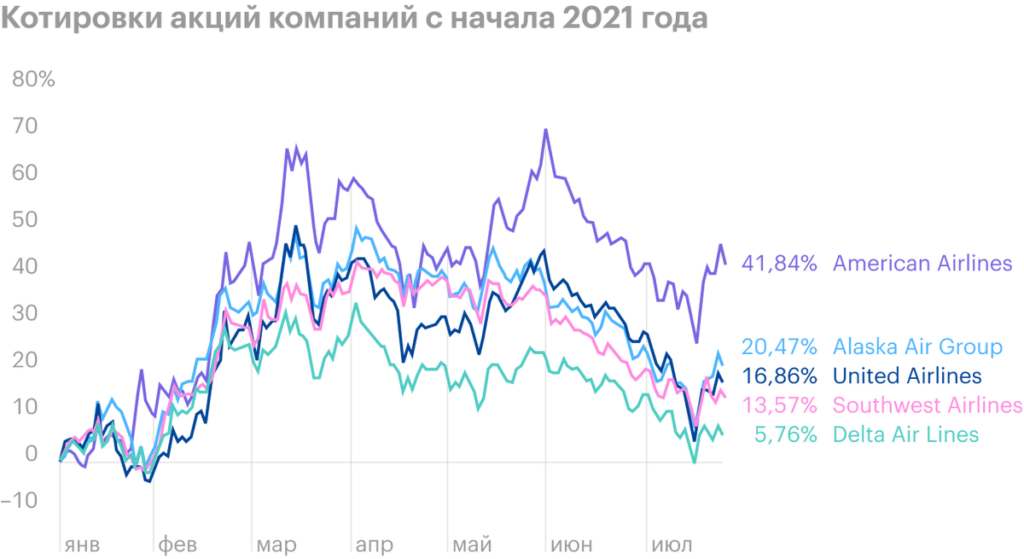

Now we will analyze the American aviation market using an example. 5 its main authorized persons, we trade?? on the St. Petersburg Stock Exchange.

Leading players

American Airlines (Nasdaq: AAL) - the largest aviation company in the world in terms of a huge number of characteristics, for example, in terms of fleet size and passenger traffic. The company makes interstate and local flights. Before the severe epidemic, she made 6,700 daily dispatches on 350 fronts in 50 States.

United Airlines (Nasdaq: UAL) - 2nd largest airline in the United States, which employs approximately 74 thousand people. In addition to its market, the air carrier flies to all continents, except Antarctica.

Delta Air Lines (NYSE: FROM THE) - international aviation company, based in the USA. In 2019, it transported more than 200 million people and was recognized as the largest air carrier in the world in terms of integrated revenue and income before tax.

Southwest Airlines (NYSE: LUV) a large American aviation company, flying?? only in North America. Serves 107 destinations in 40 states of the United States and also delivers passengers to 10 Caribbean States: Mexico, Cuba, Jamaica, Bahamas, Aruba, Costa Rica, Dominican Republic, Belize, Cayman islands, Turks and Caicos Islands (English overseas territory in the West Indies).

Alaska Air Group (NYSE: ALK) - the smallest of the companies represented here. Works in 4 States: USA, Canada, Mexico and Costa Rica. On average, an airline company transports approximately 44 million people a year..

The main monetary characteristics of companies, billion dollars

| American Airlines | United Airlines | Delta Air Lines | Southwest Airlines | Alaska Air Group | |

