Arrow Electronics (NYSE: ARW) - supplier and reseller in the field of high technologies. The business of the company is favored by the market environment. But low margins and geopolitical tensions could hurt reporting.

What's going on here

Readers have long asked us to start analyzing the reporting and the foundation of the business of foreign issuers.. The idea of the Arrow review was suggested by our reader Alexey Shevelev in the comments to the analysis of ServiceNow. Suggest in the company's comments, analysis of which you would like to read.

There are many screenshots with tables from reports in the overview. To make it easier to use them, we translated them into Google tables and translated them into Russian. note: there are several sheets. And keep in mind, that companies round up some numbers in their reports, therefore, the totals in graphs and tables may not converge.

Download the table from the report

What do they earn

Arrow is a provider of products and services in the field of complex electronics and high technology. According to the annual report, its revenue is divided into two segments.

Components. These are services and goods in the field of electronics, which the company purchases from third-party manufacturers. The segment gives 71,5% proceeds. Segment operating profit - 3,8% from its proceeds. The company's revenue in the segment is divided into types of products and solutions:

- semiconductors - 76%;

- electromechanical products such as capacitors, potentiometers, resistors, switches - 14%;

- computing and memory 8%;

- other goods and services — 2%.

Enterprise computing services. These are software solutions and maintenance services: cloud computing, cyber security, education, analytics and more. The segment gives 28,5% proceeds. Segment operating profit - 4,32% from its proceeds. The segment's revenue is divided as follows:

- software - 35%;

- data storage - 43%;

- maintenance of standard servers - 9%;

- proprietary servers - 5%;

- other types of goods and services — 8%.

In general, Arrow resembles a cross between a service center and a wholesale warehouse for electronic parts..

The geographical distribution of the company's revenue is calculated by regions-blocks, therefore it is not clear, how many companies give sales in France, How much is in Guinea?. What is important for our history, that almost a third of the company's sales are made in the Asia-Pacific region and sales in this area are growing the best, while in other regions they stagnate or fall. It is worth noting, that the report specifically mentions the importance of sales in China.

The clients of the company are mainly engineering and design enterprises., as well as resellers and assemblers.

Number of company employees by regions

| Of America | 6000 |

| Europe, Middle East and Africa | 6500 |

| Asian-Pacific area | 7100 |

Of America

6000

Europe, Middle East and Africa

6500

Asian-Pacific area

7100

This will never end cause I want more — Lord, give me more, give me more

We have already written a lot about, how the semiconductor shortage is positively affecting companies, working in this industry: for example, in Applied Materials and Entegris review. Arrow is no exception., whose reporting, in the light of these trends, shows excellent growth rates. And what is characteristic, growth took place in all segments and regions.

Given the positive conjuncture - the lack of semiconductors, despite the fact that they are of enormous importance for the modern economy, - the company can count on a further increase in revenues.

Sales of components in regions by quarters, million dollars

| Of America | Asia | Europe | |

|---|---|---|---|

| 1 neighborhood 2020 | 1553 | 1688 | 1310 |

| 2 neighborhood 2020 | 1489 | 2114 | 1118 |

| 3 neighborhood 2020 | 1516 | 2595 | 1197 |

| 4 neighborhood 2020 | 1625 | 2935 | 1362 |

| 1 neighborhood 2021 | 1701 | 3173 | 1569 |

Of America

1 neighborhood 2020

1553

2 neighborhood 2020

1489

3 neighborhood 2020

1516

4 neighborhood 2020

1625

1 neighborhood 2021

1701

Asia

1 neighborhood 2020

1688

2 neighborhood 2020

2114

3 neighborhood 2020

2595

4 neighborhood 2020

2935

1 neighborhood 2021

3173

Europe

1 neighborhood 2020

1310

2 neighborhood 2020

1118

3 neighborhood 2020

1197

4 neighborhood 2020

1362

1 neighborhood 2021

1569

Sales of computing services at the enterprises in regions by quarters, million dollars

