special natural boxes for electrical equipment and other equipment, related to energy, which is sold to telecommunications and factory companies.

Motive Power (Engines) - thirty nine percent. Development and sale of lithium-ion and lead-acid batteries for various specialized equipment. Minus sector: it depends on the stock price of raw materials.

Approximately 30% revenue of the whole company, but not only this sector depends on contracts, which are pegged to market prices for lead. It means, that commodity prices are falling, when lead falls in value, and vice versa. This state of affairs does not allow the company to earn much during periods of rapid increase in commodity prices..

Specialty (monitoring) - sixteen percent. Sale of devices for monitoring the condition of batteries, troubleshooting.

Company revenue by segments, billion dollars

| you 2020 - July 2021 | 2021 | 2020 | |

|---|---|---|---|

| Energy Systems | 1,40 | 1,38 | 1,36 |

| Motive Power | 1,24 | 1,16 | 1,35 |

| Specialty | 0,51 | 0,43 | 0,38 |

| Total | 3,14 | 2,98 | 3,09 |

How buying other companies affects the business

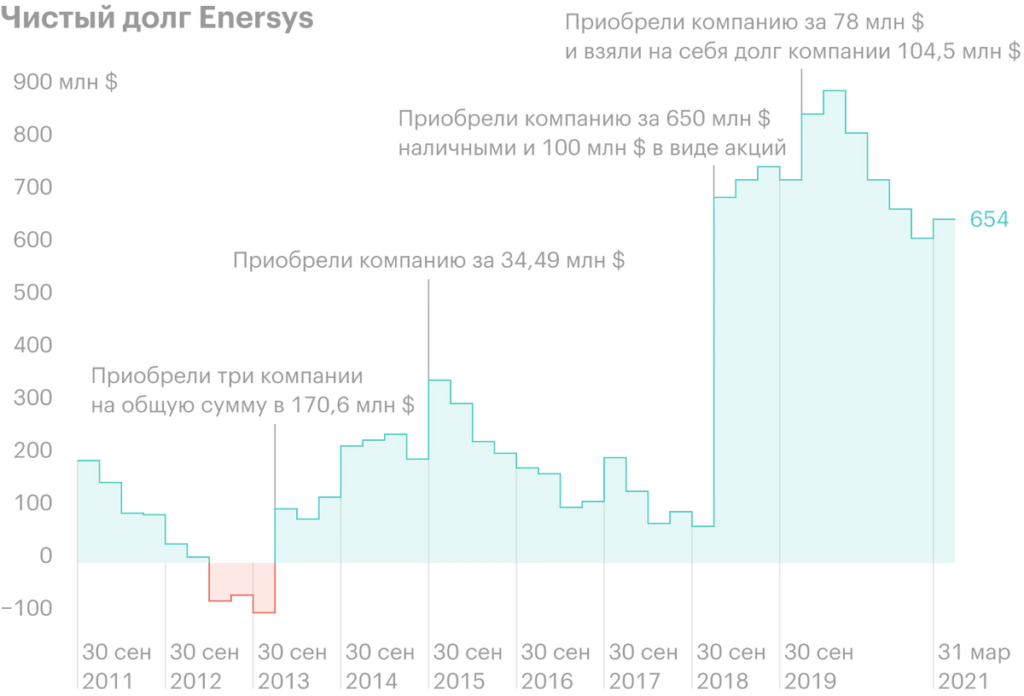

EnerSys buys other companies, that improve the current product line or allow you to enter regional markets. Revenue growth is more the result of profitable mergers, rather than rising prices and sales volumes of existing products.

