CSX (Nasdaq: CSX) - a large American logistics organization, providing?? freight railway transportation services: classic railway transportation, transportation of intermodal containers and trailers and other transport services.

Business of the company

CSX operates in the eastern United States, where almost half of the population of the state lives, and serves large settlements in 23 States. The company's railway network totals approximately 19 500 miles, and she has access to more than 70 port terminals.

In ten years, the number of CSX locomotives has decreased by thirteen percent, but this does not prevent the company from increasing its cash performance.. The main reason for these 2 reasons is a decrease in the number of locomotives and an increase in monetary characteristics - this is a relatively low load.: only sixty-six percent of the fleet is heavily exploited, and the other thirty-four percent are in storage for use when needed. According to the situation on 31 December 2020 more years in CSX affiliation 3500 locomotives, the average age of which is twenty-one years.

CSX's income structure 2 quarter 2021 of the year, million dollars

| Revenue | share | |

|---|---|---|

| Chemicals | 606 | 20% |

| Intermodal containers | 511 | 17% |

| Coal | 423 | 14% |

| Agricultural products | 370 | 12% |

| Forest products | 233 | 8% |

| Automotive products | 216 | 7% |

| Metals | 204 | 7% |

| Minerals | 152 | 5% |

| Fertilizers | 122 | 5% |

| Other | 153 | 5% |

| Overall result | 2990 | 100% |

Distribution of dividends

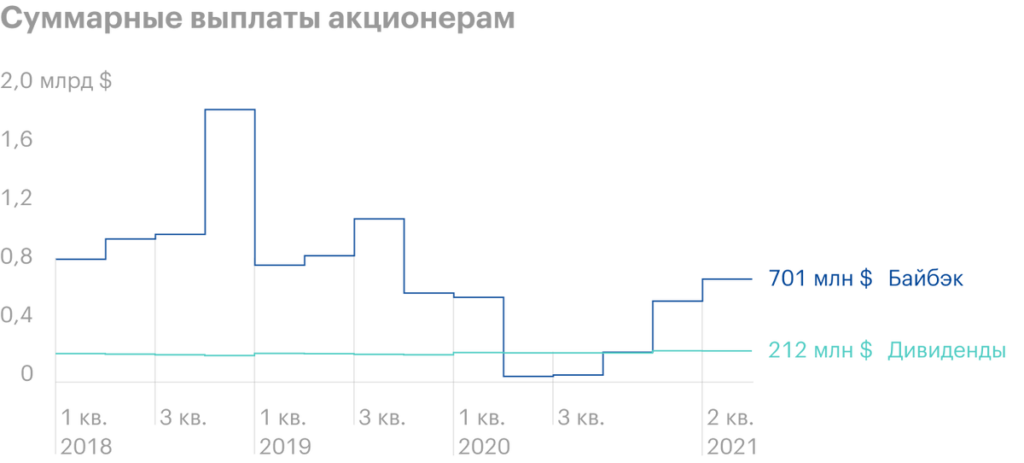

The main attraction of CSX is that, that the company is trying to return to shareholders the maximum possible profit for the reporting period. This is done through the payment of dividends and buyback of shares - Baibek.

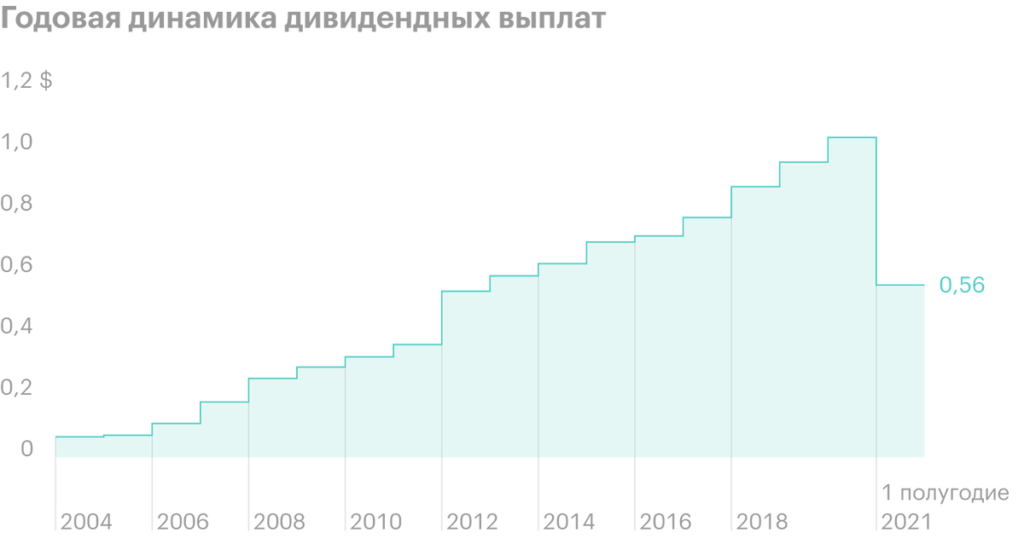

Dividends. Company with 2004 increases its dividend payments every year. CSX Next Dividend Per 3 neighborhood 2021 year will be 0,093 $, which is three times less than the payment for the previous quarter - 0,28 $. We are not talking about a reduction in dividend payments.: in 2 quarter 2021 the board of directors approved splitting up company shares in the ratio 3:1. This means, that the number of securities held by CSX shareholders has tripled and they will receive the same payment, as in the previous quarter.

