Dexcom (NASDAQ: DXCM) is a developer of continuous glucose monitoring systems (continuous glucose monitoring, CGM) for people with diabetes. Dexcom has a high growth rate, and with 2019 year it became profitable - a good reason to analyze the company in more detail.

Working principle and advantages of CGM

Before diving into financial statements, you should get acquainted with the company's product. The current model of the Dexcom G6 system consists of three main parts.

Applicator. With it, the user places a small sensor on a specific area of the body.. The sensor has a thin needle, which penetrates the subcutaneous layer and measures glucose levels. Dexcom G6 sensor lasts up to ten days, then they change it.

Transmitter (transmitter). Small device, which connects to the sensor and transmits information wirelessly to the receiver. Runs on batteries for three months. The batteries in the transmitter cannot be replaced..

Receiver (receiver). Device for displaying information. This is a separate gadget the size of a cell phone., which displays data in a user-friendly way. In modern CGM, the receiver can be a smartphone or smart watch.

Once installed, CGM measures glucose levels every five minutes and displays the result in real time. Sugar level range can be set, upon exiting which the user will receive notifications. Data is stored in the cloud, Therefore, close people can also monitor the condition of the patient. This is true for parents, who want to monitor their child's health, when he is away.

Owners of classic glucometers during measurements are forced to pierce their fingers every time. It makes you uncomfortable., therefore, it is not possible to measure the level of sugar often. Gotta wake up at night, to learn about the state of health during sleep. CGM is devoid of these disadvantages: He provides all the necessary information around the clock and painlessly..

Revenue structure

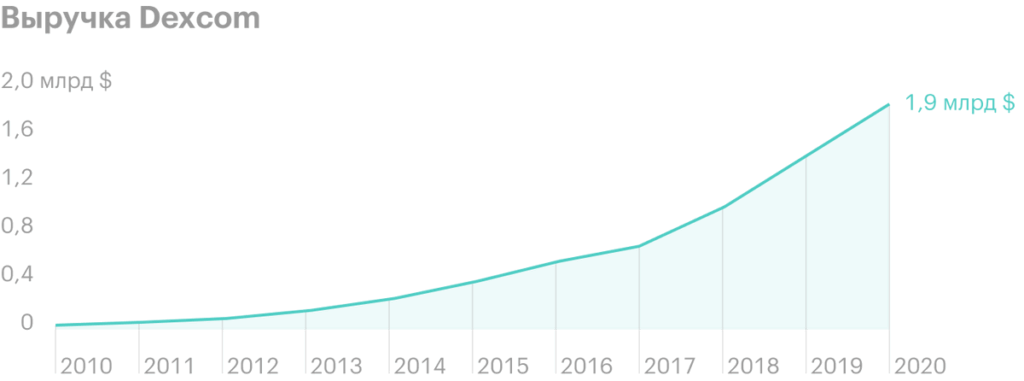

11 February Dexcom reported on 2020 year. The company divides its revenue into two segments. sensor — 81%, transmitters and receivers 19%. Sensors are expensive consumables, which need to be changed frequently. Not surprising, that this segment generates most of the revenue.