|---|---|---|---|---|---|

| Fleet size, Units | 1399 | 1287 | 1090 | 718 | 291 |

| Capitalization | 13,8 | 15,68 | 26,15 | 30,03 | 7,4 |

| Assets | 72,464 | 71,049 | 75,309 | 38,206 | 14,656 |

| Equity | — | 4,904 | 1,281 | 9,688 | 3,324 |

| net debt | 39,674 | 13,346 | 18,694 | — | 0,722 |

Impact of the pandemic

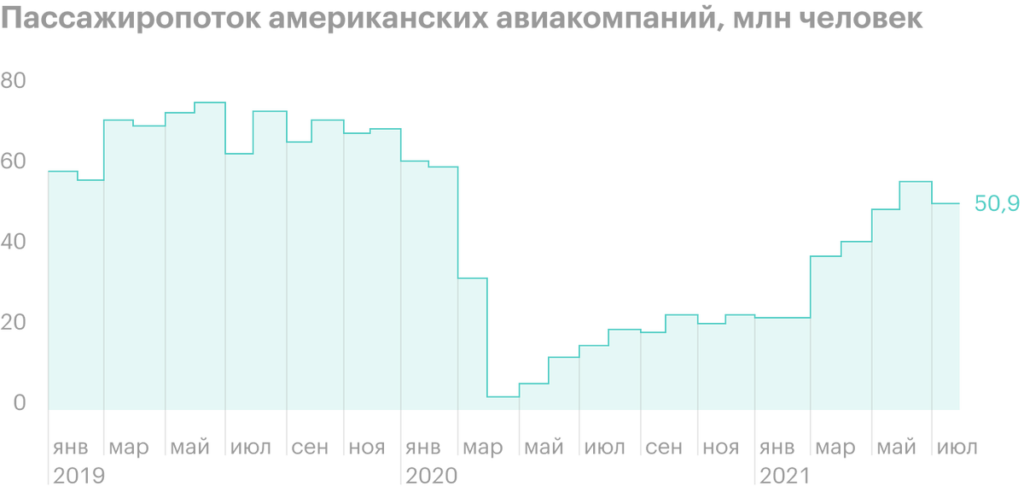

In 2020, many air carriers were on the verge of bankruptcy after the introduction of quarantine restrictions in the spring and summer. From this, the passenger traffic fell by more than 90%, according to TSA - agencies in the USA, which tracks, how many people at the airport enter the security zones.

US government provides $50 billion in aid in 2020, and in 2021 another $14 billion. This avoided reductions: money used to pay employees.

The downside of this support is a number of limitations.:

- Airlines were banned from 31 March 2022 to pay dividends and carry out buyback.

- Imposed restrictions up to 1 October 2022 for the payment of bonuses to the management.

- To 31 March 2022, companies are prohibited from laying off their employees or reducing their salaries.

- Airlines to 31 March 2022 must support regular air travel.

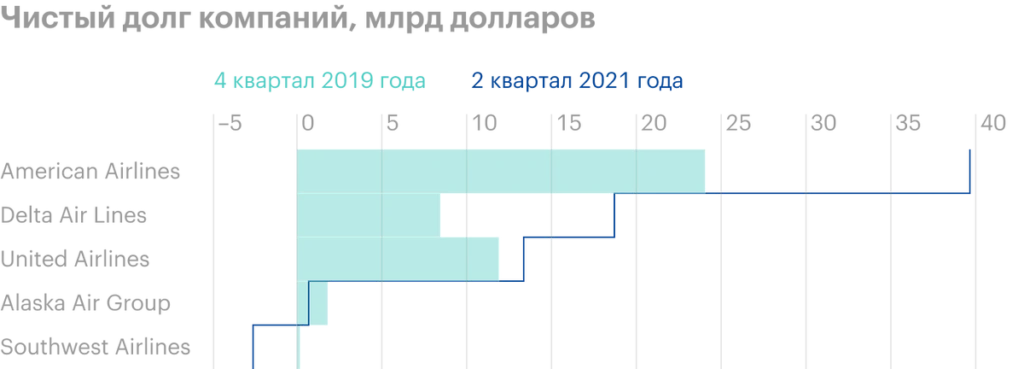

Many companies, trying to increase your financial strength, performed a number of negative corporate actions: issue new shares and dilute current shareholders or take on more debt.