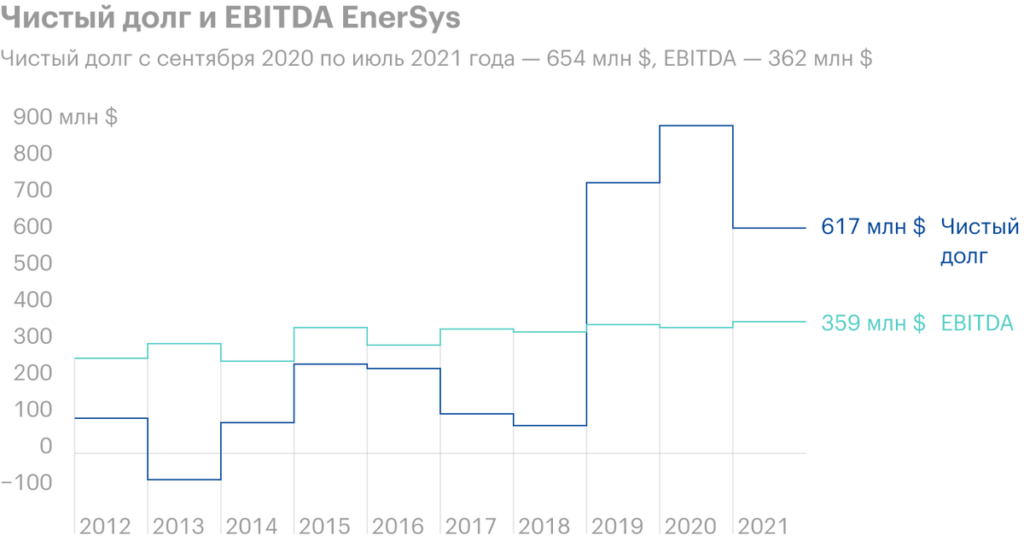

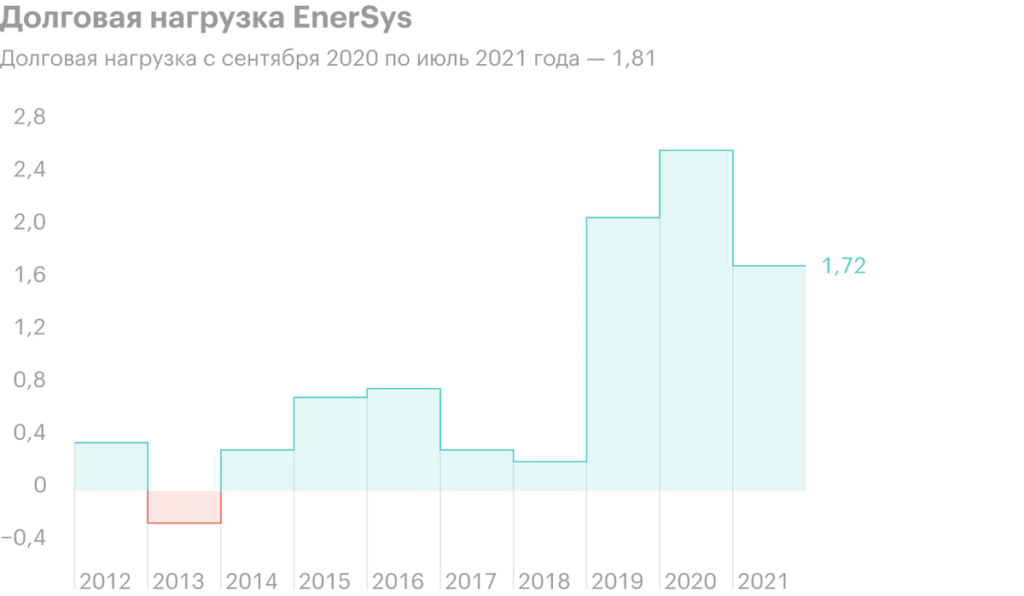

The latest major acquisition at the end of 2018 dramatically increased the company's debt, but everything is in order with the debt load: interest expenses eat up about 11% EBITDA, loan rate is approx. 4%, and debt on loans and borrowings can be repaid in two annual EBITDA.

In April 2023, the company will spend $300 million, to pay off bonds, but the management simply refinances the debt at the expense of credit funds.

At the same time, EnerSys does not plan to reduce debt. Management agreed to extend the credit line until 2026. If necessary, the company will be able to raise an additional 600 million dollars.

Although the board of directors allocates only 11% operating cash flow before changes in working capital, in my opinion, do not expect an increase in dividends. Since 2015, dividend spending has been at the level of $29-30 million per year. The company is more likely to use the extra money to buy another company, as she did earlier.

Positive factors

5G to the masses. T-Mobile covered 92% major highways with 5G network in the USA, other operators are also pulling up and have covered at least 51% highways.

Until 2021 for AT capital expenditures&T accounted for about 14 billion dollars a year. But plans for the coming years are to increase spending to $24 billion., to provide access to the fifth generation of mobile communications to 200 million US residents.

The US government plans to spend 65 billion dollars on the development of broadband networks.

All these companies will build new towers with government support., and they will need to purchase equipment, which will provide power and store energy. Wave of spending on 5G investment could boost demand for EnerSys products.