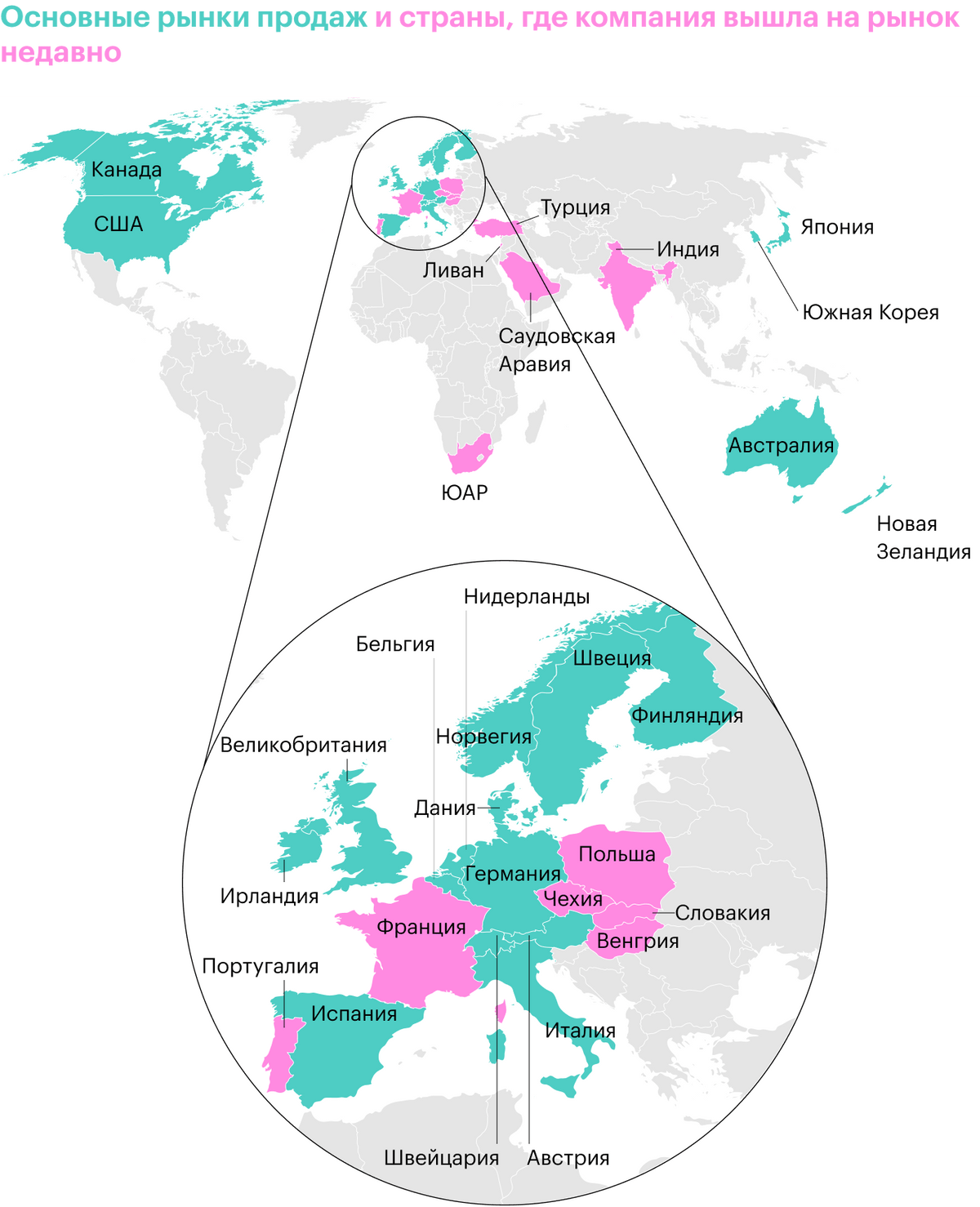

Dexcom identifies two sales markets in report: USA - 78% of total revenue and other countries, which bring 22%. The main share of revenue comes from the home region, but the company is actively expanding and entering the markets of other countries.

Sales dynamics, million dollars

Sales dynamics by segments, million dollars

| By segment | 2018 | Δ | 2019 | Δ | 2020 | Δ |

|---|---|---|---|---|---|---|

| Sensors | 758,1 | 47% | 1149,0 | 52% | 1561,4 | 36% |

| Transmitters and Receivers | 273,5 | 35% | 327,0 | 20% | 365,3 | 12% |

| Total | 1031,6 | 44% | 1476,0 | 43% | 1926,7 | 31% |

Sensors 2018 758,1 Δ 47% 2019 1149,0 Δ 52% 2020 1561,4 Δ 36% Transmitters and Receivers 2018 273,5 Δ 35% 2019 327,0 Δ 20% 2020 365,3 Δ 12% Total 2018 1031,6 Δ 44% 2019 1476,0 Δ 43% 2020 1926,7 Δ 31%

Sales dynamics by regions, million dollars

| By region | 2018 | Δ | 2019 | Δ | 2020 | Δ |

|---|---|---|---|---|---|---|

| USA | 818,4 | 37% | 1161,5 | 42% | 1509,5 | 30% |

| Other countries | 213,2 | 74% | 314,5 | 48% | 417,2 | 33% |

| Total | 1031,6 | 44% | 1476,0 | 43% | 1926,7 | 31% |

USA 2018 818,4 Δ 37% 2019 1161,5 Δ 42% 2020 1509,5 Δ 30% Other countries 2018 213,2 Δ 74% 2019 314,5 Δ 48% 2020 417,2 Δ 33% Total 2018 1031,6 Δ 44% 2019 1476,0 Δ 43% 2020 1926,7 Δ 31%

Growth space

The company sells its products in the USA, Canada, Western Europe, australia, New Zealand, Japan and South Korea. Target audience - patients, who are on insulin therapy. These are people with type 1 diabetes and some patients with type 2 diabetes..

