«Alrosa» (MCX: ALRS) — a large mining company in the diamond mining sector.

Alrosa is a vertically integrated company, the leader of the world diamond mining industry. Her story began in 1957 year since the creation of the Yakutalmaz trust, in 2011 year the company was transformed into an open joint stock company, and in 2013 in 2009, she held an IPO on the Moscow Exchange.

The company owns the world's largest diamond reserves, it accounts for more than a quarter of the world and 90% Russian production. In these parameters, it is significantly ahead of even the largest competitors..

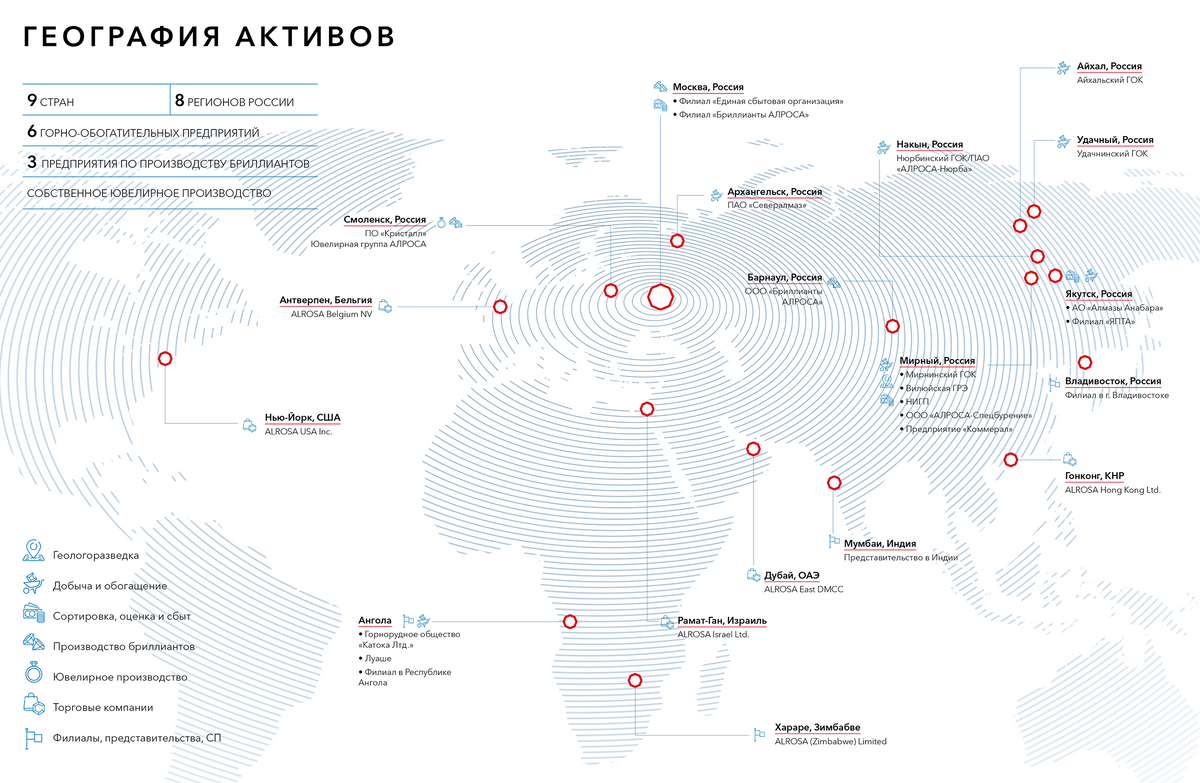

Also, Alrosa is engaged in the cutting and production of jewelry at its enterprises and the sale of diamond products.. The company is represented in 9 countries and 8 regions of Russia, main assets are concentrated in the Republic of Sakha (Yakutia), there are mining assets in African countries.

The company's reserves are estimated at approximately 1,1 billion carats, they will be enough for more than 20 years of production. The volume of production varies depending on the market conditions. For 2020 year, about half of the diamonds were mined by open pit, another quarter - at alluvial deposits and underground. It's good, since mining underground is more dangerous and costly.