Ready to show respect for electric vehicles. The company has only one client, for which the first 100 energy storage systems for charging stations will be developed. Expected investment in development - 50-100 million dollars a year. If the company succeeds in launching the project and scaling it up, a large and growing market will open up.

According to forecasts, electric vehicle market will grow at double-digit growth rates. Producers and government will need infrastructure, so users can charge cars. This is where EnerSys should appear.

There, where not needed, Close, Over there, where needed, are revealed. The company closes a plant in Germany, which will help save 20 million dollars a year. For the last 12 months, the company earned $268 million in operating cash flow before changes in working capital. Savings will help increase cash flow by 7% from current values. At the same time, the construction of a plant in the USA is gradually coming to an end., which will increase the production of batteries based on lead plates.

Negative factors

Dependence on external circumstances. EnerSys products predominantly rely on lead and tar, the cost of transportation and tariffs within countries for the import of products. The company is partially insured by, that concludes long-term contracts at fixed prices, due to which it will not be possible to radically reduce costs, even if prices fall.

Company in trend, but at what cost? Fans of big dividends or serious share buybacks are advised to transfer to another bus, because this bus plans to spend $100 million on investment for fiscal year 2022. Previously, such large investments were rare.

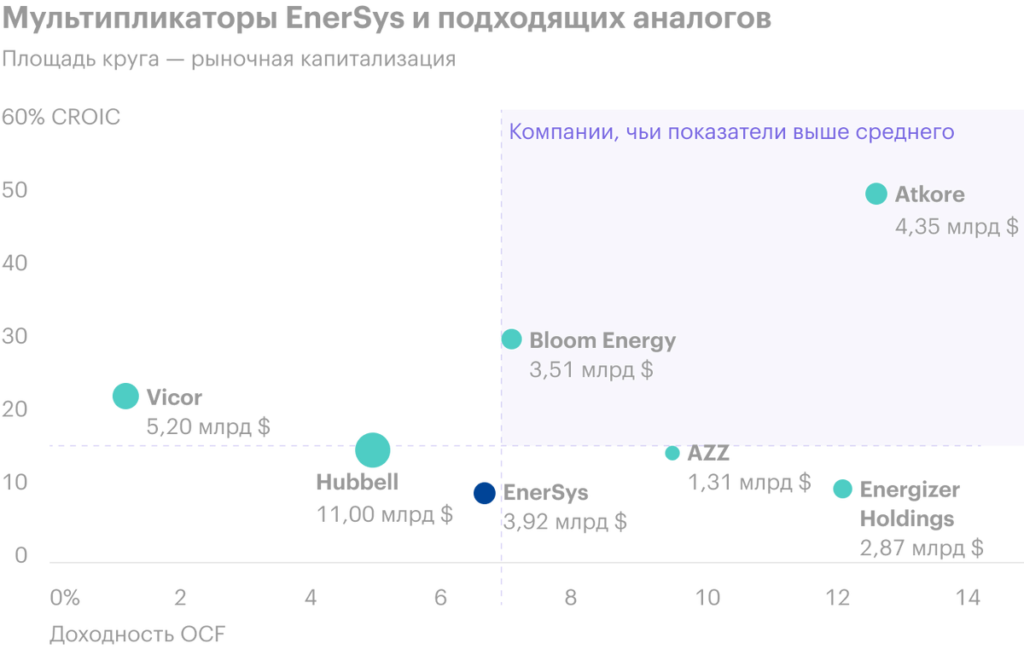

Expensive. Despite all the company's prospects, in my opinion, EnerSys is priced fairly fairly: return on invested capital of the company, based on operating cash flow (CROIC), below the median among competitors. This means, what are the companies, whose business is more efficient and requires less funds.

Let's look at the operating cash flow yield multiplier. As a matter of fact, this is a multiplier, inverse of market capitalization to operating cash flow (or Market Cap / Operating Cash Flow), that is, it is calculated: operating cash flow divided by market capitalization. Here, too, the company has a value less than the median.

While expensive, but keep watching

On 19 August 2021 EnerSys shares were worth 86,07 $ for pike. For me, they are overpriced., despite the prospects, which management described in its presentations as revenue growth of 6-8% annually through fiscal year 2025.

The history of the past five years shows, that stocks are falling from local highs by 20-30%. The last local maximum was in March 2021, and then the shares were worth 101,46 $. Most attractive cost, in my opinion, is in the range of 71-81 $ per share.