Number of insulin dependent people in countries, where Dexcom is represented, is 10 million people. Of these, only one in four uses CGM - the company has room to grow in already occupied markets. By the end 2023 year, the target audience may increase by 13 million people by expanding the geography of sales, but expansion may fail.

Emerging markets

Today Dexcom only works in developed countries. The currencies of such countries are relatively stable, and the level of disposable income of the population is high. The company may face weak consumer demand as it enters emerging markets.

In Russia in 2020 year, the median salary was at the level 35 thousand rubles. Cost of a set of three Dexcom sensors, enough for a month, starts from 18 thousand rubles. Median Russians, probably, will use a conventional glucometer and pierce fingers, but it is unlikely to spend half the salary on sensors.

Another lion in this cage

Abbott Laboratories (NYSE: ABT) — a giant in the medical device industry and a nightmare Dexcom. IN 2020 Abbott Laboratories had diabetic device sales of 3,3 billion dollars, or 9,5% of total revenue, - it's much more, than Dexcom's annual revenue.

Abbott's CGM line is called the FreeStyle Libre. Last year Freestyle Libre sales volume 1 grew up on 43%.

In summer 2020 The FDA granted permission for the use of FreeStyle Libre 2 in USA. In the updated version, you can receive notifications and use your smartphone as a receiver. Following the European regulator approved FreeStyle Libre 3. The sensor size in the latest CGM is reduced by 70%.

Making a choice between Dexcom and Abbott based on online reviews is difficult: each user praises their system.

According to consultants, it is more profitable to use FreeStyle Libre 2. Required minimum - sensors. One sensor costs 6953 R. He serves 14 days. It is not necessary to buy a reader: You can use the application on an NFC-enabled smartphone.

Dexcom G6 requires sensors and transmitter to work. Sensor cost 6129 R and works 10 days. The cost of the transmitter 15 806 R, and the service life 3 months. FreeStyle Libre System 2 more popular, because it's cheaper.

