Bayer (ETR: BAYN) - a huge German company. She recently suffered heavy losses due to legal fees., but now business is back to normal. And the company successfully creates an image of a very progressive, which can also positively affect quotes.

The company's website is not available to users from the Russian Federation. We hope, Do you know, what to do.

What's going on here

Readers have long asked us to start analyzing the reporting and the foundation of the business of foreign issuers.. The idea to review Bayer was proposed by our reader Elena Khrileva in the comments to the Hologic review.. Suggest in the company's comments, analysis of which you would like to read.

There are many screenshots with tables from reports in the overview. To make it easier to use them, we translated them into Google tables and translated them into Russian. note: there are several sheets. And keep in mind, that companies round up some numbers in their reports, therefore, the totals in graphs and tables may not converge.

What do they earn

The company has three main segments.

Plant growing. Products and service, including software for growing various crops, — 45,79% proceeds.

Pharmaceutics. Manufacture and sale of prescription drugs, as well as medical equipment 41,9% proceeds.

Consumer health. Non-prescription medicines - 12,31% proceeds.

Germany is a relatively small market for the company - 5,73% proceeds. Much more important for reporting America - 31,32%. But in general, this is truly an international company., for which no region and no country provides more than half of the total revenue.

Shareholding structure of the company by geography, as a percentage of the total

| USA and Canada | 27,9% |

| Germany | 22,5% |

| United Kingdom | 13,9% |

| France, Italy, Spain | 5,7% |

| Singapore | 4,7% |

| Norway, Denmark, Sweden | 3,6% |

| Switzerland | 2,5% |

| Japan | 1,4% |

| Other countries | 4,4% |

| Did not participate in the study | 13,4% |

Annual revenue, company profit in billion euros, total margin as a percentage of revenue

| Revenue | Net income | Profit Margin | |

|---|---|---|---|

| 2017 | 35,02 | 7,34 | 20,95% |

| 2018 | 36,74 | 1,70 | 4,61% |

| 2019 | 43,55 | 4,09 | 9,39% |

| 2020 | 41,40 | −10,49 | −25,35% |

The winter of our anxiety is over

2020 the company had a profitable year, but mostly not because of the coronavirus, and due to court cases - maybe, Have you heard about the asbestos story?, as a result of which the company had to pay huge compensation. But all the troubles seem to be over, and the situation with the profitability of the company's business began to bounce back already in the first quarter 2021 of the year.