The most satisfactory result was shown by Alaska Air Group: the company managed to get through the troubled 2020 without a significant deterioration in its performance, followed by Southwest Airlines with an average result, Delta Air Lines и United Airlines, and the clear outsider closes the top five - American Airlines.

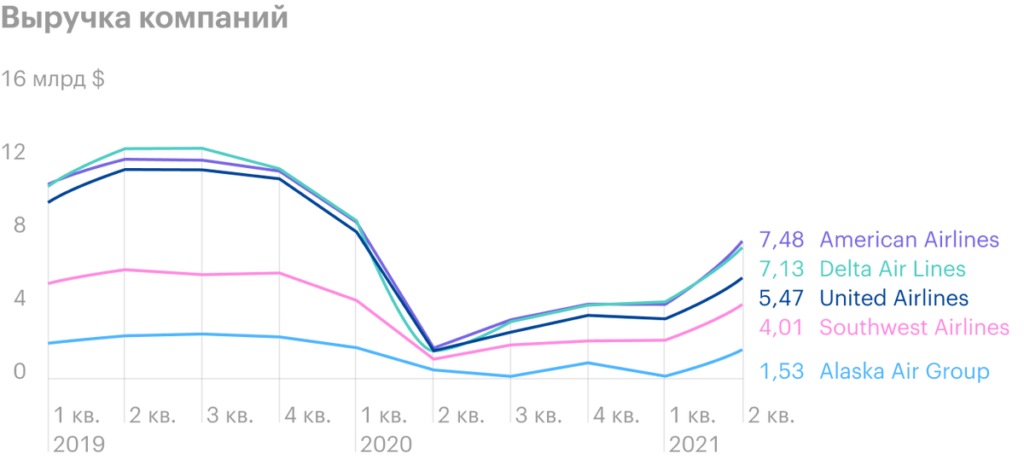

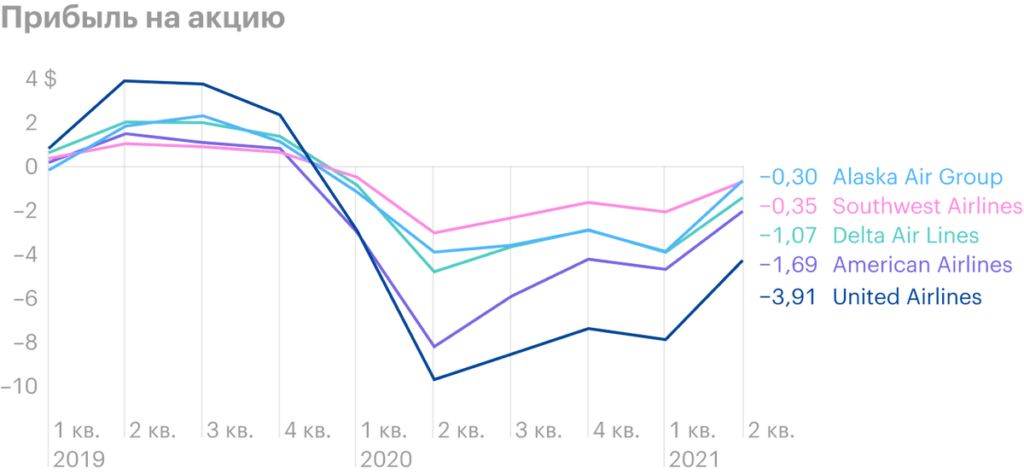

Financial results of companies

So far, none of the companies represented have been able to reach their 2019 indicators. All the five presented are now operating at a loss, Alaska Air Group and Southwest Airlines are closest to profit.

