Daimler (ETR: DAI) - German car manufacturer. The company has not been hit hard by the coronavirus crisis, and the current situation even contributes to it. However, financiers should be aware of the company's large debt.

What happens here

Readers have been asking us for a long time to start sorting out the financial statements and business foundations of foreign issuers.. The idea to review Daimler was suggested by our author Igor Moroshkin in the comments to the review of Carl Zeiss Meditec. Offer in the comments of the company, analysis of which you would like to read.

The overview contains many screenshots with tables from reports. To make it more convenient to use them, we transferred them to google-sheets and translated into Russian. Direct your attention: there are several sheets. And keep in mind, that companies round off certain numbers in documents, therefore, the totals in graphs and tables may not converge.

Download the table from the report

What do they earn

The company produces cars and trucks under different brands..

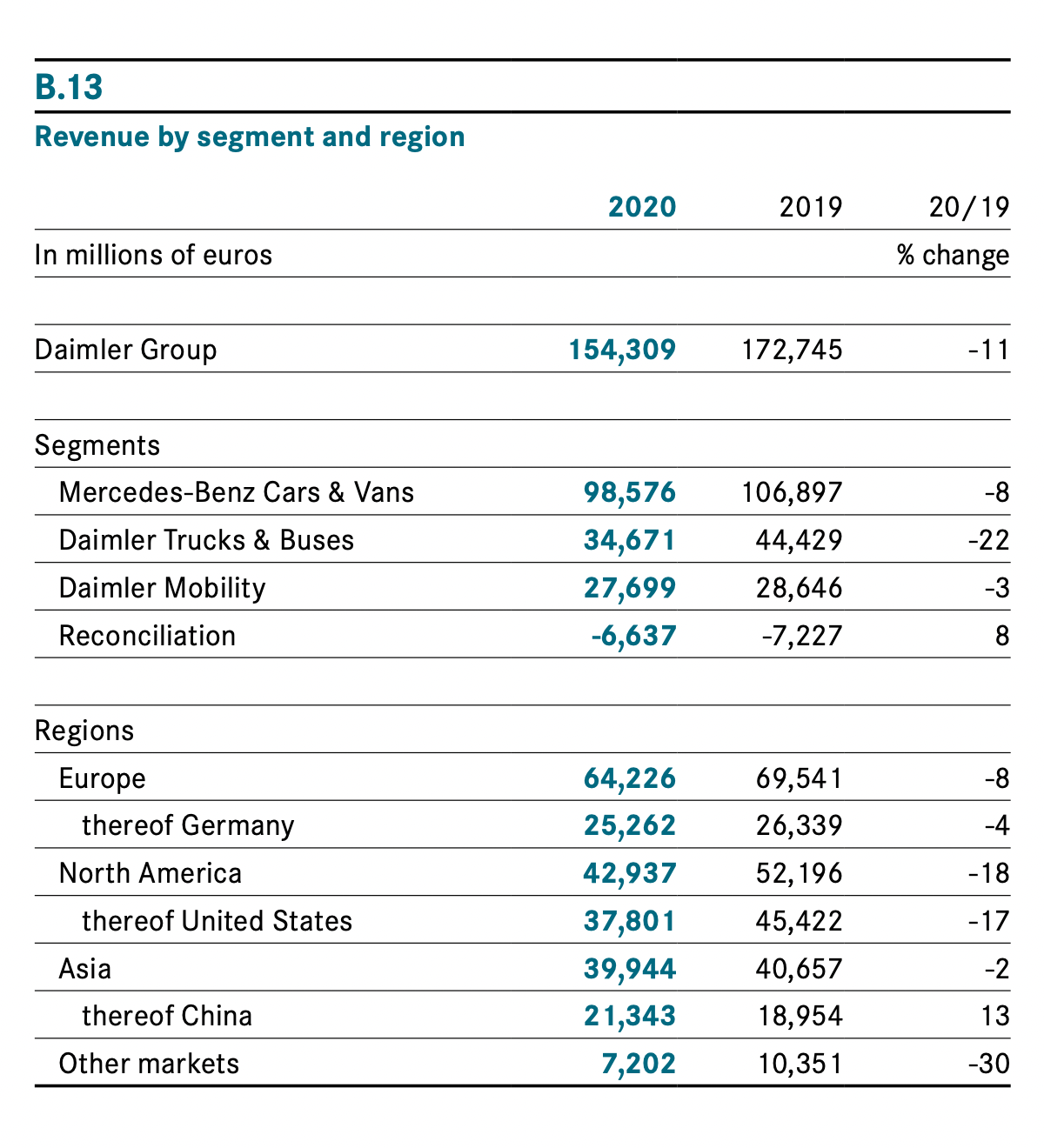

By sectors, the company's revenue is distributed as follows::

- Auto Mercedes-Benz — 63,86 %. Sector profit before taxes — 5,43 % of the sector's revenue.

- Trucks and buses Daimler — 22,46 %. Sector profit before taxes — 1,51 % of the sector's revenue.

- Mobility Daimler - 13,68 %. In this sector, the company is engaged in leasing, car loans and selling insurance. Sector profit before taxes — 5,56 % of the sector's revenue.