| Of America | Europe | |

|---|---|---|

| 1 neighborhood 2020 | 1129 | 702 |

| 2 neighborhood 2020 | 1223 | 662 |

| 3 neighborhood 2020 | 1274 | 650 |

| 4 neighborhood 2020 | 1484 | 1047 |

| 1 neighborhood 2021 | 1151 | 791 |

Of America

1 neighborhood 2020

1129

2 neighborhood 2020

1223

3 neighborhood 2020

1274

4 neighborhood 2020

1484

1 neighborhood 2021

1151

Europe

1 neighborhood 2020

702

2 neighborhood 2020

662

3 neighborhood 2020

650

4 neighborhood 2020

1047

1 neighborhood 2021

791

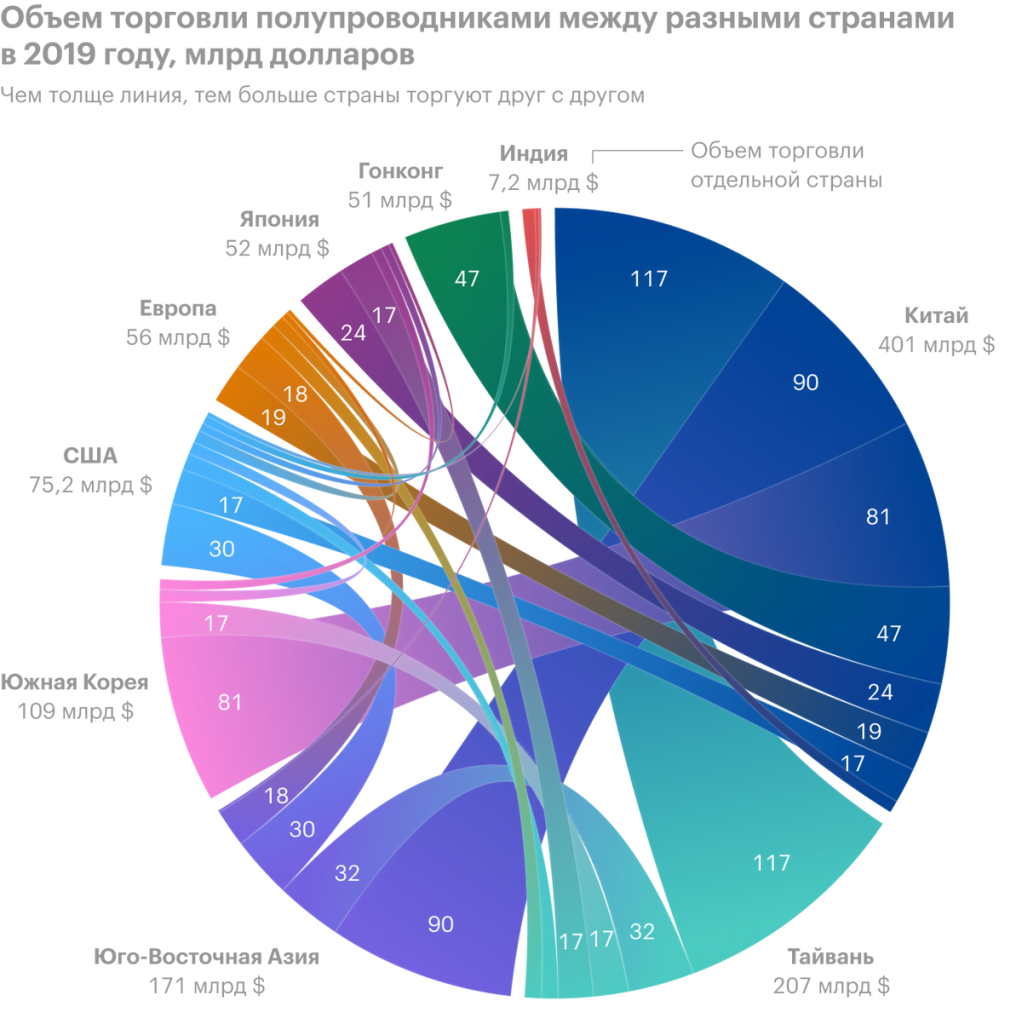

Chinese question

Chinese sales are important to the company, and I think, that, given current trends, this direction will improve Arrow's reporting.