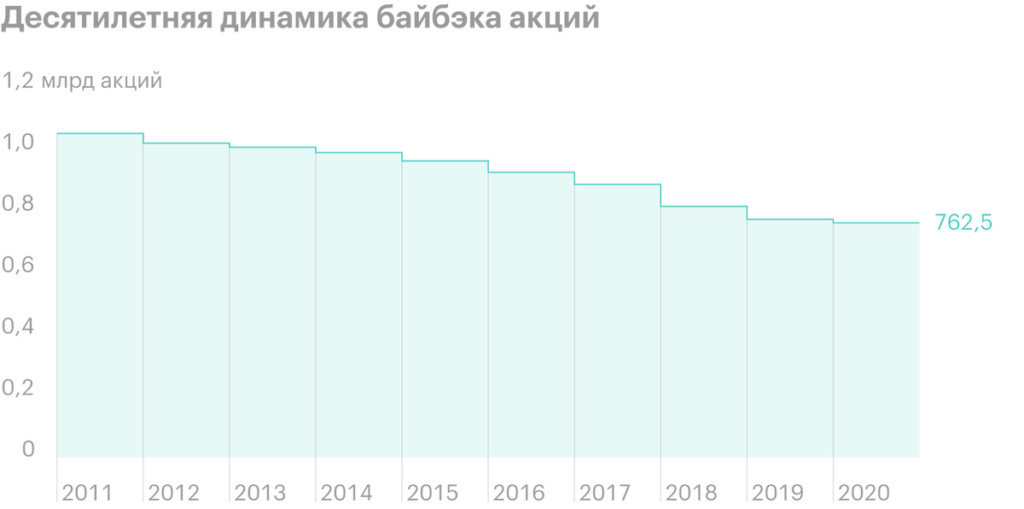

Baibek. Principle, adhered to by CSX management, is the distribution of excess money among the company's shareholders through balanced share repurchases. For 1 half a year 2021 years in this way, shareholders returned almost 1,3 billion dollars.

Financial results and forecast for 2021 year

CSX shows stable financial results, with the exception of 2017 of the year, when the company received a one-time profit 3,5 billion dollars as a result of revaluation of tax liabilities. Well 2020 the year was unstable due to quarantine restrictions.

Management has set the following goals for 2021 year:

- Double-digit revenue growth excluding results from previously acquired Quality Carriers, the deal with which was closed in early July 2021.

- Quality Carriers will add approximately 6% annual revenue CSX.

- Annual capital expenditures of the railway operator will amount to 1.7-1.8 billion dollars.

- The company will continue to return capital to shareholders through dividends and buyback.

- CSX is focused on providing customers with high-quality service products.

Financial results for the last 5 years, billion dollars

| Revenue | EBITDA | Net profit | net debt | |

|---|---|---|---|---|

| 2016 | 11,069 | 4,69 | 1,714 | 10,69 |

| 2017 | 11,408 | 4,982 | 5,471 | 11,408 |

| 2018 | 12,25 | 6,2 | 3,309 | 13,899 |

| 2019 | 11,937 | 6,314 | 3,331 | 15,28 |

| 2020 | 10,583 | 5,745 | 2,765 | 13,576 |

| 1п2021 | 5,803 | 3,485 | 1,879 | 13,365 |

Arguments for

Dividends and buyback. For the first half of the year 2021 years CSX returned to shareholders 1,677 billion dollars, that with the current capitalization of the company in 76,36 billion dollars gives 2,2% profitability for 6 Months.

Debt load. As of 31 June 2021 year, the company's net debt amounted to 13,3 billion dollars, a "net debt" / EBITDA» — 2,04.

Pollution control. CSX announces collaboration with Wabtec, which will help the company modernize its locomotives, to minimize harmful greenhouse gas emissions.

ESG investing. Increased demand for ESG investment may lead to further growth in shares of railway operators, because railways are one of the most economical and environmentally efficient means of transporting goods by land.

Arguments against

Growth of quotations. Company capitalization from lows 2020 has almost doubled.

Low dividend yield. If we take into account only dividends, then the company shows low results in comparison with competitors. For the last 4 quarter, CSX's dividend yield was about 1%. Other players in this sector have more interesting percentages.: Norfolk Southern — 1,5%, Union Pacific — 1,7%.

What's the bottom line?

CSX is one of the leaders of the American railway sector. The issuer is ideal for investors, which use the principle of value investing, because of the strong strategy of the company, consisting of two parts. The first is to maximize returns for its shareholders through dividends and buybacks.. The second is the growth of financial performance due to the acquisition of small competitors, e.g. Quality Carriers or Pan Am Railways.