Alrosa singles out jewelry and technical diamonds in the sales structure. Most are jewelry. It is very good, because their prices are much higher.: for example, behind 2020 year, the share of sales of technical diamonds in physical terms amounted to about 25% from the total, and in terms of value - only 2%.

Alrosa is a pronounced exporter. Less than 8% diamonds and 5% diamonds, 85% diamonds are sold to three countries: Belgium, India and UAE. Another positive point for the predictability of the company - 70% sales takes place under long-term contracts.

Vertical integration allows the company to provide provenance diamonds. To further promote this product, the company has developed and introduced a unique nano-marking technology. It can be used to uniquely identify a diamond., gaining access to its unique identifier and digital passport.

The company has taken a course to get rid of non-core assets: in 2018 gas assets sold to Novatek, in 2019 the company got rid of the sanatorium, and in 2020 - from a non-state pension fund.

The share of diamond mining by the largest companies in the industry for 2020 year

| Alrosa | 27,5% |

| The Bears | 23,0% |

| Rio Tinto | 13,5% |

| Petra Diamonds | 3,0% |

| Mountain Province | 2,9% |

| Other | 30,1% |

Reserves and production of the company by years, million carats

| Reserves | Mining | |

|---|---|---|

| 2016 | 1153 | 37,4 |

| 2017 | 1172 | 39,6 |

| 2018 | 1148 | 36,7 |

| 2019 | 1114 | 38,5 |

| 2020 | 1089 | 30,0 |

The structure of the company's diamond production for 2020 year

| Open way | 51% |

| Lifting way | 25% |

| Placer deposits | 24% |

Realization of diamonds by types in physical and value terms

| Jewelry Diamonds, million carats | Technical diamonds, million carats | Jewelry Diamonds, million dollars | Technical diamonds, million dollars | |

|---|---|---|---|---|

| 2016 | 29,3 | 10,7 | 4316 | 76 |

| 2017 | 30,4 | 10,8 | 4087 | 83 |

| 2018 | 26,5 | 11,6 | 4325 | 87 |

| 2019 | 24,1 | 9,3 | 3186 | 62 |

| 2020 | 23,8 | 8,3 | 2601 | 51 |

Geographic structure of sales of rough and polished diamonds by value per 2020 year