The main sales of the company are in Europe - 41,62 % proceeds, directly Germany gives 16,37 % proceeds, USA - 24,49 % proceeds, China - 13,83 % proceeds.

Annual indicators of the company

| Revenue | Net income | Profit Margin | |

|---|---|---|---|

| 2017 | 164,15 | 10,28 | 6,26% |

| 2018 | 167,36 | 7,25 | 4,33% |

| 2019 | 172,75 | 2,38 | 1,38% |

| 2020 | 154,31 | 3,63 | 2,35% |

Revenue

2017

164,15

2018

167,36

2019

172,75

2020

154,31

Net income

2017

10,28

2018

7,25

2019

2,38

2020

3,63

Profit Margin

2017

6,26%

2018

4,33%

2019

1,38%

2020

2,35%

Quarterly indicators of the company

| Revenue | Net income | Profit Margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 30,18 | −2 | −6,63% |

| 3 neighborhood 2020 | 40,28 | 2,05 | 5,09% |

| 4 neighborhood 2020 | 46,62 | 3,48 | 7,48% |

| 1 neighborhood 2021 | 41,02 | 4,29 | 10,46% |

Revenue

2 neighborhood 2020

30,18

3 neighborhood 2020

40,28

4 neighborhood 2020

46,62

1 neighborhood 2021

41,02

Net income

2 neighborhood 2020

−2

3 neighborhood 2020

2,05

4 neighborhood 2020

3,48

1 neighborhood 2021

4,29

Profit Margin

2 neighborhood 2020

−6,63%

3 neighborhood 2020

5,09%

4 neighborhood 2020

7,48%

1 neighborhood 2021

10,46%

“Pay attention: Made in Germany"

The company survived the terrible coronavirus year 2020 without dire losses and even slightly increased profits amid falling revenues.