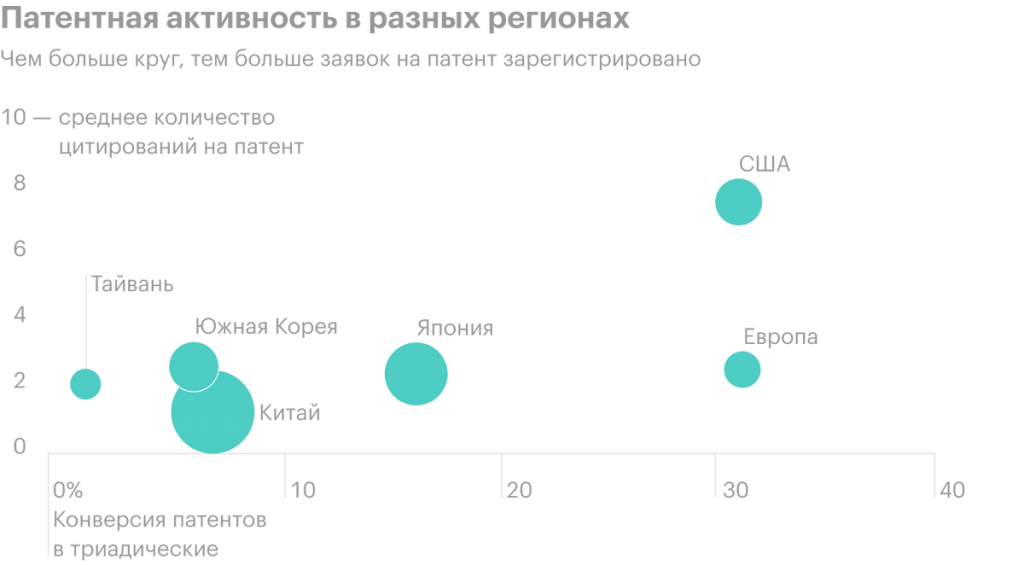

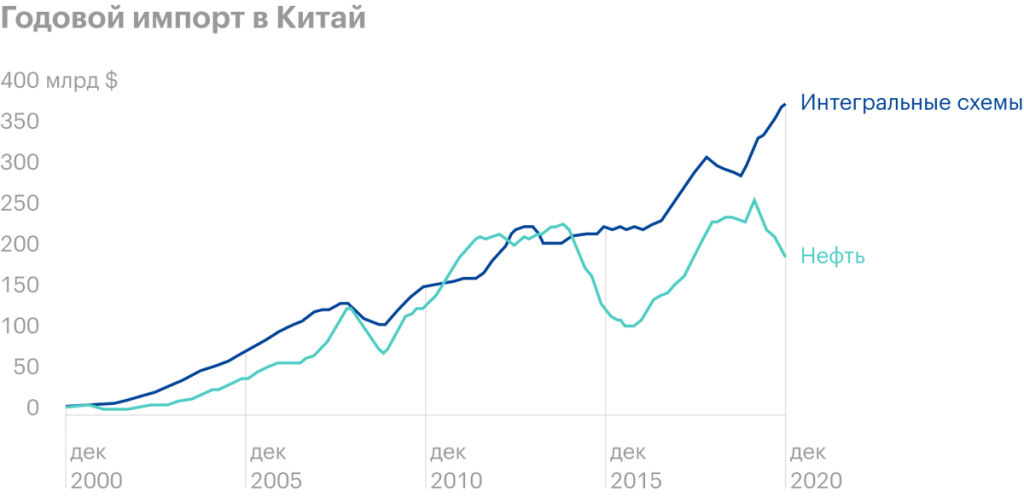

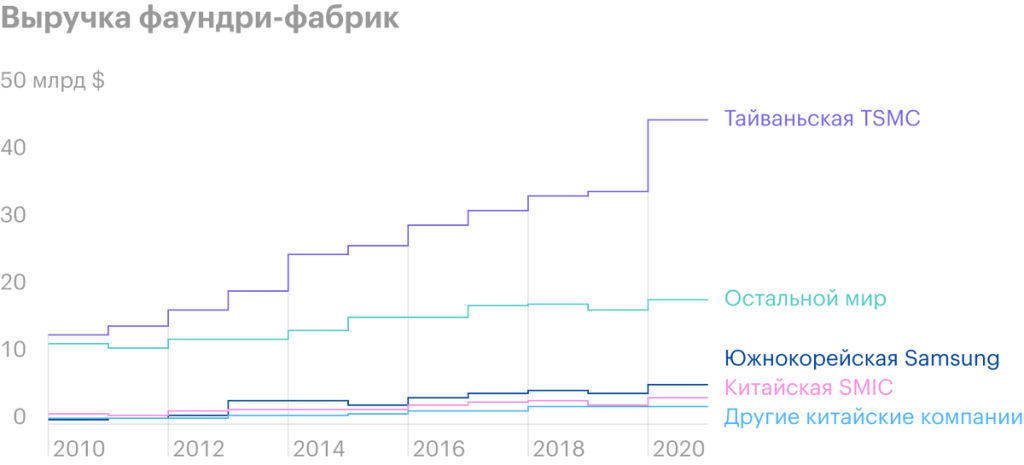

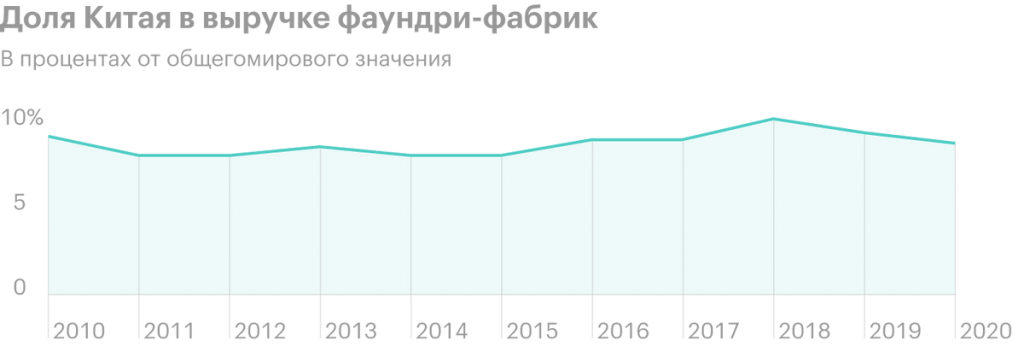

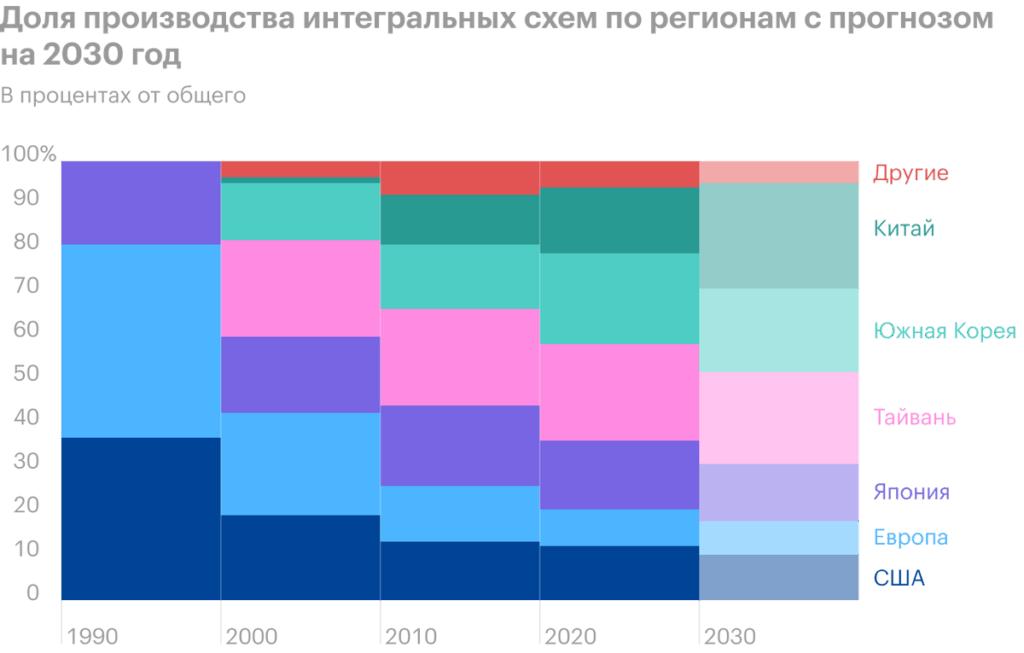

Now China is not the highest position in the supply chains: it is mainly a country of cheap labor and the assembly of high-tech products. But at the same time, China is trying to solve this problem and is spending huge amounts of money to develop its own semiconductor industry.. This will give Arrow's business an extra boost..

But it also brings risks.: if Western countries decide to ban the export of such goods to China, then it will reflect badly on Arrow.