| Diamonds | Diamonds | |

|---|---|---|

| Belgium | 39,1% | 7% |

| India | 23,3% | 0% |

| UAE | 22,3% | 12% |

| Russia | 7,8% | 5% |

| Israel | 5,5% | 27% |

| Hong Kong and China | 0,6% | 7% |

| CIS | 0,2% | 0% |

| USA | 0% | 3% |

| Other | 1,2% | 39% |

The situation in the diamond mining sector

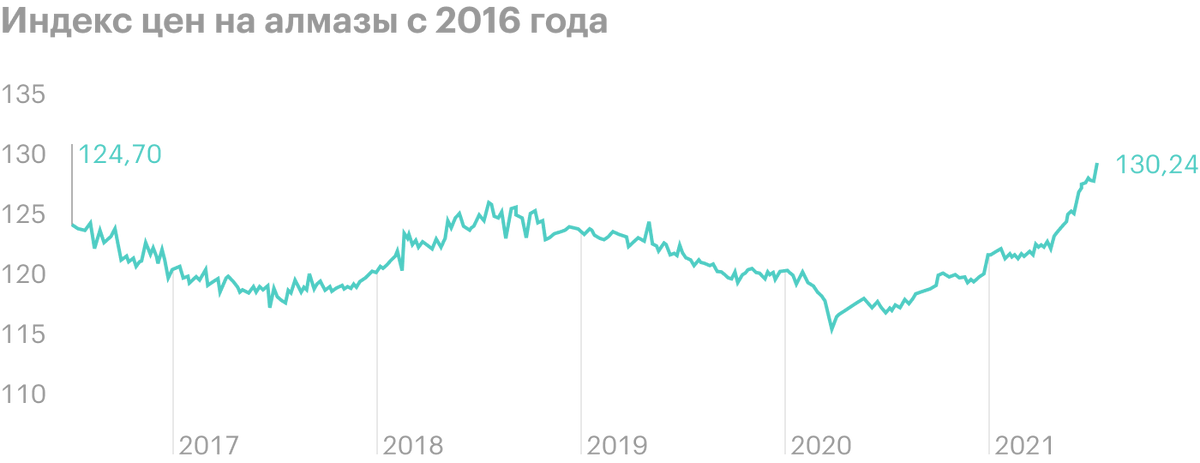

Diamond mining sector, like any commodity sector, highly dependent on the balance of supply and demand, therefore, product prices are quite volatile. In addition, a significant part of diamonds is used in the jewelry industry., so there are important components here: end consumer demand for jewelry, its seasonality, as well as the situation in the cutting sector.

World Center for Diamond Cutting and Polishing - India, so problems in this one country significantly affect the industry as a whole. For example, in 2019 the Indian diamond cutting sector experienced a liquidity crunch, as banks have tightened requirements for borrowers from the sector after the scandal with the machinations of the famous jewelry businessman Nirav Modi. The result was a decrease in demand from the Indian cutting sector, what pulled the price of diamonds down.

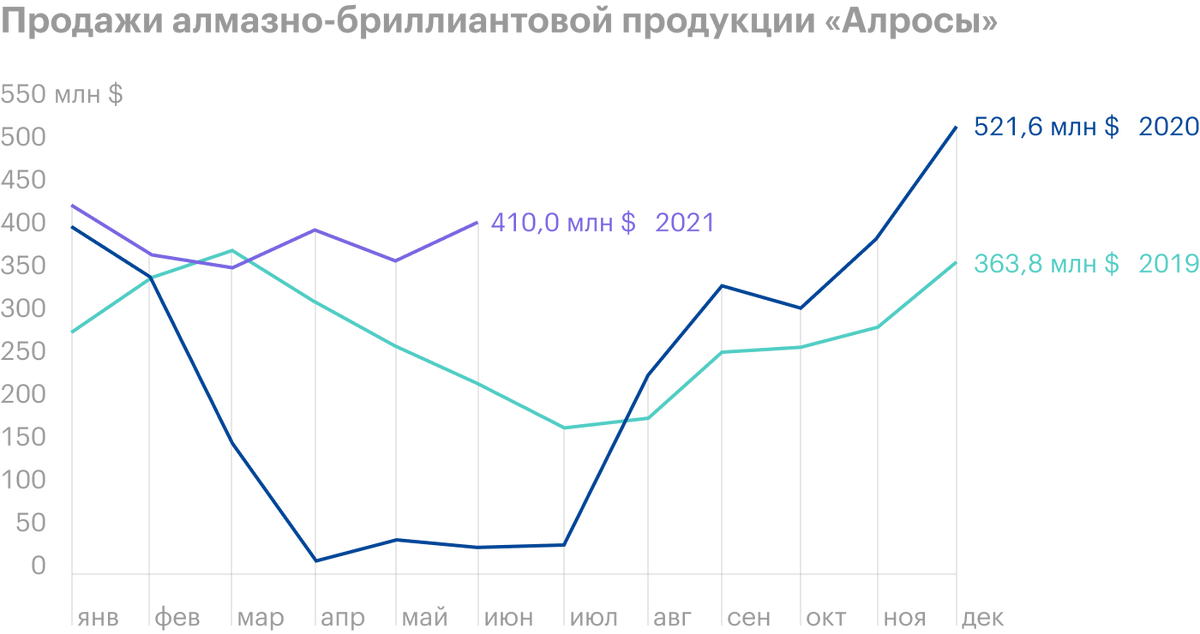

Coronavirus crisis with lockdowns, closing shops and factories, of course, hit the jewelry industry even harder: demand dropped dramatically, prices went down too. Diamond mining companies had to take unprecedented measures: for example, Alrosa has suspended several productions, allowed its clients with long-term contracts not to buy back contracted volumes, and postpone them for later - as a result, diamond sales fell to almost zero for several months.