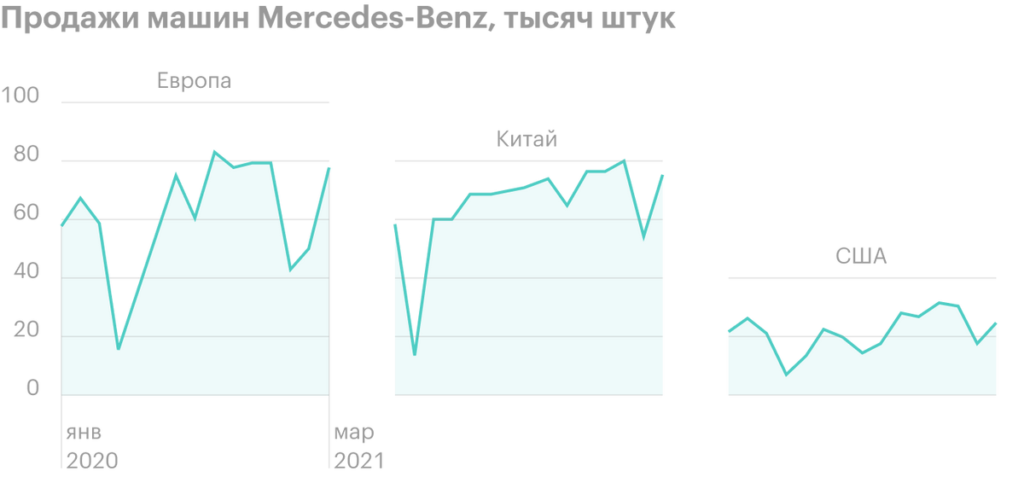

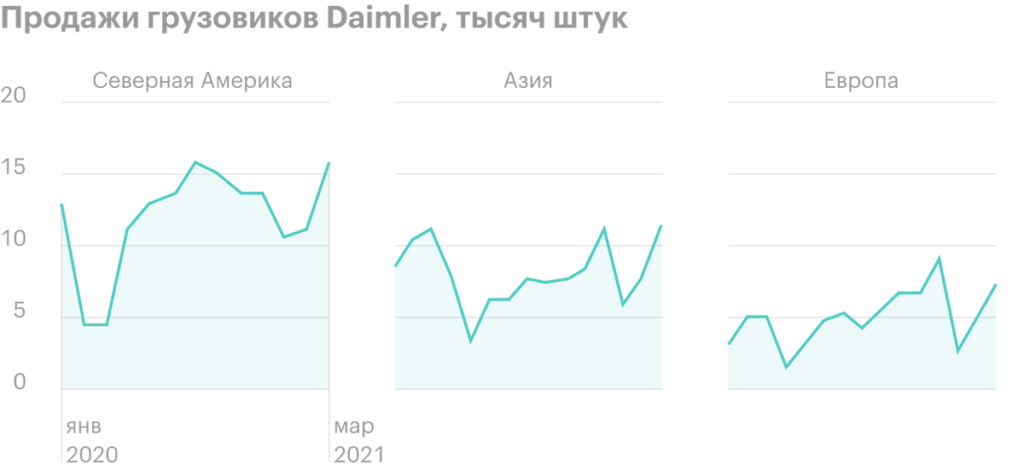

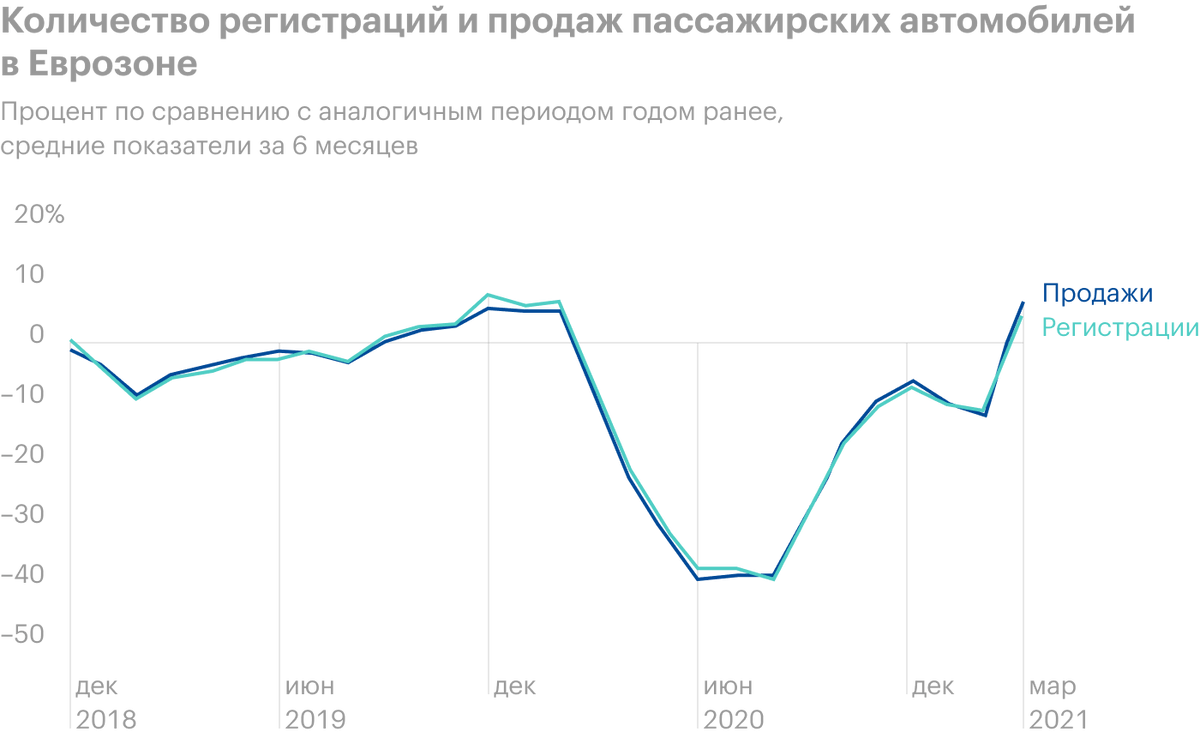

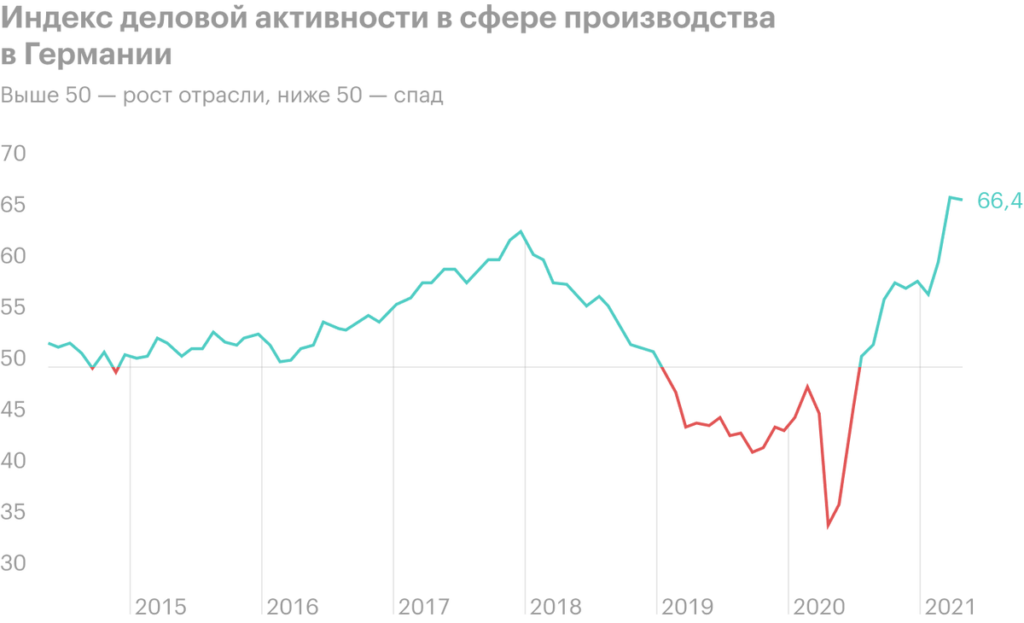

Daimler's key figures are now recovering, and given the positive statistics of car sales in Europe and production indicators in Germany, I would expect, that this quarter the company will at least not disappoint analysts' expectations for earnings, maybe, even surpass them.

But there is one caveat.