Securities

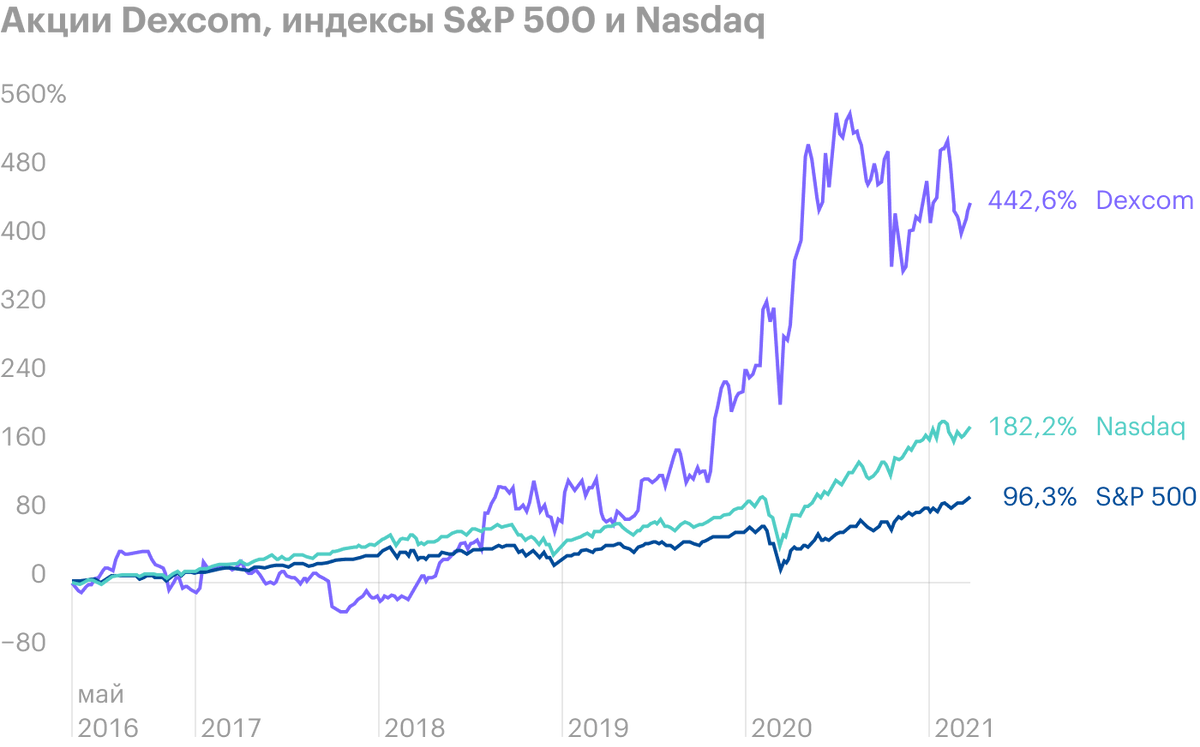

Due to high growth rates, Dexcom did not remain without attention of investors: the company is worth 75 profits and 18 revenue. Today coefficient P / E, equal 75, doesn't look fantastic, especially given the net margin in 26%. But these numbers can be misleading..

The company made a profit last year 494 million dollars. Of them 269 million — tax deduction. Excluding tax asset P / E will rise to 156, and the net margin will fall below 12%. These are not the most attractive figures against the backdrop of slowing revenue growth.

Over the past ten years, Dexcom's sales have increased by an average of 44% in year. TO 2025 year management plans to double revenue, i.e. increase sales 15% annually. It's still a lot., but, seems, the brightest days of growth are left behind.

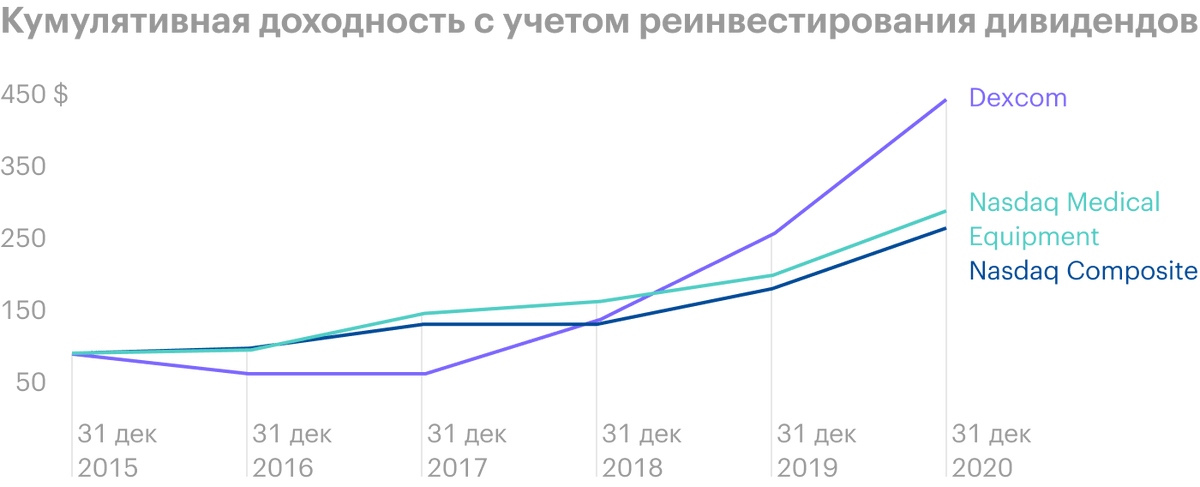

From the middle 2019 of the year, when Dexcom started to make a steady profit, the company's shares outperform the S indices&P 500 и Nasdaq. The papers are currently trading at 419 $ - on 8% below the highs. Analysts expect stocks to rise during the year by 11% - up to the mark in 466 $. In my opinion, today Dexcom is overvalued and only a relatively small percentage is worth adding it to your portfolio.

Output

Dexcom creates quality, high-tech, but expensive product. Because of this, the demand for the company's devices in developing countries may be low.. Important, that Dexcom products are not unique. Main competitor, Abbott Laboratories, quickly closes the technological gap and begins to take the lead.

Dexcom's revenue growth rates begin to decline: the company has collected the lowest-hanging fruits and it will be more difficult to expand further. Unlikely, that the issuer's shares will continue to grow at the same rate.

If you want to invest in the growing market for medical devices for diabetics, then it is better to pay attention to the Wallace Abbott company. In addition to diabetes, Abbott has many other promising areas, it pays dividends and is not so overpriced.