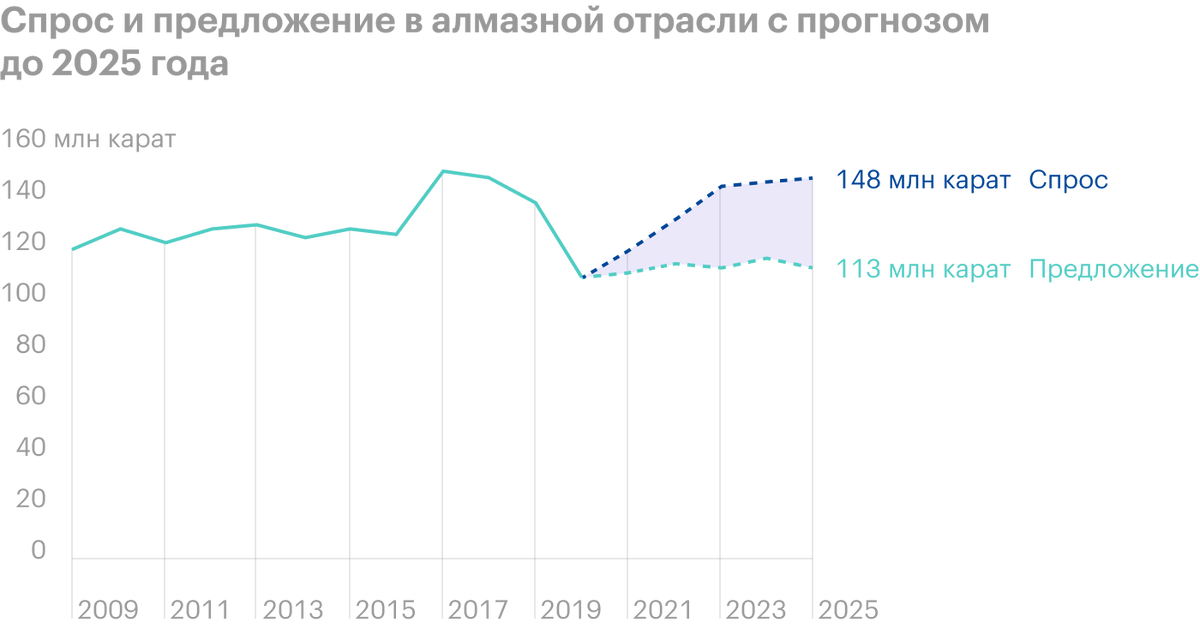

Nose 3 quarter 2020 year everything changed again: the weakening of lockdowns and the adaptation of people to the epidemiological situation led to a rapid increase in demand for rough and polished diamonds, which had a positive effect on prices. As a result, sales for 6 Months 2021 years have almost caught up with sales for the entire 2020 year and make up 70% from sales for the whole 2019 year. Furthermore, in the comments to the sales results for June, Alrosa's top manager Evgeny Agureev expresses the company's opinion, that the industry is on the verge of a protracted structural shortage of rough diamonds.

Financial indicators

Alrosa's business depends significantly on the market conditions - on diamond prices and on changes in the exchange rate, - which is why financial indicators are quite volatile from year to year. At the same time, they have a good mutual correlation: growth in revenue is usually matched by growth in net income and free cash flow, as well as a decrease in net debt - and vice versa.

In reporting, the company identifies four segments of revenue, and its structure clearly shows, what Alrosa earns from its main operating activities.

Already mentioned above, that Alrosa is a pronounced exporter. It shows even better in financial terms.: based on the results of 1 quarter 2021 of the year 94% proceeds, 93% money and their equivalents and 79% debt denominated in dollars, wherein 82% cost and 80% capital expenditures - in rubles.

Revenue, net profit, free cash flow and net debt by year, billion rubles

| Revenue | Net profit | free cash flow | net debt | |

|---|---|---|---|---|

| 2017 | 275,4 | 78,6 | 73,5 | 86,0 |

| 2018 | 299,7 | 90,4 | 92,3 | 67,4 |

| 2019 | 238,2 | 62,7 | 47,6 | 79,7 |

| 2020 | 221,5 | 32,2 | 79,5 | 80,8 |

| 2021, 1 neighborhood | 90,8 | 24,0 | 52,7 | 112,6 |

Revenue by business segment for 1 neighborhood 2021 of the year

| Diamond segment | 97% |

| Transport | 1% |

| Social infrastructure | 0% |

| Other activities | 2% |

Share capital and dividends

The share capital of the company is divided into three approximately equal parts: belonging to the Russian Federation, owned by the Republic of Sakha (Yakutia) and in free circulation. Such a shareholder structure is also beneficial for the company's minority shareholders., because the main shareholders want dividends.