Earnings per share in euros

| Current | Expectation | |

|---|---|---|

| 2 neighborhood 2020 | −1,87 | −1,19 |

| 3 neighborhood 2020 | 1,92 | 1,66 |

| 4 neighborhood 2020 | 3,26 | 2,52 |

| 1 neighborhood 2021 | 4,01 | 3,07 |

| 2 neighborhood 2021 | 2,53 | — |

Current

2 neighborhood 2020

−1,87

3 neighborhood 2020

1,92

4 neighborhood 2020

3,26

1 neighborhood 2021

4,01

2 neighborhood 2021

2,53

Expectation

2 neighborhood 2020

−1,19

3 neighborhood 2020

1,66

4 neighborhood 2020

2,52

1 neighborhood 2021

3,07

2 neighborhood 2021

—

Kite food

The company pays 1,35 € dividend per share per year, what she spends 1.4 billion euros on. Basically, there is enough money at the disposal of the company - 5.956 billion euros, but the amount of debt is very large - 198.4 billion.

Since this company is German, then the payment of dividends is definitely not a priority for her: such is the tacit contract between the German government and large financial and industrial groups of Germany. The former cover the latter and provide them with maximum-favored-nation treatment, including easy access to cheap loans, in exchange for job security. So in which case, Daimler will cut payments without question, which will lead to an exodus of passive profit lovers from stocks.

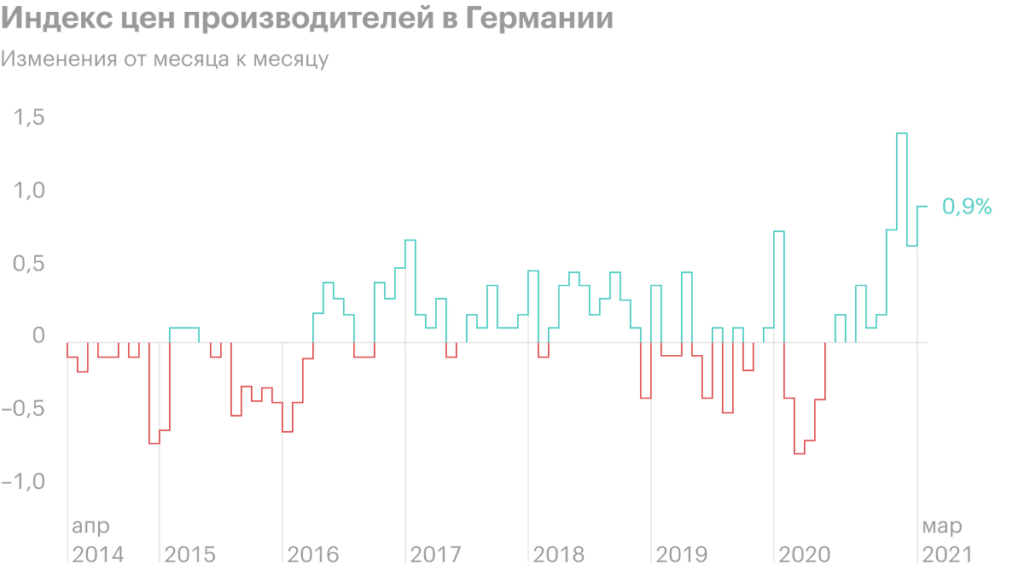

On the other hand, I don't see the circumstances, which would lead to a cut in dividends, apart from debt and rising production costs in Germany.

Daimler's dividend yield is 1,81% per annum, which is quite steep by German standards and could lead to an increase in quotes due to the influx of those looking for higher returns on the German stock exchange. Moreover, Daimler is a cool well-known brand., and the company is inexpensive, P / E equal 10,22. All together, these factors should help pump up quotes due to the influx of new investors.

Resume

Daimler is an interesting issuer, in which you can invest both in the short term, as well as longer term plans.. By the way,, By the end of the year, the company plans to split into Mercedes-Benz and Daimler.. All shareholders of a single Daimler will receive shares in the new venture. It's hard to say yet, How will this affect prices?, rather, how big will be the sum of the value of two shares of two different companies, how, for example, turned out at Synnex. I think, that everything will be fine, but you should still remember about the huge debts of the company.