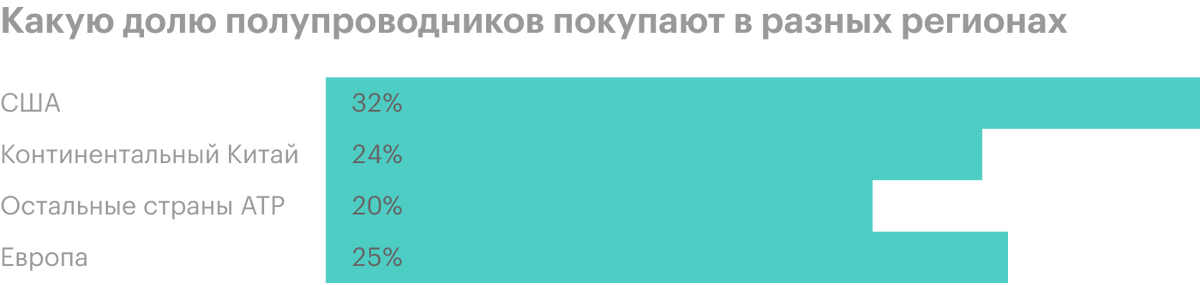

You should also consider that, that Arrow is a reseller. The company's bottom line is very low, like some car dealers, - near 2% from proceeds. That's not a lot, but, On the other hand, the company performs an important intermediary function in a very important industry. That fact, that China and Western countries are striving to develop independent high-tech supply chains in the medium term, favors the company's business.

Arrow's services as an operator of a logistics infrastructure for the supply of parts for high-tech industries in the current circumstances are in demand more than ever, because we are talking about hundreds of billions of dollars of investment alone in new production, for which you will need a lot of components. But what if there are no such investments?, then Arrow will continue to earn as an intermediary in the existing logistics scheme.

Resume

The company is inexpensive: P / E — 12, - and it works in a strategically important industry for all developed and developing countries. So that, in my opinion, now is a good time for that, to invest in these stocks. But still, one should keep in mind the low marginality of this business and geopolitical risks., related to the PRC.