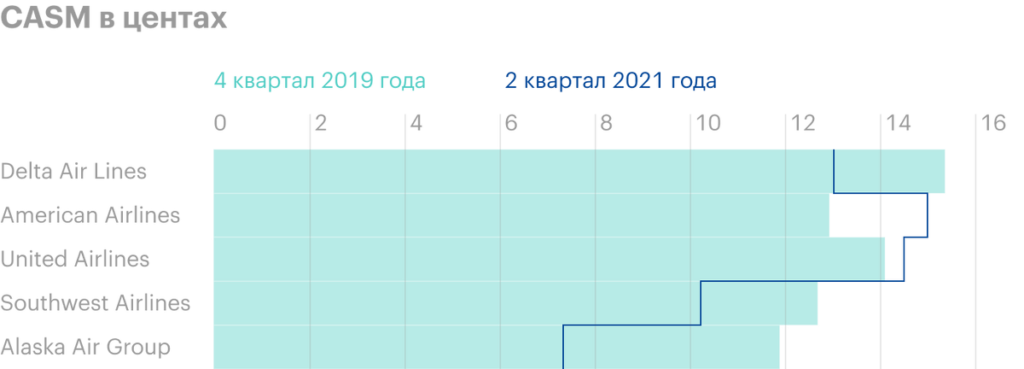

One of the main competitive advantages of Alaska Air Group and Southwest Airlines is a lower CASM score compared to competitors.

CASM is a unit of measurement, used to measure airline performance, it shows the cost of transporting a passenger seat per mile. The lower the CASM, the more profitable and efficient the carrier.

Besides, Southwest Airlines and Alaska Air Group have the highest occupancy rates based on 2 quarter of 2021.

Load factor on the basis 2 quarter of 2021

| Southwest Airlines | 82,9% |

| Alaska Air Group | 77% |

| American Airlines | 77% |

| United Airlines | 72% |

| Delta Air Lines | 69% |

82,9%

Management forecasts

Alaska Air Group. “Now we are constantly transporting about 110,000 passengers a day., and pre-orders are approximately 85% from the normalized level of 2019. This progress and our second quarter results give us confidence that, that the worst is over. To date, we are not seeing signs of a slowdown in demand.. With that in mind, we plan to return to the 100% level of 2019 no later than the summer of 2022.”.

Southwest Airlines. “We are very pleased with the positive shift in our business compared to the previous four quarters, our revenue almost doubled in the second quarter compared to the first. Tourist passenger traffic in June exceeded 2019 figures, but business travel income is still very weak, in the first summer month he is on 69% below the results of 2019. Fixing the recovery demand for the company's services, management expects to post a net profit in the third and fourth quarters.".

Delta Air Lines. “In the second quarter of 2021, the company achieved significant financial performance. The first positive result was received in June: profit before tax for the month went into plus, despite, that the proceeds are still on 40% lower compared to 2019. Given recovering demand and limited cost growth, management expects, that at current fuel prices, the third and fourth quarters will also be profitable”.

United Airlines. “Our joint efforts have led us to, that now we can announce a positive outlook for the second half of 2021, that it was difficult to imagine everything 12 months ago. The revenue forecast allows for significant improvement and profitable financial results on a pre-tax adjusted basis in the second half of the year, as in the third quarter, so in the fourth.

American Airlines. “The company still continues to generate a large net loss, based on the results of 2 quarter it amounted to $ 1.1 billion. But we expect, that in the third quarter our losses will be greatly reduced, as we continue to return to sustainable profitability. For the first time since December 2019, the company made a monthly profit in June 2021. In addition to reducing losses, production capacity will also decrease in the next quarter by about 15-20% compared to the third quarter of 2019.”.

What's the bottom line?

So far, small US airlines are performing well.: Alaska Air Group и Southwest Airlines. They can be among the first to make a profit already in 3 quarter of 2021 thanks to ultra-low CASM and high flight load.

Next come Delta Air Lines and United Airlines. These companies managed to get through the difficult year of 2020 without heavy losses., but their current pace of financial recovery lags behind the leaders.

A clear outsider American Airlines extremely painfully survived quarantine restrictions amid weak financial stability. The company emerged from the crisis with the largest net debt of the five, and only she has net worth less than zero.