Alrosa is the largest company in Yakutia, and its dividends are important for the budget of the republic, and the federal budget has recently been planning to receive 50% net profit under IFRS from all state-owned companies. In addition, in a bad market environment, the state has the opportunity to help the company: for example, in 2008-2009, the Gokhran of Russia bought a billion dollars worth of raw materials from Alrosa, the same support measures were discussed in 2020 year.

Given the large impact of exchange rate differences on net profit, Alrosa switched to paying dividends depending on free cash flow and debt load, dividends are paid twice a year. Besides, there is a condition, that dividends must be at least 50% net income under IFRS. As a result, conditions of Alrosa's dividend policy are very attractive for shareholders.

Share capital structure of the company

| Shareholder | share |

|---|---|

| the Russian Federation | 33% |

| Saha Republic (Yakutia) | 25% |

| District administrations (uluses) Sakha Republic (Yakutia) | 8% |

| Free float | 34% |

Terms of dividend policy

| Net debt / EBITDA | FCF share, paid in the form of dividends |

|---|---|

| < 0 | 100% |

| 0—1 | 70—100% |

| 1—1,5 | 50—70% |

Dividends by half year

| Dividend per share | Dividend yield | FCF share | |

|---|---|---|---|

| 1 half a year 2018 | 5,93 R | 5,9% | 70% |

| 2 half a year 2018 | 4,11 R | 5,0% | 100% |

| 1 half a year 2019 | 3,84 R | 5,2% | 100% |

| 2 half a year 2019 | 2,63 R | 4,0% | 100% |

| 1 half a year 2020 | — | — | — |

| 2 half a year 2020 | 9,54 R | 7,6% | 80% |

Why stocks can go up

Global industry leader with attractive multiples. Alrosa is the world's largest company in its industry, so for those who want to invest in diamond mining, Alrosa is the main choice. Besides, due to low production costs, a large volume of reserves and periodic devaluations of the ruble, it has the best margin of safety - which was shown 2020 year. Yes, and taking into account the market share of Alrosa, in general,, capable of influencing the global market. And the animators only emphasize, that the company is efficient and poorly leveraged.

Good business environment. We have already considered above, that since the second half of last year, the market has favored the company: prices and demand for products are high, which has a positive impact on its financial performance. More important, that the company expects demand to exceed supply over the next few years.

