Enel Russian Federation (MOEX: ENRU) — Russian generating company, which belongs to the Italian group Enel. Like a foreign shareholder, the domestic company decided to completely abandon coal-fired power plants in favor of renewable energy facilities.

About company

Business "Enel Russia", starting from the criterion for the generation of electrical energy, can be divided into two parts. 1-aya - ordinary energy, generation of electricity using natural gas. This part includes three fully operational stations:

- Sredneuralsk GRES. Sverdlovsk region, Sredneuralsk.

- Nevinnomysskaya GRES. Stavropol region, Nevinnomyssk.

- Konakovskaya GRES. Tver region, Konakovo.

2-th part is renewable, electricity will be generated by wind power plants. The tasks of the company until 2024 are to build three such stations:

- Azov wind farm. Rostov region, with 1 June 2021, the wind farm is working at one hundred percent.

- Kola wind farm. Murmansk region, the property is under construction, preparatory commissioning date — 01.05.2022.

- Rodnikovskaya wind farm. Stavropol region, the station is located in the design process, preparatory commissioning date — 01.07.2024.

If the company receives quotas under the CSA RES-2.0 program, Enel Russian Federation will be able to build several more renewable energy facilities: 2-oh wind farm in the Rostov region, 1-th wind farm in the Saratov region, the first solar power plant.

Comparison with competitors

| EV / EBITDA | P / E | P / BV | Net debt / EBITDA | |

|---|---|---|---|---|

| Enel Russia | 5,47 | 7,69 | 0,69 | 1,93 |

| Unipro | 6,5 | 13,13 | 1,37 | −0,17 |

| Inter RAO | 1,69 | 6,13 | 0,71 | −1,83 |

| OGK-2 | 3,87 | 6,04 | 0,5 | 1,41 |

| TGK-1 | 2,31 | 5,23 | 0,32 | 0,39 |

| Mosenergo | 2,7 | 7,28 | 0,25 | 0,26 |

| RusHydro | 4,06 | 8,17 | 0,54 | 1,22 |

Main driver of growth

The main reason for the possible growth is the transformation of Enel Russia's business. The company decided to completely reformat and follow the global trend of combating climate change. To do this, she sold her coal-fired Reftinskaya GRES in 2019, which brought ⅓ of total EBITDA, and received funds invested in renewable energy facilities. This, certainly, reduced operating and financial results, but the company assumes, what will catch up with the introduction of new "green" capacities.

At the end of June 2021, the first RES facility was opened - Azov wind farm. It was a significant event for the company: starting from this moment, Enel Russia will begin to receive increased payments under CSA - a power supply agreement.

EBITDA Forecast by Power Generation Technologies

| Coal | Gas | VIE | |

|---|---|---|---|

| 2019 | 32% | 68% | 0% |

| 2023, forecast | 0% | 61% | 39% |

Price per power, thousand rubles per 1 MW per month

| VIE | Old KOM blocks | Regulated market | |

|---|---|---|---|

| 2020 | — | 126 | 142 |

| 2021 | 1237 | 149 | 150 |

| 2022 | 1255 | 180 | 162 |

| 2023 | 1280 | 190 | 169 |

Shareholder structure

| Enel S. p. A. | 56,43% |

| UROC Limited | 7,40% |

| RDIF | 5,54% |

| Free-float | 30,63% |

56,43%

Dividend policy

Initially, Enel Russia fixed dividend payments until 2022 at the level of 3 billion rubles per year, what corresponds to the payment 0,085 P per share. But due to the fall in demand for electricity in 2020, the company decided to postpone the dividend payment for 2020 to 2022. Starting from 2023, Enel Russia plans to abandon fixed payments and return to distribution 65% net profit among shareholders.

Dynamics of dividend payments

| Dividend distribution, billion rubles | Dividend per share, rubles | Payout ratio from net profit | |

|---|---|---|---|

| 2017 | 5,1 | 0,145 | 60% |

| 2018 | 5 | 0,141 | 65% |

| 2019 | 3 | 0,085 | 335% |

| 2020 | 0 | 0 | 0% |

| 2021, forecast | 3 | 0,085 | 100% |

Arguments for

Record dividend yield. Enel Russia will return dividends to its shareholders in two years 28%. For 2021 - 0,085 R, which corresponds 10,3% dividend yield, for 2022 - 0,146 R, which corresponds 17,8% dividend yield.

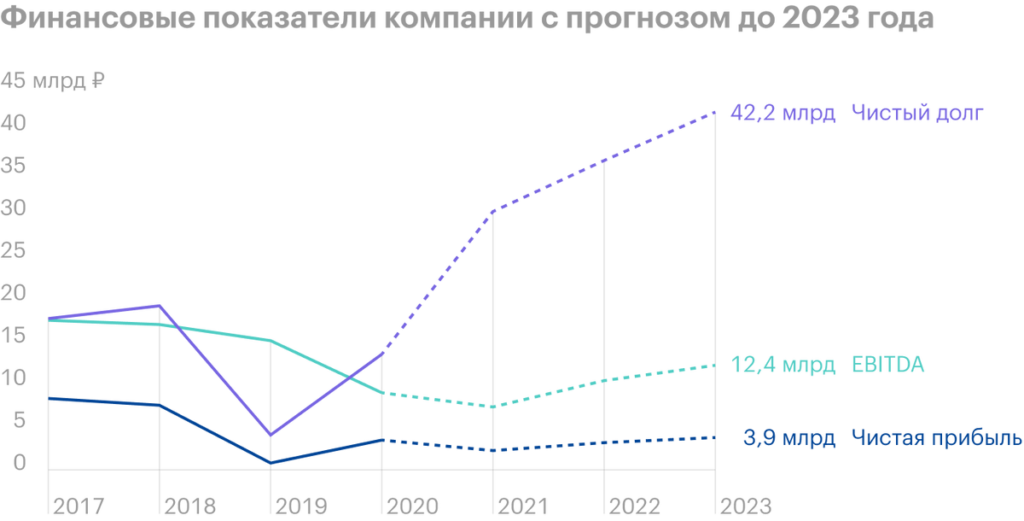

Financial results growth. Starting from 2021, the company predicts an increase in its financial performance due to the commissioning of new capacities.

Tax incentives. Kola wind farm has become a strategic investment project of the Murmansk region, therefore, Enel Russia has been 5 years will receive tax breaks on property.

Growing demand for electricity. Russia after the fall in electricity consumption by 3% in 2020 fully restored its indicators in the first half of 2021 and has already exceeded the levels of 2019.

RES development. According to the forecasts of Skolkovo and RANEPA specialists, in Russia, the wind farm market will grow from 2020 to 2035 in 4 Times.

Arguments against

Zero dividend risk for 2021. There is a risk due to the growth of net debt and a huge capex - by the end of 2021, net debt / EBITDA will reach its maximum and amount to 4,1. In the next three years, the volume of Enel Russia's investment program will amount to 36.7 billion rubles.

Multiple increase in net debt. Until 2023, net debt will grow to 42.2 billion rubles.

What's the bottom line?

The strong negative around Enel Russia shares is associated with zero dividend payments for 2020 and a drop in financial results over the past three years due to business transformation. But it creates an opportunity to invest in Russian green energy.

The movement of quotations in the next two years will largely depend on dividends: if the business plan is fulfilled, Enel Russia shareholders will receive for 2 year dividend yield 28%, in case of refusal of dividends, for example, risk next year, that the stock will fall even lower.