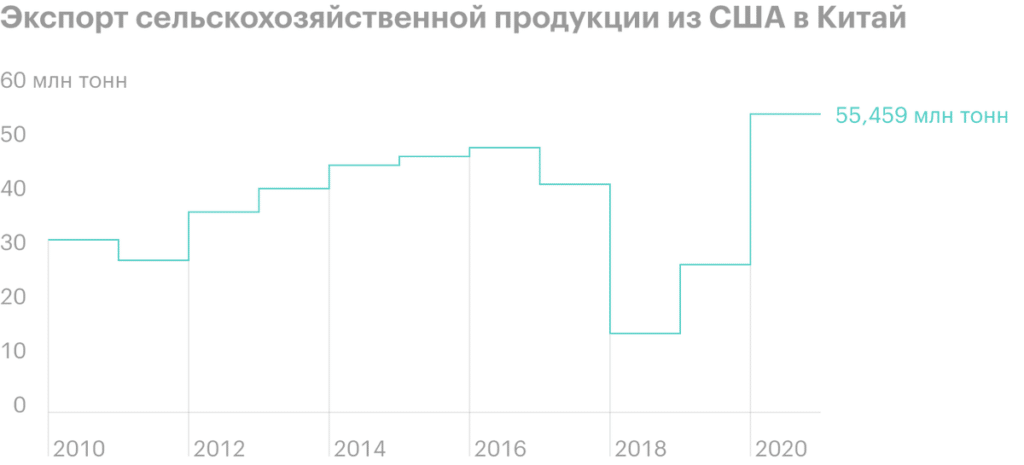

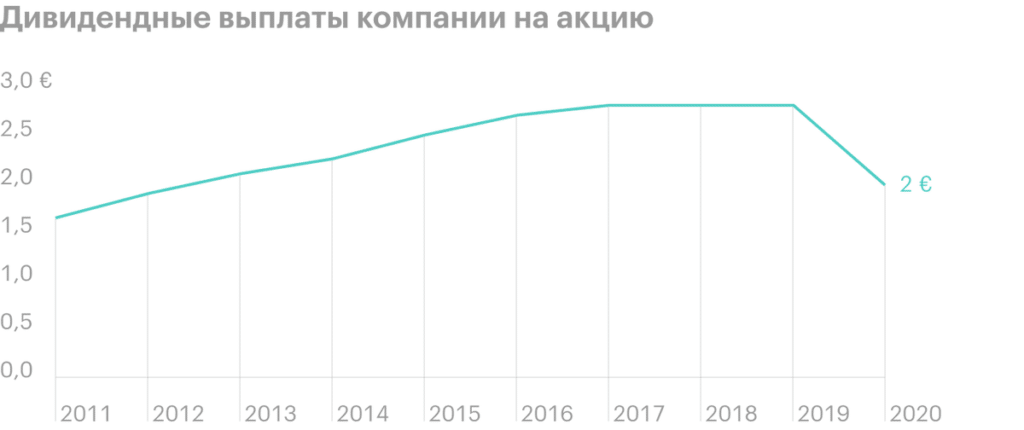

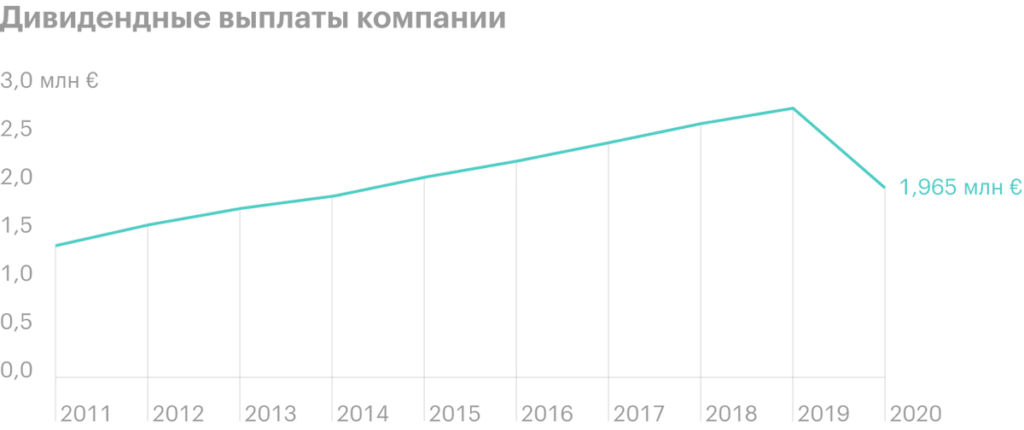

The agricultural business of the company is favored by the situation with the increase in exports and the profitability of American farms. Bayer shareholders don't need to fear dividend cuts just yet: they have already been cut 2020 year due to claims payments.

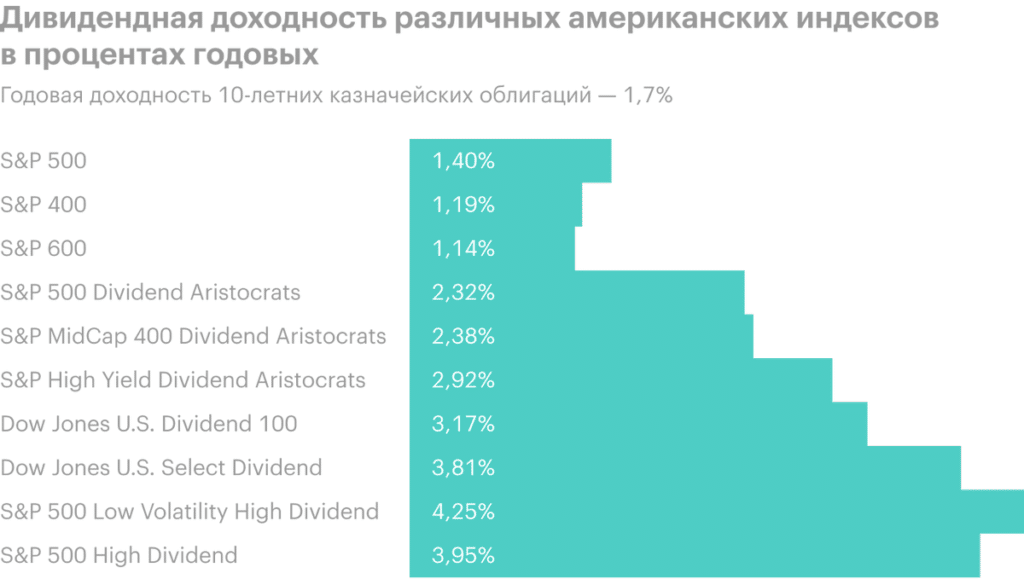

The company is currently paying 2 € per share per year, which with the current share price gives approximately 3,62% per annum. According to German standards, where is the negative return on deposits, this is space money. And by American standards, the money is very good. Therefore, you can even expect here, that lovers of passive income will crowd into stocks, why stocks rise again.

In theory, certainly, there is a chance, that any problems with revelations about toxic substances will be repeated, but I believe, that such risks are minimal. Bayer inherited this problem after buying Monsanto, and thinking, that such incidents have already been settled. But if we are afraid of the possibility of repeating these events, it's better to avoid Bayer stock altogether: this kind of news always comes out suddenly.

Quarterly revenue and profit of the company in billion euros, total margin as a percentage of revenue

| Revenue | Net income | Profit Margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 10,05 | –9,55 | –94,97% |

| 3 neighborhood 2020 | 8,51 | –2,74 | –32,26% |

| 4 neighborhood 2020 | 9,99 | 0,308 | 3,08% |

| 1 neighborhood 2021 | 12,33 | 2,09 | 16,95% |

That, what should not be forgotten

Medicines bring the company basic bread with butter and caviar. Therefore, investing in Bayer should take into account that, that patents on all drugs have a limited shelf life, after which competitors acquire the right to produce analogues, - and then the revenues from these drugs fall.

In the tables below you can see, which Bayer medicines are top-grossing and when their patent expires. Meditate on it, should think about, that Bayer has to spend a lot of money on R&D, whose success is not guaranteed at all.

On the other hand, all spending may well bring the expected effect. The hypothetical possibility of loss of income after the expiration of patents is so far exactly what is hypothetical.

They count not only the profits

In our huge material on ESG investing, we wrote about, that even the company, which has nothing to brag about in terms of business, can expect prices to rise, if she fulfills the "orders from the district center" for the implementation of a progressive agenda. Bayer has numerous non-financial KPIs and goals. And it is worth noting, that they are quite ambitious. Therefore, one can hope, that Komsomol investors will honor the company with their attention and pump up its quotes “for good deeds”.

Resume

Bayer is a huge company with a wide diversification in terms of sales geography. If you are not afraid of risks, associated with the expiration of patents, then this is a very good option for investing in the long term: revenue and profit growth, may be, do not strike the imagination, but this business is quite stable.