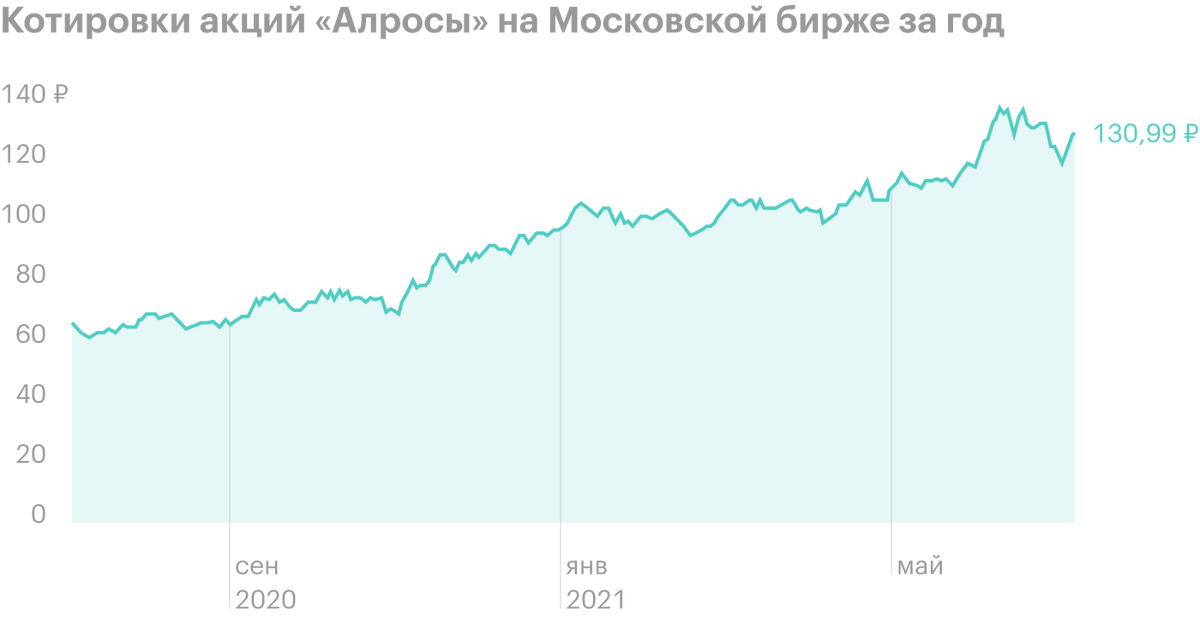

Dividends. Alrosa has a very attractive dividend policy, which provides a decent level of dividends, and now, in good conditions and, Consequently, financial performance, dividends promise to be even better, which has already allowed stock quotes to reach historical highs and may contribute to their further growth.

ESG. In materials for investors, Alrosa actively emphasizes its achievements in the field of sustainable development: 90% the energy used by the company is generated from renewable sources, high social responsibility of the company in the regions of presence and one of the highest percentage of women in the staff in the industry. This allows Alrosa to be included in various indices and sustainable development ratings., such as: FTSE4Good, RAEX-Europe, MSCI ESG. These aspects of the company's activities should have a positive impact on the attractiveness of Alrosa.

Why stocks might fall

Dependence on market conditions. This is a given for all commodity companies: if demand falls, followed by falling prices and, Consequently, financial performance and dividends, along with stock quotes. This feature just needs to be kept in mind when deciding on investments in commodity companies in general and in Alrosa in particular..

Somewhat more expensive, than usual. According to the multiplier P / E company is now priced a little expensive: about twice as expensive, than in 2017-2019. This creates some ground for correction, e.g. if monthly sales reports start to deteriorate.

Synthetic diamonds. Technology doesn't stand still, and the production of synthetic diamonds is no exception.: their production volume is growing, and the price goes down. Maybe, in the long run, they will be able to significantly replace natural stones due to a lower price.. Also, maybe, they will be promoted by analogy with electric vehicles: “when natural diamonds are mined, nature is harmed – every responsible person should buy synthetic diamonds”.

Possible man-made disasters. The mining industry is associated with the risks of man-made disasters. Unfortunately, these risks, Happens, implemented: for example, in 2017 an accident occurred at the mine "Alrosa" "Mir". In the reporting, the company reflected a loss from it in the amount of 7,4 billion rubles, the estimated restoration costs are estimated at 73 billion rubles. You need to understand these risks when investing in such companies., like Alrosa.

Multipliers "Alros"

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| 2017 | 7,03 | 29,5% | 0,68 |

| 2018 | 8,03 | 35,5% | 0,43 |

| 2019 | 9,90 | 24,7% | 0,74 |

| 2020 | 29,9 | 12,2% | 0,36 |

| 2021, 1 neighborhood | 18,1 | 18,4% | −0,20 |

Eventually

«Alrosa» — the world leader in the diamond mining industry. The scale and efficiency of its business helped to adequately survive the difficult for the industry 2019 And 2020 the years. Now the market favors diamond miners, which allowed Alrosa to significantly improve its financial performance, pay decent dividends, and stock quotes to reach all-time highs.

The company is interesting for its position in the industry, good dividends and forecasts of a structural shortage of diamonds for several years ahead, what should contribute to a favorable pricing environment. But definitely worth keeping in mind, that predictions may not come true, and a possible deterioration in the market situation will surely affect both the stock quotes, and on the future dividends of the company is not for the better.